India Milkshake Market Size, Share, Trends and Forecast by Flavor, Packaging, Distribution Channel, and Region, 2025-2033

India Milkshake Market Outlook 2025-2033:

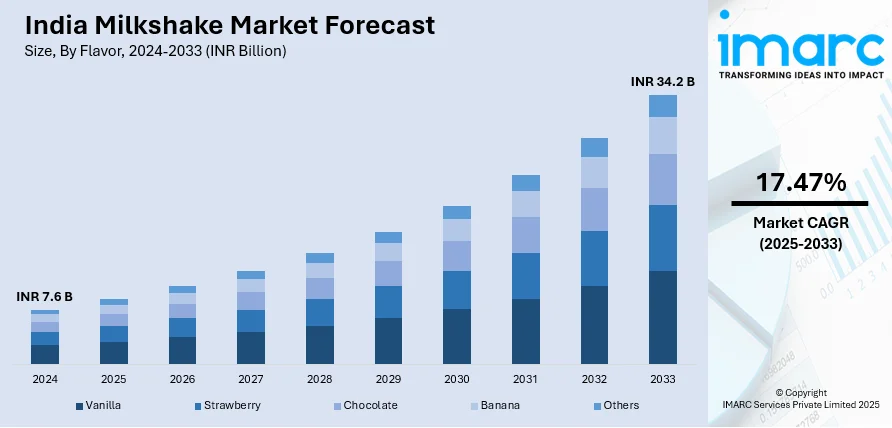

The Indian milkshake market size reached INR 7.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach INR 34.2 Billion by 2033, exhibiting a growth rate (CAGR) of 17.47% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 7.6 Billion |

|

Market Forecast in 2033

|

INR 34.2 Billion |

| Market Growth Rate 2025-2033 | 17.47% |

A milkshake is a cold and blended dairy-based beverage prepared using milk, ice-creams, flavoring syrups and sugars. It is available in a wide variety of flavors, such as vanilla, chocolate and strawberry. Various toppings, including sweetened dry cereal, toasted coconut, marshmallows, biscuits, fresh fruits, cinnamon, clove and dry cakes, are added to enhance the flavor of the beverage. Certain cafes and restaurants also offer savory variants prepared using olive oil, sesame seeds and sea salt. Thick milkshakes are usually prepared using commercial milkshake machines in professional kitchens, which have specialized settings for blending speed to adjust the consistency of the shake. They are commonly served in bottles, pouches and cartons.

To get more information on this market, Request Sample

India Milkshake Market Trends:

Significant growth in the food and beverage industry is one of the key factors creating a positive outlook for the market in the country. Moreover, increasing private label offerings across India is providing a thrust to the market growth. International milkshake brands are also establishing their franchise outlets in metropolitan cities for convenient product distribution. In line with this, changing lifestyles and dietary patterns of the consumers are also contributing to the market growth. With the increasing number of shopping malls and recreational centers, there is a shifting preference among consumers, especially millennials, from carbonated drinks toward milkshakes as a healthier alternative. Additionally, various product innovations, such as the launch of packaged milkshakes in novel flavors and ready-to-drink (RTD) travel-friendly packaging solutions, are acting as other growth-inducing factors. Product manufacturers are also developing milkshakes with natural and organic ingredients with no preservatives and artificial sugars to attract a wider consumer base. Other factors, including rapid urbanization, along with the increasing expenditure capacities of the consumers, are anticipated to drive the market toward growth.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India milkshake market report, along with forecasts at the country and state level from 2025-2033. Our report has categorized the market based on flavor, packaging and distribution channel.

Breakup by Flavor:

- Vanilla

- Strawberry

- Chocolate

- Banana

- Others

Breakup by Packaging:

- Bottles

- Pouches

- Cartons

- Others

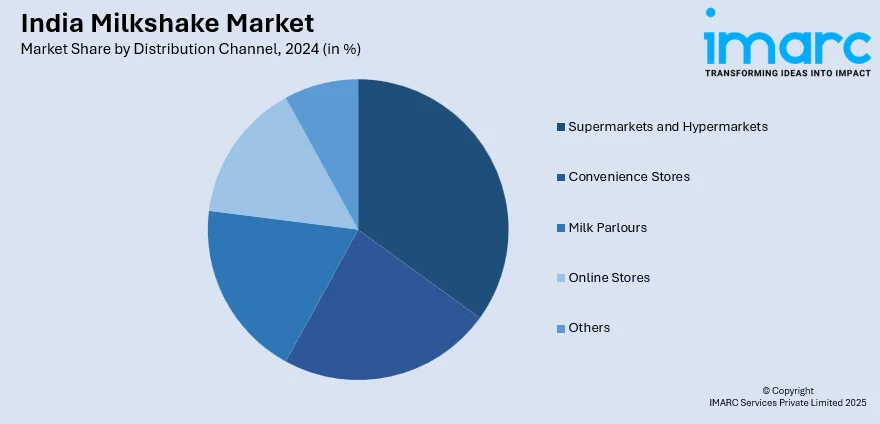

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Milk Parlours

- Online Stores

- Others

Breakup by State:

- Karnataka

- Maharashtra

- Tamil Nadu

- Delhi

- Gujarat

- Andhra Pradesh and Telangana

- Uttar Pradesh

- West Bengal

- Kerala

- Haryana

- Punjab

- Rajasthan

- Madhya Pradesh

- Bihar

- Orissa

- Others

Value Chain Analysis

Key Drivers and Challenges

Porters Five Forces Analysis

Government Regulations

Competitive Landscape

- Competitive Structure

- Key Player Profiles

- CavinKare

- Mother Dairy

- GCMMF

- KMF

- Hershey

This report provides a deep insight into the Indian milkshake market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. This report is a must-read for milkshake manufacturers, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Indian milkshake market in any manner.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Billion, Million Litres |

| Segment Coverage | Flavor, Packaging, Distribution Channel, State |

| States Covered | Karnataka, Maharashtra, Tamil Nadu, Delhi, Gujarat, Andhra Pradesh and Telangana, Uttar Pradesh, West Bengal, Kerala, Haryana, Punjab, Rajasthan, Madhya Pradesh, Bihar, Orissa, Others |

| Companies Covered | CavinKare, Mother Dairy, GCMMF, KMF and Hershey |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India milkshake market was valued at INR 7.6 Billion in 2024.

We expect the India milkshake market to exhibit a CAGR of 17.47% during 2025-2033.

The growing popularity of milkshakes as a healthier alternative to carbonated drinks, along with the introduction of milkshakes with natural and organic ingredients with no preservatives and artificial sugars, is primarily driving the India milkshake market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of milkshakes across the nation.

Based on the flavor, the India milkshake market has been divided into vanilla, strawberry, chocolate, banana, and others. Among these, chocolate currently holds the majority of the total market share.

Based on the distribution channel, the India milkshake market can be segregated into supermarkets and hypermarkets, convenience stores, milk parlors, online stores, and others. Currently, online stores exhibit clear dominance in the market.

On a regional level, the market has been classified into Karnataka, Maharashtra, Tamil Nadu, Delhi, Gujarat, Andhra Pradesh and Telangana, Uttar Pradesh, West Bengal, Kerala, Haryana, Punjab, Rajasthan, Madhya Pradesh, Bihar, Orissa, and others, where Maharashtra currently dominates the India milkshake market.

Some of the major players in the India milkshake market include CavinKare, Mother Dairy, GCMMF, KMF, Hershey, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)