Indian Sanitary Napkin Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Indian Sanitary Napkin Market Summary:

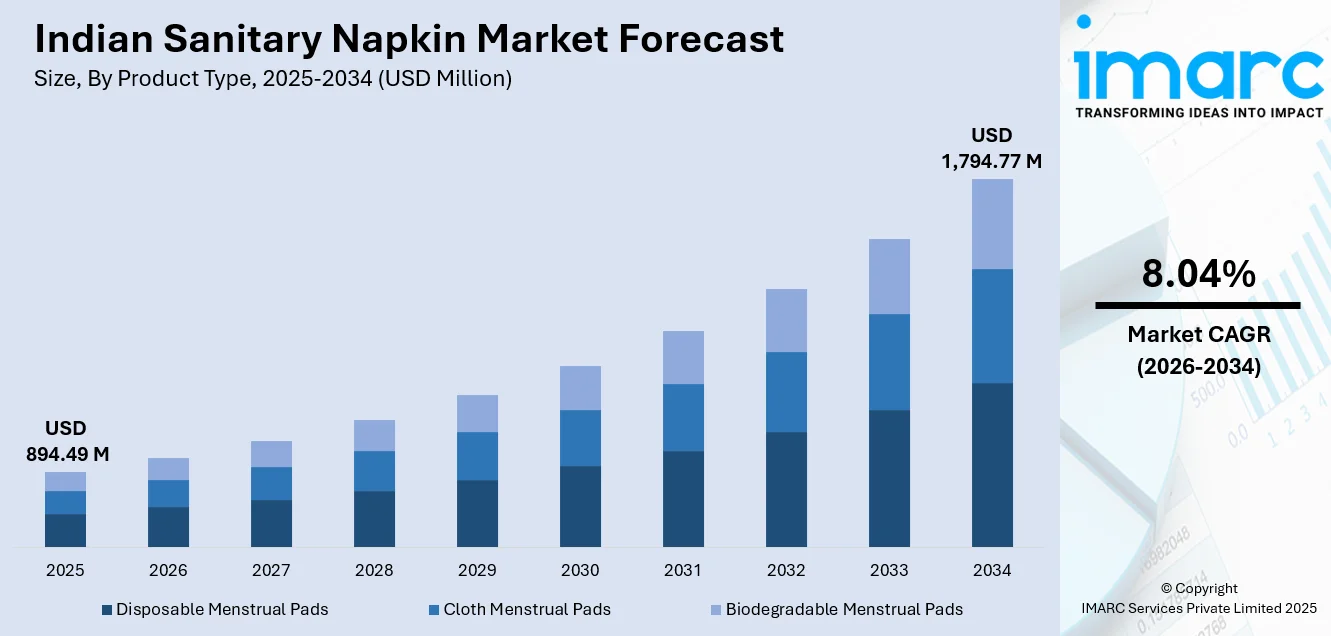

The Indian sanitary napkin market size was valued at USD 894.49 Million in 2025 and is projected to reach USD 1,794.77 Million by 2034, growing at a compound annual growth rate of 8.04% from 2026-2034.

The Indian sanitary napkin market is experiencing robust expansion driven by heightened awareness of menstrual hygiene and evolving consumer preferences. Government initiatives promoting feminine hygiene, increasing female workforce participation, and rising urbanization are accelerating product adoption. The shift toward convenient, comfortable, and eco-friendly menstrual care solutions is reshaping the industry landscape, with modern retail and e-commerce channels improving accessibility across urban and rural regions throughout the country.

Key Takeaways and Insights:

- By Product Type: Disposable menstrual pads dominate the market with a share of 72% in 2025, owing to their convenience of use, extensive availability through retail networks, and high hygiene appeal. Government subsidy schemes and school distribution programs propel volume growth.

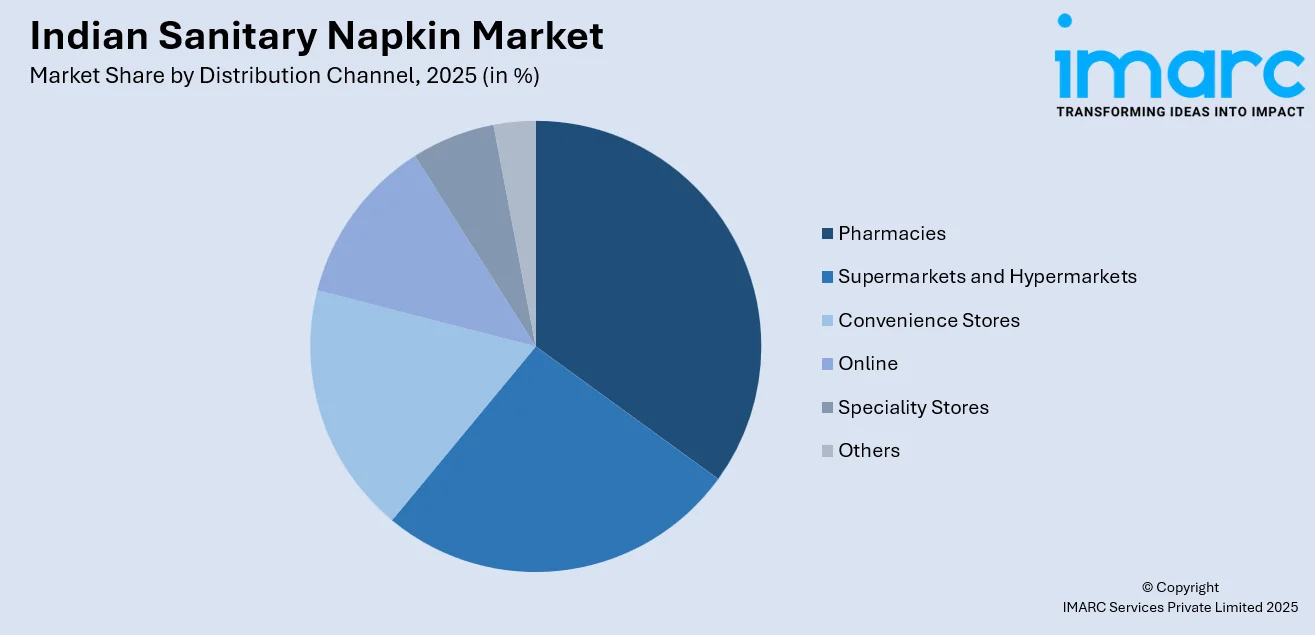

- By Distribution Channel: Pharmacies lead the market with a share of 31% in 2025. This dominance is driven by healthcare-related trust associations that reduce purchasing discomfort, professional guidance availability, and strategic placement alongside essential health products.

- By Region: Maharashtra represents the largest region with a 20% share in 2025, driven by high population density, urbanization, improved healthcare awareness, widespread retail infrastructure, and successful government-sponsored menstrual hygiene schemes.

- Key Players: Key players drive the Indian sanitary napkin market by expanding product portfolios, improving comfort and absorbency technologies, and strengthening nationwide distribution. Their investments in marketing, affordability, and partnerships with healthcare providers boost awareness, accelerate adoption, and ensure consistent product availability across diverse consumer segments. Some of the key players operating in the industry are JNTL Consumer Health (India) Private Limited, Kimberly-Clark, Nua (Lagom Labs Private Limited), Plush, Procter & Gamble, Saathi and Unicharm Corporation.

To get more information on this market Request Sample

The Indian sanitary napkin market is witnessing transformative growth underpinned by progressive government policies and heightened public awareness around menstrual health. Educational campaigns and institutional outreach programs have successfully dismantled long-standing taboos, enabling more women and girls to prioritize menstrual hygiene as an essential aspect of overall wellness. The Scheme for Promotion of Menstrual Hygiene among Adolescent Girls, initiated by the government in December 2025, focuses on increasing MH awareness, improving access to sanitary napkins, and encouraging secure and eco-friendly disposal methods. Rising female participation in the workforce and expanding disposable incomes have further empowered women to make independent purchasing decisions, favoring quality and comfort over cost alone. The proliferation of modern retail formats and digital commerce platforms has dramatically improved product accessibility, particularly in tier-two and tier-three cities where traditional distribution networks were historically limited. Additionally, the emergence of younger, health-conscious consumers seeking innovative hygiene solutions contributes significantly to sustained market demand.

Indian Sanitary Napkin Market Trends:

Rising Adoption of Biodegradable and Eco-Friendly Products

Environmental consciousness among Indian consumers is driving a notable shift toward biodegradable and sustainable menstrual products. Women are increasingly aware of the ecological impact of conventional plastic-based sanitary napkins, prompting heightened interest in alternatives made from bamboo, banana fiber, and organic cotton. This sustainability movement aligns with broader governmental efforts to reduce plastic waste and promote eco-friendly manufacturing practices. Urban consumers, particularly in metropolitan areas, are leading this transition by actively seeking products that balance performance with environmental responsibility, reshaping product development priorities. In January 2025, CSIR-IICT Hyderabad partnered with Aakar Innovations to develop 'Wealth out of Waste' technology that converts banana pseudostem agricultural waste into pulp for compostable sanitary pads, enabling affordable and environmentally beneficial substitutes for conventional raw materials.

Growing Emphasis on Workplace Menstrual Health Policies

Progressive workplace policies recognizing menstrual health as a fundamental employee welfare concern are gaining traction across India. State governments and private enterprises are increasingly acknowledging menstruation as a legitimate health consideration requiring institutional support. This evolving corporate mindset is normalizing open discussions about period care while driving demand for workplace-accessible sanitary products. Employers are establishing dedicated facilities and implementing supportive leave frameworks that enhance women's dignity and productivity during menstruation. In October 2025, Karnataka became the first Indian state to mandate paid menstrual leave across both public and private sectors, entitling women employees to twelve paid leave days annually, marking a significant milestone in workplace menstrual health reform.

Innovation in Product Design and Material Technology

Manufacturers are investing significantly in research and development to enhance product performance, comfort, and safety. Ultra-thin designs featuring advanced gel-based absorption technology provide superior protection without compromising on discretion or mobility. Herbal-infused and chemical-free variants are gaining popularity among health-conscious consumers concerned about skin sensitivity and potential irritants. Additionally, smart sanitary napkins equipped with anion strips offering antibacterial properties and odor control represent emerging innovations that address evolving consumer expectations for premium menstrual care solutions. In January 2024, Soothe Healthcare launched Paree Super Nights featuring XXL size with unique Double Feathers design offering 64% extra coverage, addressing period night challenges including leakage protection and enhanced comfort for heavy flow users.

Market Outlook 2026-2034:

The sanitary napkins market in India appears to be promising as far as future growth is concerned due to increasing trends of urbanization and rising awareness among people in both cities and rural areas of the country. It is quite evident that with the increasing support from government services with respect to the free distribution of sanitary napkins, as well as increasing health awareness through institutions in the country, proper support for sanitary napkins will continue to grow in the future. The future of sanitary napkins will be driven by increasing education among women and their active role in the labor force, as well as awareness related to their health and well-being. The market generated a revenue of USD 894.49 Million in 2025 and is projected to reach a revenue of USD 1,794.77 Million by 2034, growing at a compound annual growth rate of 8.04% from 2026-2034.

Indian Sanitary Napkin Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Disposable Menstrual Pads |

72% |

|

Distribution Channel |

Pharmacies |

31% |

|

Region |

Maharashtra |

20% |

Product Type Insights:

- Disposable Menstrual Pads

- Cloth Menstrual Pads

- Biodegradable Menstrual Pads

Disposable menstrual pads dominate with a market share of 72% of the total Indian sanitary napkin market in 2025.

Disposable menstrual pads continue to enjoy the single-largest share due to their unparalleled convenience, high availability, and better brand recognition across retail networks. These products efficiently manage moisture for leakage protection by using absorbent cellulose and synthetic materials. The disposable nature of the products meets the modern consumer's demand for hassle-free hygiene solutions, especially among urban and semi-urban women with active lifestyles who seek reliable protection against menstruation without the bother of washing or reusing the products.

Government-funded pad distribution programs have predominantly adopted disposable varieties due to their cost-effectiveness and ease of mass distribution. In September 2024, the state of Uttar Pradesh distributed sanitary pads to girls in government schools, allocating INR 300 to each student in classes 6 to 8 under the PM Shri scheme. The range of affordability from ultra-thin to heavy-flow options ensures these products address diverse menstrual requirements, expanding the consumer base significantly.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online

- Speciality Stores

- Others

Pharmacies lead with a share of 31% of the total Indian sanitary napkin market in 2025.

Pharmacies retain their leading position in the distribution of sanitary napkins because consumers genuinely trust the brand ethics embedded in the store. Because feminine hygiene products are primarily used on a monthly basis, consumers want a more convenient shopping experience that involves purchasing sanitary products at the pharmacy, where consumers are able to acquire advice relevant to their specific needs. A crucial determinant is the placement of feminine hygiene products with other essential healthcare products, reinforcing the overall perception that the products are crucial rather than supplementary.

Pharmacies play a critical role during government health drives and NGO campaigns by distributing subsidized or free sanitary napkins, extending menstrual hygiene outreach to underserved regions. Their established presence as trusted healthcare destinations position them as primary access points for feminine hygiene products across diverse consumer segments. The widespread pharmacy network spanning urban, semi-urban, and rural areas ensures consistent product availability for both necessity-based and impulse purchases, reinforcing their significance in expanding menstrual hygiene accessibility.

Regional Insights:

- Maharashtra

- Delhi-NCR

- Tamil Nadu

- Karnataka

- Gujarat

- Others

Maharashtra exhibits a clear dominance with a 20% share of the total Indian sanitary napkin market in 2025.

Maharashtra tops the segment attributable to the high density of the urban population, high literacy rates, and developed health care facilities. Key cities like Mumbai, Pune, and Nagpur have robust retail operations to ensure the easy accessibility of varied MHP through differing price rates. Higher rates of participation of the female workforce have led to increased economic empowerment of the population to spend on high-class consumable goods to suit contemporary consumeristic lifestyles.

The state of Maharashtra has launched various government schemes that offer progressive support in ensuring easy accessibility of menstruation hygiene products. The state government has introduced the initiative of “Asmita Yojana,” under which self-help groups help procure sanitary napkins and then sale them off to cardholders of Asmita, primarily teenage girls who attend educational institutes, at a low subsidized price. The state government has made announcements about sanitary napkin provision to women living below the poverty line and those living in rural areas and participating in self-help groups for a very low price.

Market Dynamics:

Growth Drivers:

Why is the Indian Sanitary Napkin Market Growing?

Government Initiatives and Institutional Support

Central and state government initiatives have turned out to be strong catalysts for market growth by improving product access and dismantling social taboos related to menstruation. Policy frameworks that place menstrual hygiene as a public welfare issue have helped distribute subsidized sanitary napkins through schools, Anganwadi centers, and community health programs in a systematic manner. The Scheme for Promotion of Menstrual Hygiene among Adolescent Girls in Rural India targets young women in the age group of ten to nineteen years, providing napkins at nominal rates, along with conducting hygiene education sessions. These institutional efforts collectively stimulate first-time use among disadvantaged sections of society while normalizing menstrual hygiene conversations across communities.

Rising Female Workforce Participation and Economic Empowerment

The increasing participation of women in India's workforce is fundamentally reshaping purchasing patterns and product preferences within the sanitary napkin market. As more women assume professional roles across industries, their financial independence enables autonomous decision-making regarding personal hygiene expenditures without relying on household budget allocations. Working women prioritize convenience, comfort, and reliability in menstrual products to maintain productivity throughout their cycles without disruption. Higher educational attainment among women correlates strongly with improved awareness of menstrual health significance and informed product selection based on quality rather than cost alone. Urban working women increasingly demand premium features including ultra-thin designs, extended protection, and skin-friendly materials that accommodate active lifestyles. The progressive introduction of workplace policies such as menstrual leave in certain organizations further acknowledges menstruation as a legitimate health consideration, reducing stigma and encouraging open discussions that positively influence product adoption rates. According to the Ministry of Labor and Employment, the Labour Force Participation Rate for women aged 15 years and above has increased from 23.3% in 2017-18 to 41.7% in 2023-24, indicating enhanced engagement of women in economic activity.

Expanding Retail Infrastructure and E-Commerce Penetration

The rise of modern retail channels and e-commerce has greatly improved sanitary napkin usage throughout India’s geographical and demographic spectrum. Supermarkets, hypermarkets, and organized retail pharmacies promote a wide range of sanitary napkins with reasonable prices in comparison to other forms of retail channels to ensure consumers can easily choose products that meet their demands. Modern retail has improved the range of sanitary napkin products available to women by expanding these ranges in major retail store formats to include both biodegradable and organic sanitary napkins in addition to regular sanitary napkins sold in other retail channels. The e-commerce revolution has transformed sanitary napkin usage in society in many positive ways to overcome social embarrassment felt in making direct retail transactions to purchase these products from retail pharmacies or any other retail store format. E-commerce has a much greater positive effect on sanitary napkin usage in society than any other retail channel due to E-commerce’s subscription services to overcome issues of stock shortages that might impact consistent purchase of sanitary napkin products on a regular basis from retail pharmacies or other retail store channels throughout society. The growth of e-commerce is especially significant in tier-two and tier-three cities where traditional retail infrastructure remains limited, but smartphone penetration and digital payment adoption continue expanding rapidly.

Market Restraints:

What Challenges the Indian Sanitary Napkin Market is Facing?

Persistent Cultural Stigma and Social Taboos

In general, factors such as the taboo nature accompanied by menstrual issues discourage free discussion, thereby forming psychological hurdles to adopt products in India. Traditionally, women are barred from actively contributing to regular activities during menstrual periods, leading to a lack of discussion about menstrual hygiene practices. This is especially common among young girls who live in rural areas, where a lack of knowledge is leading them to unhygienic practices.

Inadequate Disposal Infrastructure

There is an absence of proper sanitary napkin disposal facilities that create problems for schools, public places, and even individuals’ houses. This encourages women to dispose of sanitary napkins in an improper manner by either burning them or discarding them anywhere due to poor waste management facilities in their areas. This does not create an environmental problem for such women but also leads them to not use the product due to poor disposal facilities.

Affordability Constraints in Low-Income Segments

Despite these being subsidized by the Government, the issue of affordability becomes a key factor of concern for the economically disadvantaged group of people, where the expenditure on sanitary napkins is competing expenditure. Rural populations of the country, as well as people living in poverty-affected areas, use these only when they can afford food, education, and healthcare services.

Competitive Landscape:

The sanitary napkin market in the Indian country is witnessing high-level competition from companies such as multinational organizations as well as emerging companies from the country as they develop various strategies to achieve market share. The companies in the Indian sanitary napkin industry are focused on various innovations regarding the product, aiming to improve and enhance the product to cater to the rising needs of customers. Product bundling is also done effectively by companies to achieve high-level competition, especially in rural areas. Distribution channels also help the companies achieve the needs of their customers. High-level awareness regarding the product is also created by companies through various digital media, helping to improve brand credibility as well as create high-level awareness regarding the importance of menstrual hygiene. The Indian sanitary napkin market is also witnessing high-level constructions of various sustainable measures for the companies to cater to the needs of their customers while also maintaining the health of the Indian environment through the use of chemical-free sanitary napkins.

Some of the key players operating in the industry include:

- JNTL Consumer Health (India) Private Limited

- Kimberly-Clark

- Nua (Lagom Labs Private Limited)

- Plush

- Procter & Gamble

- Saathi

- Unicharm Corporation

Recent Developments:

- In February 2025, Niine Sanitary Pads, in collaboration with Vatsalya Seva Samiti and local officials, distributed biodegradable sanitary pads at the Maha Kumbh Mela to ensure menstruation did not impede women's participation. This initiative promoted menstrual hygiene awareness and sustainability, representing a significant achievement in dismantling menstrual taboos and offering environmentally friendly, accessible period care during public events.

- In December 2024, the Indian Army established a manufacturing plant for biodegradable sanitary napkins at Martselang village in Ladakh as part of Operation Sadbhavana. Operated and managed by local women, the facility manufactures UV-treated, biodegradable, reasonably priced sanitary napkins, promoting menstrual hygiene awareness and environmental sustainability across Ladakh and Jammu and Kashmir.

Indian Sanitary Napkin Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Disposable menstrual pads, Cloth menstrual pads and Biodegradable menstrual pads |

| Distribution Channels Covered |

Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online, Specialty Stores and Others |

| Regions Covered | Maharashtra, Delhi-NCR, Tamil Nadu, Karnataka, Gujarat, Others |

| Companies Covered | JNTL Consumer Health (India) Private Limited, Kimberly-Clark, Nua (Lagom Labs Private Limited), Plush, Procter & Gamble, Saathi, Unicharm Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indian sanitary napkin market size was valued at USD 894.49 Million in 2025.

The Indian sanitary napkin market is expected to grow at a compound annual growth rate of 8.04% from 2026-2034 to reach USD 1,794.77 Million by 2034.

Disposable menstrual pads dominated the market with a share of 72%, driven by their convenience, extensive retail availability, affordability, and strong brand recognition across government distribution programs and commercial channels.

Key factors driving the Indian sanitary napkin market include government menstrual hygiene initiatives, rising female workforce participation, increasing disposable incomes, expanding retail and e-commerce channels, and growing consumer awareness about menstrual health.

Major challenges include persistent cultural stigma around menstruation, limited affordability among rural populations, inadequate disposal infrastructure in schools and public areas, low awareness of sustainable alternatives, and logistics barriers hindering last-mile distribution.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)