India Food Processing Market Size, Share, Trends and Forecast by Sector, and Region, 2025-2033

India Food Processing Market Overview:

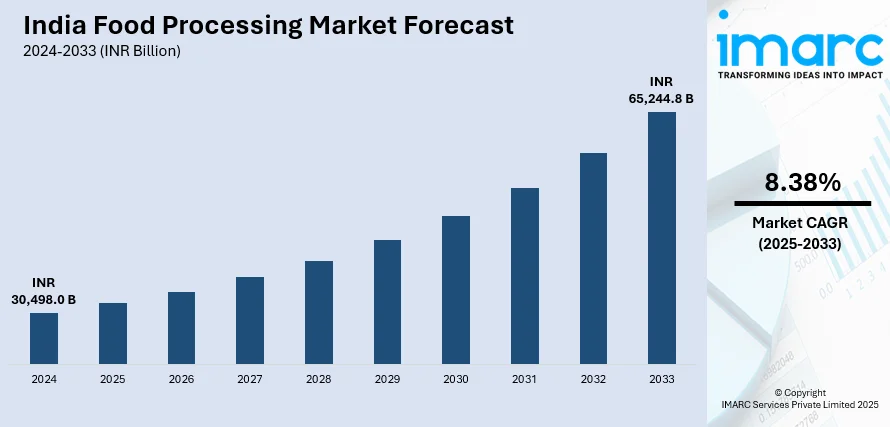

The India food processing market size reached INR 30,498.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach INR 65,244.8 Billion by 2033, exhibiting a growth rate (CAGR) of 8.38% during 2025-2033. Rapid urbanization, the rising consumer preference for processed foods, favorable government initiatives, ongoing technological advancements in food processing, and an evolving retail landscape promoting convenient RTE food products are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 30,498.0 Billion |

|

Market Forecast in 2033

|

INR 65,244.8 Billion |

|

Market Growth Rate 2025-2033

|

8.38% |

Food processing is the systematic transformation of raw ingredients into edible or marketable food products. This process involves various techniques such as cleaning, sorting, cooking, canning, freezing, and packaging to enhance food safety, shelf life, and consumer convenience. During food processing, additives and preservatives may be used to maintain quality and freshness. Additionally, advanced technologies such as pasteurization, dehydration, and extrusion play vital roles. The food processing industry helps meet the global food demand, ensuring food availability, reducing food waste, and providing diverse food options to consumers across the world.

To get more information on this market, Request Sample

India's large and diverse population, coupled with rising disposable incomes and changing lifestyles, is fueling the demand for processed and convenience foods, which, in turn, is primarily driving the market growth. Moreover, increased urbanization and a shift towards more hectic work schedules have led to a surge in the preference for packaged and ready-to-eat (RTE) meals, creating a favorable outlook for market expansion. Concurrent with this, the government's supportive policies and initiatives, such as the Make in India campaign and the establishment of food parks and processing units, are attracting investments and contributing to the market's growth. Additionally, significant advancements in technology and innovation are enabling efficient food processing methods that improve product quality and reduce post-harvest losses, which is presenting remunerative growth opportunities for the market. Furthermore, the escalating awareness of food safety and quality standards among consumers is encouraging manufacturers to maintain high production standards and comply with regulations, thus propelling the market forward.

India Food Processing Market Trends/Drivers:

Large and diverse population with changing lifestyles

India's population is one of the largest globally, with a diverse mix of consumers representing various cultural backgrounds and dietary preferences. With the steady growth of the population, there is a growing demand for food products, creating a lucrative outlook for the food processing market. Moreover, increasing urbanization and rising disposable incomes have led to changes in consumer preferences and eating habits. With more people moving to cities and leading hectic lifestyles, there is a growing inclination towards processed and convenient foods. These products offer time-saving benefits and cater to the demand for on-the-go consumption options. The rising trend of nuclear families and working professionals also contributes to the preference for RTE meals and packaged foods that require minimal preparation, strengthening the market growth.

Supportive government policies and initiatives

The Government of India (GOI) is actively promoting the food processing sector through various policies and initiatives. The "Make in India" campaign, launched to boost domestic manufacturing, has been extended to the food processing sector, attracting domestic and foreign investments. In addition to this, the government has set up dedicated food parks and processing units, offering infrastructural support and incentives to encourage businesses in this sector. These initiatives help reduce logistics costs, improve supply chain efficiencies, and foster a conducive environment for food processing companies to thrive. Moreover, the enactment of the goods and services Tax (GST) has simplified the tax structure, streamlining processes for food manufacturers and enhancing the ease of doing business, which, in turn, is presenting remunerative opportunities for market expansion.

India Food Processing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India food processing market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on sector.

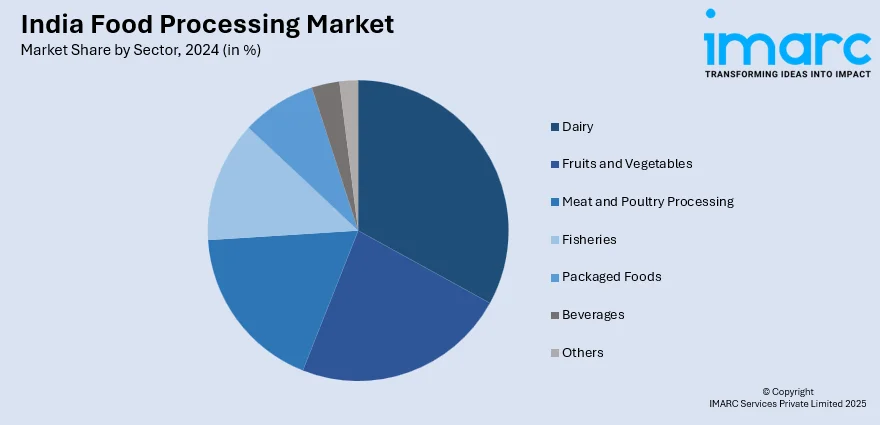

Breakup by Sector:

- Dairy

- Fruits and Vegetables

- Meat and Poultry Processing

- Fisheries

- Packaged Foods

- Beverages

- Others

Packaged foods represent the largest segment

The report has provided a detailed breakup and analysis of the market based on the sector. This includes dairy, fruits and vegetables, meat and poultry processing, fisheries, packaged foods, beverages, and others. According to the report, packaged food represented the largest segment.

The rise in awareness of health and wellness among consumers has resulted in an increased demand for minimally processed and nutritionally enriched packaged foods. Food processing techniques allow manufacturers to incorporate functional ingredients, fortify products with essential nutrients, and reduce undesirable components, aligning with the health-conscious choices of consumers. Furthermore, rising urbanization and busy lifestyles have created a demand for convenient and easily consumable food products. Food processing enables the production of RTE meals, pre-cut fruits, vegetables, and other convenience items, catering to time-constrained consumers seeking quick and hassle-free meal solutions, which is propelling its adoption. In addition to this, food processing extends the shelf life of packaged foods, reducing food wastage and ensuring a stable supply of products to meet the demands of modern-day consumers, presenting remunerative opportunities for market expansion.

Breakup by Region:

- North India

- South India

- East India

- West India

West India holds the largest share of the market

A detailed breakup and analysis of the India food processing market has been provided based on country. This includes North, South, East, and West India. According to the report, West India accounted for the largest market share.

Competitive Landscape:

The competitive landscape of the food processing market in India is characterized by a diverse mix of players, ranging from large multinational corporations to small and medium-sized enterprises (SMEs) and local players. The market witnesses intense competition as companies vie to capture a significant share in this rapidly growing sector. Key players in the food processing industry deploy various strategies to gain a competitive edge, including product innovation and diversification, as companies seek to cater to changing consumer preferences and introduce healthier, more convenient, and novel food products. Apart from this, expanding distribution networks and effective marketing strategies are employed to enhance market penetration. Government policies and regulations also influence competition, as compliance with quality standards and food safety norms becomes a crucial aspect for sustained success in the market.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

India Food Processing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Billion |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Sectors Covered | Dairy, Fruits, and Vegetables, Meat and Poultry Processing, Fisheries, Packaged Foods, Beverages, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India food processing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India food processing market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India food processing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India food processing market was valued at INR 30,498.0 Billion in 2024.

We expect the India food processing market to exhibit a CAGR of 8.38% during 2025-2033.

The expanding working women population, along with the increasing demand for processed foods such as ready-to-eat products and snacks that require limited time for cooking and meal preparation, is primarily driving the India food processing market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards e-commerce platforms for the purchase of processed food in India.

Based on the sector, the India food processing market can be segmented into dairy, fruits and vegetables, meat and poultry processing, fisheries, packaged foods, beverages, and others. Currently, the packaged food sector holds the majority of the total market share.

On a regional level, the market has been classified into North India, South India, East India, and West India, where West India currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)