India Organic Food Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

India Organic Food Market Summary:

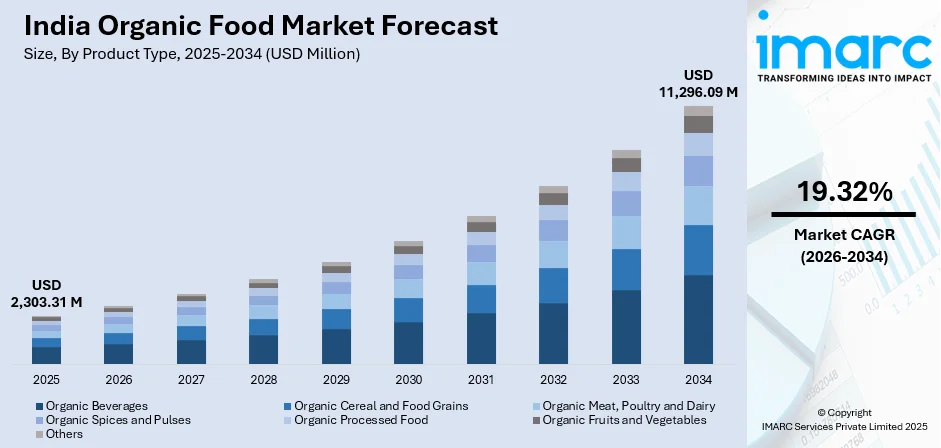

The India organic food market size was valued at USD 2,303.31 Million in 2025 and is projected to reach USD 11,296.09 Million by 2034, growing at a compound annual growth rate of 19.32% from 2026-2034.

The organic food sector in India has been registering immense growth due to rising awareness about healthy eating habits among the Indian population and the rising awareness regarding the advantages offered by chemical-free food products. The organic food market for India has been displaying immense potential due to increasing attention from urban communities towards healthy food choices, along with governmental encouragement for organic farming practices.

Key Takeaways and Insights:

-

By Product Type: Organic cereal and food grains dominate the market with a share of 24% in 2025, driven by India's staple food culture and growing preference for chemical-free grains among health-conscious consumers.

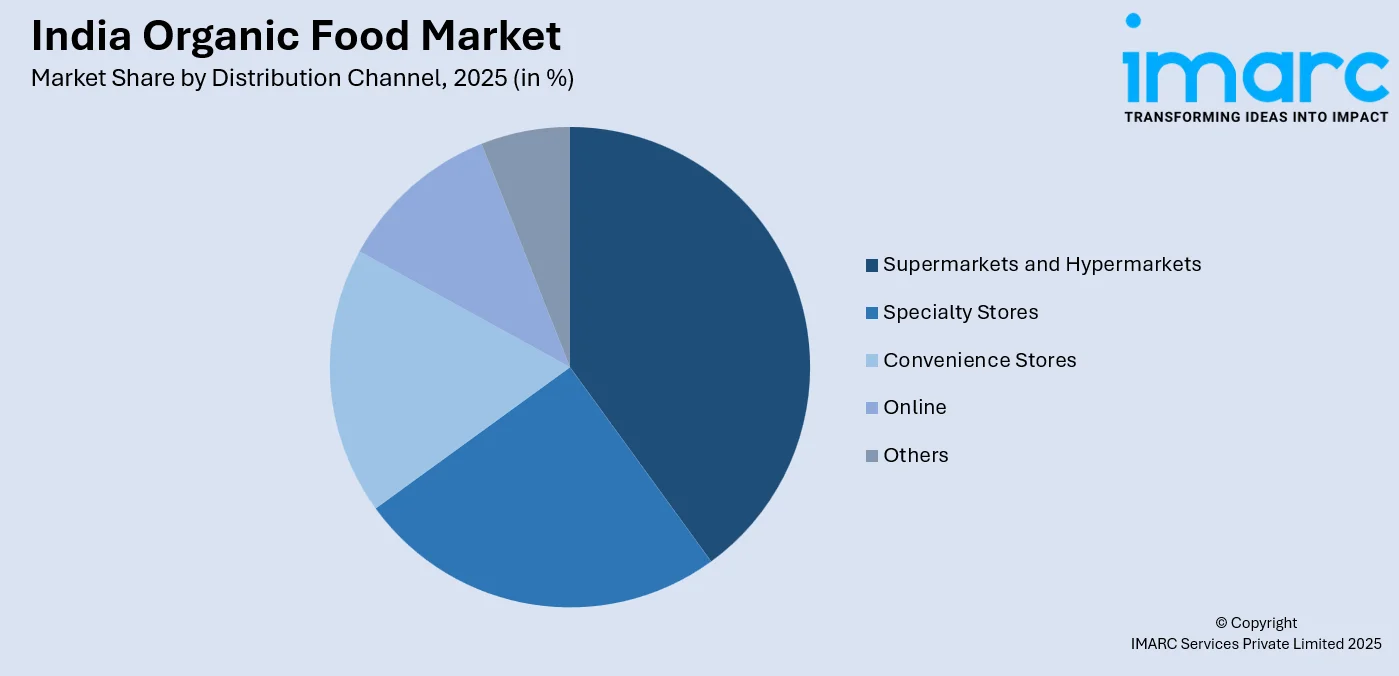

- By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 32% in 2025, owing to organized retail expansion, product variety availability, and enhanced consumer shopping experience.

- By Region: North India represents the largest segment with a market share of 34% in 2025, supported by higher disposable incomes, greater health awareness, and established organic retail infrastructure in metropolitan areas.

- Key Players: The India organic food market exhibits a moderately fragmented competitive landscape with established domestic players and emerging brands competing across various product categories. Some of the key players operating in the market include Conscious Food Private Limited, Ecofarms, Elworld Organic, Mehrotra Consumer Products Pvt. Ltd., Nature Bio-Foods Ltd, Nature Pearls Pvt Ltd, Natureland Organics, Nourish Organic Foods Pvt. Ltd, Organic India Pvt. Ltd., Phalada Agro Research Foundations Pvt. Ltd., Pure & Sure, Sresta Natural Bioproducts Pvt. Ltd., and Suminter India Organics.

To get more information on this market Request Sample

The India organic food market is undergoing a transformative phase characterized by evolving consumer preferences and expanding product availability. Rising concerns about food safety, pesticide residues, and the long-term health implications of conventionally grown produce are driving consumers toward organic alternatives. Reflecting this shift, Tata Consumer Products completed its acquisition of Organic India in 2024, aiming to expand its distribution of organic food and health products across India and globally, reinforcing the strategic importance of the category. The market is benefiting from the increasing penetration of organized retail formats in tier-II and tier-III cities, making organic products more accessible to a wider consumer base. Additionally, the proliferation of e-commerce platforms has significantly enhanced the reach of organic food products, enabling consumers in remote areas to access premium organic offerings. The certification frameworks established under the National Programme for Organic Production and Participatory Guarantee System are building consumer trust and ensuring product authenticity.

India Organic Food Market Trends:

Rising Demand for Clean-Label and Traceable Products

Indian consumers are increasingly demanding transparency in food sourcing and production methods, leading to heightened preference for clean-label organic products. Reflecting this trend, brands like Earthen Connect have begun using QR‑code‑enabled traceability systems that allow buyers to scan packaging and view the complete farm‑to‑fork journey of products, including farm location, grower name, harvest dates, and sustainability practices, to build verified trust in what they eat. The adoption of QR-code-based traceability systems is gaining momentum, enabling consumers to verify the origin and farming practices behind their food purchases. This trend is particularly pronounced among urban millennials and health-conscious families who prioritize authenticity and are willing to pay premium prices for verified organic products.

Digital Commerce Revolution in Organic Food Distribution

The rapid expansion of e-commerce and quick-commerce platforms is transforming how Indian consumers access organic food products. For example, in 2025 Swiggy’s Instamart partnered with farmer‑led cooperative Bharat Organics to offer 21 certified organic staples directly to consumers via its quick‑commerce network, bringing organic pulses, spices, oils, and more to urban households with digital convenience. Online marketplaces are offering extensive organic product catalogs with doorstep delivery convenience, while subscription-based models for organic groceries are gaining traction among urban households. This digital shift is enabling smaller organic brands to reach consumers directly, bypassing traditional distribution barriers and democratizing access to organic food across geographic boundaries.

Government-Supported Organic Farming Expansion

Government initiatives supporting organic agriculture are creating favorable conditions for market expansion through financial incentives, training programs, and certification support for farmers. According to a March 2025 government update, since 2015-16, 59.74 lakh hectares in India have come under organic farming through PKVY and MOVCDNER schemes, offering financial aid, certification, marketing support, and training. The government aims to promote sustainable agriculture and strengthen farmers’ climate-resilient practices. These policy interventions are increasing domestic organic production capacity while strengthening the supply chain infrastructure necessary for market growth.

Market Outlook 2026-2034:

The India organic food market is poised for substantial expansion over the forecast period, driven by escalating health consciousness, urbanization, and evolving dietary preferences among Indian consumers. The integration of technology in organic farming and supply chain management is expected to enhance product quality and availability while reducing operational inefficiencies. Growing export opportunities for Indian organic products in international markets will further stimulate domestic production capacity expansion and strengthen the overall market ecosystem. The market generated a revenue of USD 2,303.31 Million in 2025 and is projected to reach a revenue of USD 11,296.09 Million by 2034, growing at a compound annual growth rate of 19.32% from 2026-2034.

India Organic Food Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Organic Cereal and Food Grains |

24% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

32% |

|

Region |

North India |

34% |

Product Type Insights:

- Organic Beverages

- Organic Cereal and Food Grains

- Organic Meat, Poultry and Dairy

- Organic Spices and Pulses

- Organic Processed Food

- Organic Fruits and Vegetables

- Others

The organic cereal and food grains dominates with a market share of 24% of the total India organic food market in 2025.

The organic cereal and food grains segment holds the leading position in the India organic food market, reflecting the fundamental role of grains and cereals in the Indian diet. India’s organic cereals and millets have also emerged as a key driver of export growth, with government data showing that cereals and millets contributed over 24 % of total organic food export value in fiscal 2024‑25 as India’s organic food exports jumped from US $213 million in 2012‑13 to US $665 million. This segment benefits from the deep-rooted cultural preference for rice, wheat, millets, and other staple grains that form the foundation of daily meals across diverse regional cuisines. Consumers are increasingly opting for organic variants of these essential food items to reduce exposure to harmful pesticide residues and chemical fertilizers commonly used in conventional farming.

The rising awareness among consumers about the health benefits and nutraceutical superiority of organically grown cereals and millets is driving the market among health-conscious and urban folks and parents with children. Traditional food grains such as jowar, bajra, and ragi are also gaining popularity because of health benefits and the practice among farmers to cultivate using organic methods. Support from the government to cultivate and eat millets and the rise in organized cereal sales through e-commerce portals are also increasing this market.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Others

The supermarkets and hypermarkets lead with a share of 32% of the total India organic food market in 2025.

Supermarkets, hypermarkets, etc., have become the most popular distribution channel for organic food products in India, due to the increased growth of the organized market in the country. The retail market gives consumers the benefit of one-point shopping for a variety of organic products. The special stores for organic products in the supermarkets provide an increased display for the products, along with the benefit of observing the various brands within a controlled environment.

The trust factor provided by well-recognized retail brands and the guarantee of authentic products through proper storage and handling also serve to build consumer support for this distribution channel. Supermarkets and hypermarkets also provide a facility to offer lower pricing through buying in large quantities and acting as an intermediary between manufacturers and suppliers. Combining loyalty programs and promotions further increases customer retention and repeat business with organic products through this distribution channel.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 34% share of the total India organic food market in 2025.

North India dominates the organic food market, as the region holds the maximum number of affluent class populations in the National Capital Region as well as large cities like Delhi, Gurugram, and Chandigarh. Infrastructural facilities in the region, in the form of supermarkets as well as organic shops, assist in fulfilling the requirement for superior organic products. Greater purchasing power and awareness among the middle class, especially in cities, influence the preference for organic foods.

Being close to organic farming practices in Uttarakhand and Himachal Pradesh allows North India to derive benefit from fresh organic produce at economical rates. The area is home to many organic food start-ups and online marketplaces that have developed efficient supply chains. Learning institutions and business organizations in major cities in North India have played their part in increasing awareness of the advantages of consuming organic food.

Market Dynamics:

Growth Drivers:

Why is the India Organic Food Market Growing?

Rising Health Consciousness and Awareness About Food Safety

The increasing awareness among Indian consumers regarding the health implications of consuming chemically treated food products is fundamentally driving the organic food market expansion. Growing concerns about pesticide residues, chemical fertilizers, and artificial additives in conventionally produced food have prompted health-conscious consumers to seek safer alternatives. For instance, in 2025, Two Brothers Organic Farms, a Pune‑based organic food company, raised ₹110 crore in a Series B funding round, highlighting strong investor confidence rooted in rising consumer demand for clean‑label and nutrition‑focused organic foods. The rising incidence of lifestyle diseases, including diabetes, cardiovascular conditions, and obesity, has heightened consumer focus on preventive healthcare through dietary modifications. Educated urban consumers are increasingly researching food origins and production methods, leading to informed purchasing decisions favoring organic products. The influence of social media, health influencers, and nutritional experts has amplified awareness about the benefits of organic consumption, particularly among younger demographics.

Government Support and Policy Initiatives for Organic Agriculture

The Indian government's comprehensive support for organic farming through various policy initiatives and financial incentives is creating a favorable environment for market growth. Programs such as Paramparagat Krishi Vikas Yojana, Mission Organic Value Chain Development for North Eastern Region, and National Mission for Sustainable Agriculture provide subsidies, training, and certification support to farmers transitioning to organic practices. The establishment of robust certification frameworks under the National Programme for Organic Production and Participatory Guarantee System has built consumer trust and facilitated international market access. In 2025, the Ministry of Commerce and Industry unveiled an upgraded NPOP portal and TraceNet 2.0, a streamlined digital platform for organic certification and traceability, as part of efforts to strengthen India’s organic export ecosystem and support its ambition to become a global organic food hub. Government efforts to promote India as a global organic hub through export incentives and quality standards are enhancing the country's competitive positioning in international organic trade.

Expanding Retail Infrastructure and E-commerce Penetration

The rapid expansion of organized retail and e-commerce platforms across India is significantly improving organic food accessibility and driving market growth. Modern retail formats including supermarkets, hypermarkets, and specialty organic stores are dedicating increasing shelf space to organic products, enhancing visibility and consumer convenience. The proliferation of e-commerce platforms and quick-commerce services has revolutionized organic food distribution, enabling consumers in tier-II, tier-III cities, and rural areas to access products previously available only in metropolitan markets. For instance, India’s clean‑label grocery retailer The Organic World expanded its footprint with a new store in Bengaluru’s Sahakarnagar in November 2025, offering over 2,000 organic and natural groceries to local consumers and broadening retail access beyond traditional urban centers. Online platforms offer extensive product variety, competitive pricing, and doorstep delivery convenience that appeal to time-constrained urban consumers. The integration of digital payment systems and subscription models for regular organic purchases has further simplified the consumer buying journey.

Market Restraints:

What Challenges the India Organic Food Market is Facing?

Premium Pricing and Affordability Concerns

The price premium linked with organic consumer products, being significantly higher compared to the conventional alternatives, is indeed a major hindrance in the country’s mass market penetration. Higher costs of production, low yields, and the premium involved in the certification process cumulatively add up to higher costs, making it a major hindrance in mass market penetration. This majorly prevents the middle and low-income sections from consuming more of the organic products.

Limited Supply Chain Infrastructure and Product Availability

It can be noted that the poor development of the cold chain logistics system for organic products poses challenges to product freshness and quality. Storage space and transport network bottlenecks cause increased product wastage and quality variability for smaller cities and rural areas. The involvement of middlemen in the supply chain may cause product price to escalate and decrease farming profitability.

Certification Complexities and Consumer Trust Issues

Being an expensive and complicated process, the organic certification system can be challenging for small and marginal farmers to enter the organic market. This problem of various standards for certifications and varying levels of quality tests leads to consumer uncertainty about authenticity and claims related to the products. Cases of misleading labeling and adulteration of organic products have disrupted the trust level of consumers and require steeper government action.

Competitive Landscape:

The magnitude of the organic food market in the India market is moderately fragmented. Key players in the market, ranging from new age startups to domestic players, compete in different ranges. The key players in the market are presently focused on innovation, building their brand, and impressing the wider distribution channel to acquire a larger market. Backward integration programs, such as farming contracts or farming partnerships, are in progress to acquire good quality. Collaborations between the existing brands in the organic food industry and web portals have augmented the market. The level of competition is set to increase with the foray of MNC FMCG companies in the organic food market. Foreign brands would also eye the Indian market.

Some of the key players include:

- Conscious Food Private Limited

- Ecofarms

- Elworld Organic

- Mehrotra Consumer Products Pvt. Ltd.

- Nature Bio-Foods Ltd

- Nature Pearls Pvt Ltd

- Natureland Organics

- Nourish Organic Foods Pvt. Ltd

- Organic India Pvt. Ltd.

- Phalada Agro Research Foundations Pvt. Ltd.

- Pure & Sure

- Sresta Natural Bioproducts Pvt. Ltd.

- Suminter India Organics

Recent Developments:

- April 2025: ITC Ltd announced it will acquire Sresta Natural Bioproducts, the company behind the 24 Mantra Organic brand, in a ₹472.5 crore all‑cash deal to strengthen its presence in the fast‑growing organic foods segment domestically and internationally.

India Organic Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Segment Coverage | Product Type, Distribution Channel, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Conscious Food Private Limited, Ecofarms, Elworld Organic, Mehrotra Consumer Products Pvt. Ltd., Nature Bio-Foods Ltd, Nature Pearls Pvt Ltd, Natureland Organics, Nourish Organic Foods Pvt. Ltd, Organic India Pvt. Ltd., Phalada Agro Research Foundations Pvt. Ltd., Pure & Sure, Sresta Natural Bioproducts Pvt. Ltd., Suminter India Organics, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India organic food market size was valued at USD 2,303.31 Million in 2025.

The India organic food market is expected to grow at a compound annual growth rate of 19.32% from 2026-2034 to reach USD 11,296.09 Million by 2034.

Organic cereal and food grains dominated the market with a share of 24%, driven by India's staple food culture and growing consumer preference for chemical-free grains and millets among health-conscious households.

Key factors driving the India organic food market include rising health consciousness among consumers, growing awareness about pesticide and chemical residues in food, government support for organic farming through various policy initiatives, and expanding retail and e-commerce infrastructure.

Major challenges include premium pricing limiting mass market adoption, underdeveloped cold chain and logistics infrastructure, complex certification processes for small farmers, consumer trust issues regarding product authenticity, and limited awareness in rural and semi-urban areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)