Indian Wallpaper Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End-User, and Region, 2025-2033

Market Overview:

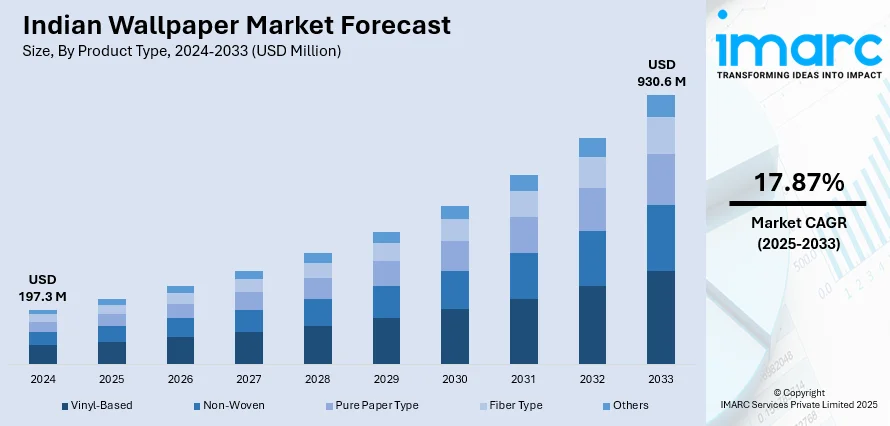

The Indian wallpaper market size reached USD 197.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 930.6 Million by 2033, exhibiting a growth rate (CAGR) of 17.87% during 2025-2033. The growing trend of home renovation activities, rising demand for decorative walls, and increasing utilization due to the ability to paste on any surface represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 197.3 Million |

|

Market Forecast in 2033

|

USD 930.6 Million |

| Market Growth Rate 2025-2033 | 17.87% |

Wallpaper refers to a thick colored or patterned paper that comprises vinyl-based, non-woven, pure paper type, fiber glass, and bamboo wallpaper. It is widely available in different graphic patterns, sizes, textures, colors, and shapes to improve the appearance of a wall. It is easily peelable, highly durable, washable, and scrubbable with a brush and a detergent solution. It is cost-effective, offers longevity, and has a longer life span as compared to paint. It has abrasion resistance and stain resistance properties, which easily removes grease, butter, and coffee stains. It provides colorfastness by resisting change and loss of color due to exposure to light. It assists in preventing the growth of various harmful bacteria and fungi due to its antibacterial properties. Besides this, it aids in covering damaged, cracked, and uneven walls while providing an aesthetic look to the area. As a result, it is employed in the residential, administrative, and commercial sectors across India.

To get more information on this market, Request Sample

Indian Wallpaper Market Trends:

At present, the rising trend of home renovation activities due to inflating income levels of individuals represent one of the primary factors impelling the growth of the market in India. Besides this, the growing demand for decorative walls on account of the changing lifestyles and modernization among consumers is offering a positive market outlook. Additionally, there is a rise in the utilization of wallpapers, as they have the ability to paste on any surface, such as plaster, painted surfaces, prefabricated panels, concrete, and brick. This, coupled with the increasing popularity of customized wallpapers on account of the rising do-it-yourself (DIY) trend among individuals, is propelling the growth of the market in the country. Apart from this, the escalating demand for eco-friendly decorative options due to the increasing awareness among consumers about harmful chemicals in paints is offering lucrative growth opportunities to industry investors in the country. Moreover, the rising adoption of non-woven wallpapers, as they have tear-resistant qualities that make installation and removal easier, is supporting the growth of the market. In addition, the growing utilization of removable wallpapers among renters to decorate the walls without destroying the original paint is positively influencing the market. Furthermore, the introduction of graphic design and new production methods for designing wallpapers are strengthening the market growth in India.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Indian wallpaper market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product type, distribution channel and end-user.

Product Type Insights:

- Vinyl-Based

- Non-Woven

- Pure Paper Type

- Fiber Type

- Others

The report has provided a detailed breakup and analysis of the Indian wallpaper market based on the product type. This includes vinyl-based, non-woven, pure paper type, fiber type, and others.

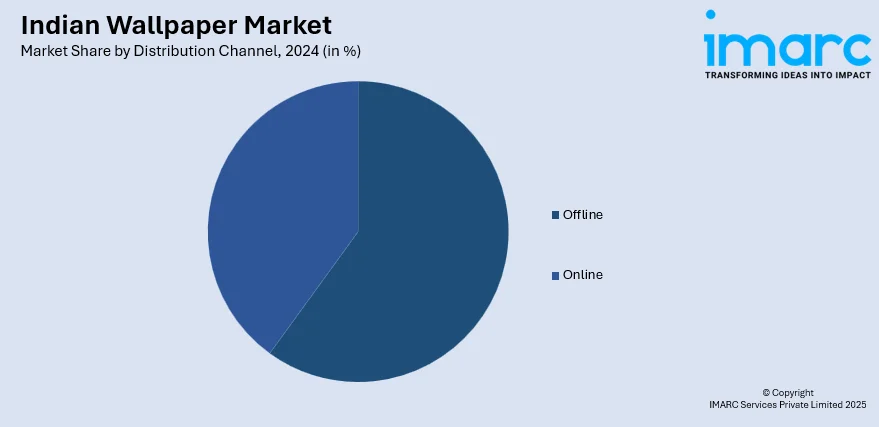

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the Indian wallpaper market based on the distribution channel has also been provided in the report. This includes offline and online.

End-User Insights:

- Residential

- Commercial

A detailed breakup and analysis of the Indian wallpaper market based on the end-user has also been provided in the report. This includes residential and commercial.

Regional Insights:

- North India

- West and Central India

- South India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East India.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the Indian wallpaper market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Product Type, Distribution Channel, End-User, Region |

| Region Covered | North India, East India, West and Central India, South India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indian wallpaper market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Indian wallpaper market.

- The study maps the leading, as well as the fastest-growing, regional markets

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indian wallpaper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Indian wallpaper market was valued at USD 197.3 Million in 2024.

We expect the Indian wallpaper market to exhibit a CAGR of 17.87% during 2025-2033.

The emerging trend of home renovation activities, along with the rising demand for removable wallpapers among renters to decorate the walls without destroying the original paint, is primarily driving the Indian wallpaper market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of wallpapers across the nation.

Based on the product type, the Indian wallpaper market can be bifurcated into vinyl-based, non-woven, pure paper type, fiber type, and others. Currently, vinyl-based holds the majority of the total market share.

Based on the distribution channel, the Indian wallpaper market has been segmented into offline and online, where offline currently exhibits a clear dominance in the market.

Based on the end-user, the Indian wallpaper market can be divided into residential and commercial. Currently, commercial accounts for the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where North India currently dominates the Indian wallpaper market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)