India Onion Powder Market Size, Share, Trends and Forecast by End-Use Sector, Application, Packaging, and Region, 2025-2033

India Onion Powder Market Size and Share:

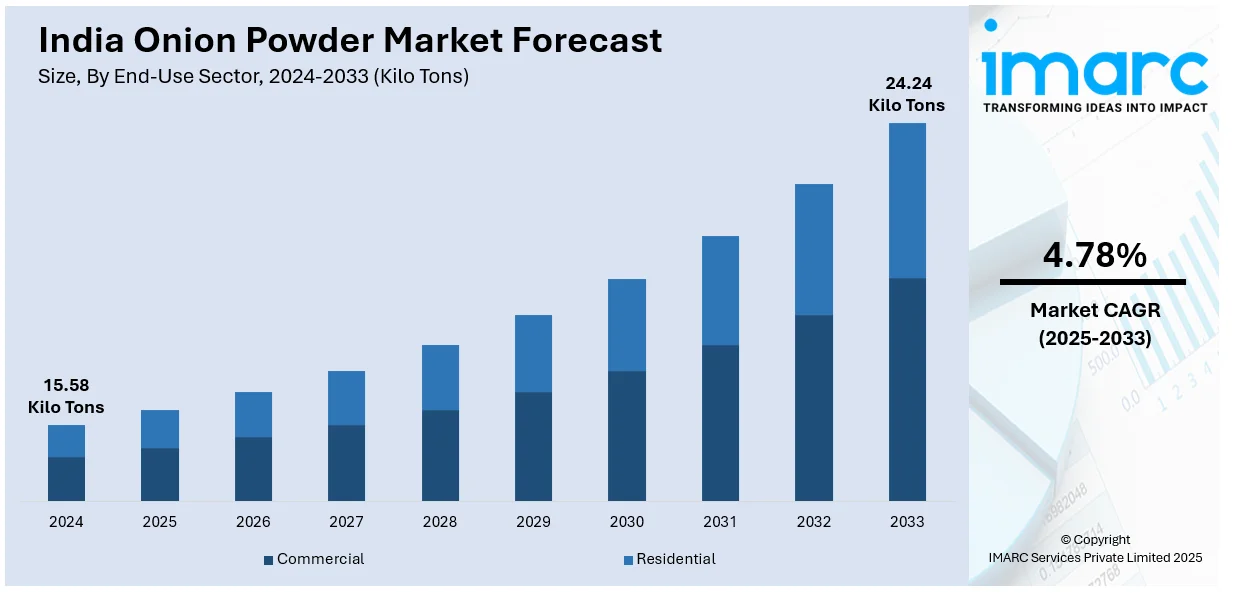

The India onion powder market size was valued at 15.58 Kilo Tons in 2024. Looking forward, IMARC Group estimates the market to reach 24.24 Kilo Tons by 2033, exhibiting a CAGR of 4.78% from 2025-2033. Improvements in technology, which aid in streamlining production processes and extending shelf life, along with the growing investments in branding and promotional activities through retail channels, are influencing the India onion powder market share positively.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

15.58 Kilo Tons |

|

Market Forecast in 2033

|

24.24 Kilo Tons |

| Market Growth Rate 2025-2033 | 4.78% |

The rising demand for convenience food items is fueling the market growth in India. The country’s high working population is leading to busy lifestyles, leaving less time for traditional food preparation. As per the SBI Research, the working-age demographic in India is projected to rise to 65.2% by 2031. Onion powder offers a practical alternative to chopping fresh onions, making it a popular choice among urban households, fast food outlets, and ready-to-eat (RTE) food manufacturers. It blends easily into a wide range of recipes and helps maintain consistency in flavor and texture, which appeals to commercial kitchens and food processors. Additionally, the long shelf life and ease of storage make onion powder a go-to option for packaged food products. As people are opting for instant and processed meals, the demand for convenient and stable ingredients like onion powder is increasing in the country.

To get more information on this market, Request Sample

The growing onion production in India is positively influencing the market. As per the information provided by the Agriculture Ministry, India's onion output is projected to increase by 19% to 288.77 Lakh Tons in June 2025. As farmers are cultivating larger volumes of onions, the availability of surplus yield is encouraging processors to convert the excess into value-added products like onion powder. This aids in minimizing wastage, stabilizing prices, and supporting year-round availability of onion-based ingredients. The increase in onion cultivation is also enabling manufacturers to scale production, reduce unit costs, and cater to rising demand from food processing industries and retail users. With a steady input supply, businesses are investing in better processing infrastructure and expanding their market presence.

India Onion Powder Market Trends:

Improvements in technology

Technological improvements are propelling the market growth. Advanced machinery and drying techniques ensure better retention of flavor, color, and nutrients in the powder, making it more appealing to both domestic and industrial users. These innovations reduce manual labor, increase output, and maintain quality, allowing manufacturers to meet rising demand efficiently. Improved packaging technologies also help preserve item quality during storage and transportation. Technology supports better supply chain management and traceability, which assists in building user trust. Moreover, the high urbanization rate in India is leading to high demand for processed and ready-to-use food ingredients, which in turn is encouraging investments in advanced food processing technologies. As per industry estimates, at the beginning of 2025, 37.1% of the population of India lived in urban areas, equating to 542,742,539 individuals.

Rising applications in food processing industry

The growing applications in the food processing industry are offering a favorable India onion powder market outlook. Onion powder serves as a key ingredient in snacks, sauces, seasoning blends, and instant mixes due to its long shelf life and ease of use. The food processing industry values it for its ability to deliver uniform flavor without the hassle of peeling and chopping fresh onions. As the food processing industry is striving to cater to evolving consumer tastes, the demand for versatile ingredients like onion powder is increasing. According to a report by the IMARC Group, the India food processing market was valued at INR 30,498.0 Billion in 2024 and is set to attain INR 65,244.8 Billion by 2033, growing at a CAGR of 8.38% during 2025-2033. High usage of onion powder in bakery products, meat processing, and convenience is further boosting its utilization. This trend is stimulating the market growth, as food processors increasingly rely on onion powder for efficiency, consistency, and flavor enhancement in mass production.

Expansion of retail outlets

The expansion of retail channels is impelling the India onion powder market growth. According to the 'Retail Kaleidoscope' report created collaboratively by the Boston Consulting Group (BCG) and the Retailers Association of India (RAI), India's retail sector hit ₹82 Lakh Crore in 2024, rising from ₹35 Lakh Crore in 2014 and growing at a rate exceeding 8.9% over the past ten years. With the broadening of supermarkets, hypermarkets, and convenience stores, onion powder is becoming easily available to a broader consumer base. Organized retail chains offer a variety of packaging sizes and brands, allowing people to choose as per their preference and budget. This visibility is encouraging impulse purchases and helps promote the product as a staple kitchen ingredient. The retail sector is also supporting branding and promotional activities, making individuals more aware about the uses and benefits of onion powder. Additionally, online retail platforms are contributing to market expansion by offering doorstep delivery and discounts, further boosting sales.

India Onion Powder Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India onion powder market, along with forecast at the country and regional levels from 2025-2033. The market has been categorized based on end-use sector, application, and packaging.

Analysis by End-Use Sector:

- Commercial

- Residential

The commercial sector, including food processing companies, restaurants, hotels, and catering services, is extensively using onion powder as a flavoring and seasoning agent in a variety of dishes and packaged food products. The convenience of onion powder, with its long shelf life and easy handling, makes it an ideal choice for commercial kitchens and food manufacturers who require ingredients in bulk. As urbanization activities are rising and eating out is becoming more common, quick service restaurants (QSRs) and cloud kitchens increasingly rely on onion powder to maintain consistency and save preparation time. The commercial sector is benefiting from bulk packaging options, which reduce cost and improve operational efficiency. In addition, the growing demand for processed and RTE food items is increasing the utilization of onion powder in commercial food production. With evolving consumer preferences and increasing awareness about hygiene in food preparation, commercial establishments continue to prefer onion powder as a clean, efficient, and time-saving ingredient.

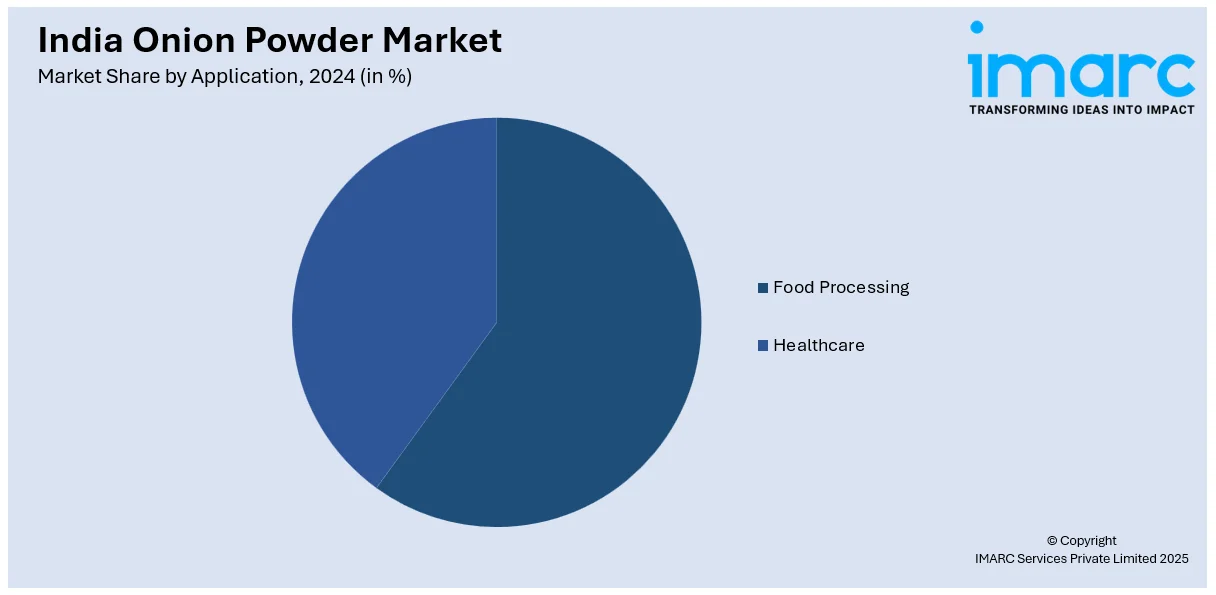

Analysis by Application:

- Food Processing

- Healthcare

In the food processing industry, onion powder is employed due to its extensive shelf life and flavor. Onion powder serves as a key flavoring agent in snacks, soups, sauces, gravies, RTE meals, and packaged food items, making it an essential ingredient in large-scale food manufacturing. Its easy storage and ability to blend well with other ingredients make it highly suitable for industrial food processing. As consumer preferences are shifting towards convenience food products and ready mixes, food processing companies are adopting onion powder to enhance savor while maintaining quality and efficiency. The segment is also benefiting from cost-effective bulk procurement, which supports mass production. Additionally, rising exports of processed food items is driving the Indian onion powder market demand. The growing urban population, changing dietary habits, and expansion of the food processing industry are further strengthening this trend.

Analysis by Packaging:

- Bulk Packaging

- Pouches

Bulk packaging is preferred in food processing companies, hotels, catering services, and large-scale kitchens, as it offers cost-efficiency, easy handling, and reduced packaging waste. Bulk packaging supports high-volume operations, enabling businesses to maintain a steady supply of onion powder without frequent restocking. It also guarantees product consistency and aids in streamlining the supply chain for large users. As the food processing and hospitality sectors are thriving in India, the need for bulk quantities of essential ingredients like onion powder is increasing. Bulk packaging options, such as large sacks, drums, or cartons, also make storage and transportation more manageable for wholesalers and distributors. Moreover, bulk packaging reduces the per-unit cost, making it more economical for business users. With the rise in demand from commercial kitchens and manufacturing units, bulk packaging continues to dominate the market, offering practicality, efficiency, and affordability across India’s burgeoning food-related industries.

Regional Analysis:

- Gujarat

- Maharashtra

- Madhya Pradesh

- Rajasthan

- Others

Gujarat has favorable climatic conditions and soil quality that support large-scale onion cultivation, ensuring a steady supply of raw materials for powder production. Gujarat also houses several processing units equipped with modern technology that enable efficient drying and grinding of onions into powder. The state’s proximity to key ports is also supporting the export of onions and onion powder. In April 2024, the Indian Union government eased the ongoing ban on onion exports, allowing the immediate shipment of 2,000 Tons of white onions, mainly from Gujarat, through three specified ports, Mundra and Pipavav in Gujarat, and Nhava Sheva in Mumbai. The presence of organized food processing clusters and support from state initiatives helps manufacturers scale operations and maintain product quality. Additionally, Gujarat is benefiting from skilled labor, access to advanced machinery, and supportive policies that promote agro-industries. With increasing demand for processed food items and dehydrated products, Gujarat continues to dominate the market by combining strong production capacity, industrial expertise, and efficient distribution channels, which is expected to influence the India onion powder market forecast.

Competitive Landscape:

Key players are investing in advanced processing technologies and ensuring consistent product quality. They are streamlining supply chains, enhancing storage capacities, and implementing efficient packaging solutions to meet both domestic and international standards. These companies are engaging in product innovations and introducing variants of onion powder tailored to the needs of the food processing industry, QSRs, and households. They also focus on expanding distribution networks across urban and rural areas, making the product more accessible. With strong branding and marketing strategies, key players are increasing consumer awareness and trust in packaged onion powder. Their participation in trade fairs and collaborations with export agencies further aids in enhancing India's presence in the worldwide market. For instance, in October 2024, Walmart revealed its plans to broaden the sourcing of its food and snack products by incorporating new and renowned Indian brands, such as Jayanti Spices, Britannia, and Bikano. Jayanti Spices marketed its products under Walmart's Great Value brand. The brand offered a variety of fragrant spices and herbs like onion powder and cumin powder, supplying spices cultivated in India to American customers.

The report provides a comprehensive analysis of the competitive landscape in the India onion powder market with detailed profiles of all major companies, including:

- Jain Irrigation Systems Pvt. Ltd

- Kings Dehydration

- Gujarat Dehyd Foods Ltd.

- Gujarat Agro Exports Ltd.

Latest News and Developments:

- March 2025: Haldiram's revealed the entry of two new investors, International Holding Company (IHC) and Alpha Wave Global, joining Temasek, which were involved in its current equity round. This strategic decision enhanced the brand’s financial standing, enabling the company to speed up its worldwide growth, especially focusing on the US and Middle East markets. The flavorful items contained onion powder in their ingredients.

India Onion Powder Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Kilo Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End-Use Sectors Covered | Commercial, Residential |

| Applications Covered | Food Processing, Healthcare |

| Packagings Covered | Bulk Packaging, Pouches |

| Regions Covered | Gujarat, Maharashtra, Madhya Pradesh, Rajasthan, Others |

| Companies Covered | Jain Irrigation Systems Pvt. Ltd, Kings Dehydration, Gujarat Dehyd Foods Ltd. and Gujarat Agro Exports Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India onion powder market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India onion powder market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India onion powder industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India onion powder market was valued at 15.58 Kilo Tons in 2024.

The India onion powder market is projected to exhibit a CAGR of 4.78% during 2025-2033, reaching a value of 24.24 Kilo Tons by 2033.

The thriving food processing industry is increasing the consumption of onion powder in various food products, such as soups, sauces, and seasonings. Besides this, technological advancements in food preservation and processing are stimulating the market growth, making it easier to produce and distribute high-quality onion powder. Moreover, the increasing preferences for natural and preservative-free ingredients in food items are driving the demand for onion powder.

Gujarat currently dominates the India onion powder market, accounting for a share of XX% in 2024, due to high onion production, a well-established food processing infrastructure, and efficient logistics. The region is supporting large-scale manufacturing and exports, driven by favorable policies, skilled labor, and proximity to major ports.

Some of the major players in the India onion powder market include Jain Irrigation Systems Pvt. Ltd, Kings Dehydration, Gujarat Dehyd Foods Ltd., Gujarat Agro Exports Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)