Indian Frozen Potato Products Market Size, Share, Trends and Forecast by Product Type, End-Use, Distribution Channel, and Region, 2025-2033

Market Overview:

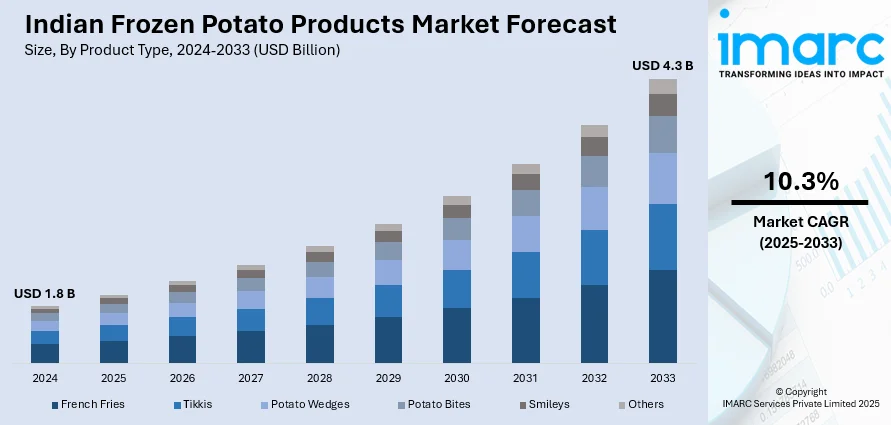

The Indian frozen potato products market size reached USD 1.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.3 Billion by 2033, exhibiting a growth rate (CAGR) of 10.3% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.8 Billion |

|

Market Forecast in 2033

|

USD 4.3 Billion |

| Market Growth Rate (2025-2033) | 10.3% |

Potato is one of the most produced and consumed crops in India and forms an important part of the regular diet. It is consumed in the form of different snack foods as well as elaborate dishes. Some of the most popular potato snacks include wedges, fries, patties, etc. In recent years, the demand for frozen potato products in India has increased on account of their introduction by various national and multinational companies. Additionally, frozen potato products have rapidly gained prominence in the country as they are convenient to cook and come in a large variety of flavours and shapes.

To get more information on this market, Request Sample

The biggest factor catalysing the growth of the frozen potato products market is the expansion of fast food service restaurants, such as Subway, McDonald’s, Burger King, KFC, etc., in the country. Moreover, introduction of new product variants with different flavours have attracted a larger consumer-base for frozen potato products, in turn, boosting the growth of the market. Busy lifestyles, inflating income levels and high purchasing power of the consumers in the region have further created a shift towards easy-to-cook frozen food products, thereby maintaining the growth prospects of the market.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Indian frozen potato products market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product type, end-use, and distribution channel.

Breakup by Product Type:

- French Fries

- Tikkis

- Potato Wedges

- Potato Bites

- Smileys

- Others

Based on the product type, the market has been segmented as french fries, tikkis, potato wedges, potato bites, smileys and others. Currently, french fries dominate the market, holding the largest share.

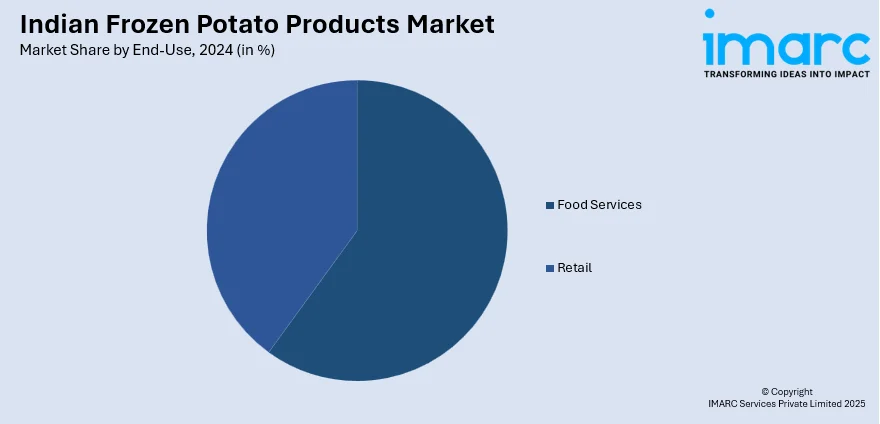

Breakup by End-Use:

- Food Services

- Retail

On the basis of end-use, food service represents the largest segment, accounting for around two-thirds of the total market share. This can be attributed to the increasing number of fast food chains in the country.

Breakup by Distribution Channel:

- Business to Business

- Supermarkets and Hypermarkets

- Convenience Stores

- Departmental Stores

- Online

- Others

Based on the distribution channel, the report has segregated the market into business-to-business, supermarkets & hypermarkets, convenience stores, departmental stores, online and others.

Regional Insights:

- North India

- Central and West India

- South India

- East India

Region-wise, the market has been segmented into North India, West and Central India, South India, and East India. Amongst these, North India holds the majority of the total share, representing the biggest market.

Competitive Landscape:

The competitive landscape of the market has also been examined with some of the key players being McCain Foods (India) Private Ltd., Hyfun Frozen Foods Private Ltd., Iscon Balaji Foods Private Limited, Golden Fries Limited and Bhanu Farms.

This report provides a deep insight into the Indian frozen potato products industry covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. The report also provides a comprehensive analysis for setting up a frozen potato products manufacturing plant. The study analyses the processing and manufacturing requirements, project cost, project funding, project economics, expected returns on investment, profit margins, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Indian frozen potato products industry in any manner.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, ‘000 Tons |

| Segment Coverage | Product Type, End-Use, Distribution Channel, Region |

| Countries Covered | North India, Central and West India, South India, East India |

| Companies Covered | McCain Foods (India) Private Ltd., Hyfun Frozen Foods Private Ltd., Iscon Balaji Foods Private Limited, Golden Fries Limited and Bhanu Farms |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indian frozen potato products market was valued at USD 1.8 Billion in 2024.

We expect the Indian frozen potato products market to exhibit a CAGR of 10.3% during 2025-2033.

The rising number of fast food service restaurants, along with the growing adoption of ready-to-eat snacks by nuclear families and young professionals, is primarily driving the Indian frozen potato products market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of frozen potato-based products across the nation.

Based on the product type, the Indian frozen potato products market has been segmented into French fries, tikkis, potato wedges, potato bites, smileys, and others. Among these, French fries currently hold the majority of the total market share.

Based on the end-use, the Indian frozen potato products market can be divided into food services and retail. Currently, food services exhibit a clear dominance in the market.

On a regional level, the market has been classified into North India, Central and West India, South India, and East India, where North India currently dominates the Indian frozen potato products market.

Some of the major players in the Indian frozen potato products market include McCain Foods (India) Private Ltd., Hyfun Frozen Foods Private Ltd., Iscon Balaji Foods Private Limited, Golden Fries Limited, and Bhanu Farms.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)