Indian Honey Market Size, Share, Trends and Forecast by Distribution Channel, Flavor, and State, 2026-2034

Indian Honey Market Summary:

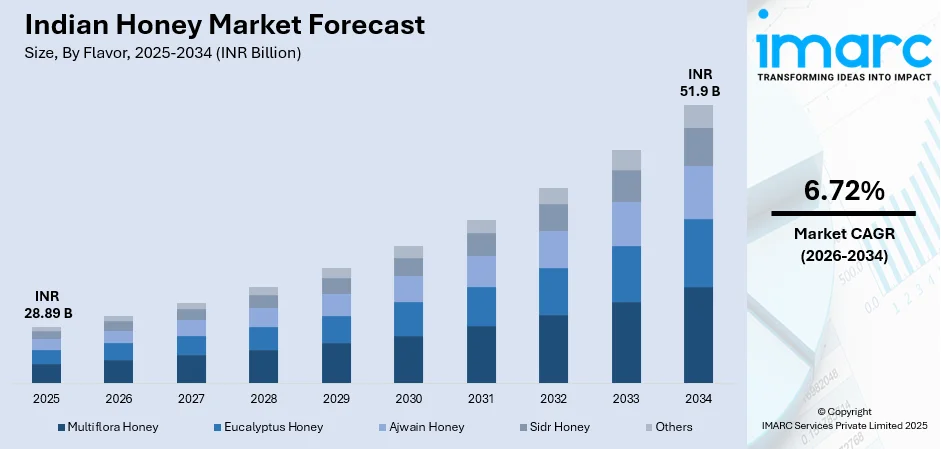

The Indian honey market size was valued at INR 28.89 Billion in 2025 and is projected to reach INR 51.9 Billion by 2034, growing at a compound annual growth rate of 6.72% from 2026-2034.

The Indian honey market is experiencing robust expansion driven by rising health consciousness, growing preference for natural sweeteners over refined sugars, and increasing recognition of honey's medicinal and nutritional properties. Government initiatives through the National Beekeeping and Honey Mission, coupled with expanding e-commerce accessibility and product innovation in organic and specialty honey variants, are transforming traditional consumption patterns and strengthening India's position as a global honey producer and exporter, thereby expanding the Indian honey market share.

Key Takeaways and Insights:

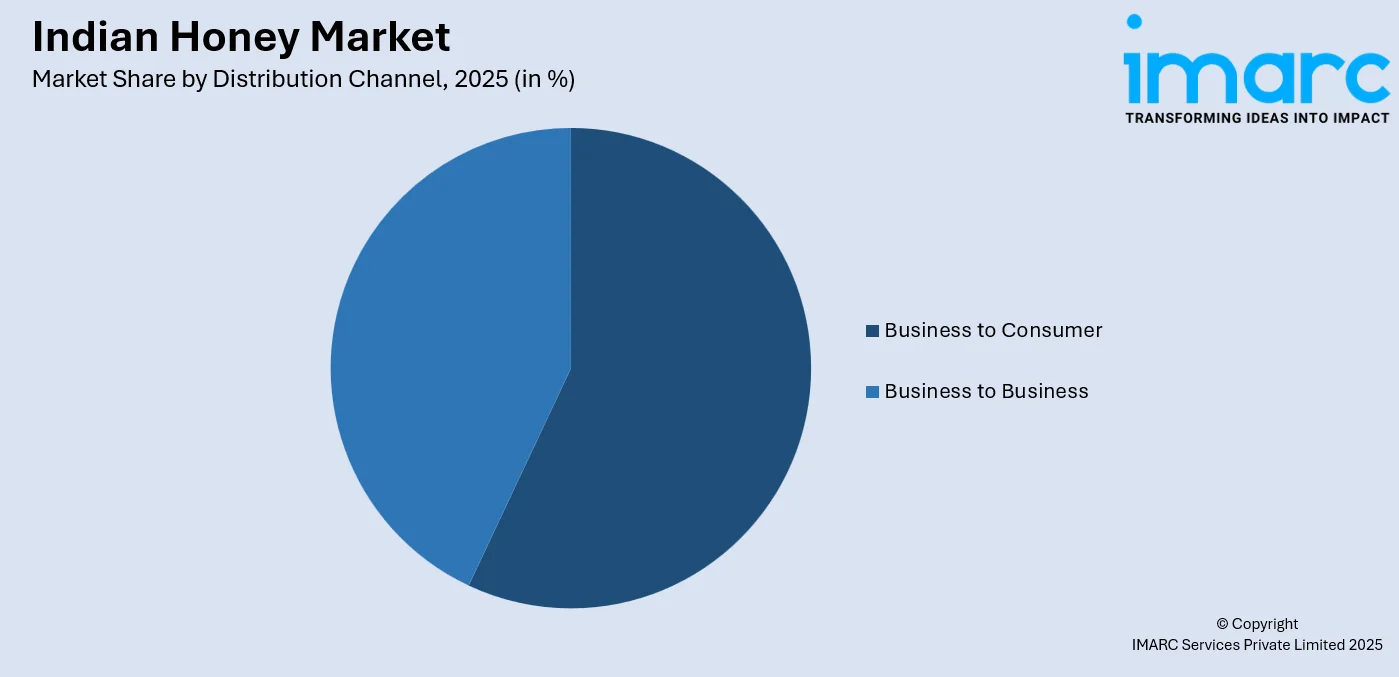

- By Distribution Channel: Business to consumer dominates the market with a share of 57% in 2025, propelled by e-commerce expansion and modern retail growth, especially in urban areas.

- By Flavor: Multiflora honey leads the market with a share of 34% in 2025, driven by its diverse taste profile and broad consumer appeal.

- By State: Rajasthan leads the market with a share of 24% in 2025, benefiting from favorable agro-climatic conditions and established beekeeping infrastructure.

- Key Players: The Indian honey market exhibits intense competition with multinational FMCG corporations and regional honey brands competing across organized and unorganized segments. Leading companies include Apis India Ltd, Baidyanath, Beez International, Dabur India Limited, Hitkary, Nature’s Nectar (Kejriwal Bee Care India Pvt Ltd), Organic India Pvt. Ltd., Patanjali Ayurved Limited, Saffola, and Zandu Care.

To get more information on this market Request Sample

The market's growth trajectory is underpinned by fundamental shifts in consumer behavior toward preventive healthcare and natural products. India's diabetes prevalence has reached approximately 77 million adults with type 2 diabetes and 25 million prediabetics, intensifying demand for healthier sugar alternatives. The National Beekeeping and Honey Mission's establishment of 6 world-class testing laboratories and 47 mini testing labs by March 2025 has enhanced quality assurance throughout the supply chain. India achieved second-largest honey exporter status globally by 2024, demonstrating the sector's export competitiveness. E-commerce platforms have democratized market access, with India's online shopper base reaching 270 million in 2024, enabling regional honey producers to reach nationwide consumers without extensive distribution infrastructure while offering buyers access to diverse organic, raw, and specialty honey varieties with transparent product information and competitive pricing.

Indian Honey Market Trends:

Proliferation of Digital Commerce Platforms Transforming Honey Distribution Channels

E-commerce platforms have emerged as critical distribution infrastructure for honey sales, fundamentally altering traditional retail dynamics in India's honey market. Online marketplaces provide regional honey producers direct access to nationwide consumer bases without establishing costly physical distribution networks, while offering buyers convenient purchasing experiences with extensive product variety, detailed specifications, customer reviews, and competitive pricing. Quick commerce platforms have accelerated delivery capabilities, with major players like BigBasket transitioning entirely to quick commerce in October 2024 after expanding to dark stores providing 10-15 minute delivery windows. The country's online shopper base exceeded 270 million in 2024, surpassing the United States to become the world's second-largest e-retail market by shopper count, creating unprecedented opportunities for honey brand visibility and consumer acquisition across urban and rural markets.

Government Infrastructure Investment in Scientific Beekeeping Ecosystem Development

The National Beekeeping and Honey Mission represent comprehensive government commitment to transforming India's apiculture sector through systematic infrastructure development and capacity building initiatives. The India Honey Alliance held its fourth Annual General Meeting at the India International Centre in New Delhi in September 2025, attracting over a hundred participants from the honey value chain, including beekeepers, farmer-producer organisations, aggregators, brand retailers, exporters, scientists, and policymakers. The event marked its ongoing advancements in unifying the industry, enhancing beekeeper welfare, establishing testing protocols, and fostering consumer confidence in Indian honey. The session commenced with a ceremonial lighting of lamps, succeeded by an extensive assessment of accomplishments since the last AGM, covering enhanced technical training initiatives, joint research efforts to establish a National database for Indian honey, and a thorough consumer education initiative on honey intended to strengthen confidence in both domestic and international markets

Premium and Specialty Honey Product Innovation

Product diversification through specialty and region-specific honey variants has accelerated as producers target health-conscious consumers seeking authentic, premium honey alternatives to conventional multiflora varieties. Companies are launching organic, wild forest, desert, and single-origin honey products emphasizing sustainable sourcing, specific floral characteristics, and superior nutritional profiles. In October 2024, Farmery introduced Organic Honey and Wild Forest Honey in eco-friendly glass bottles. In January 2024, Apis India released organic honey from Kashmir's certified organic lands. These specialty products command premium pricing ranging from INR 600-650 for 500-600 gram packages compared to conventional honey, reflecting consumer willingness to pay for perceived quality, authenticity, and health benefits associated with organic certification, wild harvesting, and single-origin traceability.

Market Outlook 2026-2034:

The Indian honey market is poised for sustained expansion as health consciousness, government infrastructure investment, and digital commerce proliferation converge to transform traditional consumption patterns and production systems. The market generated a revenue of INR 28.89 Billion in 2025 and is projected to reach a revenue of INR 51.9 Billion by 2034, growing at a compound annual growth rate of 6.72% from 2026-2034. Rising disposable incomes coupled with growing awareness of honey's therapeutic properties will drive continued substitution of refined sugars and artificial sweeteners across food, beverage, pharmaceutical, and cosmetic applications.

Indian Honey Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Distribution Channel |

Business To Consumer |

57% |

|

Flavor |

Multiflora Honey |

34% |

|

State |

Rajasthan |

24% |

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Business to Consumer

- General Trade

- Modern Trade Facilities

- E-Commerce

- Business to Business

- Food and Beverage

- Pharmaceuticals

- Cosmetics

Business to consumer dominates with a market share of 57% of the total Indian honey market in 2025.

Business-to-consumer distribution has emerged as the dominant channel through rapid expansion of organized retail infrastructure and e-commerce platforms that directly connect honey producers with end consumers. Modern trade facilities including supermarkets, hypermarkets, and specialized organic stores provide curated honey selections with transparent labeling, brand variety, and quality assurance that appeal to urban middle-class consumers seeking reliable honey sources. E-commerce platforms have revolutionized honey accessibility by offering extensive product ranges including organic, raw, and specialty honey varieties with detailed descriptions, ingredient transparency, customer reviews, and competitive pricing compared to traditional retail channels. The convenience of online purchasing, home delivery services, and subscription models particularly resonate with time-constrained urban consumers and health-conscious buyers seeking specific honey types not readily available in local retail outlets.

General trade channels comprising traditional kiranas and local grocery stores maintain significant market presence, particularly in semi-urban and rural areas where modern retail penetration remains limited. These outlets serve price-sensitive consumer segments through smaller package sizes, flexible payment options, and neighborhood convenience, though facing increasing competition from organized retail and e-commerce expansion into tier-2 and tier-3 cities. The business-to-consumer channel benefits from growing health awareness driving direct honey consumption as natural sweetener, home remedy ingredient, and wellness supplement, with marketing emphasis on honey's antibacterial, antioxidant, and immunity-boosting properties resonating with preventive healthcare trends. Brand differentiation through organic certification, single-origin claims, and specialty flavor variants enables premium positioning in business-to-consumer channels, creating segmented offerings across value-conscious mainstream consumers and affluent buyers seeking artisanal, traceable honey products with superior quality attributes.

Flavor Insights:

- Multiflora Honey

- Eucalyptus Honey

- Ajwain Honey

- Sidr Honey

- Others

Multiflora honey leads with a share of 34% of the total Indian honey market in 2025.

Multiflora honey's market leadership stems from its unique composition derived from nectar collected from multiple flowering plant species, resulting in complex taste profiles that appeal to diverse consumer preferences across India's varied culinary traditions. This honey variant is perceived as more natural and authentic compared to monofloral alternatives, resonating with consumers seeking traditional honey characteristics. The versatility of multiflora honey makes it suitable for various applications including direct consumption, cooking, baking, and beverage sweetening, contributing to its widespread adoption across household and commercial segments.

The multiflora segment benefits from established production systems where beekeepers manage colonies in areas with diverse flowering plants rather than targeting specific monofloral sources, reducing operational complexity and enabling consistent year-round production across India's varied agro-climatic zones. This production approach aligns with traditional Indian beekeeping practices, facilitating easier adoption among small-scale beekeepers without requiring specialized knowledge of monofloral honey production techniques. Consumer familiarity with multiflora honey's characteristic amber color, moderate sweetness, and mild flavor profile has established strong brand loyalty and repeat purchase behavior, particularly among price-sensitive segments.

State Insights:

- Maharashtra

- Tamil Nadu

- Karnataka

- Punjab

- Rajasthan

Rajasthan leads with a share of 24% of the total Indian honey market in 2025.

Rajasthan's market leadership derives from its extensive beekeeping activities supported by diverse flora including Khejri, Acacia, and seasonal wildflowers thriving in the state's arid and semi-arid regions. The state's agro-climatic diversity supports multiple honey production seasons with distinct floral sources creating varied honey types including the specialty desert honey gaining market recognition for unique flavor profiles and regional authenticity. Government initiatives through the National Beekeeping and Honey Mission have established processing infrastructure, testing facilities, and beekeeper training programs across Rajasthan, enhancing production quality and market linkages for local honey producers. In 2024, to encourage beekeeping for high-quality honey production, 25 farmers from Kota, Rajasthan participated in a five-day training course on "Beekeeping" at the Skill Development Centre of Punjab Agricultural University (PAU). Coordinated with assistance from the Directorate of Extension Education, PAU, the training program offered valuable knowledge on the newest beekeeping technologies essential for advancing beekeeping as a business and enhancing the financial well-being of beekeepers.

Rajasthan's honey production benefits from relatively lower agricultural intensification compared to other states, reducing bee colony exposure to pesticides and supporting organic honey production potential attractive to health-conscious consumers and export markets. The state's processing facilities and collection networks enable honey aggregation from dispersed small-scale beekeepers, facilitating quality standardization and commercial-scale packaging required for organized retail and export channels. Marketing initiatives positioning Rajasthan honey as specialty regional product leveraging the state's heritage associations have created brand differentiation in premium market segments. Distribution infrastructure connecting Rajasthan's production centers with major consumption markets supports consistent supply flows, while export capabilities through established trader networks enable participation in international honey markets where Indian origin products command growing acceptance based on quality and competitive pricing.

Market Dynamics:

Growth Drivers:

Why is the Indian Honey Market Growing?

Export Market Expansion and Rising Global Demand for Indian Honey Products

India's transformation into the world's second-largest honey exporter by 2024 from ninth position in 2020 demonstrates accelerating international market acceptance and demand for Indian honey across global markets. The country exported 1.07 lakh metric tonnes valued at USD 177.55 million during FY 2023-24, reflecting substantial export volume growth driven by competitive pricing, improving quality standards, and diversification of export destinations beyond traditional markets. International buyers increasingly recognize Indian honey's quality attributes, diverse floral varieties, and cost competitiveness compared to alternative sourcing countries, creating sustained export demand that incentivizes domestic production expansion and quality enhancement investments by Indian honey producers and processors.

Cross-Industry Application Diversification in Food Processing, Pharmaceuticals, and Cosmetics Manufacturing

Honey's expanding utilization across diverse industrial applications beyond direct consumption is driving substantial demand growth from food processing companies, pharmaceutical manufacturers, and cosmetics producers seeking natural ingredient alternatives to synthetic additives and artificial sweeteners. The food and beverage industry increasingly incorporates honey as natural sweetener, flavor enhancer, and functional ingredient in packaged products including breakfast cereals, energy bars, flavored beverages, bakery items, and ready-to-eat meals targeting health-conscious consumers willing to pay premium pricing for clean-label formulations featuring recognizable natural ingredients. Pharmaceutical companies utilize honey's scientifically validated antibacterial, anti-inflammatory, and wound-healing properties in developing cough syrups, throat lozenges, topical ointments, and health supplements that leverage honey's therapeutic reputation and consumer familiarity as trusted natural remedy with minimal side effects compared to synthetic pharmaceutical compounds. The cosmetics and personal care industry incorporates honey as key ingredient in skincare formulations, hair care products, and beauty treatments capitalizing on honey's moisturizing, antioxidant, and anti-aging properties that appeal to consumers seeking natural beauty solutions without harsh chemicals or synthetic additives. In 2025, QNET, an international direct-selling firm, has launched its high-quality Nutriplus Monofloral Honey collection in India, which includes two varieties including Ramtil (Guizotia abyssinica) and Tulsi (Holy Basil). The launch showcases the brand’s emphasis on the nation’s increasing need for genuine, health-oriented food items.

Ayurvedic Healthcare Resurgence and Traditional Medicine Integration

The revival of traditional Ayurvedic medicine practices and growing consumer preference for natural health remedies is significantly boosting honey consumption as therapeutic ingredient in home remedies, wellness formulations, and traditional healthcare applications deeply rooted in Indian cultural practices. Ayurvedic medicine's emphasis on honey as carrier substance for herbal preparations, natural sweetener in medicinal formulations, and standalone therapeutic agent for treating respiratory ailments, digestive disorders, and immunity enhancement aligns with contemporary wellness trends favoring preventive healthcare and natural treatment alternatives over pharmaceutical interventions. In 2025, Guardian Healthcare Pvt. Ltd., the main franchisee of GNC in India (“GNC India”), a reputable name in health and wellness supplements, announced the introduction of a pioneering innovation, Ayurvedic Honeysticks enriched with Shilajit + Saffron and Ashwagandha. Through this daring move into functional Ayurveda, GNC India combines traditional Indian adaptogens with contemporary convenience, providing a tasty new method to enhance energy, vitality, and stress resilience, anytime, anywhere.

Market Restraints:

What Challenges the Indian Honey Market is Facing?

Quality Assurance Concerns and Sophisticated Adulteration Techniques Undermining Consumer Trust

Maintaining honey purity standards presents persistent challenges as adulteration techniques evolve to circumvent standard laboratory testing protocols, undermining consumer confidence and damaging brand reputations across the industry. Sugar syrup blending designed specifically to pass conventional testing parameters including Hydroxymethylfurfural levels and total reducing sugars requires advanced detection methods like Nuclear Magnetic Resonance spectroscopy not universally available across testing facilities. The prevalence of adulterated honey in retail channels creates competitive disadvantages for authentic producers incurring higher costs for pure honey sourcing and quality verification, while price-sensitive consumers may unknowingly purchase adulterated products based on lower pricing without recognizing quality differences. Brand value erosion from adulteration controversies affects entire market segments when consumer trust declines, requiring continuous investment in quality certification systems, transparent traceability, and advanced testing infrastructure to differentiate genuine products from compromised alternatives.

Seasonal Production Variability and Climate Dependency Creating Supply Inconsistencies

Honey production exhibits significant seasonal fluctuations tied to flowering patterns, weather conditions, and bee colony health cycles that complicate inventory planning and consistent supply maintenance across retail channels. Autumn and spring seasons generate peak production volumes due to abundant nectar-rich blooms and favorable temperatures, while summer monsoon periods and winter months show reduced or variable production depending on regional climatic patterns and flowering plant species availability. Climate variability including unpredictable rainfall, temperature extremes, and changing flowering schedules affects nectar production and bee foraging behaviors, creating year-to-year production inconsistencies that challenge processors and distributors requiring stable supply flows for retail contracts and export commitments. The seasonal nature of beekeeping income concentrates cash flows around harvest periods, creating working capital constraints for small-scale beekeepers lacking financial reserves to invest in equipment upgrades, colony expansion, or value addition during non-productive seasons.

Fragmented Supply Chain Structure and Limited Processing Infrastructure Constraining Quality and Efficiency

India's beekeeping sector comprises predominantly small-scale traditional practitioners operating with limited access to modern processing technologies, quality testing facilities, and organized market linkages that enable efficient value chain participation. Fragmented production networks create inefficiencies in honey collection, aggregation, processing, and distribution systems where numerous intermediaries extract value without adding processing or quality enhancement services. Limited cold storage infrastructure and inadequate packaging facilities compromise honey quality preservation particularly during transportation from remote production areas to urban consumption markets, reducing shelf life and marketability compared to properly processed alternatives. Weak value chain integration results in price volatility and limited bargaining power for individual beekeepers negotiating with processors or traders, while lack of collective marketing mechanisms prevents small producers from accessing organized retail channels and export markets requiring consistent volumes, quality standardization, and regulatory compliance documentation.

Competitive Landscape:

The India honey market demonstrates intense competition characterized by established multinational FMCG corporations, traditional Ayurvedic companies, and emerging regional specialty honey brands competing across organized and unorganized market segments. Major players leverage extensive distribution networks, brand recognition, and marketing capabilities to maintain dominant positions in mainstream retail channels, while regional producers compete through specialized product offerings, regional authenticity claims, and competitive pricing strategies. The market exhibits bifurcation between organized sector brands emphasizing quality certification, modern processing, and transparent sourcing versus unorganized sector producers operating through traditional channels with lower overhead costs but limited quality assurance infrastructure. Recent market entry by D2C brands and organic honey specialists targeting health-conscious urban consumers has intensified competition in premium segments where product differentiation through organic certification, single-origin claims, and specialty flavor variants commands higher margins despite smaller market volumes. Some of the key players in the market include:

- Apis India Ltd

- Baidyanath

- Beez International

- Dabur India Limited

- Hitkary

- Nature’s Nectar (Kejriwal Bee Care India Pvt Ltd)

- Organic India Pvt. Ltd.

- Patanjali Ayurved Limited

- Saffola

- Zandu Care

Recent Developments:

- In August 2025, Nutrica, a wellness and lifestyle brand part of BN Holdings Limited, the main entity of the Rs 9,000 crore BN Group, has launched Nutrica Bee Honey in the honey market. This latest product range includes three unique versions designed for energy, fitness, and immune support. The collection is now accessible via regular retail channels in Delhi NCR and Mumbai.

- In June 2025, Students at Mother Terasa College of Agriculture (MTCA) in Iluppur, Mettusalai, have enhanced their learning about beekeeping by engaging in small business ventures centered around value-added honey products. MTCA Honey Cafe, an initiative led by students that provides honey-infused drinks and nutritious snacks to enhance nutrition awareness, was inaugurated on the college campus with M. Shahreyar, senior regional manager of Indian Overseas Bank in Karaikudi, and other senior officials present.

Indian Honey Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Billion |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Distribution Channels Covered | Business To Consumer, Business-To-Business |

| Flavors Covered | Multiflora Honey, Eucalyptus Honey, Ajwain Honey, Sidr Honey, Others |

| States Covered | Maharashtra, Tamil Nadu, Karnataka, Punjab, Rajasthan |

| Companies Covered | Apis India Ltd, Baidyanath, Beez International, Dabur India Limited, Hitkary, Nature’s Nectar (Kejriwal Bee Care India Pvt Ltd), Organic India Pvt. Ltd., Patanjali Ayurved Limited, Saffola, Zandu Care, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indian honey market size was valued at INR 28.89 Billion in 2025.

The Indian honey market is expected to grow at a compound annual growth rate of 6.72% from 2026-2034 to reach INR 51.9 Billion by 2034.

Business to Consumer channel leads with 57% market share, propelled by organized retail expansion, e-commerce platform proliferation, and growing direct consumer purchase of honey for household consumption as natural sweetener and health supplement.

Key factors driving the Indian honey market include expanding export opportunities with India becoming second-largest global exporter, diversifying industrial applications across food processing, pharmaceuticals, and cosmetics sectors, and resurgence of Ayurvedic healthcare practices integrating honey as therapeutic ingredient in traditional wellness formulations.

Major challenges include sophisticated adulteration techniques undermining quality assurance and consumer trust, seasonal production variability creating supply inconsistencies due to climate dependency and flowering patterns, and fragmented supply chain structure with limited processing infrastructure constraining efficiency and market access for small-scale beekeepers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)