Indian Online Grocery Market Size, Share, Trends and Forecast by Product Type, Payment Method, Platform, and Region, 2026-2034

Indian Online Grocery Market Summary:

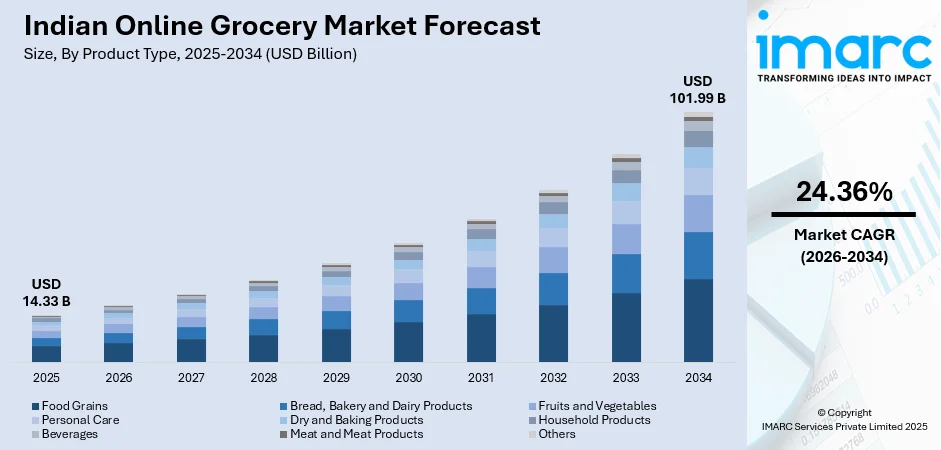

The Indian online grocery market size was valued at USD 14.33 Billion in 2025 and is projected to reach USD 101.99 Billion by 2034, growing at a compound annual growth rate of 24.36% from 2026-2034.

The market is driven by rising smartphone penetration and expanding internet accessibility, alongside changing consumer preferences favoring convenient digital shopping. Rapid urbanization and busy lifestyles are pushing consumers toward online platforms offering doorstep delivery and wide product variety. Simultaneously, the growth of quick commerce models and robust digital payment infrastructure is accelerating adoption across metropolitan and tier two cities. Continued investments in cold chain logistics and last mile delivery are further improving efficiency, reliability, and customer satisfaction, supporting sustained market expansion.

Key Takeaways and Insights:

- By Product Type: Food grains dominate the market with a share of 22% in 2025, driven by staple consumption of rice, wheat, and pulses, bulk online purchases, competitive pricing, and scheduled doorstep deliveries reducing frequent store visits.

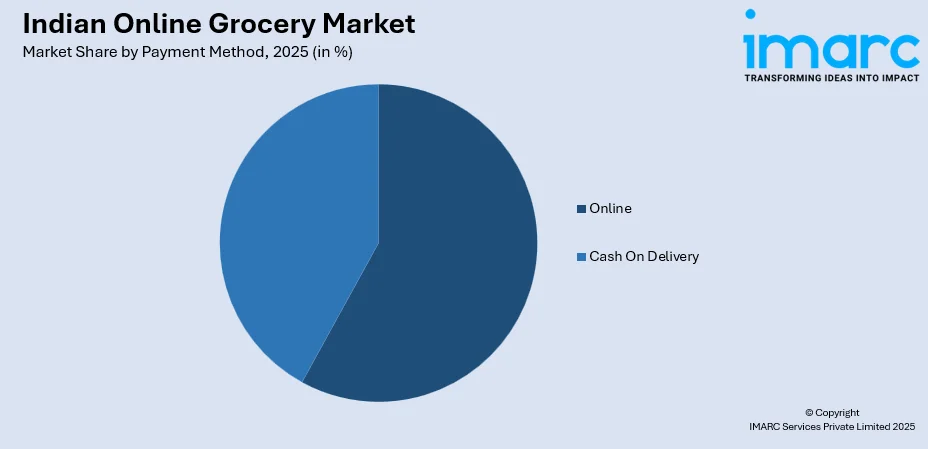

- By Payment Method: Online leads the market with a share of 58% in 2025, owing to widespread UPI adoption, cashback incentives, bank promotions, integrated mobile wallets, and seamless checkout experiences for tech savvy urban consumers nationwide.

- By Platform: App-based represents the largest segment with a market share of 68% in 2025, driven by personalized recommendations, deal alerts, faster checkouts, high smartphone penetration, and anytime shopping convenience across urban and semi urban regions nationwide in India.

- By Region: North India dominates the market with a share of 31% in 2025, owing to metro concentration, Delhi NCR clusters, high internet penetration, digital payments, dense populations, and convenience focused urban lifestyles boosting order volumes significantly.

- Key Players: The Indian online grocery market shows strong competition among e-commerce platforms, quick commerce operators, and regional players, driven by technological innovation, expanded product assortments, partnerships with local suppliers, and ongoing investments in supply chain infrastructure to meet evolving consumer preferences. Some of the key players operating in the market include Amazon.com, Inc, Bigbasket (Supermarket Grocery Supplies Pvt Ltd), Blink Commerce Private Limited, Flipkart Internet Private Limited, JioMart (Reliance Retail Limited), Nature's Basket, Swiggy Instamart, and Zepto Marketplace Private Limited.

To get more information on this market Request Sample

The Indian online grocery market is experiencing transformative growth fueled by fundamental shifts in consumer behavior and technological advancement. Rapid urbanization has created time-constrained consumers who prioritize convenience over traditional shopping methods, driving preference for digital platforms offering extensive product selections and doorstep delivery. The proliferation of affordable smartphones and widespread high-speed internet connectivity has democratized access to online grocery services across metropolitan cities and emerging tier-two markets. Digital payment infrastructure, particularly UPI-based transactions, has eliminated friction in online purchases while promotional incentives encourage trial and repeat usage. The emergence of quick commerce models promising ultra-fast deliveries has revolutionized consumer expectations and accelerated platform adoption. As per sources, India's quick commerce sector made two-thirds of all 2024 e-grocery orders, with total market share growing to $6-7 Billion and accounted for a tenth of overall e-retail dollars spent in 2024. Additionally, young demographics with higher digital literacy are increasingly comfortable purchasing fresh produce and daily essentials through mobile applications, reshaping traditional grocery procurement patterns.

Indian Online Grocery Market Trends:

Rise of Quick Commerce and Ultra-Fast Delivery Models

The Indian online grocery landscape is undergoing rapid transformation driven by the expansion of quick commerce services offering deliveries within minutes instead of hours. As per sources, in July 2025, Amazon launched its 10-minute delivery service, Amazon Now, in western Delhi, expanding its quick commerce operations after a successful pilot in Bengaluru in June 2025. This model relies on hyperlocal dark stores and micro fulfillment centers located in densely populated urban areas, ensuring close proximity to consumers. The promise of near instant grocery delivery strongly appeals to urban professionals and younger consumers who prioritize speed, convenience, and time efficiency in daily purchasing decisions.

Integration of Artificial Intelligence and Personalization Technologies

Online grocery platforms are increasingly incorporating sophisticated artificial intelligence (AI) and machine learning (ML) capabilities to enhance customer engagement and operational efficiency. These technologies enable personalized product recommendations based on purchasing history and browsing behavior, creating curated shopping experiences for individual consumers. Predictive analytics are optimizing inventory management and demand forecasting, reducing wastage particularly for perishable items. Voice-enabled shopping assistants and visual search functionalities are emerging as innovative interfaces that simplify the ordering process. As per sources, in October 2025, OpenAI partnered with NPCI and Razorpay to integrate UPI payments in ChatGPT, enabling users to shop directly from BigBasket within the chat interface during pilot testing.

Expansion into Tier-Two and Tier-Three Cities

The Indian online grocery sector is experiencing geographical diversification as platforms aggressively expand their presence beyond metropolitan centers into smaller cities and semi-urban areas. According to sources, in 2025, Swiggy Instamart expanded its quick commerce service to 100 cities, with one in four new users from tier‑2 and tier‑3 cities, offering over 30,000 products including groceries and essentials. Moreover, improving digital infrastructure and increasing smartphone adoption in these regions are creating substantial untapped consumer pools. Platforms are customizing their product assortments to accommodate regional preferences, local language interfaces, and culturally specific dietary requirements. Strategic partnerships with local suppliers and investment in decentralized warehousing are enabling efficient operations in previously underserved markets.

Market Outlook 2026-2034:

The Indian online grocery market is expected to witness strong revenue growth over the forecast period, driven by sustained digital adoption and shifting consumer preferences toward convenience focused shopping. Ongoing investments in supply chain infrastructure, cold chain logistics, and last mile delivery will improve efficiency and geographic coverage. The rapid expansion of quick commerce and deeper penetration into tier two and tier three cities will create new revenue streams. Advances in artificial intelligence, personalization, and seamless digital payments will enhance user experience, encourage repeat purchases, and strengthen market integration. The market generated a revenue of USD 14.33 Billion in 2025 and is projected to reach a revenue of USD 101.99 Billion by 2034, growing at a compound annual growth rate of 24.36% from 2026-2034.

Indian Online Grocery Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Food Grains | 22% |

| Payment Method | Online | 58% |

| Platform | App-based | 68% |

| Region | North India | 31% |

Product Type Insights:

- Food Grains

- Bread, Bakery and Dairy Products

- Fruits and Vegetables

- Personal Care

- Dry and Baking Products

- Household Products

- Beverages

- Meat and Meat Products

- Others

Food grains dominate with a market share of 22% of the total Indian online grocery market in 2025.

Food grains maintain its leading position in the Indian online grocery market owing to the fundamental dietary importance of staples including rice, wheat, pulses, and cereals in Indian households. These products represent essential pantry items requiring regular replenishment, creating consistent demand patterns that favor online procurement. Consumers appreciate the convenience of purchasing bulk quantities delivered directly to their residences, eliminating the physical burden of transporting heavy packages from traditional retail stores.

Online platforms have optimized their food grains offerings by partnering directly with agricultural suppliers and mills to ensure competitive pricing and quality assurance. In June 2025, Swiggy Instamart partnered with Bharat Organics and NCOL to offer 21 certified organic staples, including pulses, rice, and cereals, to consumers across major Indian cities via its digital platform. The extended shelf life of these products reduces concerns about freshness degradation during delivery, making them ideal candidates for online purchasing. Subscription models and scheduled delivery options have gained traction, enabling households to maintain consistent supplies without repeated ordering efforts. Regional variations in grain preferences are being accommodated through diverse product assortments tailored to local consumption patterns.

Payment Method Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Cash on Delivery

Online leads with a share of 58% of the total Indian online grocery market in 2025.

Online dominates the Indian online grocery market, reflecting the nationwide digital payment revolution driven by unified payment interface infrastructure. The convenience of completing transactions through mobile wallets, UPI applications, and net banking has eliminated traditional barriers associated with cash handling during delivery. As per sources, groceries and supermarkets led UPI transactions in India, capturing 24.6% in August 2025 of total volumes, driven by quick commerce platforms, up from 22.4% a year ago. Moreover, promotional incentives including cashback offers, reward points, and exclusive discounts for digital transactions have accelerated consumer migration toward electronic payment modes.

The seamless integration of payment gateways within grocery applications enables frictionless checkout experiences that enhance customer satisfaction and encourage repeat purchases. Collaborations between online grocery platforms and financial institutions have introduced cobranded credit cards and dedicated offers that incentivize digital payment adoption. Security enhancements and transaction authentication protocols have addressed consumer concerns regarding online financial transactions. The younger demographic's inherent comfort with digital financial services continues driving sustained preference for online payment methods across urban and emerging markets.

Platform Insights:

- App-based

- Web-based

App-based exhibits a clear dominance with a 68% share of the total Indian online grocery market in 2025.

App-based commands the largest market share in the Indian online grocery sector, attributable to the ubiquitous smartphone penetration and superior mobile user experiences. In January 2025, Swiggy announced the launch of Instamart as a separate app, adopting a multi-app strategy to enhance user experience and focus on quick commerce offerings. Furthermore, dedicated grocery applications offer intuitive interfaces, personalized recommendations, and streamlined navigation that simplify product discovery and purchase completion. Push notifications enable platforms to communicate promotional offers, delivery updates, and personalized deals directly to consumers, maintaining engagement and driving repeat orders.

Mobile applications leverage device capabilities including location services, camera functionality for visual search, and biometric authentication that enhance convenience and security. The ability to save shopping lists, reorder previous purchases, and track deliveries in real-time creates compelling value propositions that website interfaces cannot fully replicate. App-exclusive discounts and loyalty programs further incentivize platform installation and regular usage. The portability of smartphone-based shopping enables purchases during commutes and leisure moments, maximizing conversion opportunities throughout daily routines.

Regional Insights:

- North India

- East India

- West India

- South India

North India dominates with a market share of 31% of the total Indian online grocery market in 2025.

North India maintains its position as the leading regional market for online grocery services, driven by the concentration of major metropolitan areas including Delhi-NCR, which hosts substantial urban populations with elevated digital adoption rates. The region benefits from superior logistics infrastructure enabling efficient delivery operations across densely populated residential clusters. High internet penetration and widespread smartphone usage create favorable conditions for digital commerce adoption among diverse demographic segments.

Consumer behavior in North India demonstrates strong preference for convenience-oriented services, with busy urban lifestyles driving demand for time-saving shopping alternatives. The competitive presence of multiple online grocery platforms has intensified service quality improvements and promotional activities that benefit consumers. Cold chain infrastructure investments in the region support fresh produce delivery capabilities, expanding product categories beyond packaged goods. Rising disposable incomes and increasing nuclear family structures are further accelerating household adoption of online grocery services throughout North Indian states.

Market Dynamics:

Growth Drivers:

Why is the Indian Online Grocery Market Growing?

Rapid Digital Infrastructure Development and Smartphone Proliferation

The exponential growth of digital infrastructure across India represents a fundamental catalyst for online grocery market expansion. Affordable smartphone devices and competitive mobile data pricing have democratized internet access across urban and semi-urban populations. Consumers who previously lacked connectivity now possess constant access to digital platforms through their mobile devices. This widespread connectivity enables grocery applications to reach previously underserved demographic segments and geographical regions. The younger population's inherent digital literacy and comfort with mobile transactions create natural adoption pathways for online grocery services. Government initiatives promoting digital India and cashless transactions have further accelerated infrastructure development and consumer readiness for e-commerce participation. According to sources, in 2025, the Union Budget raised BharatNet allocation to Rs22,000 crores to expand broadband connectivity to rural schools and health centres across India.

Evolving Consumer Lifestyles and Convenience-Driven Preferences

Contemporary Indian consumers, particularly urban professionals and dual-income households, face increasing time constraints that elevate the value of convenience-oriented services. Traditional grocery shopping requiring physical store visits, product selection, queuing, and transportation consumes significant time that busy consumers prefer allocating elsewhere. Online grocery platforms offering doorstep delivery, scheduled time slots, and extensive product selections address these pain points effectively. In September 2025, Amazon Fresh expanded to over 270 cities in India, connecting 13,000 farmers to millions of customers, offering two-hour grocery delivery and enhanced access to fresh produce. Moreover, the ability to compare prices, read reviews, and discover new products digitally enhances the shopping experience beyond physical retail capabilities. Subscription services and automatic replenishment options further reduce cognitive burden associated with routine household procurement. This lifestyle alignment between digital grocery services and modern consumer requirements drives sustained adoption and usage frequency.

Quick Commerce Revolution and Enhanced Delivery Capabilities

The emergence of quick commerce models promising delivery within minutes has fundamentally transformed consumer expectations and market dynamics. Strategic deployment of dark stores and micro-fulfillment centers in residential neighborhoods enables unprecedented delivery speed for essential grocery items. As per sources, in 2025, Flipkart Minutes, Flipkart’s quick commerce arm, expanded to over 200 dark stores across 14 cities, offering 10–15minute deliveries of groceries, essentials, and electronics. Furthermore, this capability addresses immediate consumption needs and impulse purchasing occasions that previously favored nearby physical stores. The reliability and consistency of quick delivery services build consumer trust and encourage platform dependency for daily grocery requirements. Investment in delivery fleet management, route optimization, and real-time tracking technologies enhance operational efficiency and customer satisfaction. The competitive intensity among quick commerce operators drives continuous service improvements and geographical expansion, accelerating overall market growth.

Market Restraints:

What Challenges the Indian Online Grocery Market is Facing?

Competition from Traditional Kirana Stores and Established Retail Networks

Local kirana stores maintain deep-rooted relationships with neighbourhood consumers through personalized service, credit facilities, and cultural familiarity that online platforms struggle to replicate. These traditional retailers are increasingly adopting digital tools and delivery services to retain customers while preserving their proximity advantages. The trust established through decades of community presence creates loyalty that resists migration toward impersonal digital alternatives.

Logistics Complexity and Last-Mile Delivery Challenges

The Indian online grocery market faces persistent challenges related to logistics infrastructure and last-mile delivery operations, particularly outside major metropolitan centers. Traffic congestion, inconsistent address systems, and infrastructure limitations complicate timely delivery execution. Managing perishable inventory across diverse climatic conditions requires sophisticated cold chain capabilities that demand substantial capital investment.

Consumer Trust and Quality Perception Concerns

Certain consumer segments maintain reservations regarding product quality, freshness, and authenticity when purchasing groceries through digital platforms without physical inspection. Fresh produce categories including fruits, vegetables, and dairy products face particular scrutiny as consumers question whether delivered items match expectations. Past experiences with damaged packaging, incorrect substitutions, or substandard products create hesitancy toward repeat purchases.

Competitive Landscape:

The Indian online grocery market exhibits a highly competitive and evolving environment with participation from large e-commerce players, specialized grocery platforms, quick commerce operators, and regional startups. Intense competition is driving innovation in delivery speed, pricing models, and product assortment diversification. Companies differentiate through advanced technology, exclusive supplier tie-ups, loyalty programs, and enhanced user experiences. Investments in supply chain infrastructure, warehousing, and cold chain logistics remain critical for scalability. Additionally, mergers, acquisitions, and strategic alliances are reshaping market dynamics, supporting geographical expansion, hyperlocal fulfillment, and deeper customer engagement across urban and emerging markets.

Some of the key players include:

- Amazon.com, Inc

- Bigbasket (Supermarket Grocery Supplies Pvt Ltd)

- Blink Commerce Private Limited

- Flipkart Internet Private Limited

- JioMart (Reliance Retail Limited)

- Nature's Basket

- Swiggy Instamart

- Zepto Marketplace Private Limited

Recent Developments:

- In December 2025, Dealshare relaunched its two-hour delivery model in Jaipur, targeting middle-income households. The initiative, part of a multi-city expansion including Kolkata, Lucknow, and Ghaziabad, utilizes eight dark stores and ten physical Dealshare Marts to ensure rapid, reliable, and cost-effective grocery delivery across these regions.

Indian Online Grocery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Food Grains, Bread, Bakery and Dairy Products, Fruits and Vegetables, Personal Care, Dry and Baking Products, Household Products, Beverages, Meat and Meat Products, Others |

| Payment Methods Covered | Online, Cash on Delivery |

| Platforms Covered | App-Based, Web-Based |

| Regions Covered | North India, East India, West India, South India |

| Companies Covered | Amazon.com, Inc, Bigbasket (Supermarket Grocery Supplies Pvt Ltd), Blink Commerce Private Limited, Flipkart Internet Private Limited, JioMart (Reliance Retail Limited), Nature's Basket, Swiggy Instamart, Zepto Marketplace Private Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indian online grocery market size was valued at USD 14.33 Billion in 2025.

The Indian online grocery market is expected to grow at a compound annual growth rate of 24.36% from 2026-2034 to reach USD 101.99 Billion by 2034.

Food grains held the largest market share owing to its fundamental importance as dietary staples in Indian households, the convenience of bulk purchasing through online platforms, competitive pricing offerings, and extended shelf life that reduces freshness concerns during delivery fulfilment.

Key factors driving the Indian online grocery market include increasing smartphone penetration and internet accessibility, evolving consumer preferences toward convenience-oriented shopping, rapid urbanization creating time-constrained lifestyles, expansion of digital payment infrastructure, and emergence of quick commerce delivery models.

Major challenges include intense competition from established kirana stores and traditional retail networks, logistics complexity and last-mile delivery infrastructure limitations, consumer trust concerns regarding product quality and freshness, high customer acquisition costs, managing perishable inventory across diverse climatic conditions, and regulatory compliance requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)