Indonesia Car Rental Market Size, Share, Trends and Forecast by Booking Type, Rental Duration, Application Type, and Region, 2026-2034

Indonesia Car Rental Market Size and Share:

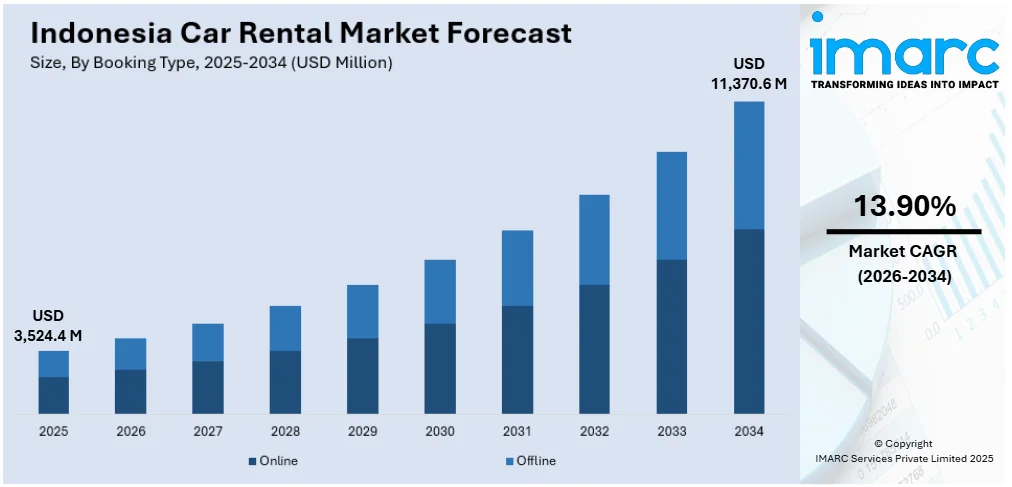

The Indonesia car rental market size was valued at USD 3,524.4 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 11,370.6 Million by 2034, exhibiting a CAGR of 13.90% from 2026-2034.The market is driven by corporate leasing requirements and urban mobility, while tourism is helping market propel further. Moreover, digital booking, growing infrastructure, and flexible rentals are increasing accessibility, and car rentals have become a preferred alternative for both short- and long-term transportation requirements, thereby favouring market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3,524.4 Million |

| Market Forecast in 2034 | USD 11,370.6 Million |

| Market Growth Rate (2026-2034) | 13.90% |

The Indonesia car rental market is expanding due to rising tourism, urbanization, and business travel. With Indonesia being a major tourist destination, demand for short-term and self-drive rentals is increasing, particularly in Bali, Jakarta, and Yogyakarta. For instance, as per industry reports, in 2024, Bali recorded 6,333,360 foreign tourist arrivals, reflecting a 20.10% increase from 5,273,258 visitors in 2023, highlighting the island’s growing appeal as a global travel destination. Additionally, corporate leasing and long-term rentals are gaining traction as businesses seek cost-effective fleet management solutions. Besides this, the government’s investments in infrastructure development, including airports and highways, are further driving demand for airport car rentals and intercity transport services.

To get more information on this market Request Sample

Technological advancements and digital transformation are also key market drivers. The rise of app-based car rentals and online booking platforms is improving accessibility and convenience, making rentals more attractive to both domestic and international customers. For instance, in February 2024, Sejasa introduced car rental services with drivers, allowing customers to choose vehicle types and rental durations with online payment options. Moreover, companies are integrating AI-driven pricing, real-time vehicle tracking, and contactless payment solutions to enhance customer experience and operational efficiency. Additionally, the growing focus on sustainability is pushing rental firms to expand their electric vehicle (EV) fleets, supported by government incentives and charging infrastructure expansion.

Indonesia Car Rental Market Trends:

Increasing Demand for Long-Term and Corporate Leasing Services

The Indonesia car rental market is seeing rising demand for long-term leasing and corporate rental services, driven by business expansion, employee mobility, and cost efficiency. Companies prefer leasing over ownership to reduce operational expenses, fleet maintenance costs, and depreciation risks. For instance, in 2023, Grab launched the Sahabat Sejati car rental initiative, supporting the growing demand for long-term leasing services in Indonesia. This program enables drivers to rent vehicles and gain ownership after five years, expanding access to ride-hailing opportunities. Additionally, government contracts and infrastructure projects contribute to the growth of fleet leasing services. Furthermore, rental companies are expanding service agreements, integrating telematics for fleet management, and offering customized leasing packages, strengthening their position in the corporate mobility segment.

Growing Integration of Digital Platforms and App-Based Rentals

The digital transformation of the Indonesia car rental market is accelerating, with companies leveraging mobile apps and online platforms for seamless booking, real-time vehicle tracking, and payment integration. Consumers prefer app-based rentals due to convenience, competitive pricing, and instant vehicle availability. For instance, as per industry reports, TRAC, an Indonesia-based car rental app, is gaining recognition for its streamlined digital platform, enabling users to book vehicles online. They provide easy reservation, payment, and order tracking through the TRAC website without requiring a physical visit. In addition, the rise of subscription-based car rentals and self-drive options is further expanding Indonesia car rental market share. Companies are enhancing user experience through digital innovations, ensuring efficient vehicle access for both domestic travelers and international tourists.

Expansion of Electric Vehicle (EV) Rental Services

The push for sustainability and government incentives for electric vehicles (EVs) are driving EV adoption in Indonesia’s car rental market. Rental companies are expanding their EV fleets to meet environmental regulations and growing consumer interest in green mobility. With charging infrastructure improving, demand for short-term and corporate EV rentals is increasing, particularly in urban centers and tourism hubs. Government policies promoting tax incentives and infrastructure development further support this shift. For instance, in February 2024, Indonesia’s Ministry of Finance announced the removal of luxury tax on electric vehicles for 2024 and waived import tax until 2025. Rental firms are partnering with automakers and energy providers to strengthen EV availability, ensuring a sustainable and eco-friendly transportation alternative for Indonesian consumers.

Indonesia Car Rental Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Indonesia car rental market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on booking type, rental duration, and application type.

Analysis by Booking Type:

- Online

- Offline

The rise of digital platforms has transformed Indonesia’s car rental market, making online booking the preferred choice for many consumers. Mobile apps and websites offer seamless reservations, price comparisons, and flexible rental options, enhancing convenience. Ride-hailing services and dedicated car rental platforms have expanded access, allowing customers to book vehicles instantly. Online transactions are further supported by digital payments and integrated GPS tracking, ensuring a smoother rental experience. This segment is driven by Indonesia’s growing internet penetration and smartphone adoption.

Traditional offline bookings remain relevant in Indonesia, particularly in smaller cities and rural areas where digital adoption is lower. Many customers still prefer visiting rental agencies directly to inspect vehicles and negotiate terms. Hotels, airports, and travel agencies also facilitate offline car rentals, especially for tourists who may not use digital platforms. Corporate clients often rely on offline agreements for long-term leases, benefiting from personalized services. Despite digital advancements, offline booking continues to serve key market segments needing in-person interaction.

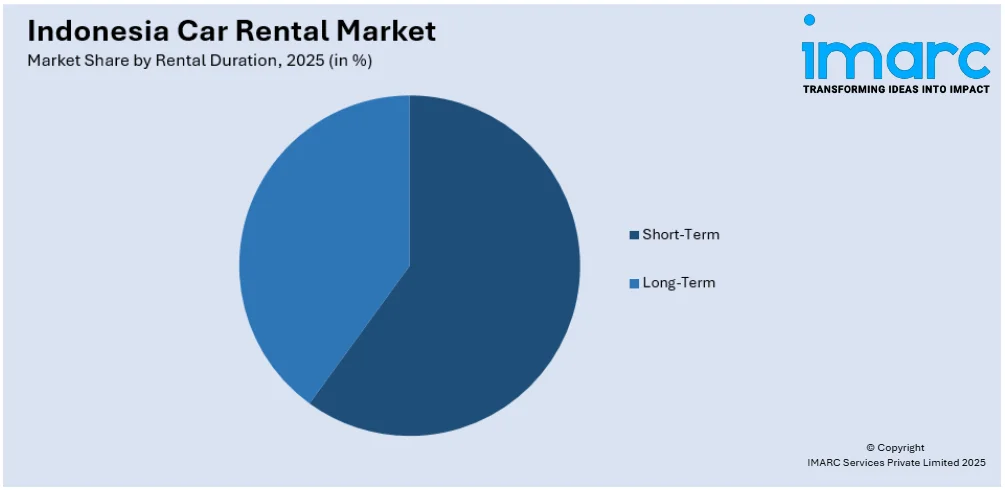

Analysis by Rental Duration:

Access the comprehensive market breakdown Request Sample

- Short-Term

- Long-Term

Short-term car rentals in Indonesia cater to tourists, business travelers, and residents seeking temporary transportation solutions. These rentals, typically ranging from a few hours to several days, are popular in major cities like Jakarta, Bali, and Surabaya, where visitors require flexible mobility options. Tourists exploring Indonesia’s islands, as well as corporate professionals attending meetings, often prefer short-term rentals for convenience. Ride-hailing companies and app-based rental platforms have also expanded the accessibility of short-term car rentals, enhancing customer convenience with seamless digital bookings.

Long-term car rentals are gaining traction in Indonesia, particularly among corporations, expatriates, and fleet management services. Businesses frequently lease vehicles for employees to avoid the costs and maintenance of ownership, while expatriates prefer long-term rentals for extended stays. Leasing companies offer customized packages, including insurance and maintenance, making these solutions cost-effective for individuals and companies. The increasing demand for corporate mobility solutions, coupled with infrastructure expansion, is driving the growth of long-term rentals as a practical alternative to ownership.

Analysis by Application Type:

- Tourism

- Commuting

Tourism is a key driver of Indonesia’s car rental market, particularly in popular destinations like Bali, Yogyakarta, and Lombok. International and domestic tourists frequently opt for rental services to explore remote beaches, cultural landmarks, and national parks with greater flexibility. Self-drive rentals and chauffeur-driven services cater to varying preferences, while premium vehicle options appeal to high-end travelers. The rise of eco-tourism and adventure tourism has also increased demand for SUVs and off-road vehicles for exploring rugged terrains and rural areas.

Commuting-based car rentals are gaining traction in Indonesia, particularly in urban centers like Jakarta, Surabaya, and Bandung, where traffic congestion and limited public transport options encourage alternative mobility solutions. Long-term rentals and corporate leasing services provide cost-effective solutions for professionals and expatriates requiring daily transportation. Ride-hailing services and flexible rental plans cater to individuals who prefer on-demand access to private vehicles without ownership costs. As Indonesia’s workforce grows, commuting rentals are becoming an integral part of urban mobility.

Regional Analysis:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

Java holds prominence in Indonesia’s car rental market due to its high population density, economic significance, and major urban centers like Jakarta, Surabaya, and Bandung. Business travel, tourism, and daily commuting drive rental demand, particularly in metropolitan areas where traffic congestion and parking limitations make short-term rentals and chauffeur-driven services popular. Corporate leasing is also expanding as businesses seek cost-effective mobility solutions. Java’s well-developed transportation infrastructure, including toll roads and airports, supports intercity rentals, catering to both domestic and international travelers.

Sumatra’s car rental market is fueled by tourism, agriculture, and industrial activities, with cities like Medan, Palembang, and Padang serving as key rental hubs. The island’s vast plantations, mining operations, and expanding infrastructure projects create demand for commercial vehicle rentals, including trucks and utility vehicles. Tourist destinations like Lake Toba and Bukit Lawang drive demand for self-drive and chauffeur-driven services. Limited public transport options in rural areas also encourage long-term car rentals, making rental services essential for business and leisure travelers.

Kalimantan’s car rental market is shaped by its resource-based economy, including forestry, palm oil, and mining industries. With underdeveloped public transport, rental services are crucial for business operations and government agencies. Major cities like Balikpapan and Samarinda experience steady demand for corporate leasing, particularly from oil and gas companies. The region’s ecotourism sector, including destinations like Tanjung Puting National Park, supports car rental growth, with visitors opting for SUVs and off-road vehicles suited for Kalimantan’s rugged terrain.

Sulawesi’s car rental market is expanding due to economic growth, tourism, and industrial development. Cities like Makassar and Manado serve as major rental hubs, catering to business travelers, government officials, and tourists exploring Bunaken and Tana Toraja. The growing nickel mining sector and infrastructure projects fuel demand for corporate leasing and utility vehicles. With public transport options limited outside urban centers, car rentals remain a preferred mobility choice, particularly for long-distance travel across Sulawesi’s mountainous terrain and coastal areas.

Competitive Landscape:

The Indonesia car rental market is highly competitive, driven by tourism growth, urban mobility demand, and business travel. Major players, including local operators and international companies, compete through fleet expansion, digital platforms, and service differentiation. Additionally, government initiatives promoting sustainable mobility and EV adoption influence market dynamics. For instance, in December 2024, Indonesia government announced plans to provide tax incentives to manufacturers, including China’s BYD and GAC Aion, and France’s Citroën, to strengthen electric vehicle production and sales in the country’s growing EV market, significantly influencing competition in car rental market. In addition, companies focus on technology integration, competitive pricing, and customer experience enhancements to gain an edge.

The report provides a comprehensive analysis of the competitive landscape in the Indonesia car rental market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2023, Sumitomo Mitsui Auto Service and Sumitomo Corporation launched PT. SMAS Mobility Indonesia to expand vehicle rental and fleet management services. This development aims strengthens Indonesia’s car rental market by meeting rising corporate demand, enhancing fleet solutions, and supporting global companies entering the market.

- In October 2024, Sabre Corporation announced its prolonging partnership with Indonesia’s tiket.com, enhancing flight options, travel inventory, secure payments, and automation tools, including car rental services.

Indonesia Car Rental Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Booking Types Covered | Online, Offline |

| Rental Durations Covered | Short-Term, Long-Term |

| Application Types Covered | Tourism, Commuting |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia car rental market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Indonesia car rental market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia car rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Indonesia car rental market was valued at USD 3,524.4 Million in 2025.

The market is driven by rising tourism, a robust domestic travel sector, and growing urban populations. Increased disposable incomes, enhanced transportation infrastructure, and the convenience of digital booking platforms are further boosting demand for rental vehicles across the country.

IMARC estimates the global Indonesia car rental market to reach USD 11,370.6 Million in 2034, exhibiting a CAGR of 13.90% during 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)