Indonesia Commercial Real Estate Market Size, Share, Trends and Forecast by Type and Region, 2026-2034

Indonesia Commercial Real Estate Market Size and Share:

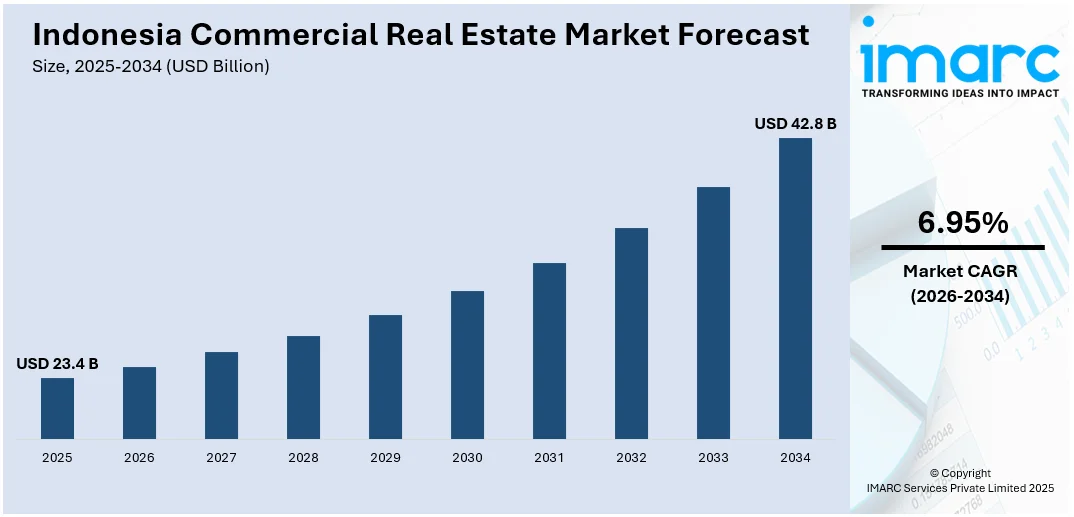

The Indonesia commercial real estate market size was valued at USD 23.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 42.8 Billion by 2034, exhibiting a CAGR of 6.95% from 2026-2034. Technological progress, supportive regulations, urban migration, infrastructure expansion, green building practices, increasing investment and shift toward digital and experiential developments are some of the factors positively influencing Indonesia commercial real estate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 23.4 Billion |

|

Market Forecast in 2034

|

USD 42.8 Billion |

| Market Growth Rate (2026-2034) | 6.95% |

The market in Indonesia is primarily driven by rapid urbanization, inflating disposable incomes, and increasing middle-class population. According to an industry report, the number of impoverished persons in metropolitan areas fell by 0.1 Million from 11.74 Million in March 2023 to 11.64 Million in March 2024. Meanwhile, from 14.16 Million in March 2023 to 13.58 Million in March 2024, there were 0.58 Million fewer impoverished individuals living in rural areas. Additionally, the proliferation of coworking spaces, coupled with the growth of small and medium-sized enterprises, is shaping the office space segment. Moreover, the growing tourism industry is fueling the need for hospitality properties, and retail trends are driving investments in mixed-use developments, which is accelerating the Indonesia commercial real estate market growth. In addition to this, continual technological advances in digital technologies and sustainability practices are further influencing design and operational efficiencies within the market.

To get more information on this market Request Sample

Furthermore, the growth of data-driven industries is leading to a higher need for data centers and high-tech facilities, thereby increasing the market demand. For example, on November 12, 2024, Tencent announced a USD 500 Million investment to establish a third data center in Indonesia by 2030, enhancing its cloud and AI services. The initiative is part of a collaboration with GoTo Group and Alibaba, supporting Indonesia's digital infrastructure and training programs. Besides this, economic diversification efforts are encouraging the development of new industrial parks and export-oriented facilities. Also, rising consumer interest in experiential retail is propelling innovative retail concepts and entertainment-focused spaces. In line with this, the increasing integration of smart building technologies is enhancing operational efficiency and tenant satisfaction across the commercial real estate sector, which is also a significant growth-inducing factor for the market.

Indonesia Commercial Real Estate Market Trends:

Increasing Government Initiatives

The implementation of favorable government initiatives to vitalize the commercial property market are contributing to the Indonesia commercial real estate market growth. Tax breaks, subsidies, and foreign investor incentives have been introduced as policies to channel growth in the sector. For instance, on August 27, 2024, Indonesia's Chief Economic Minister, Airlangga Hartarto, reinstated a full tax break on property purchases valued at approximately USD 323,000 for the latter part of 2024. This policy will cover VAT on up to USD 123,696.80 (2 Billion rupiah) of the purchase price for houses or apartments eligible for the measure. The initiative aims at strengthening the purchasing power of the middle class. These measures increase demand for office spaces, retail locations, and industrial properties, especially in urban areas like Jakarta and Surabaya. The government also focuses on infrastructure projects, such as new transportation networks, to enhance connectivity and boost demand for commercial real estate. These efforts boost the market and improve investor confidence, thus contributing to steady and long-term growth prospects.

Growing Emphasis on Sustainable and Green Building Practices

The focus on sustainability practices is enhancing the Indonesia commercial real estate market outlook. Developers and investors are increasingly paying attention to green building certifications and sustainable construction practices. Green building certifications are gaining widespread acceptance in the real estate market. This is due to both the set environmental targets as well as rising tenant demand for more energy-conscious and environmentally sound areas. The Indonesian government further supports this transition through regulations and incentives designed to encourage sustainable development, accelerating the adoption of green building practices and making sustainability a critical aspect of future commercial real estate projects. In October 2024, Indonesia launched its National Roadmap for Green Building Implementation, a key initiative for sustainable urbanization and decarbonization of the building sector. The aim of this drive, supported by the Ministry of Public Works and Housing, Ministry of Energy and Mineral Resources, and Ministry of Home Affairs, is to help reduce emissions and energy consumption through buildings. This roadmap provides clarity on guidelines and performance metrics and encourages coordination with government agencies and the private sector to improve the green building practice in the entire country.

Growing Requirement for Industrial and Logistics Real Estate

The growth in e-commerce and expansion in the manufacturing industry in Indonesia increase Indonesia's commercial real estate market demand, especially for industrial and logistics real estate. Strategic locations near main ports and transport nodes are highly attractive due to their efficient supply chain operations, which is critical to meeting demand both domestically and internationally. The improvement in infrastructure through the construction of new highways and the development of ports further facilitates market growth. Also, the expansion of industrial spaces and increased investments are providing a boost to market development. For example, Frasers Property Thailand (FPT) announced significant expansion plans in Southeast Asia, setting targets of building 50,000 square meters of factory space in Vietnam and 20,000 square meters of warehouses in Indonesia. The company aims to achieve a 90% occupancy rate for its industrial properties by 2025, and up to USD 88769250.00 (3 Billion Baht) has been allocated for the development of industrial units. This Indonesia commercial real estate market trend is expected to make industrial real estate a vital segment of the market.

Indonesia Commercial Real Estate Industry Segmentation:

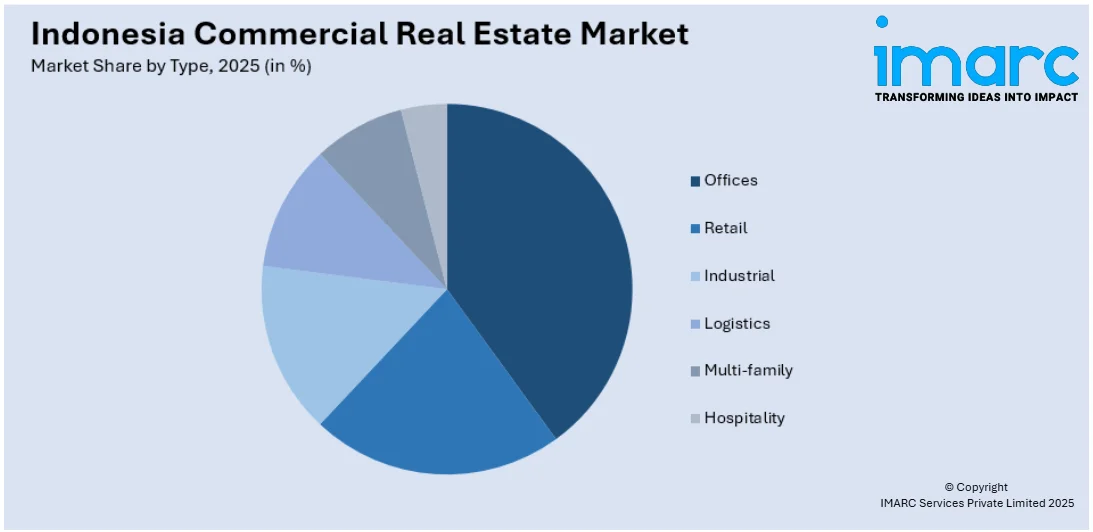

IMARC Group provides an analysis of the key trends in each segment of the Indonesia commercial real estate market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type.

Analysis by Type:

Access the comprehensive market breakdown Request Sample

- Offices

- Retail

- Industrial

- Logistics

- Multi-family

- Hospitality

Offices are one of the most prominent parts of the commercial real estate market in Indonesia, as it reflects an increasingly active and growing economy of the country with its business environment. The expansion of local businesses and multinational businesses requires office space demand in Jakarta, Surabaya, and Bandung, among others. With Indonesia's continuous infrastructure and digital economy development, demand for office space is heightened to cater to finance and technology industries, consulting, and retail. Office demand is also changing with flexible working arrangements, hybrid models, and co-working areas. Offices are significant in the commercial real estate market in Indonesia, with increased investment reflecting the dynamic economic progress of the country.

Retail spaces form an important part of the commercial real estate market in Indonesia and play a significant role in the country's economic activities. Indonesia is one of the prime consumption markets in Southeast Asia, which is also witnessing a growing middle class and fast-urbanizing social space. Since it has a large population, retail properties along with malls, shopping centers, and street-front shops are in constant requirement for local and international brands. Omnichannel strategies, in-store experience improvements, and experience-based retailing strengthen walk-in traffic for retail operators. The growth of tourism in Jakarta, as well as Bali, continues to increase demand for retail.

The industrial real estate market in Indonesia is growing rapidly, driven by the country's strategic position in global trade routes, robust manufacturing sector, and increasing demand for logistics and distribution centers. As Indonesia's economy grows, the need for warehouses, factories, and logistics hubs has been increasing, mainly due to e-commerce and retail demand. Places like Jakarta, Surabaya, and the Batam region are becoming the most sought-after locations for industrial real estate, given their proximity to ports, infrastructure improvements, and a skilled labor force. The expansion of e-commerce leads to a significant demand for warehouses as logistics companies seek bigger and more advanced facilities to handle supply chains economically.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

Java is the most populated and economically significant island in Indonesia and represents the preponderant player in the country's commercial real estate market. Cities like Jakarta, Surabaya, and Bandung are in Java. The capital, Jakarta, is the main hub for office spaces, retail, and hospitality sectors due to the concentration of the headquarters of corporate institutions, governmental departments, and international companies. Surabaya is more of a commercial and trade city with industrial and retail development, while Bandung is a city for tech and innovation. Infrastructure development on the island of Java, such as transportation and digital connectivity, further boosts real estate demand within sectors. Commercial investments in real estate continue to influence the future growth of Indonesia's economy with steady urbanization and business expansion.

Sumatra is Indonesia's second-largest island and an important pivot in the country's commercial real estate market in sectors such as industrial, logistics, and resource-based industries. Major cities like Medan, Palembang, and Pekanbaru emerge as significant commercial centers. Sumatra has rich natural resources, including oil, gas, palm oil, and mining, which push demand for industrial facilities, warehouses, and logistical infrastructure. The island is also strategically located for trade with international markets through its ports, including those in Medan and Batam, which boosts the demand for distribution centers. In addition, with the development of Sumatra's infrastructure and growing population, retail spaces are becoming increasingly important in urban areas. As the government continues to invest in Sumatra's economic growth, including transportation and energy, commercial real estate in the region is poised for expansion, offering unique investment opportunities outside Java's more saturated market.

Kalimantan, the Indonesia part of Borneo, is becoming highly important in terms of commercial property due to the presence of natural commodities. It has timber, palm oil, coal, and even natural gas – and its strategically located position is proximate to overseas markets such as Malaysia and Singapore. The cities of Pontianak, Balikpapan, and Banjarmasin are experiencing a high demand for industrial properties: extraction-based industries supporting the source and exportation of natural resources. Also, the emergence of environmentally friendly industries and infrastructure development drives the need for logistics and warehousing facilities. Infrastructure developments, such as roads, highways, and ports, fast-track drive commercial real estate opportunities in Kalimantan.

Sulawesi, located in the central part of Indonesia, is emerging as an important player in the country's commercial real estate market due to its unique geographic position and growing economic sectors. With cities like Makassar, Manado, and Palu at the forefront, Sulawesi is becoming increasingly important in the retail, industrial, and tourism sectors. Makassar, as the largest city and regional economic hub, is seeing a high level of office space, retail developments, and hospitality investments. The role of Sulawesi as a hub for the fisheries, agriculture, and mining industries is also increasing demand for industrial real estate in terms of storage and processing facilities. Tourism sectors are contributing to the hospitality real-estate space. Sulawesi is expected to attract potential investment in the commercial and industrial sectors of real estate with ongoing infrastructural and regional connectivity developments across the island.

Competitive Landscape:

The market in Indonesia remains highly dynamic and competitive, driven by rapid urbanization, the growing middle class, and increasing foreign investments. Jakarta, Surabaya, and Bali are the major places where investors collaborate and acquire properties for office spaces, retail properties, warehouses, and mixed development. For instance, Warburg Pincus and NWP Property, backed by Japan's CRE on November 22, 2024, concluded the acquisition of a cold storage warehouse close to Jakarta. The facility measures 5,200 square meters, is in the district of Narogong in Bekasi, and is fully leased out to a single tenant. Pressures in the real estate sector emerge from changes in tenant preferences. Sustainable and flexible spaces are emerging as the needs, post-pandemic. The competition is stiffer between the developers who seek to fill up the demand for quality, technology-enabled facilities on cost-effective terms. Market phases through the play of regulatory frameworks, economic dampening, and infrastructural development. The increased e-commerce investment in logistical and warehouse properties also increases competition.

The report provides a comprehensive analysis of the competitive landscape in the market with detailed profiles of all major Indonesia commercial real estate market companies.

- Agung Podomoro Land

- Ciputra Group

- Duta Anggada Realty

- Lippo Group

- PP Properti (PT PP (Persero) Tbk)

- RDTX Group

- Sinar Mas Land (Sinar Mas)

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- February 8, 2024: Indonesia started its new capital city construction in East Kalimantan: Nusantara, a USD 35 Billion project. It is set to be the smart and sustainable development model by incorporating mixed-used developments, housing, schools, and hospitals and targeting a population of 1.2 Million by 2029.

- June 14, 2024: Agung Podomoro Land, a Jakarta-based property firm, will spend more than USD 270 Million (4.5 trillion rupiah) on constructing 15 apartment towers in the country's future capital, Nusantara. It's one of the first private housing projects in the new capital. The project will be executed jointly with the Nusantara Capital City Authority's business arm, PT Bina Karya.

- September 25, 2024: Indonesian President Joko Widodo officiated the groundbreaking ceremony for a property complex by China's Delonix Group in Nusantara, marking the first foreign investment in the nation's new capital. The USD 33 Million project consists of hotels and offices to bring relief from overcrowding and congestion in the capital city, Jakarta.

- October 28, 2024: The Indonesia Investment Authority (INA), in cooperation with the Dutch manager APG Asset Management and Abu Dhabi Investment Authority, took control of the Medan-Binjai and Bakauheni-Terbanggi Besar sections of the Trans Sumatra Toll Road for around IDR 21 trillion (€1.2 Billion). A combination of these actions is part of a broader approach to allocating the Indonesian toll road investment of as much as USD 2.75 Billion to drive infrastructure and overall economic growth all over the nation. The portions acquired will offer better connectivity around Sumatra, improving the economic growth of regional cities.

Indonesia Commercial Real Estate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Offices, Retail, Industrial, Logistics, Multi-family, Hospitality |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Companies Covered | Agung Podomoro Land, Ciputra Group, Duta Anggada Realty, Lippo Group, PP Properti (PT PP (Persero) Tbk), RDTX Group, Sinar Mas Land (Sinar Mas) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia commercial real estate market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Indonesia commercial real estate market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia commercial real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial real estate market in the Indonesia was valued at USD 23.4 Billion in 2025.

The key factors driving the market are driven by robust economic expansion, urbanization, and a rising middle class leading to retail and office demand. The implementation of supportive government initiatives like infrastructure development and investment-friendly policies attract foreign and local investors, which further facilitates market growth.

The commercial real estate market in the Indonesia is projected to exhibit a CAGR of 6.95% during 2026-2034, reaching a value of USD 42.8 Billion by 2034.

Some of the major players in the indonesai commerical real estate market include Agung Podomoro Land, Ciputra Group, Duta Anggada Realty, Lippo Group, PP Properti (PT PP (Persero) Tbk), RDTX Group, and Sinar Mas Land (Sinar Mas), among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)