Indian Shrimp Market Size, Share, Trends and Forecast by Species, Shrimp Size, and State, 2026-2034

Indian Shrimp Market Summary:

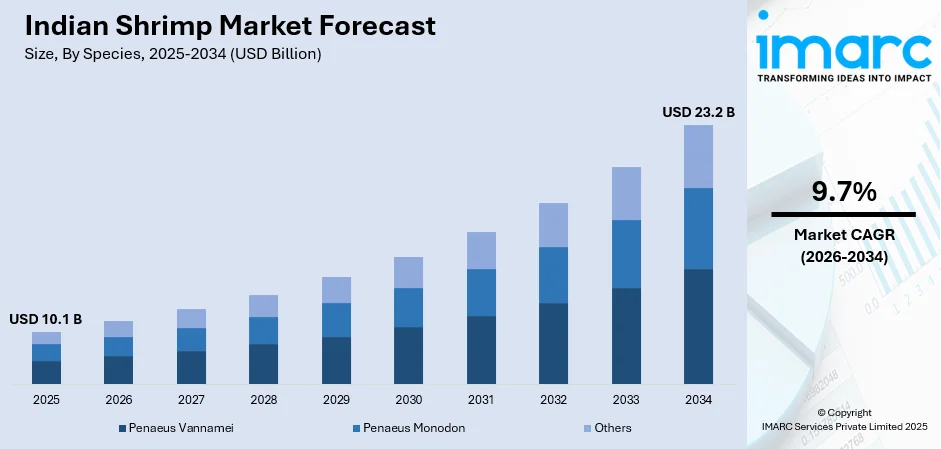

The Indian shrimp market size was valued at USD 10.1 Billion in 2025 and is projected to reach USD 23.2 Billion by 2034, growing at a compound annual growth rate of 9.7% from 2026-2034.

The Indian shrimp market is experiencing robust expansion driven by escalating global demand for protein-rich seafood and the country's established position as the world's second-largest shrimp producer and exporter. Favorable coastal geography, advancing aquaculture technologies, and supportive government initiatives continue to strengthen production capabilities. Rising health consciousness among consumers worldwide, combined with competitive pricing and compliance with international quality standards, is propelling India's prominence in the global shrimp trade and driving the Indian shrimp market share.

Key Takeaways and Insights:

-

By Species: Penaeus vannamei dominates the market with a share of 72.15% in 2025, driven by its fast growth rate, high reproductive capacity, and adaptability to diverse aquaculture systems across coastal farming regions.

-

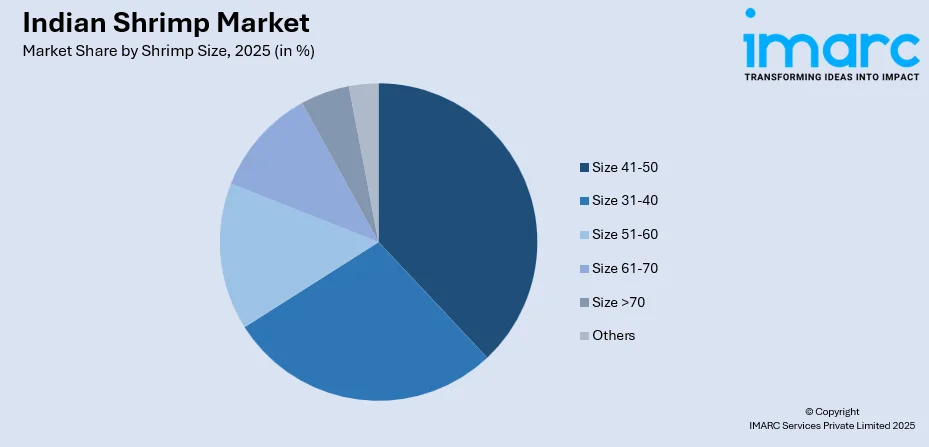

By Shrimp Size: Size 41-50 leads the market with a share of 21.84% in 2025, owing to its versatile culinary applications, optimal balance between portion size and consumer preference for grilling, frying, and value-added preparations.

-

By State: Andhra Pradesh represents the largest segment with a market share of 78% in 2025, attributed to its extensive coastline, favorable climatic conditions, established aquaculture infrastructure, and skilled farming workforce.

-

Key Players: The Indian shrimp market exhibits a moderately fragmented competitive structure, with established processors and exporters investing in modern processing technologies, value-added product development, sustainability certifications, and strategic export market diversification to strengthen their global positioning. Some of the key players operating in the market include Nekkanti Seafoods, Avanti Frozen Foods Private Limited, Devi Sea Foods Limited, Falcon Marine Exports Ltd., BMR Group, Baby Marine Eastern Exports, Sandhya Marines, Apex Frozen Foods Limited, Ananda Aqua Exports Private Limited, Crystal Sea Foods Private Limited, Citrus Alpha Marine LLP, Jaya Lakshmi Sea Foods Private Limited, Ifb Agro Industries Limited, S.S.F Limited, A.M.Fisheries, JRJ Sea Foods India Private Limited, Anjaneya Sea Foods, Kings Infra Ventures Limited, Kadalkanny Frozen Foods, The Waterbase Limited, Geo Sea Foods Exports Private Limited, Abad Fisheries Private Limited, K V Marine Exports, Liberty Group of Seafood Companies (Premier Marine Foods, Kader Exports Private Limited, Liberty Frozen Foods Private Limited, and Devi Marine Foods Exports Private Limited), Zeal Aqua Limited, Frontline Exports Private Limited, Jude Foods India Private Limited, etc.

To get more information on this market Request Sample

The Indian shrimp market continues to solidify its global standing through strategic investments in aquaculture infrastructure and processing capabilities. The country’s extensive coastline offers abundant brackish water resources, creating favorable conditions for shrimp cultivation, especially in coastal regions. Key competitive advantages include cost-efficient labor, well-established supply chains, and the increasing use of disease-free broodstock programs, which improve productivity and overall production efficiency in aquaculture operations. These factors collectively support sustainable growth and enhance the reliability and quality of shrimp farming across the region. India’s fish production has grown from 95.79 lakh tonnes in FY 2013–14 to 195 lakh tonnes in FY 2024–25, with inland fisheries and aquaculture contributing over 75% of output. In FY 2023–24, India exported 17.81 lakh MT of seafood valued at ₹60,523.89 crore (US$7.38 billion), led by 7.16 lakh MT of frozen shrimp, which accounted for 40.19% of export volume and 66.12% of export earnings.

Indian Shrimp Market Trends:

Rising Adoption of Sustainable Aquaculture Practices

The Indian shrimp industry is witnessing accelerated adoption of sustainable farming methodologies as exporters align with international certification requirements. Producers are increasingly pursuing Best Aquaculture Practices and Aquaculture Stewardship Council certifications to access premium markets demanding traceability and environmental responsibility. In August 2025, the ASC and Sustainable Fisheries Partnership released a collaborative roadmap for landscape-level improvements in Andhra Pradesh's shrimp farming sector, demonstrating industry commitment to scaling responsible production while supporting the Indian shrimp market growth.

Expansion of Value-Added Processing Capabilities

Indian shrimp processors are transitioning from raw commodity exports toward higher-margin value-added products to capture greater market value. Companies are investing in breading plants, marination facilities, and ready-to-cook product lines that command premium pricing in international markets. Modern processing technologies including automated peeling, deveining, and packaging systems are enabling processors to meet stringent food safety standards while improving operational efficiency and product consistency for discerning global consumers seeking convenient seafood options.

Market Diversification Beyond Traditional Export Destinations

The industry is pursuing strategic market diversification to reduce dependence on traditional export destinations and mitigate tariff-related vulnerabilities. Exporters are strengthening presence in the European Union, Japan, South Korea, and Southeast Asian markets while exploring emerging opportunities in the Middle East and Australia. For instance, the Ministry of Food Processing Industries, in collaboration with the Agricultural & Processed Food Products Export Development Authority (APEDA), the Trade Promotion Council of India (TPCI), and the Government of Bihar, hosted the International Buyer Seller Meet (IBSM) in Patna on 19th and 20th May 2025. The event convenes key participants from the food and allied sectors to facilitate trade, boost exports, and harness the agri-food potential of Bihar.

Market Outlook 2026-2034:

The Indian shrimp market demonstrates strong growth potential as global seafood consumption patterns increasingly favor high-protein, health-conscious dietary choices. Continued government support through infrastructure investments, duty rationalization, and export promotion initiatives positions the industry for sustained expansion. Technological advancements in disease management, precision aquaculture, and cold chain logistics are expected to enhance production efficiency and product quality, supporting India's competitiveness in international markets. The market generated a revenue of USD 10.1 Billion in 2025 and is projected to reach a revenue of USD 23.2 Billion by 2034, growing at a compound annual growth rate of 9.7% from 2026-2034.

Indian Shrimp Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Species | Penaeus Vannamei | 72.15% |

| Shrimp Size | Size 41-50 | 21.84% |

| State | Andhra Pradesh | 78% |

Species Insights:

- Penaeus Vannamei

- Penaeus Monodon

- Others

The penaeus vannamei segment dominates with a market share of 72.15% of the total Indian shrimp market in 2025.

Penaeus vannamei, commonly known as Pacific white shrimp or whiteleg shrimp, has become a transformative species in Indian aquaculture. It is highly valued for its rapid growth, adaptability to different pond management systems, high survival rates, and efficient feed conversion. Disease-resistant genetics from improved broodstock further enhance its appeal for commercial operations. These traits make it a reliable choice for farmers seeking consistent yields and scalable production, supporting the growth and modernization of shrimp farming practices across the country.

The widespread adoption of Penaeus vannamei also aligns with international market preferences for shrimp with mild flavor and tender texture, suitable for a variety of culinary applications. Access to genetically improved, disease-free broodstock has enabled farmers to reduce production risks and improve efficiency. This has facilitated more intensive and productive aquaculture practices, helping coastal regions optimize output and meet growing demand while maintaining quality standards in commercial shrimp farming.

Shrimp Size Insights:

Access the comprehensive market breakdown Request Sample

- Size 31-40

- Size 41-50

- Size 51-60

- Size 61-70

- Size >70

- Others

The size 41-50 category leads with a share of 21.84% of the total Indian shrimp market in 2025.

The size 41-50 category, indicating 41 to 50 pieces per pound, represents an optimal balance between production economics and market demand, making it highly sought after in both domestic and international trade channels. This size range offers versatility across multiple culinary applications, including grilling, sautéing, and incorporation into value-added processed products, while maintaining attractive portion presentation for foodservice and retail consumers.

The popularity of this size category reflects harvest optimization strategies employed by Indian farmers who balance growth cycle duration against feed costs and market pricing dynamics. Processing facilities favor this size for consistent product specifications that meet stringent buyer requirements, particularly for ready-to-cook and quick-service restaurant applications. Export markets, particularly in regions like the United States and the European Union, show strong preference for medium-sized shrimp, making them a highly valued segment for exporters. Consistent quality, reliable supply, and the ability to meet buyer specifications throughout the year enhance their market appeal. This demand encourages producers to focus on maintaining uniform standards and operational efficiency, ensuring that the shrimp meet international expectations and command higher value in global trade.

State Insights:

- West Bengal

- Gujarat

- Andhra Pradesh

Andhra Pradesh exhibits clear dominance with a 78% share of the total Indian shrimp market in 2025.

Andhra Pradesh has established itself as India's shrimp farming capital through decades of aquaculture development supported by favorable natural resources and progressive policy frameworks. The state's extensive brackish water availability across its 974-kilometer coastline, combined with suitable climatic conditions and established support infrastructure, enables year-round farming operations across multiple crop cycles. Concentrated farming clusters in districts including East Godavari, West Godavari, Krishna, and Nellore provide economies of scale in input supply, technical services, and product aggregation.

The state government’s active promotion of aquaculture has encouraged private investment in hatcheries, feed production, and processing units, fostering a well-integrated supply chain ecosystem. Supportive policies and financial facilitation for shrimp farming have further strengthened the sector, enabling farmers to access improved broodstock, adopt modern practices, and enhance productivity across coastal aquaculture regions. The state's target of increasing aquaculture area from 400,000 to one million acres by 2030 signals continued production expansion, while landscape-level sustainability initiatives address environmental considerations associated with intensive farming practices.

Market Dynamics:

Growth Drivers:

Why is the Indian Shrimp Market Growing?

Strong Government Support Through Policy Initiatives and Infrastructure Development

The Indian government has demonstrated sustained commitment to aquaculture sector development through comprehensive policy frameworks and financial allocations supporting production expansion and export competitiveness. The Pradhan Mantri Matsya Sampada Yojana received enhanced allocation of Rs. 2,352 crores for fiscal year 2024-25, representing a 56 percent increase from the previous year, enabling infrastructure development including cold storage facilities, processing units, and transportation networks. In September 2025, the government reduced GST rates from 12-18 percent to 5 percent on several fisheries and aquaculture-related products, including farm equipment, feed ingredients, water conditioners, and fishing nets, directly lowering production costs for farmers and enhancing industry competitiveness in international markets.

Technological Advancements Enhancing Production Efficiency and Sustainability

The Indian shrimp industry is experiencing technological transformation through adoption of advanced aquaculture systems that improve productivity while reducing environmental impact. Recirculating aquaculture systems, biofloc technology, and precision pond management tools are enabling farmers to achieve higher survival rates, improved feed conversion, and consistent production quality. In August 2025, the Chief Minister of Andhra Pradesh launched an innovative seaweed-shrimp integration model developed by ICAR-CIBA, demonstrating advancement in sustainable farming approaches that generate additional revenue streams without requiring additional inputs while providing environmental benefits through natural water filtration.

Growing Global Demand for Premium Protein Sources and Health-Conscious Seafood

International consumer preferences are increasingly favoring shrimp as a lean, high-protein food option rich in omega-3 fatty acids and essential nutrients aligned with health-conscious dietary trends. Major export markets, including the United States, European Union, China, and Japan demonstrate sustained demand growth for quality-assured, sustainably produced shrimp products. India's competitive positioning benefits from lower production costs compared to other major producing countries, established processing infrastructure meeting international food safety standards, and growing capability to supply value-added products that command premium pricing in retail and foodservice channels.

Market Restraints:

What Challenges the Indian Shrimp Market is Facing?

Disease Outbreaks Affecting Production Stability

The occurrence of shrimp diseases including White Spot Syndrome Virus, Enterocytozoon hepatopenaei, and Early Mortality Syndrome continues to threaten farming operations, causing production losses, increased mortality rates, and economic disruptions across coastal aquaculture zones. Disease management requires substantial investment in biosecurity infrastructure, diagnostic capabilities, and preventive protocols that increase production costs while limiting intensification potential.

High Production Costs and Input Price Volatility

Rising costs of critical inputs including quality feed, specific pathogen-free broodstock, energy, and disease management products, compress farmer margins despite strong market prices. Feed represents the largest production cost component, and fluctuations in fishmeal and soybean meal prices directly impact farming profitability. Smaller farmers lacking economies of scale face particular challenges accessing competitively priced inputs and technical services.

International Trade Tariffs and Market Access Uncertainties

Exposure to trade policy changes in major export markets creates revenue uncertainty for Indian shrimp exporters despite diversification efforts. The imposition of higher tariffs by the United States has prompted industry restructuring toward alternative destinations, while ongoing negotiations aim to secure improved market access conditions. Currency fluctuations and competing supply from Ecuador, Vietnam, and Indonesia add pricing pressure in international markets.

Competitive Landscape:

The Indian shrimp market exhibits a moderately competitive structure characterized by numerous integrated processors and exporters operating across the production value chain. Leading companies are differentiating through investments in modern processing technologies, value-added product development, and international quality certifications that enable premium market positioning. Strategic focus areas include strengthening backward integration with farming operations, expanding processing capacities in key production states, and developing direct relationships with major importers in target markets. The competitive environment encourages continuous improvement in product quality, supply chain efficiency, and sustainability practices as exporters seek to maintain market share amid evolving buyer requirements.

Some of the key players include:

- Nekkanti Seafoods

- Avanti Frozen Foods Private Limited

- Devi Sea Foods Limited

- Falcon Marine Exports Ltd.

- BMR Group

- Baby Marine Eastern Exports

- Sandhya Marines

- Apex Frozen Foods Limited

- Ananda Aqua Exports Private Limited

- Crystal Sea Foods Private Limited

- Citrus Alpha Marine LLP

- Jaya Lakshmi Sea Foods Private Limited

- Ifb Agro Industries Limited

- S.S.F Limited

- A.M.Fisheries

- JRJ Sea Foods India Private Limited

- Anjaneya Sea Foods

- Kings Infra Ventures Limited

- Kadalkanny Frozen Foods

- The Waterbase Limited

- Geo Sea Foods Exports Private Limited

- Abad Fisheries Private Limited

- K V Marine Exports

- Liberty Group of Seafood Companies (Premier Marine Foods, Kader Exports Private Limited, Liberty Frozen Foods Private Limited, and Devi Marine Foods Exports Private Limited)

- Zeal Aqua Limited

- Frontline Exports Private Limited

- Jude Foods India Private Limited

Recent Developments:

-

August 2025: The Marine Products Export Development Authority announced that India shipped 1,698,170 metric tonnes of seafood worth Rs. 62,408.45 crores (USD 7.45 billion) during fiscal year 2024-25.

-

In April 2025, India prepared to export 35,000–40,000 tonnes of shrimp to the United States, with orders remaining steady after Washington reduced a planned reciprocal tariff from 26% to 10%, industry officials reported. The adjustment is expected to support trade stability and bolster India’s seafood exports to key international markets.

Indian Shrimp Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons, Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Species Covered | Penaeus Vannamei, Penaeus Monodon, Others |

| Shrimp Sizes Covered | Size 31-40, Size 41-50, Size 51-60, Size 61-70, Size >70, Others |

| States Covered | West Bengal, Gujarat, Andhra Pradesh |

| Companies Covered | Nekkanti Sea Foods Limited, Avanti Frozen Foods Private Limited, Devi Sea Foods Limited, Falcon Marine Exports Ltd., BMR Group, Baby Marine (Eastern) Exports, Sandhya Marines Ltd., Apex Frozen Foods Limited, Ananda Aqua Exports Private Limited, Crystal Sea Foods Private Limited, Citrus Alpha Marine LLP, Jaya Lakshmi Seafoods Private Limited, Ifb Agro Industries Limited, SSF Limited, A.M.Fisheries, JRJ Seafoods India Private Limited, Anjaneya Sea Foods, Kings Infra Ventures Limited, Kadalkanny Frozen Foods, The Waterbase Limited, Geo Sea Foods Exports Private Limited, Abad Fisheries Private Limited, K V Marine Exports, Liberty Group of Seafood Companies, Kader Exports Private Limited, Liberty Frozen Foods Private Limited, Devi Marine Foods Exports Private Limited, Zeal Aqua Limited, Frontline Exports Private Limited, Jude Foods India Private Limited etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indian shrimp market size was valued at USD 10.1 Billion in 2025

The Indian shrimp market is expected to grow at a compound annual growth rate of 9.7% from 2026-2034 to reach USD 23.2 Billion by 2034.

Penaeus vannamei, representing a 72.15% market share in 2025, dominates Indian shrimp production due to its superior growth rate, high adaptability to varied aquaculture conditions, and strong international demand for its mild flavor profile.

Key factors driving the Indian shrimp market include strong government policy support, technological advancements in sustainable aquaculture, growing global demand for protein-rich seafood, competitive production costs, and expanding export market diversification.

Major challenges include disease outbreaks affecting production stability, high input costs and price volatility, international trade tariffs, infrastructure gaps in cold chain logistics, and environmental sustainability concerns associated with intensive farming practices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)