Indonesia Health and Medical Insurance Market Report by Product Type (Single/Individual Health Insurance Products, Group Health Insurance Products), Term (Short-Term, Long-Term), Providers (Public/Social Health Insurance, Private), and Region 2026-2034

Indonesia Health and Medical Insurance Market:

The Indonesia health and medical insurance market size reached USD 1.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.7 Billion by 2034, exhibiting a growth rate (CAGR) of 4.19% during 2026-2034. The expanding middle-class population, along with the growing medical tourism, is propelling the market across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1.9 Billion |

|

Market Forecast in 2034

|

USD 2.7 Billion |

| Market Growth Rate 2026-2034 | 4.19% |

Access the full market insights report Request Sample

Indonesia Health and Medical Insurance Market Recent Analysis:

- Major Market Drivers: The increasing consumer awareness towards the importance of health and medical insurance is bolstering the market across the country. Moreover, the launch of favorable policies by government bodies for providing essential medical care to individuals is also driving the market.

- Key Market Trends: The rising number of mobile applications and digital platforms for purchasing and managing insurance policies is one of the emerging trends catalyzing the market in Indonesia. Additionally, the introduction of customized plans that offer extra services, including gym memberships, wellness programs, and mental health services, is acting as a significant growth-inducing factor.

- Challenges and Opportunities: Delays in claim settlements are among the key challenges hindering the market. There are incidences when insurance companies take a lot of time to process the settlement and claims, which generally causes inconvenience and financial stress for policyholders. However, the inflating integration of artificial intelligence and data analytics to better understand customer needs is expected to fuel the market across the country in the coming years.

Indonesia Health and Medical Insurance Market Recent Trends:

Growing Costs of Healthcare Services

The rising expenses related to medication, hospitalization, doctor consultation fees, etc., are elevating the need for health and medical insurance in the country. According to the data showcased by Statista's key market indicators (KMI) in January 2024, healthcare spending in Indonesia is estimated to reach approximately US$ 74.5 Billion by 2029. Moreover, as per the MMB Health Trends 2024 report, an increase in medical costs in Indonesia is projected to be around 13%. Besides this, the increasing geriatric population in the country who are prone to developing chronic diseases is also bolstering the requirement of general premiums, thereby elevating the Indonesia health and medical insurance market revenue. As per the findings by Statistics, by 2050, the elderly population in Indonesia will reach up to 74 million, accounting for 25% of the total population. Apart from this, the increasing prevalence of fatal accidents is further strengthening the market. According to the data published by Statista in September 2023, the total number of road traffic accidents in Indonesia was roughly around 204,45,000 cases in 2022. All of these above-mentioned factors are expected to drive the need for health and medical insurance services in the country over the coming years.

Various Government Initiatives

The launch of national health insurance schemes, such as Jaminan Kesehatan Nasional (JKN), previously known as Askeskin, by government bodies in Indonesia to achieve universal healthcare coverage (UHC), is driving the market growth. Additionally, the JKN scheme saw remarkable expansion over a short span of time, thereby covering over 260 million individuals, or more than 95% of the population, by December 2023. Moreover, the scheme provides beneficiaries with free healthcare services in community health centers called Puskemas, third-class (basic level) wards in government hospitals, and some designated private hospitals. Besides this, continuous improvements in the healthcare system are also acting as significant growth-inducing factors. Ranked 92nd by the World Health Organization (WHO), authorities in Indonesia have undertaken favorable plans to improve universal access to care across the board. Furthermore, various banks, key players, and concerned government entities are collaborating with each other to commercialize and expand their product offerings, which, in turn, is increasing the Indonesia health and medical insurance market's recent price. For example, in April 2022, PT Bank CIMB Niaga Tbk and PT Sun Life Financial Indonesia, a subsidiary of Sun Life Financial Inc., signed a strategic partnership that combined Sun Life Indonesia, the provider of insurance solutions to CIMB Niaga customers via all channels for a term of 15 years starting in January 2025.

Increasing Usage of Digital Technologies

The rising integration of the Internet of Things (IoT) and artificial intelligence (AI) is strengthening the market. Moreover, the increasing demand for seamless digital experiences is also catalyzing the market growth across the country. For example, in September 2023, PT AIA FINANCIAL was the first insurance company in Indonesia to integrate artificial intelligence (AI) in the recruitment process for insurance agents, known as Life Planners. Moreover, various insurtech companies are providing intuitive mobile apps and online platforms that enable customers to submit claims, purchase policies, and access information with ease, which is one of the Indonesia health and medical insurance market's recent opportunities. For instance, in February 2024, PasarPolis, one of the insurtech companies in Indonesia, unevolved its strategic plans to launch a wide array of insurance products catering to evolving customer needs combined with a more innovative customer experience. In line with this, in March 2024, Carrot General Insurance, one of the digital insurance companies based in South Korea, partnered with Lippo General Insurance (LGI) to support LGI's introduction of the behavior-based insurance (BBI) solution in Indonesia. Furthermore, continuous collaborations among key players are expected to fuel the market in the coming years. For example, in January 2024, a Thailand-based insurtech, Roojai Group, acquired Lifepal, an online insurance aggregator in Indonesia with over 2 million unique visitors per month, to expand the product portfolio, thereby ensuring a comprehensive and customer-centric approach to insurance services.

Indonesia Health and Medical Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the Indonesia health and medical insurance market forecast at the country level for the period 2026-2034. Our report has categorized the market based on the product type, term, and providers.

Breakup by Product Type:

To get detailed segment analysis of this market Request Sample

- Single/Individual Health Insurance Products

- Group Health Insurance Products

The report has provided a detailed breakup and analysis of the market based on the product type. This includes single/individual health insurance products and group health insurance products.

Single/individual health insurance products in the country are specifically designed to offer comprehensive medical coverage to individuals. These plans provide numerous services, such as emergency services, specialist consultations, inpatient and outpatient care, dental and optical care, etc. Additionally, the increasing popularity of personalized healthcare solutions, as they ensure accessibility to quality medical services, is driving the adoption of single/individual health insurance products in Indonesia. On the other hand, companies opt for group health insurance products to foster a healthier workforce, enhance employee benefits, and improve job satisfaction and retention. Insurers offer tailored packages that can be customized based on the size and specific needs of the organization, ensuring comprehensive coverage for all employees.

Breakup by Term:

- Short-Term

- Long-Term

The report has provided a detailed breakup and analysis of the market based on the term. This includes short-term and long-term.

Short-term health and medical insurance plans range from a few months up to a year. These plans are ideal for individuals in transitional phases, such as those between jobs or awaiting employer-provided insurance. Conversely, long-term health insurance plans offer extended coverage, usually for several years or a lifetime, providing a more comprehensive healthcare safety net. These plans include many benefits, such as preventive care, specialist consultations, surgery, and management of chronic conditions. Long-term plans are well-suited for individuals seeking sustained healthcare support and financial protection against medical expenses over the long haul. Indonesia health and medical insurance market companies offer both short-term and long-term options in Indonesia that are crucial in ensuring that residents have access to necessary medical services, tailored to their specific temporal needs and financial capabilities.

Breakup by Providers:

- Public/Social Health Insurance

- Private

The report has provided a detailed breakup and analysis of the market based on the providers. This includes public/social health insurance and private.

The public health insurance system, known as Jaminan Kesehatan Nasional (JKN), is administered by the Social Security Administrator for Health (BPJS Kesehatan). It aims to offer universal health coverage, ensuring that all citizens and residents of the country have access to essential healthcare services, including inpatient and outpatient care, preventive services, and maternal and child health. JKN is funded through contributions from both employers and employees, as well as government subsidies for those unable to afford premiums, thus promoting equitable access to healthcare across different socio-economic groups. On the other hand, private health insurance in Indonesia provides an alternative or supplementary option for individuals seeking more extensive or specialized coverage. Private insurance plans often offer a wider range of benefits, such as faster access to medical services, coverage for private hospitals, and additional perks like dental and optical care. These plans cater to individuals who desire more personalized healthcare services and are willing to pay higher premiums for enhanced benefits.

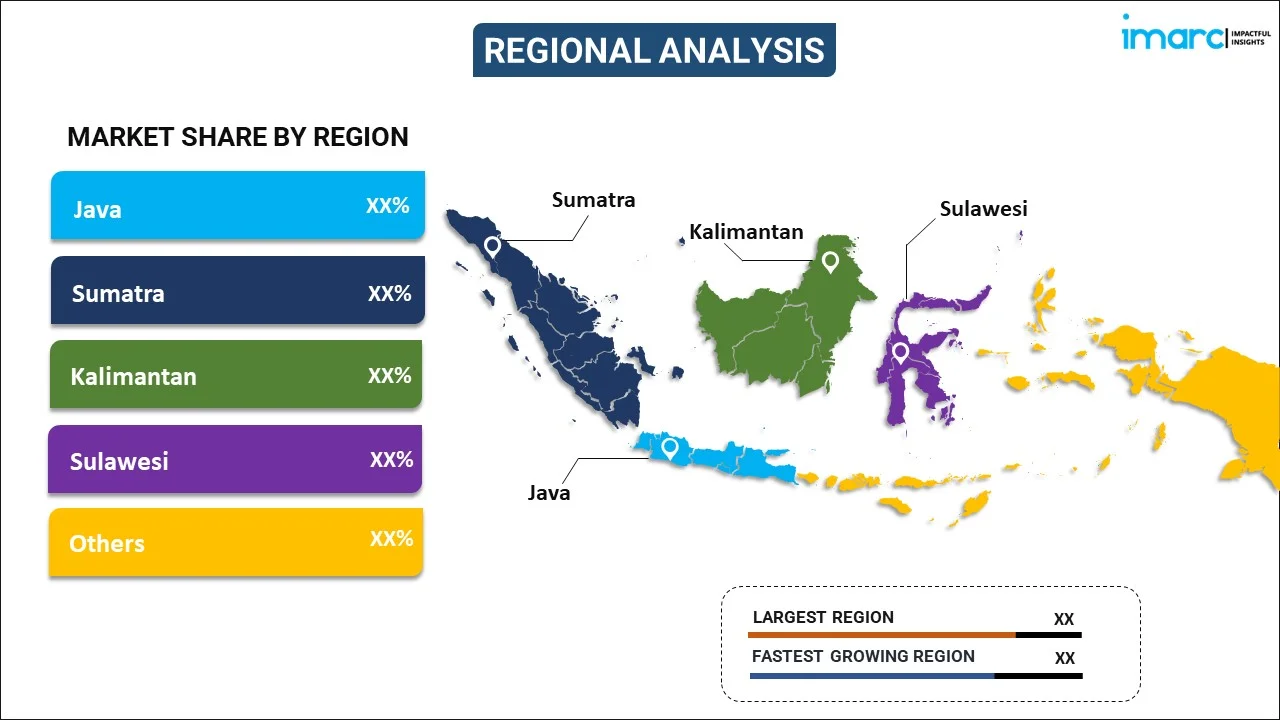

Breakup by Region:

To get detailed regional analysis of this market Request Sample

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Medical and healthcare insurance in Indonesia varies across its diverse regions, including Java, Sumatra, Kalimantan, Sulawesi, and others, reflecting the unique healthcare needs and economic conditions of each area. In Java, the most populous and economically developed region, both public and private health insurance penetration is high. Moreover, Sumatra and Kalimantan, with their rapidly developing economies, are seeing an increased uptake of both public health insurance under the Jaminan Kesehatan Nasional (JKN) scheme and private insurance products. However, access to healthcare services can be more limited in remote areas. Besides this, other islands and regions, such as Bali and Papua, also exhibit varying degrees of insurance adoption and healthcare infrastructures.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the Indonesia health and medical insurance market overview and competitive landscape. Competitive analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Health and Medical Insurance Market Recent Developments:

- April 2024: Ghufron Mukti, President Director of BPJS Kesehatan, a social security agency in Indonesia, in an interview, told GovInsider its plans to ensure affordable health and medical insurance through digitalization and inclusive financing.

- March 2024: JULO launched JULO Health to finance the healthcare and medical needs of individuals across various facilities in Indonesia, such as hospitals, clinics, dental care, pharmacies, laboratories, and diagnostic centers.

- September 2023: InterSystems announced an extension to the InterSystems IRIS, a data platform that eases SATUSEHAT compliance for healthcare providers in Indonesia.

Indonesia Health and Medical Insurance Market Report:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Single/Individual Health Insurance Products, Group Health Insurance Products |

| Terms Covered | Short-Term, Long-Term |

| Providers Covered | Public/Social Health Insurance, Private |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How big is the health and medical insurance market in Indonesia?

- How has the Indonesia health and medical insurance market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Indonesia health and medical insurance market?

- What is the breakup of the Indonesia health and medical insurance market on the basis of product type?

- What is the breakup of the Indonesia health and medical insurance market on the basis of term?

- What is the breakup of the Indonesia health and medical insurance market on the basis of providers?

- What are the various stages in the value chain of the Indonesia health and medical insurance market?

- What are the key driving factors and challenges in the Indonesia health and medical insurance?

- What is the structure of the Indonesia health and medical insurance market and who are the key players?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia health and medical insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia health and medical insurance market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia health and medical insurance industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)