Indian Smart Lighting Market Size, Share, Trends and Forecast by Offering, Communication Technology, Installation Type, Light Source, Application, and Region, 2025-2033

Market Overview:

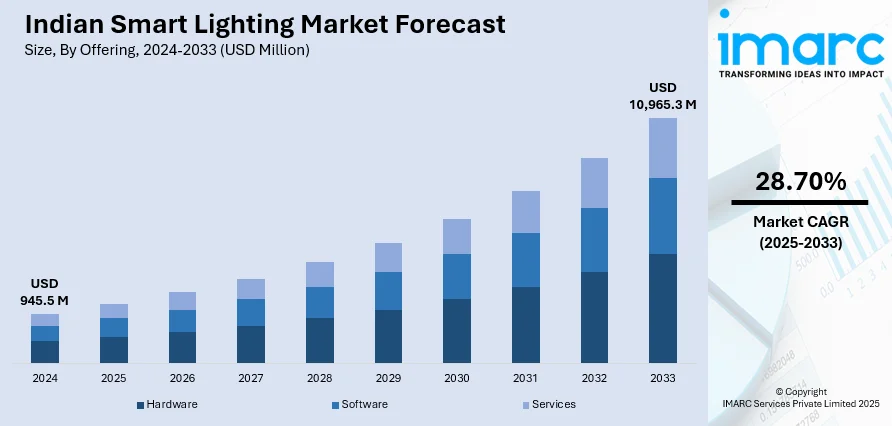

The Indian smart lighting market size reached USD 945.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 10,965.3 Million by 2033, exhibiting a growth rate (CAGR) of 28.70% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 945.5 Million |

|

Market Forecast in 2033

|

USD 10,965.3 Million |

| Market Growth Rate 2025-2033 | 28.70% |

Smart lighting is an innovative technology that is replacing conventional lightings such as incandescent bulbs, halogens, CFLs, etc. with more efficient LED lights and sensors for energy conservation. With India being the second most populated country in the world and one of the largest consumers of electricity, it has been witnessing an increasing electricity demand-supply gap. This has resulted in regular power shortages and blackouts across the country. The lighting sector currently accounts for around 18% of the total electricity consumption in India. As a result, the government is playing an active role in replacing the current lighting sector with more energy efficient products. This is expected to drive the market for smart lighting in India.

To get more information of this market, Request Sample

Apart from reducing energy consumption and cutting electricity costs, smart lighting also offers numerous other advantages to end users. Instead of using switches and push-buttons, smart lights use motion sensors which can automatically switch the lights on and off when the consumer enters or leaves a room. Moreover, smart light bulbs use LEDs that can be adjusted using a smart phone so that it can change color according to the user’s requirements and can also be switched on and off from a remote location. Some of the other major factors driving the smart light market in India include increasing affordability of smart lights, technological advancements, development of various smart cities, increasing awareness levels, etc.

IMARC Group’s latest report provides a deep insight into the Indian smart lighting market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the smart lighting market in India in any manner.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Indian smart lighting market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on offering, communication technology, installation type, light source and application.

Breakup by Offering:

- Hardware

- Lights and Luminaires

- Lighting Controls

- Software

- Services

- Design and Engineering

- Installation

- Post-Installation

Breakup by Communication Technology:

- Wired Technology

- Wireless Technology

Breakup by Installation Type:

- New Installation

- Retrofit Installation

Breakup by Light Source:

- LED Lamps

- Fluorescent Lamps

- Compact Fluorescent Lamps

- High Intensity Discharge Lamps

- Others

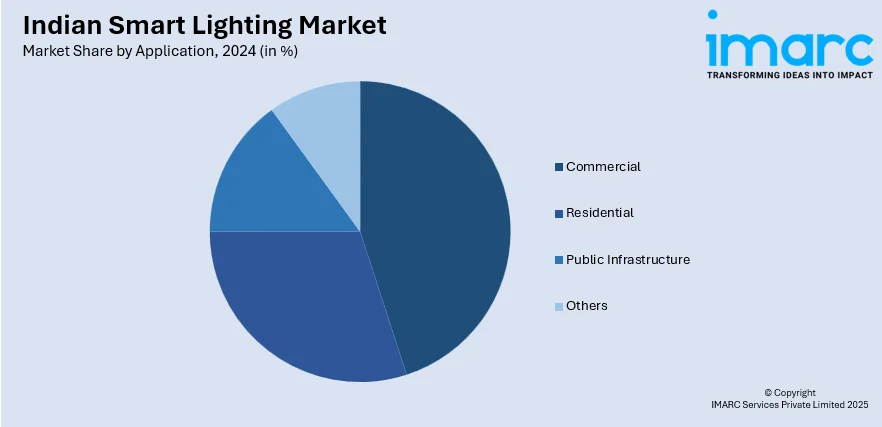

Breakup by Application:

- Commercial

- Residential

- Public Infrastructure

- Others

Breakup by Region:

- North India

- East India

- West and Central India

- South India

Value Chain Analysis

Key Drivers and Challenges

Porters Five Forces Analysis

PESTEL Analysis

Government Regulations

Competitive Landscape:

The report provides a comprehensive analysis of the competitive landscape in the Indian smart lighting market with detailed profiles of all major companies, including:

- Bajaj Electricals Ltd

- Crescent Lighting

- Crompton Greaves Consumer Electricals Limited

- Havells India Ltd

- Jaquar India

- Signify Holding

- Syska

- Wipro Lighting

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Offering, Communication Technology, Installation Type, Light Source, Application, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Bajaj Electricals Ltd, Crescent Lighting, Crompton Greaves Consumer Electricals Limited, Havells India Ltd, Jaquar India, Signify Holding, Syska, Wipro Lighting, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

We expect the Indian smart lighting market to exhibit a CAGR of 28.70% during 2025-2033.

The rising development of various smart cities, along with the growing demand for energy-efficient lighting solutions, such as smart lightings, that enable automated control for smooth operations and reduce power consumption, is primarily driving the Indian smart lighting market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary closure of numerous manufacturing units for smart lightings.

Based on the offering, the Indian smart lighting market has been segregated into hardware, software, and services. Currently, hardware accounts for the largest market share.

Based on the communication technology, the Indian smart lighting market can be divided into wired technology and wireless technology, where wired technology currently exhibits a clear dominance in the market.

Based on the light source, the Indian smart lighting market has been segmented into LED lamps, fluorescent lamps, compact fluorescent lamps, high intensity discharge lamps, and others. Currently, LED lamps hold the majority of the total market share.

Based on the application, the Indian smart lighting market can be bifurcated into commercial, residential, public infrastructure, and others. Among these, the commercial sector currently exhibits a clear dominance in the market.

On a regional level, the market has been classified into North India, East India, West and Central India, and South India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)