Indian Solar Electric System and Inverter Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033

Market Overview 2025-2033:

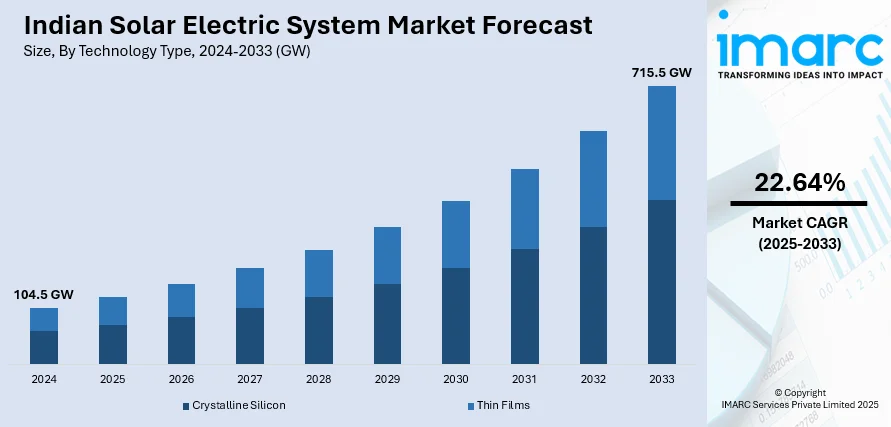

The Indian solar electric system and inverter market size reached 104.5 GW in 2024. Looking forward, IMARC Group expects the market to reach 715.5 GW by 2033, exhibiting a growth rate (CAGR) of 22.64% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

104.5 GW |

|

Market Forecast in 2033

|

715.5 GW |

| Market Growth Rate 2025-2033 | 22.64% |

A solar panel refers to a collection of solar cells which is employed to generate electricity using sunlight as the energy source. A solar inverter, on the other hand, is a device which helps in converting the direct current produced by the solar panels into alternating current. This current is then supplied to either storage batteries, power grids or houses for operating various appliances. Several efforts are being made by the Government of India to harness renewable sources, such as wind, solar, geothermal, etc. for energy production due to their easy availability. Amongst these, solar power is amongst the fastest developing segment, owing to the suitable geographical location of India which offers an ample supply of sunlight throughout the year.

To get more information of this market, Request Sample

Indian Solar Electric System and Inverter Market Trends:

- The Indian government is encouraging the use of renewable sources of energy like solar, wind, etc. so as to decrease the dependency on non-renewable sources and reduce their carbon footprint. As a result, the Government has undertaken several initiatives including the Solar Rooftop Scheme, Jawaharlal Nehru National Solar Mission and Solar Energy Subsidy Scheme which are catalyzing the demand for solar power systems in the region.

- Solar power systems are currently available in various forms such as off-grid solar power system, grid inter-tied solar power system with battery backup, and grid inter-tied solar power system without battery backup. According to their requirements, the consumers can easily choose from these varieties and install the system in their houses or office buildings.

- Due to its location between the Tropic of Cancer and the Equator, India has an average annual temperature that ranges from 25 degree Celsius to 27 degree Celsius. Owing to this, the country has a huge potential for solar power generation. As per government estimations, India receives solar radiation of about 5,000tn kWh per year. This, coupled with the availability of barren land, increases the feasibility of solar energy systems in the country.

- Although, the initial cost for setting up a solar power system is very high, the maintenance cost associated with solar products is relatively low. Moreover, there is no professional operator required to run the system, unlike the conventional power system.

- Decreasing prices of equipment used for solar panel manufacturing has significantly reduced the overall cost of solar PV panels, enabling solar power companies to expand their capacities.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Indian solar electric system and inverter market report, along with forecasts at the country and state levels from 2025-2033. Our report has categorized the market based on technology type, installation type and inverter type.

Solar Electric System Market

Breakup by Technology Type:

- Crystalline Silicon

- Thin Films

On the basis of technology type, the market has been segmented into crystalline silicon and thin films. Amongst these, crystalline silicon (c-Si) represents the bigger segment.

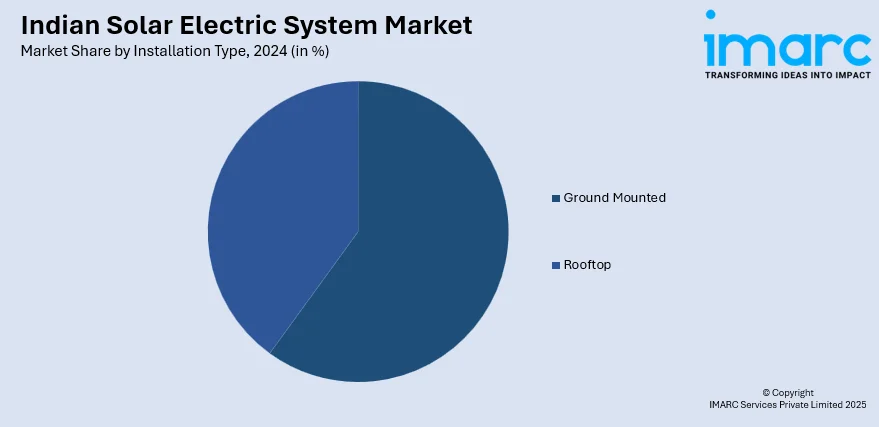

Breakup by Installation Type:

- Ground Mounted

- Rooftop

Based on the installation type, ground mounted solar panels exhibit a clear dominance, accounting for the majority of the total market. This can be attributed to their advantages, such as easy installation, productivity and easy accessibility for cleaning and maintenance.

Regional Insights:

- Telangana

- Rajasthan

- Andhra Pradesh

- Tamil Nadu

- Karnataka

- Gujarat

- Others

Region-wise, the market has been divided into Telangana, Rajasthan, Andhra Pradesh, Tamil Nadu, Karnataka, Gujarat and others. Amongst these, Telangana holds the largest market share owing to several initiatives by the State Government under the ‘Telangana Solar Power Policy 2015’.

Solar Inverter Market

Breakup by Inverter Type:

- Central Inverter

- String Inverter

- Others

On the basis of inverter type, central inverters represent the biggest segment, holding the largest market share. This can be attributed to the advantages offered by these inverters like high efficiency, low cost, credibility and easy installation.

Regional Insights:

- Telangana

- Tamil Nadu

- Rajasthan

- Andhra Pradesh

- Gujarat

- Karnataka

- Others

On a geographical front, Telangana represents the leading market for solar power inverters. Upcoming construction of floating solar power plants in Himayathsagar and Osmansagar are expected to propel the growth of the market.

Competitive Landscape:

-

- Vikram Solar Pvt Ltd

- Waree Solar Energy Pvt Ltd

- Adani Enterprises Ltd

- Goldi Green Technologies Pvt Ltd

- Tata Power Solar Systems Ltd

- Moser Baer Solar Ltd

- XL Energy Ltd

- Solar Semiconductor Pvt Ltd

- Emmvee Photovoltaics Pvt Ltd

- Navitas Green Solutions Pvt Ltd

- Solar Inverter

- ABB

- TMEIC

- SMA

- Hitachi

- Sungrow Power Supply Co., LTD.

- Huawei

- Schneider Electric

This report provides a deep insight into the Indian solar electric system and solar inverter market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the solar electric system and solar inverter industry in any manner.

Key Questions Answered in This Report

The Indian solar electric system and inverter market reached a volume of 104.5 GW in 2024.

We expect the Indian solar electric system and inverter market to exhibit a CAGR of 22.64% during 2025-2033.

The increasing adoption of energy-efficient appliances, along with the launch of several initiatives by the Indian government for encouraging the use of renewable sources of energy, is catalyzing the Indian solar electric system and inverter market.

Sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation resulting in temporary halt in the installation activities for solar electric system and inverter.

Based on the technology type, the Indian solar electric system market can be segmented into crystalline silicon and thin films. Currently, crystalline silicon (c-Si) technology holds the largest market share.

Based on the installation type, the Indian solar electric system market has been divided into ground mounted and rooftop, where ground mounted solar panels currently exhibit a clear dominance in the market.

Based on the inverter type, the Indian solar inverter market can be categorized into central inverters, string inverters, and others. Among these, central inverters account for the majority of the total market share.

On a regional level, the market has been classified into Telangana, Rajasthan, Andhra Pradesh, Tamil Nadu, Karnataka, Gujarat, and others, where Telangana currently dominates the Indian solar electric system and inverter market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)