Indian Frozen Foods Market Size, Share, Trends and Forecast by Product Type, and Region, 2025-2033

Indian Frozen Foods Market Summary:

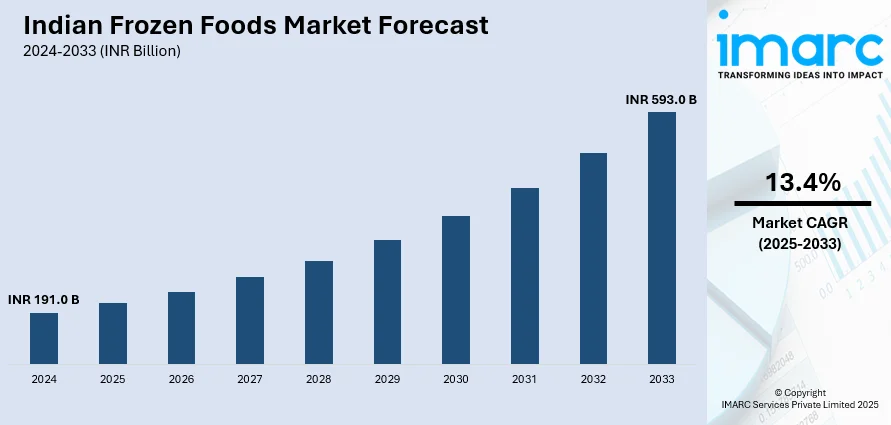

The Indian frozen foods market reached INR 191.0 Billion in 2024. It is projected to grow to INR 593.0 Billion by 2033, exhibiting a CAGR of 13.4% during 2025-2033. Growth is fueled by rapid urbanization, rising demand for ready-to-eat foods, improved cold chain infrastructure, and changing dietary preferences across urban centers.

Market Insights:

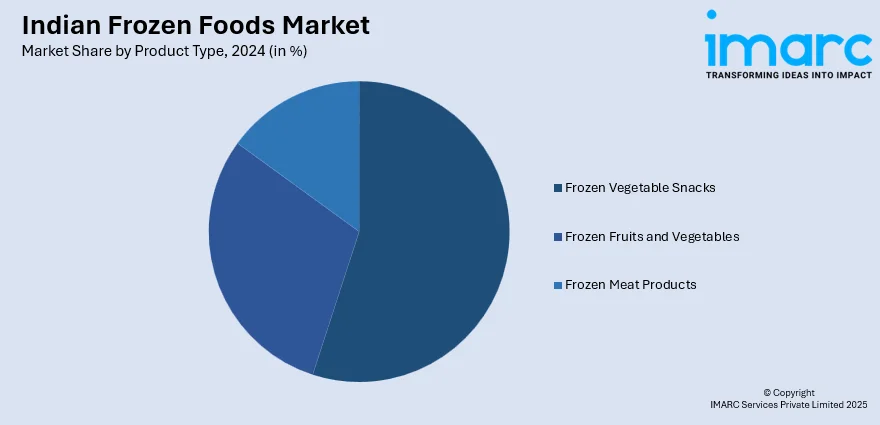

- Frozen vegetable snacks accounted for the largest share by product type.

- Rising health awareness and demand for plant-based alternatives are driving frozen vegetable snack sales.

- Increasing penetration of supermarkets and online retail is enhancing product accessibility.

- Urban India continues to dominate market demand due to shifting lifestyles and work culture.

Market Size & Forecast:

- 2024 Market Size: INR 191.0 Billion

- 2033 Projected Market Size: INR 593.0 Billion

- CAGR (2025–2033): 13.4%

- Frozen Vegetable Snacks: Largest product segment in 2024

Frozen food refers to edible items preserved by the process of freezing. It includes products such as fruits, vegetables, meat, poultry, and seafood, along with prepared meals and baked goods. The freezing process slows the decomposition by turning residual moisture into ice, thereby inhibiting the growth of most bacterial species, ensuring the food's longevity and safety. This process retains nutritional content, providing a year-round supply of otherwise seasonal products. One of the key advantages of frozen food is that it allows for the preservation and availability of seasonal products all year round. Moreover, the convenience offered by frozen food items, particularly in terms of meal planning and preparation time, is highly valued by consumers leading busy, modern lifestyles.

To get more information on this market, Request Sample

A convergence of several socioeconomic and cultural factors, such as rapid urbanization, the inflating disposable incomes of individuals, and the burgeoning middle class primarily is augmenting the frozen food market size in India. Besides this, the rising demand for convenient and ready-to-eat (RTE) food products due to their time-saving nature and longer shelf-life are creating a favorable outlook for market growth. Moreover, the escalating awareness of global food trends and a shift towards Western eating habits, spurred by international travel and global media, are contributing to the market's growth. Additionally, significant improvements in cold storage and supply chain infrastructure are ensuring better product accessibility and quality, propelling the market forward. Concurrently, the implementation of various government initiatives promoting food processing industries is strengthening the Indian frozen foods market growth. Furthermore, changing consumer perceptions about the nutritional value of frozen food, backed by scientific evidence, are helping to break down traditional reservations, fostering wider acceptance among Indian consumers.

Indian Frozen Foods Market Trends/Drivers:

Rapid urbanization and lifestyle shifts

Increasing urbanization is driving significant changes in India's lifestyle and dietary habits, primarily due to the rise in disposable incomes and changing work patterns. Cities are expanding, and with them, an increasingly time-crunched population is seeking convenient, quick, and easy-to-prepare meals, thus creating a favorable outlook for frozen food market share in India. As the pace of life quickens, people have less time to cook traditional, time-consuming recipes, fueling the adoption of frozen food products as a popular choice due to their convenience, variety, and year-round availability. Moreover, the rise of nuclear families and the increasing number of working women have also propelled the demand for these products. The penetration of Western culture and food habits with a greater inclination towards products like frozen pizza, pasta, and desserts are presenting remunerative growth opportunities for the market.

Significant technological advancements in cold chain infrastructure

Ongoing technological advancements in India's cold chain logistics and storage infrastructure have played a crucial role in driving the frozen foods market in India. Robust cold chain systems are essential for maintaining the quality and extending the shelf-life of frozen food products, which ultimately impacts consumer satisfaction and demand. Besides this, enhanced cold storage facilities, refrigerated transport, and efficient logistics networks have improved product accessibility and availability across urban and rural areas of India, contributing to the market's growth. In addition to this, the implementation of various favorable government initiatives to strengthen the cold chain infrastructure presents remunerative growth opportunities in the industry. These advancements have also enabled the expansion of online grocery platforms and supermarkets, which have become vital distribution channels for frozen food.

Growth and Export Opportunities

India’s frozen foods market is expanding rapidly, driven by rising urban populations, increasing disposable incomes, and a growing preference for convenient, ready-to-cook meals. One of the key growth accelerators is the seafood export boom, with India exporting 716,004 MT of seafood, valued at INR 40,013.5 crore (USD 4.88 Billion), with frozen shrimp accounting for 40.19% of volume and 66.1% of dollar earnings. Coastal states like Andhra Pradesh and Gujarat are investing heavily in seafood processing infrastructure, thereby supporting the Indian frozen foods market demand. Additionally, the global appetite for Indian frozen meals has fueled export opportunities in the Middle East, Europe, and Southeast Asia, encouraging domestic producers to scale capacity and meet international food safety and taste standards.

Cold Chain and Tech Advancements

Rapid advancements in cold chain logistics are enabling nationwide penetration of frozen food products. Modern cold storage warehouses equipped with IoT temperature control, GPS-enabled transport tracking, and automated loading systems are reducing spoilage risks and improving delivery efficiency. Several startups and established firms are investing in rural cold storage facilities to expand frozen product access beyond urban hubs. This infrastructure supports major quick-commerce platforms like Blinkit and Zepto, which rely on real-time inventory management and low-latency logistics. These technologies also assure safety and quality, enhancing consumer trust and making frozen products more viable for mass consumption across India, and contribute to the development of the frozen food industry in India.

Dominance of Frozen Snacks

Frozen snacks continue to dominate India’s frozen food landscape, led by high sales of green peas, French fries, nuggets, and Indian items like aloo tikki. These products are favored due to ease of preparation, long shelf life, and year-round availability. In 2024, frozen snacks accounted for the highest volume and value share in the market. Contract farming practices have helped processors secure reliable access to quality produce, especially for items like peas and potatoes. Leading players are diversifying offerings with region-specific flavors and premium formats, while quick-service restaurants and cafes increasingly rely on frozen snacks to ensure speed, consistency, and hygiene.

Challenges and Government Support

Despite high growth potential, the Indian frozen foods market faces challenges such as erratic electricity supply, lack of cold storage access in rural zones, and limited consumer awareness in non-metro areas. Logistics costs remain high due to fuel prices and poor road infrastructure in some regions. To address these issues, the government has launched the PMKSY scheme, offering financial aid to set up cold chain units and Mega Food Parks. Further support comes from subsidies under the Ministry of Food Processing Industries and GST relief for food processors. These initiatives aim to bridge infrastructure gaps and stimulate rural participation in the value chain.

Indian Frozen Foods Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Indian frozen foods market report, along with forecasts for the period 2025-2033. Our report has categorized the market based on product type.

Breakup by Product Type:

- Frozen Vegetable Snacks

- Frozen Fruits and Vegetables

- Frozen Meat Products

Frozen vegetable snacks represents the most widely used product type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes frozen vegetable snacks, frozen meat products, and frozen fruits and vegetables. According to the report, frozen vegetable snacks represented the largest segment.

The rising demand for frozen vegetable snacks in India due to an increasing focus on health and wellness among consumers is strengthening market growth. With the rising emphasis on healthy eating in the country, consumers seek more nutritious food options and snacks. This trend is coupled with a growing societal awareness of environmental sustainability, encouraging people to incorporate more plant-based foods into their diets. This shift is driving demand for vegetable-centric frozen products that offer a healthier, more eco-friendly alternative to traditional snacks. In addition to this, the rise of the 'foodie' culture in India, driven by social media and food-oriented television shows, has piqued consumer interest in trying different types of cuisines and dishes. This has sparked demand for a wider variety of frozen vegetable snacks catering to diverse tastes and culinary exploration. Furthermore, significant advancements in food preservation technology have allowed manufacturers to maintain the taste and nutritional value of frozen vegetable snacks, enhancing market demand.

Competitive Landscape:

The competitive landscape of the market is defined by a robust mix of established entities and new entrants, which creates a vibrant and dynamic environment. As per the Indian frozen foods market analysis, the market is dominated by certain prominent players that have carved out a significant market share due to their extensive product range, effective distribution networks, and powerful brand recognition among consumers. In recent years, emerging domestic players have been gaining market share as they offer a diverse range of products that cater to regional tastes and preferences, capitalizing on a deep understanding of the local market dynamics. The competitive landscape is further influenced by the rise of e-commerce and online grocery platforms. These platforms often introduce private-label frozen food products, thereby intensifying market competition.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players include:

- McCain India Pvt Limited

- Venky’s (India) Limited

- Mother Dairy Fruit and Vegetable

- Godrej Tyson Foods Limited

- Al Kabeer Group

- Innovative Foods Limited (Sumeru)

Latest News and Developments:

- On June 2, 2025, HyFun Foods, a Gujarat-based frozen foods company, announced the launch of new Indian street-style frozen snacks, including Mumbai Aloo Vada, with plans to target INR100 crore (USD 12.08 Million) in retail revenue by 2025. The company is expanding its presence in both the HoReCa and retail markets, with projections showing that quick commerce platforms will contribute 33% of its B2C revenue by next year. HyFun Foods is also targeting INR 5,000 crore (USD 602.85 Million) in revenue over the next five years, with a strategic shift towards increasing domestic sales.

- On January 6, 2025, Allana Consumer Products Ltd. (ACPL), part of the Allana Group, announced an INR 300 crore (USD 36.23 Million) investment to enter the frozen food segment, starting with French fries. Initially targeting international markets, ACPL aims to capture at least 3% of the global market share for regular fries by 2029. The company plans to enter the Indian market by 2027, leveraging global distribution networks and a long-term agreement for high-quality Santana G3 seed potatoes to ensure product consistency.

- On May 21, 2025, Falcon Agrifriz Foods Private Limited inaugurated its fully automated frozen potato products manufacturing facility in Mehsana, Gujarat, marking a significant milestone in India’s food processing industry. The company invested approximately INR 1,050 crore (USD 126.72 Million) in the state-of-the-art facility, which is designed to make Gujarat a global hub for frozen potato-based products, featuring India’s largest French Fries production line.

- On February 7, 2025, ITC announced its plans to acquire 100% of Prasuma, a prominent player in India's frozen food market, over the next three years. The acquisition will begin with ITC purchasing a 43.8% stake upfront, with the remaining shares to be acquired by June 2028, based on valuation-linked criteria. This move aims to strengthen ITC's presence in the rapidly growing frozen foods sector, valued at over INR 10,000 crore (USD 1.2 Billion), with Prasuma offering a diverse product portfolio including momos, baos, and Korean fried chicken.

Indian Frozen Foods Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Billion |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Frozen Vegetable Snacks, Frozen Fruits and Vegetables, Frozen Meat Products |

| Companies Covered | McCain India Pvt Limited, Venky’s (India) Limited, Mother Dairy Fruit and Vegetable, Godrej Tyson Foods Limited, Al Kabeer Group, Innovative Foods (Sumeru) etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indian frozen foods market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Indian frozen foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indian frozen foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Indian frozen foods market was valued at INR 191.0 Billion in 2024.

We expect the Indian frozen foods market to exhibit a CAGR of 13.4% during 2025-2033.

The growing demand for RTE and convenience food products among the working population, coupled with the emerging application of sustainable packaging solutions, is primarily driving the Indian frozen foods market.

In India, the sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of frozen food items.

Based on the product type, the Indian frozen foods market can be segmented into frozen vegetable snacks, frozen fruits and vegetables, and frozen meat products. Currently, frozen vegetable snacks hold the majority of the total market share.

Some of the major players in the Indian frozen foods market include McCain India Pvt Limited, Venky’s (India) Limited, Mother Dairy Fruit and Vegetable, Godrej Tyson Foods Limited, Al Kabeer Group and Innovative Foods (Sumeru).

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)