Indian Sports and Fitness Goods Market Size, Share, Trends and Forecast by Product Type, Fitness Goods, Cardiovascular Training Goods, End-Use, and Region, 2025-2033

Market Outlook 2025-2033:

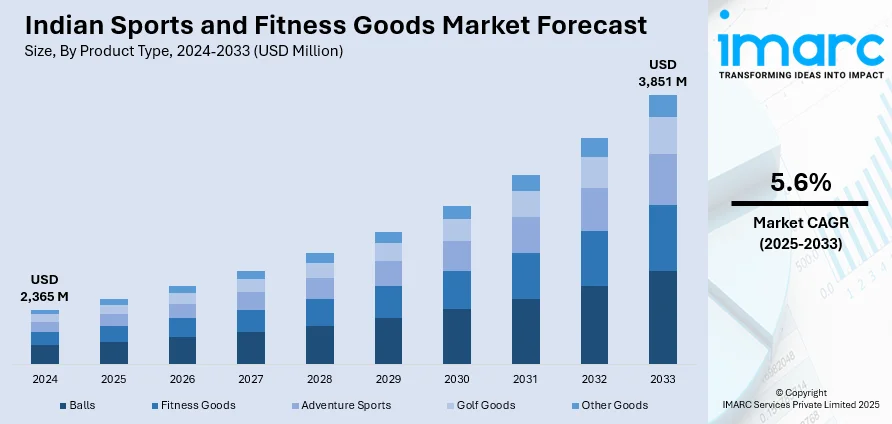

The Indian sports and fitness goods market size reached USD 2,365 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,851 Million by 2033, exhibiting a growth rate (CAGR) of 5.6% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2,365 Million |

|

Market Forecast in 2033

|

USD 3,851 Million |

| Market Growth Rate 2025-2033 | 5.6% |

Sports goods refer to equipment and clothes that are required for participating in sports and preventing related injuries. On the other hand, fitness goods are a subset of sports goods, which are employed during workouts. These goods are widely utilized as they aid in maintaining overall fitness, improving flexibility, muscle strength, and cardiovascular and pulmonary health of an individual. In recent years, with the increasing focus on fitness, various institutions in India are encouraging people to actively participate in physical activities.

To get more information of this market, Request Sample

Due to the rising prevalence of lifestyle diseases, such as obesity, stroke, type 2 diabetes, heart disease and atherosclerosis, individuals in India have started focusing on their wellbeing. As a result, there is a rise in the number of gyms and fitness centers, which in turn is boosting the sales of sports and fitness goods in the country. Social media is acting as another catalyst in driving the growth of the market. Through social media channels, such as Facebook, Instagram and Twitter, sports and fitness product manufacturers are directly communicating with the audience. They are also using these platforms to advertise, thereby informing the potential customers about the specifications and functionalities of their products. Furthermore, the market is increasingly being driven by innovations in manufacturing technologies and domestic as well as international brands are offering a variety of advanced equipment. Some of these products include smart tennis racquets, speed training equipment, motorized treadmills and fitness bands.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Indian sports and fitness goods market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product type, fitness goods, cardiovascular training goods and end-use.

Breakup by Product Type:

- Balls

- Fitness Goods

- Adventure Sports

- Golf Goods

- Other Goods

At present, Fitness Goods represent the most popular product type, owing to the growing popularity of sports, such as squash, hockey, cricket, tennis, bowling, table tennis, football, volleyball, basketball, dodge ball and handball. In addition to this, upcoming international sports events in India, such as Men’s and Women’s Hockey World League, and Women’s World T20, will further bolster the market growth.

Breakup by Fitness Goods:

- Cardiovascular Training Goods

- Strength Training Goods

Cardiovascular training goods account for the majority of the total market share as they help in increasing muscular endurance and improving the performance of the heart and lungs. This further aids in efficiently distributing the blood and oxygen to the rest of the body.

Breakup by Cardiovascular Training Goods:

- Treadmills

- Stationary Bikes

- Rowing Machines

- Ellipticals

- Others

Treadmills currently exhibit a clear dominance in the market as they provide an efficient aerobic workout that can be done without expert guidance.

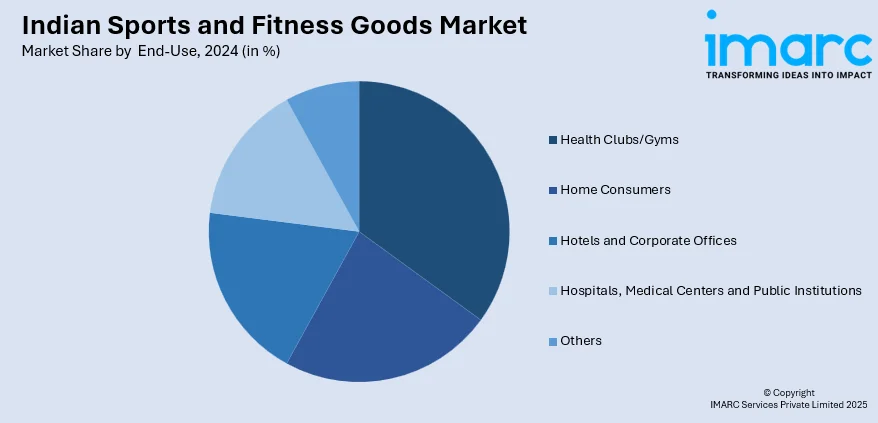

Breakup by End-Use:

- Health Clubs/Gyms

- Home Consumers

- Hotels and Corporate Offices

- Hospitals, Medical Centers and Public Institutions

- Others

Health clubs/gyms hold the leading market share, owing to the high obesity rates and rising incidences of lifestyle diseases, which have increased the health consciousness among individuals.

Regional Insights:

- West and Central India

- North India

- South India

- East India

On the geographical front, West and Central India represent the largest market. This can be attributed to the rapid urbanization and increasing per capita income in the region.

Competitive Landscape:

The competitive landscape of the market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Some of these players are:

- Bhalla International

- Cosco (India) Limited

- Nivia Sports (Freewill Sports Pvt Ltd)

- Sanspareils Greenlands Pvt. Ltd.

- Sareen Sports Industries Private Limited

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Product Type, Fitness Goods, Cardiovascular Training Goods, End-Use, Region |

| Region Covered | West and Central India, North India, South India, East India |

| Companies Covered | Bhalla International, Cosco (India) Limited, Nivia Sports (Freewill Sports Pvt Ltd), Sanspareils Greenlands Pvt. Ltd., Sareen Sports Industries Private Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indian sports and fitness goods market was valued at USD 2,365 Million in 2024.

We expect the Indian sports and fitness goods market to exhibit a CAGR of 5.6% during 2025-2033.

The rising adoption of sports and fitness goods, as they assist in improving flexibility, muscle strength, cardiovascular and pulmonary health of an individual, etc., is primarily driving the Indian sports and fitness goods market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary closure of gyms and fitness centers, thereby negatively impacting the Indian market for sports and fitness goods.

Based on the product type, the Indian sports and fitness goods market has been bifurcated into balls, fitness goods, adventure sports, golf goods, and other goods. Currently, fitness goods hold the majority of the total market share.

Based on the fitness goods, the Indian sports and fitness goods market can be divided into cardiovascular training goods and strength training goods, where cardiovascular training goods currently exhibit a clear dominance in the market.

Based on the cardiovascular training goods, the Indian sports and fitness goods market has been categorized into treadmills, stationary bikes, rowing machines, ellipticals, and others. Among these, treadmills account for the majority of the total market share.

Based on the end-use, the Indian sports and fitness goods market can be segmented into health clubs/gyms, home consumers, hotels and corporate offices, hospitals, medical centers and public institutions, and others. Currently, health clubs/gyms hold the largest market share.

On a regional level, the market has been classified into West and Central India, North India, South India, and East India, where West and Central India dominates the Indian sports and fitness goods market.

Some of the major players in the Indian sports and fitness goods market include Cosco (India) Limited, Nivia Sports Private Limited (Freewill Sports Pvt. Ltd.), Bhalla International – Vinex Sports, Sareen Sports Industries, Sansparelis Greenland Private Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)