Indian Pesticides Market Size, Share, Trends and Forecast by Product Type, Segment, Formulation, Crop Type, and Region, 2025-2033

Indian Pesticides Market Size and Share:

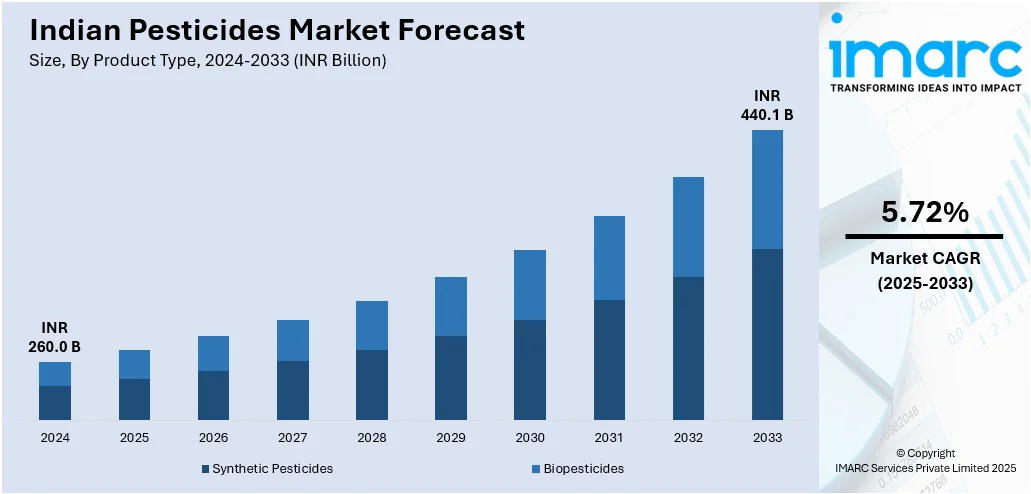

The Indian pesticides market size reached INR 260.0 Billion in 2024. The market is expected to reach INR 440.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.72% during 2025-2033. The market growth is attributed to the increasing agricultural demand, the need for enhanced crop protection, rising adoption of modern farming techniques, government support through subsidies, growing awareness about pest control, and the shift towards high-yielding crops, alongside advancements in pesticide formulations and distribution channels.

Market Insights:

- On the basis of region, the market is divided into Uttar Pradesh, Punjab, Maharashtra, Rajasthan, Haryana and others.

- Based on the product type, synthetic pesticides dominate the market in 2024.

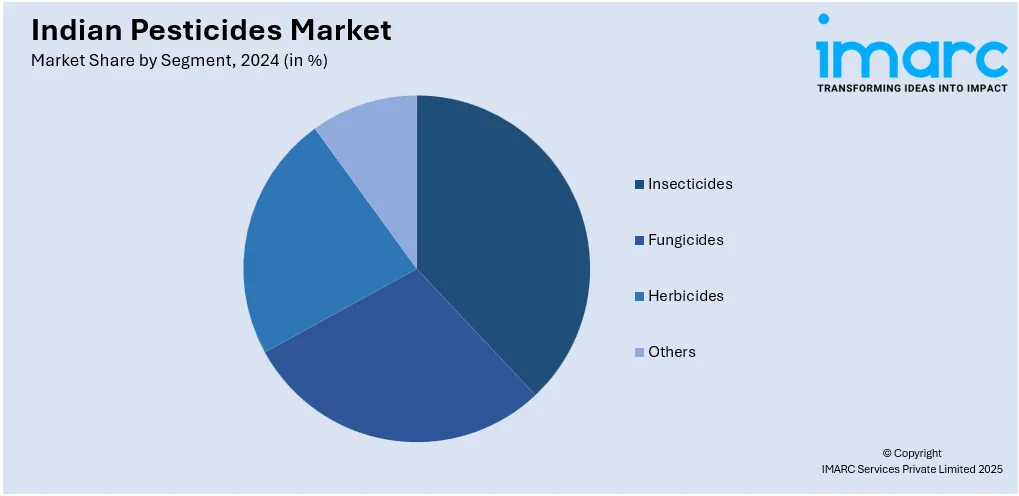

- On the basis of segment, the market is segmented into insecticides, fungicides, herbicides, and others.

- Based on the formulation, the market is categorized as liquid pesticides and dry pesticides.

- On the basis of crop type, the market is segmented into cereals, fruits, vegetables, plantation crops, and others.

Market Size and Forecast:

- 2024 Market Size: INR 260.0 Billion

- 2033 Projected Market Size: INR 440.1 Billion

- CAGR (2025-2033): 5.72%

Pesticides are substances or a mixture of substances intended for preventing, destroying, repelling or mitigating any pest. Pesticides represent the last input in an agricultural operation and are applied for preventing the spoilage of crops from pests such as insects, fungi, weeds, etc., thereby increasing the agricultural productivity. The significance of pesticides has been rising over the last few decades catalyzed by the requirement to enhance the overall agricultural production and the need to safeguard adequate food availability for the continuously growing population in the country. In India, pests and diseases, on an average eat away around 20-25% of the total food produced.

To get more information on this market, Request Sample

Indian Pesticides Market Drivers:

- The total available arable land per capita has been reducing in recent years as a result of increasing urbanization levels and is expected to reduce further in the coming years. Driven by rising population levels, food demand is expected to continue increasing in the coming years. We expect pesticides to play a key role in increasing the average crop yields per hectare.

- Government initiatives to provide credit facilities to farmers in the rural areas is expected to provide a strong boost to the pesticides industry. Increasing availability and low interest rates of farm loans are expected to encourage farmers to use more pesticides in order to improve crop yields.

- Both government and private initiatives are increasing the awareness of pesticides among farmers. Initiatives to educate farmers on the right usage of pesticides in terms of quantity, the right application methodology and appropriate chemicals to be used for identified pest problems, etc. are currently being conducted in various parts of the country.

- The penetration levels of pesticides in India are significantly lower than other major countries such as the US and China. This suggests that the market for pesticides is still largely unpenetrated with a huge room for future growth.

Indian Pesticides Market Trends:

Shift Towards Bio-Based and Sustainable Pesticides

Increasing awareness of the environment and consumer demand for chemical-free fruits and vegetables are driving a transition toward bio-based and eco-friendly pesticides in India. These pesticides, which originate from natural materials like plant extracts, bacteria, and fungi, provide targeted pest control with no residues harming humans or the environment, thus making them ideal for home consumption as well as export-oriented agriculture. In addition, regulatory support and quicker clearance procedures for biopesticides are supporting manufacturers to increase product offerings in this space. Further, farmers are increasingly adopting integrated pest management (IPM) techniques that involve biological control approaches combined with minimal use of chemicals to preserve soil fertility and biodiversity. In addition to this, the growth of organic farming clusters and contract farming deals with export houses has further raised demand for eco-friendly pest control products. This development supports the Indian pesticides market growth and is putting bio-based pesticides at the forefront as a key growth sector in the changing agricultural landscape.

Regulatory Reforms and Compliance-Driven Market Evolution

The market is undergoing structural change in response to changing regulatory landscapes and compliance needs. Implementation of the Pesticide Management Bill and tougher residue level standards are forcing manufacturers to redesign products and enhance quality control measures. In addition, regulatory bodies are paying more attention to phasing out extremely toxic pesticides and introducing safer, more environmentally friendly alternatives. These changes are enhancing product safety as well as aligning India's pesticide industry with global standards, making it easier to access export markets. Besides, compulsory labelling, QR code traceability systems, and online licensing procedures are making the supply chain more transparent. The regulatory convergence pressure is making the market structure more structured, lowering the incidence of counterfeit products, and encouraging stakeholders from farmers to international buyers to have trust. This trend is significantly enhancing the Indian pesticides market outlook.

Rising Demand for Crop-Specific Formulations

The market is witnessing a growing preference for crop-specific formulations designed to address the unique pest challenges of individual crops. As agriculture in India becomes more diversified, farmers are seeking targeted solutions for high-value crops such as fruits, vegetables, spices, and plantation crops. These specialized formulations help optimize efficacy by addressing pests and diseases most prevalent in particular crop varieties and climatic zones. In line with this, agribusiness firms are increasingly investing in research to develop products tailored to the growth cycles and pest vulnerability stages of specific crops, thereby reducing the need for broad-spectrum chemical applications. Besides this, export-oriented growers are demanding such customized products to meet the stringent residue limits imposed by importing countries. This trend is driving innovation in formulation technology, which results in enhanced pest control efficiency while minimizing environmental impact and ensuring compliance with both domestic and global quality standards.

Growth, Opportunities, and Barriers in the Indian Pesticides Market:

- Technology and Agri‑tech Integration: The market is witnessing increasing adoption of precision farming tools, drone-based spraying, and AI-driven pest monitoring systems. Digital platforms are enabling farmers to access real-time weather, soil, and pest data for informed pesticide application. Integration with IoT devices is helping optimize dosage and reduce wastage, improving both efficiency and sustainability. These advancements are fostering higher crop yields while minimizing environmental impact.

- Growth Drivers: Rapid population growth and the need to enhance agricultural productivity are spurring pesticide demand. Climatic changes leading to higher pest infestations are driving increased adoption of crop protection solutions, which is further augmenting the Indian pesticides market share. Supportive government subsidies and awareness campaigns are encouraging pesticide usage among smallholder farmers. Additionally, growing investment in R&D for eco-friendly formulations is expanding market potential.

- Market Opportunities: The increasing demand for organic and residue-free produce is driving the development of bio-based pesticides. Expansion of e-commerce agri-input platforms offers greater market reach, especially in rural regions. Government initiatives promoting integrated pest management (IPM) present opportunities for sustainable product adoption. Furthermore, increasing global agricultural exports opens new markets for Indian pesticide manufacturers.

- Market Challenges: As per the Indian pesticides market analysis, the market faces issues such as counterfeit products, poor quality control, and a lack of farmer awareness about safe pesticide usage. Regulatory delays and complex approval processes hinder the introduction of new, advanced formulations. Fragmented distribution channels and uneven access to modern pesticides remain significant obstacles. Additionally, environmental concerns and residue-related export rejections pose challenges to market growth.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Indian pesticides market report, along with forecasts at the country and state level from 2025-2033. Our report has categorized the market based on product type, segment, formulation and crop type.

Breakup by Product Type:

- Synthetic Pesticides

- Biopesticides

Based on the product type the market has been segmented as synthetic pesticides and biopesticides. Synthetic pesticides currently dominate the market, holding the largest share.

Breakup by Segment:

- Insecticides

- Fungicides

- Herbicides

- Others

Based on the segment, the Indian pesticides industry has been segmented as insecticides, fungicides, herbicides and others.

Breakup by Formulation:

- Liquid

- Dry

Based on the formulation, the market has been segmented as liquid pesticides and dry pesticides.

Breakup by Crop Type:

- Cereals

- Fruits

- Vegetables

- Plantation Crops

- Others

Based on the crop type, the market has been segmented as cereals, vegetables, fruits, plantation crops and others.

Breakup by State:

- Uttar Pradesh

- Punjab

- Maharashtra

- Rajasthan

- Haryana

- Others

The market has also been segmented on the basis of states, including Uttar Pradesh, Punjab, Maharashtra, Rajasthan, Haryana and others.

Competitive Landscape:

The competitive landscape of the market has also been examined in the report and the profiles of key players have also been provided.

Latest News and Developments:

- August 2025: Insecticides (India) Ltd (IIL) announced the launch of SPARCLE, a new broad-spectrum insecticide developed in collaboration with Corteva Agriscience. The product is specifically formulated to target the brown plant hopper, a significant pest affecting rice crops, aiming to enhance yield outcomes for Indian farmers. This partnership leverages Corteva’s cutting-edge chemical technology alongside IIL’s extensive farmer networks and distribution reach.

- February 2025: BASF announced the initiation of regulatory submissions for Prexio® Active, a novel Group 4E insecticide designed to control the full complex of rice hopper species across key Asia-Pacific markets, including India. The product rapidly halts hopper feeding, disrupts development and reproduction, and offers exceptional efficacy with no cross-resistance, ensuring strong environmental compatibility. The product also enhances plant health by promoting stronger stems, denser canopies, and broader flag leaves.

- December 2024: The Press Information Bureau (PIB) announced the launch of Kisan Kavach, dubbed Bharat’s First Anti-Pesticide Bodysuit, unveiled by a Union Minister. Developed collaboratively by BRIC-inStem, Bengaluru, and Sepio Health Pvt. Ltd., the suit includes a full-body garment, mask, headshield, and gloves. It uses advanced fabric technology—with cotton fibers modified via nucleophilic chemistry, to neutralize harmful pesticides upon contact.

- August 2024: Crystal Crop Protection Limited unveiled its latest innovation, Proclaim XTRA, a contact, systemic, and translaminar insecticide specially formulated for maize and soybean crops. Engineered to paralyze and eliminate caterpillar pests, the formulation offers rapid and durable control, disrupting pest metamorphosis to impede progression into further damaging life stages. Farmers are advised to apply the product at two critical intervals. Crystal has also launched training programs to guide the correct and safe usage of this breakthrough solution.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Billion |

| Segment Coverage | Product type, Segment, Formulation, Crop Type, State |

| States Covered | Uttar Pradesh, Punjab, Maharashtra, Rajasthan, Haryana, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indian pesticides market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Indian pesticides market?

- What are the major segments in the Indian pesticides market?

- What is the breakup of the Indian pesticides market on the basis of product type?

- What is the breakup of the Indian pesticides market on the basis of formulation?

- What is the breakup of the Indian pesticides market on the basis of crop type?

- What is the breakup of the Indian pesticides market on the basis of various states?

- What are the various stages in the value chain of the Indian pesticides industry?

- What are the key driving factors and challenges in the Indian pesticides industry?

- What is the structure of the Indian pesticides industry and who are the key players?

- What is the degree of competition in the Indian pesticides industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)