Indonesia Geothermal Energy Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034

Indonesia Geothermal Energy Market:

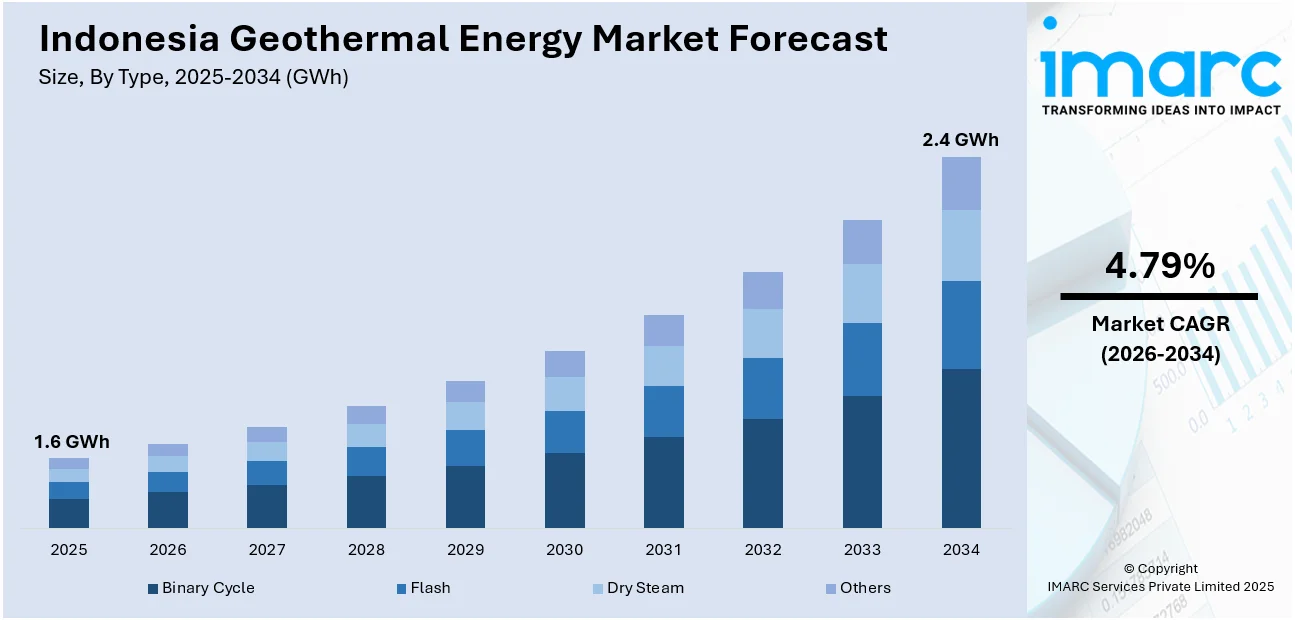

Indonesia geothermal energy market size reached 1.6 GWh in 2025. Looking forward, IMARC Group expects the market to reach 2.4 GWh by 2034, exhibiting a growth rate (CAGR) of 4.79% during 2026-2034. Abundant geothermal potential, the implementation of various government initiatives, steadily increasing energy demand, global clean energy initiatives, public awareness, technological advancements, off-grid electrification, and regulatory compliance represent some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 1.6 GWh |

| Market Forecast in 2034 | 2.4 GWh |

| Market Growth Rate 2026-2034 | 4.79% |

Indonesia Geothermal Energy Market Analysis:

- Major Market Drivers: The country's commitment to sustainable energy sources and environmental preservation is primarily driving the growth of the market. Moreover, government incentives for clean energy initiatives and technological advancements enhancing efficiency and cost-effectiveness are also contributing to the market growth.

- Key Market Trends: The growing interest in enhanced geothermal systems (EGS) for expanding geothermal capacity and the integration of geothermal energy with district heating systems to meet urban heating demands more sustainably are positively impacting the Indonesia geothermal energy market outlook.

- Challenges and Opportunities: Challenges in geothermal energy include high upfront costs of exploration and drilling, geological uncertainties, and limited availability of suitable sites. However, opportunities lie in technological advancements improving efficiency and reducing costs, increasing global demand for renewable energy sources, and the potential for geothermal to provide baseload power and support grid stability.

Indonesia Geothermal Energy Market Trends:

Increasing Demand for Electricity

The rising population in urban areas and the elevating levels of urbanization in the country are augmenting the need for electricity. In 2021, the electricity consumption in Indonesia accounted for 168.38 million BOE (barrel oil equivalent). Moreover, in 2021, the total electricity consumption of the household sector of Indonesia was approximately 70,289 thousand BOE. Households consumed the highest percentage of electricity, with almost 41.7% of the total electricity consumed. In addition to this, it is anticipated that the electricity demand in the housing sector of Indonesia is likely to increase to 350 TWh. In contrast, the demand in the industrial and commercial sectors is estimated to rise to nearly 80 TWh and 70 TWh, respectively. Apart from this, the rising utilization of electric appliances in the household sector is also contributing to increased electricity consumption. Moreover, with a growing population, Indonesian households are likely to grow to almost 80 million by 2050. This is anticipated to propel the Indonesia geothermal energy market share in the coming years.

To get more information on this market Request Sample

Government Initiatives

The government authorities of Indonesia are taking initiatives and making significant investments to develop and expand the utilization of geothermal energy. Moreover, according to the General Plan for National Energy (RUEN), Indonesia plans to reach 7.24 gigawatts of geothermal power by 2025, which, according to government officials, would necessitate US$ 15 Billion in investment. In response to this, numerous public and private banks are collaborating with the government which is augmenting the Indonesia geothermal energy market’s recent price. For instance, in March 2024, PermataBank, a prominent player in the industry, took a significant stride in this direction by disbursing a green financing facility worth Rp500 billion to SUN Energy for the development of solar energy projects across Indonesia. In addition to this, the Indonesian government wants to cut carbon emissions by 29% by 2030. This is most likely to be done by increasing the use of renewable energy to meet the growing electricity demand, which is likely to propel the Indonesia geothermal energy market’s revenue.

Technological Advancements

Technological advancements in geothermal energy including improved drilling techniques like directional drilling and slimhole drilling, and enhanced reservoir characterization through geophysical imaging and monitoring are further bolstering the Indonesia geothermal energy market demand. These advancements are increasing the efficiency, reliability, and accessibility of geothermal energy, expanding its potential as a sustainable source of electricity generation. For instance, in November 2023, PT Pertamina (Persero) deepened its collaboration with SINOPEC, a Chinese state-owned energy company, to expedite its commitment to energy transition and bolster global business development. Furthermore, in May 2024, the Geothermal Institute of the University of Auckland hosted a seminar in Indonesia as part of the broader collaboration between the Human Resources Development Agency of the Ministry of Energy and Mineral Resources Indonesia and The University of Auckland, a partnership that has been fostering educational and professional growth since 2022.

Indonesia Geothermal Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and end user.

Breakup by Type:

- Binary Cycle

- Flash

- Dry Steam

- Others

The Indonesia geothermal energy market report has provided a detailed breakup and analysis of the market based on the type. This includes binary cycle, flash, dry steam, and others.

In binary cycle geothermal power plants, hot water or steam from underground reservoirs is passed through a heat exchanger to vaporize a secondary fluid with a lower boiling point, typically an organic compound like isobutane or isopentane. The vaporized fluid then drives a turbine, generating electricity, before being condensed back into liquid form and reused in a closed-loop cycle. This technology allows for the exploitation of lower-temperature geothermal resources, making it suitable for a wider range of geothermal sites and increasing the overall efficiency of geothermal energy production.

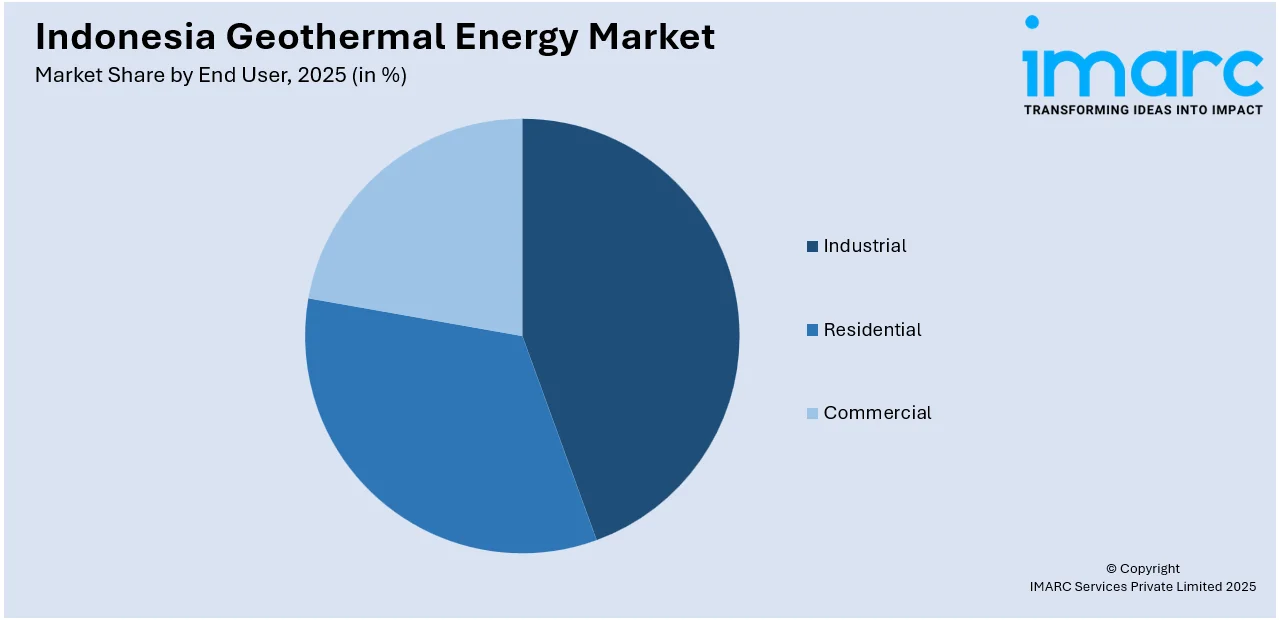

Breakup by End User:

Access the comprehensive market breakdown Request Sample

- Industrial

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes industrial, residential, and commercial.

As per the Indonesia geothermal energy market statistics, the increasing demand for electricity by the residential sector is creating a positive outlook for the overall market. In 2021, households consumed the highest percentage of electricity, with almost 41.7% of the total electricity consumed in Indonesia. The rising utilization of electric appliances in the in the household sector is also contributing to the increased electricity consumption. In addition to this, it is anticipated that the electricity demand in the housing sector of Indonesia is likely to increase to 350 TWh. In contrast, the demand in the industrial and commercial sectors is estimated to rise to nearly 80 TWh and 70 TWh, respectively.

Breakup by Region:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

According to the Indonesia geothermal energy market overview, the demand for geothermal energy in Indonesia is significantly rising due to the country's abundant geothermal resources, which represent one of the largest potential sources of renewable energy. With a growing population and increasing energy needs, there is a strong push to diversify the energy mix and reduce reliance on fossil fuels. Government support, favorable policies, and investments in geothermal infrastructure further drive the demand for geothermal energy in Indonesia, positioning it as a key player in the country's energy transition and sustainable development efforts.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major Indonesia geothermal energy market companies have been provided.

Indonesia Geothermal Energy Market Recent Developments:

- May 2024: The University of Auckland held a seminar on energy transition in Indonesia, which fostered a long-standing partnership for geothermal capacity growth.

- November 2023: Indonesia’s Pertamina deepened its collaboration with SINOPEC, a Chinese state-owned energy company, to expedite its commitment to energy transition and bolster global business development.

Indonesia Geothermal Energy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | GWh |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Binary Cycle, Flash, Dry Steam, Others |

| End Users Covered | Industrial, Residential, Commercial |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia geothermal energy market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia geothermal energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia geothermal energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The geothermal energy market in Indonesia reached 1.6 GWh in 2025.

The Indonesia geothermal energy market is projected to exhibit a CAGR of 4.79% during 2026-2034, reaching a volume of 2.4 GWh by 2034.

While the nation strives to lessen its reliance on fossil fuels and decrease greenhouse gas emissions, geothermal energy is providing a clean and dependable alternative. Government initiatives, incentives, and regulatory reforms are encouraging investments in geothermal exploration and power generation. The rising need for stable, baseload power to support the growing industrial and residential utilization is also making geothermal energy an attractive option.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)