Indonesia Biopesticides Market Size, Share, Trends and Forecast by Product, Mode of Application, Application, and Region, 2026-2034

Market Overview:

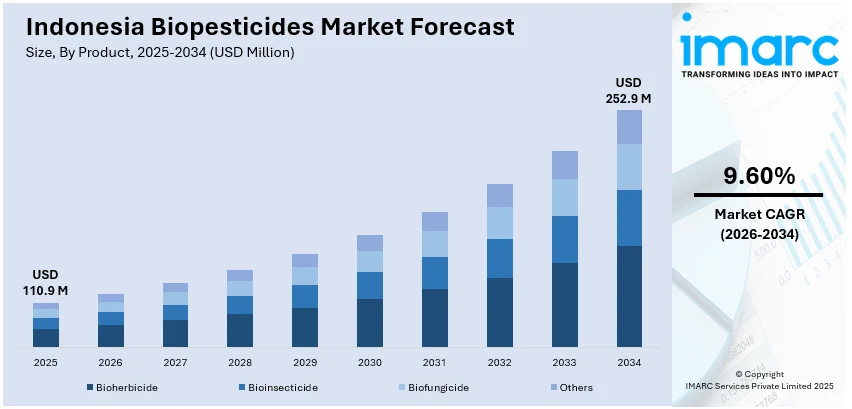

Indonesia biopesticides market size reached USD 110.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 252.9 Million by 2034, exhibiting a growth rate (CAGR) of 9.60% during 2026-2034. The increasing environmental awareness, regulatory support for sustainable farming, demand for organic produce, pesticide resistance, partnerships and research, biodiversity resources, and a growing emphasis on sustainable agriculture and integrated pest management represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 110.9 Million |

| Market Forecast in 2034 | USD 252.9 Million |

| Market Growth Rate (2026-2034) | 9.60% |

Biopesticides are a class of environmentally friendly and sustainable pest management solutions derived from natural sources or living organisms to control pests, diseases, and weeds that harm crops and ecosystems. Unlike traditional chemical pesticides, which often have adverse environmental and health impacts, biopesticides offer a safer and more eco-friendly alternative. There are three primary categories of biopesticides: microbial, plant-incorporated protectants (PIPs), and biochemical pesticides. Microbial pesticides contain beneficial microorganisms like bacteria, fungi, or viruses that target specific pests or pathogens. Meanwhile, PIPs are pesticides synthesized within genetically modified crops to defend against pests, and biochemical pesticides consist of naturally occurring substances, like pheromones or neem oil, which serve to disrupt the behavior or growth of pests. Biopesticides offer several advantages, including minimal harm to non-target species, reduced chemical residues in crops, and a lower risk of pesticide resistance development in pests. As a result, biopesticides play a crucial role in sustainable agriculture, integrated pest management strategies, and the overall effort to reduce the environmental impact of conventional chemical pesticides while ensuring food security and environmental health.

To get more information on this market Request Sample

Indonesia Biopesticides Market Trends:

The increased awareness of the environmental and health impacts of chemical pesticides is primarily driving the global demand for biopesticides. Besides this, stringent regulatory measures imposed by the Indonesian government to reduce chemical pesticide use and promote sustainable farming practices have played a pivotal role in encouraging the adoption of biopesticides. Moreover, the rising demand for organic and sustainably grown produce, with consumers increasingly concerned about food safety and quality, has created a robust market for biopesticides, strengthening the market growth. In line with this, the escalating threat of pesticide resistance among pests necessitating a shift towards biopesticides, which typically have different modes of action, is contributing to the market growth. Concurrently, Indonesia's vast agricultural sector is acting as another significant growth-inducing factor, with crops like palm oil, rice, and rubber benefiting from biopesticide applications to meet export standards and adhere to international sustainability agreements. In addition to this, increasing collaborations between government agencies, research institutions, and the private sector, spurring innovation and development in the biopesticide industry is presenting lucrative opportunities for market expansion. Furthermore, the accessibility of funding and grants for agricultural research and biopesticide production has boosted the market growth, facilitating the development and commercialization of new products. Apart from this, Indonesia's rich biodiversity provides a vast source of potential biopesticide agents, from plant extracts to microbial organisms, which can be harnessed for pest management, which is creating a positive outlook for market expansion.

Indonesia Biopesticides Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product, mode of application, and application.

Product Insights:

- Bioherbicide

- Bioinsecticide

- Biofungicide

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes bioherbicide, bioinsecticide, biofungicide, and others.

Mode of Application Insights:

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Post-harvest

A detailed breakup and analysis of the market based on the mode of application have also been provided in the report. This includes foliar spray, seed treatment, soil treatment, and post-harvest.

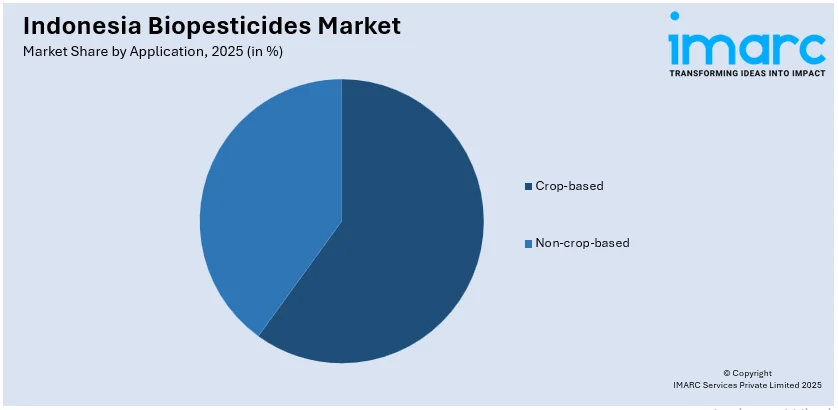

Application Insights:

Access the comprehensive market breakdown Request Sample

- Crop-based

- Non-crop-based

The report has provided a detailed breakup and analysis of the market based on the application. This includes crop-based and non-crop-based.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Biopesticides Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bioherbicide, Bioinsecticide, Biofungicide, Others |

| Modes of Application Covered | Foliar Spray, Seed Treatment, Soil Treatment, Post-harvest |

| Applications Covered | Crop-based, Non-crop-based |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia biopesticides market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia biopesticides market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia biopesticides industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biopesticides market in Indonesia was valued at USD 110.9 Million in 2025.

The Indonesia biopesticides market is projected to exhibit a CAGR of 9.60% during 2026-2034, reaching a value of USD 252.9 Million by 2034.

Indonesia’s biopesticides market is driven by growing awareness of chemical pesticide risks, government promotion of sustainable farming, increasing demand for organic products, and the country’s rich biodiversity that supports development of natural pest control solutions. Export-oriented agriculture also encourages safer, eco-friendly alternatives to meet international standards and consumer preferences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)