Indonesia Feed Additives Market Size, Share, Trends and Forecast by Additive, Animal, and Region, 2026-2034

Indonesia Feed Additives Market Size and Share:

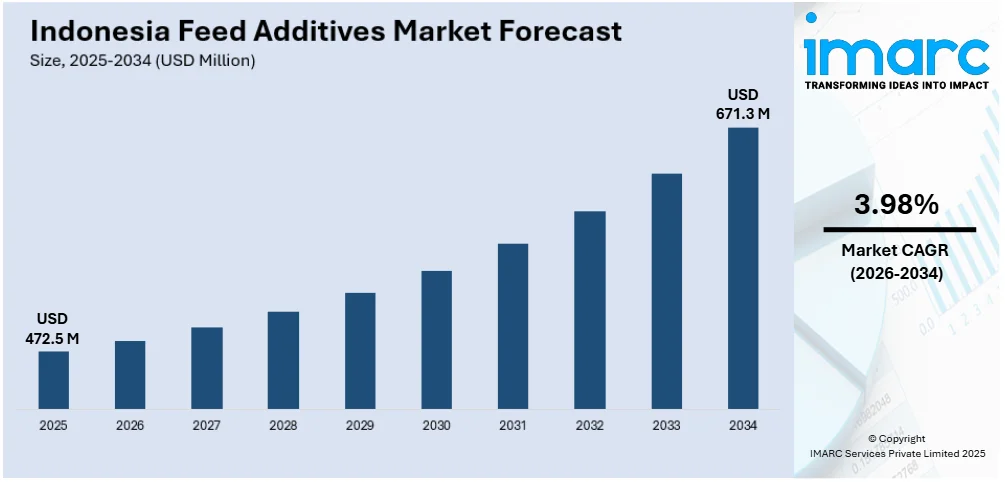

The Indonesia feed additives market size reached USD 472.5 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 671.3 Million by 2034, exhibiting a CAGR of 3.98% from 2026-2034. The growing demand for high-quality meat and dairy products due to the rising adoption of protein-rich diets, increasing awareness about the importance of disease prevention, and rising number of health-conscious individuals represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 472.5 Million |

| Market Forecast in 2034 | USD 671.3 Million |

| Market Growth Rate (2026-2034) | 3.98% |

The rising demand for animal protein plays a critical role. With a growing population and expanding middle class, the consumption of poultry, fish, and livestock products is increasing rapidly. This surge in demand for protein-rich foods has created a need for feed additives that improve feed efficiency, accelerate growth rates, and ensure high-quality meat, milk, and egg production. Livestock health and disease management is a significant driver. Disease outbreaks can lead to substantial economic losses for farmers. Feed additives, such as probiotics, enzymes, and acidifiers, help prevent diseases, boost immunity, and improve digestion, making them essential for maintaining animal health and enhancing productivity. For instance, in April 2023, the prominent ingredient manufacturer Kemin Industries announced the launch of Pathorol™, a shrimp supplement that enhances the health of the hepatopancreas, an organ in the crustacean's digestive tract. It is currently available in Thailand, India, Indonesia, Singapore, and Vietnam.

To get more information on this market Request Sample

Technological advancements in feed additives are shaping the Indonesia feed additives market growth. Innovations in additive formulations, including direct-fed microbials, amino acids, and natural enzymes, are helping farmers achieve better feed conversion and sustainability. Customized feed solutions tailored to specific regional needs are also becoming increasingly popular. For instance, in August 2023, Vetnostrum's notable feed additive product, YungStrong, also known as "Prostrum" in Indonesia, was finally granted a license in Indonesia after a protracted delay. It is said to be soon be available inn the Indonesian market, with the proprietary safety strain "Bacillus amyloliquenfaciens", which is known for its capacity to release many enzymes and different AMPs that can enhance the growth and digestion of animals. Government support and regulatory policies further propel the Indonesia feed additives market demand. The Indonesian government promotes sustainable agricultural practices, food security, and livestock productivity through subsidies, grants, and regulations. These policies encourage the use of high-quality feed additives that meet safety and nutritional standards, ensuring a thriving market environment.

Indonesia Feed Additives Market Trends:

Growing Demand for Animal Protein

Indonesia's increasing population and expanding middle class drive the demand for animal protein, particularly poultry, fish, and beef. This growth leads to a rise in the consumption of animal-based products such as eggs, dairy, and meat, which fuels the need for efficient feed additives. Farmers are turning to feed additives to improve feed conversion, accelerate growth, and ensure healthier livestock, making them essential to meet the rising demand for protein-rich foods. The growing demand for animal protein is thus a key factor in the expansion of the feed additives market in Indonesia. For instance, in October 2024, De Heus announced the launch of its sixth production facility in Indonesia to reaffirm its dedication to sustainable agriculture. The new factory helps De Heus satisfy the increasing demand for animal feed in Indonesia and solidifies its position in the market.

Technological Advancements in Feed Additives

Technological innovations in feed additives represent one of the major Indonesia feed additives market trends. New developments in nutritional formulations, probiotics, enzymes, and natural feed additives are improving feed efficiency and animal performance. These innovations help optimize feed utilization, enhance digestion, and reduce the reliance on antibiotics, making livestock farming more sustainable. The adoption of AI-based solutions for optimizing feed and the growing trend of customized feed formulations tailored to specific regional needs in Indonesia further fuel the market. These advancements are transforming the feed additives industry, offering more effective solutions for livestock health and productivity. For instance, in January 2025, IFF introduced Enviva® DUO, a novel direct-fed microbial (DFM) solution designed to enhance chicken wellbeing. Enviva DUO, which is intended for waterline application, promotes digestive health and guarantees reliable product distribution to flocks.

Government Support and Regulatory Policies

The Indonesian government plays a significant role in driving the feed additives market through supportive policies and regulations aimed at improving food security and livestock productivity. Programs focused on boosting agricultural and livestock production, including grants and subsidies for farmers, help drive demand for high-quality feed additives. Additionally, regulations related to animal health and food safety push farmers and producers to adopt feed additives that ensure compliance with national standards. This governmental support, combined with efforts to improve farming practices, continues to foster the growth of the feed additives market in Indonesia. For instance, in December 2023, a prominent leader in human and animal nutrition, ADM announced the acquisition of PT Trouw Nutrition Indonesia, a Nutreco affiliate and top supplier of nutritional and functional solutions for Indonesian livestock farming. With supportive policies encouraging sustainable farming practices, the acquisition allows ADM to expand its footprint and comply with local regulations while meeting market demands.

Indonesia Feed Additives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Indonesia feed additives market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on additive and animal.

Analysis by Additive:

- Acidifiers

- Amino Acids

- Antibiotics

- Antioxidants

- Binders

- Enzymes

- Flavors and Sweeteners

- Minerals

- Mycotoxin Detoxifiers

- Phytogenics

- Pigments

- Prebiotics

- Probiotics

- Vitamins

- Yeast

The Indonesian feed additives market shows substantial demand for acidifiers because these additives improve gut health while helping prevent diseases and enhancing nutrient absorption across livestock species. Acidifiers demonstrate broad adoption in the poultry, aquaculture, and livestock feed sectors for boosting animal growth rates alongside digestive function and total performance due to increasing concerns about animal health coupled with rising demand for high-quality animal products.

Animals require amino acids to support growth and muscle development and optimize overall performance function. Animal protein production needs in Indonesia including both poultry meat and aquaculture culture products require better feed formulation designs because consumer demand is steadily growing. Amino acids such as lysine and methionine serve as fundamental feed efficiencies that enable the industry to pursue optimal animal nutrition leading to their increasing adoption.

The Indonesian market for feed additives predicts antibiotics will remain dominant because these medications boost livestock growth and protect animals from diseases. Industrial use of antibiotics for poultry and aquaculture production goals continues despite increasing worries about anti-microbial drug resistance. Animal health and feed efficiency depend heavily on antibiotic use yet regulatory pressure to introduce alternative solutions remains increasing.

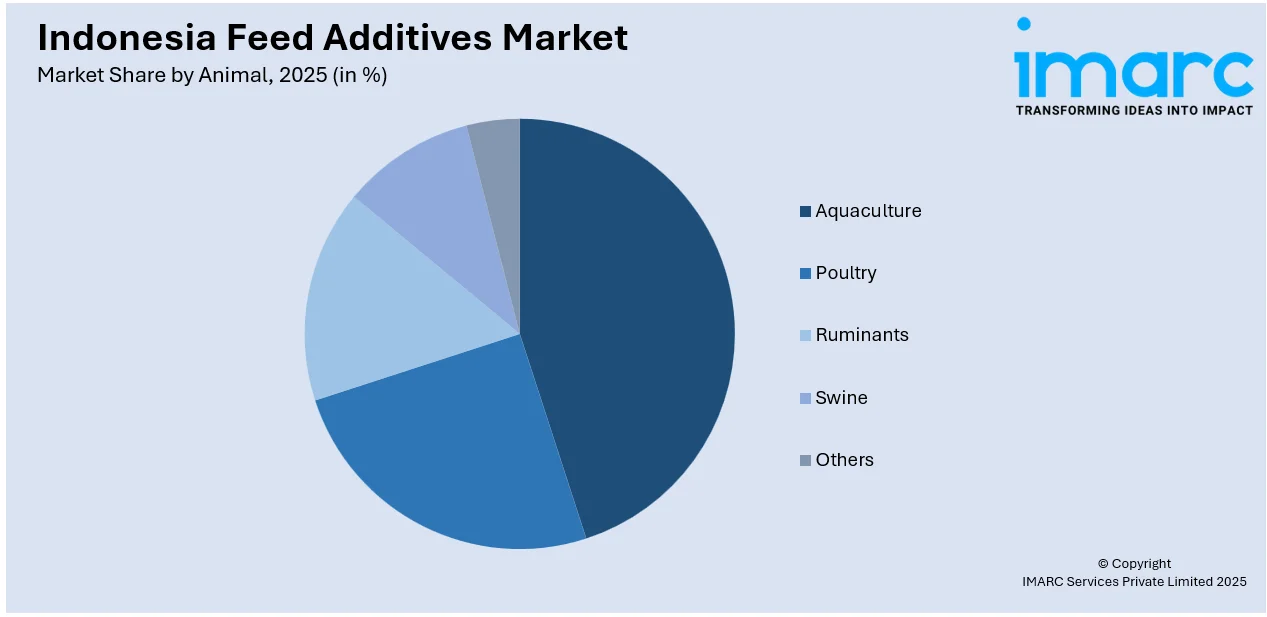

Analysis by Animal:

Access the comprehensive market breakdown Request Sample

- Aquaculture

- Poultry

- Ruminants

- Swine

- Others

Aquaculture is expected to hold a large Indonesia feed additives market share due to the growing demand for fish and seafood products. With an expanding population and increasing consumer preference for affordable protein sources, aquaculture relies heavily on efficient feed additives for improving growth rates, disease resistance, and feed conversion. The country's extensive coastline and aquaculture industry further contribute to the high adoption of specialized feed additives for fish farming.

In the poultry segment, the feed additives market of Indonesia shows strong activity because of increasing consumer interest in chicken products and eggs. Feeds require important additives as they facilitate improved development while enhancing nutrition intake and protecting poultry from diseases. High-quality feed additives serve as a vital necessity for the industry's continued productivity because the expanding middle class along with growing protein consumption drives demand for high-quality poultry products.

The Indonesian market for feed additives will likely maintain substantial dominance by ruminants like cattle and goats because livestock farming supports meat and dairy generation. The application of feed additives helps promote animal growth alongside better digestion which optimizes milk yield. Ruminant farmers use feed additives because rising market demand for beef and dairy products requires innovations to improve livestock health and feed conversion efficiency for elevated production throughput.

Regional Analysis:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The market for feed additives in Sumatra expands because of its major poultry and aquaculture industries which operate as a central hub for fish farming and poultry production. Increasing animal protein consumption of chicken and fish products drives manufacturers to increase their usage of feed additives which boost animal growth and provide disease protection and improved feed conversion efficiency. The growing urban population combined with middle-class demand for premium meat and seafood in Sumatra creates an urgent need for optimized feed formulations to maintain healthy livestock along with high production yields across the region.

Kalimantan’s feed additives market is fueled by the region's significant agricultural and livestock sectors, including palm oil, poultry, and cattle farming. The increasing need for efficient feed formulations to boost livestock productivity, improve feed conversion ratios, and enhance overall animal health drives demand for feed additives. As Kalimantan experiences economic growth and the expansion of its agricultural infrastructure, especially in livestock farming, the use of feed additives to prevent diseases, optimize nutrient absorption, and ensure sustainable farming practices is becoming more prominent. This trend aligns with the region’s increasing protein consumption and demand for high-quality animal products.

Sulawesi, with its focus on aquaculture and poultry farming, is witnessing a surge in demand for feed additives to support healthy growth and productivity in these industries. The region's vast coastline and thriving fish farming industry, along with the rising popularity of poultry, contribute to the growing adoption of feed additives for disease prevention, enhanced digestion, and improved feed efficiency. Additionally, the increasing demand for protein-rich foods from Sulawesi’s expanding population and the need for sustainable farming practices in livestock farming drive the adoption of advanced feed additives to maintain animal health and meet market needs.

Competitive Landscape:

The Indonesia feed additives market is highly competitive, with both global and local players vying for market share. Key international companies, such as Cargill, ADM, and DSM, dominate the market by offering a wide range of feed additives for poultry, aquaculture, and livestock. Local companies like Japfa Comfeed and Malindo Feedmill also hold significant positions, catering to the growing demand for cost-effective and region-specific solutions. The market is characterized by continuous innovation, with companies investing in research and development to introduce advanced, sustainable additives that improve feed efficiency, animal health, and productivity. Strategic partnerships and mergers further intensify competition.

Latest News and Developments:

- In April 2024, Zoetis Inc. and Phibro Animal Health Corporation announced that they have reached a final agreement in which Phibro Animal Health will pay $350 million, subject to customary closing adjustments, to acquire Zoetis' medicated feed additive (MFA) product portfolio, certain water-soluble products, and related assets. It is anticipated that this deal will be finalized in the second half of 2024.

Indonesia Feed Additives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Additives Covered | Acidifiers, Amino Acids, Antibiotics, Antioxidants, Binders, Enzymes, Flavors and Sweeteners, Minerals, Mycotoxin Detoxifiers, Phytogenics, Pigments, Prebiotics, Probiotics, Vitamins, Yeast |

| Animals Covered | Aquaculture, Poultry, Ruminants, Swine, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia feed additives market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Indonesia feed additives market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia feed additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The feed additives market in Indonesia was valued at USD 472.5 Million in 2025.

The growth of Indonesia's feed additives market is driven by rising livestock production, increasing demand for quality meat and dairy products, and a growing focus on animal health and nutrition. Expanding aquaculture, government support for the livestock sector, and awareness of feed efficiency and disease prevention further boost market demand. The factors, collectively, are creating an Indonesia feed additives market outlook across the country.

The Indonesia feed additives market is projected to exhibit a CAGR of 3.98% during 2026-2034. reaching a value of USD 671.3 Million by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)