Indian Biodegradable Sanitary Napkin Market Size, Share, Trends and Forecast by Material Type, Distributional Channel, and Region, 2025-2033

Indian Biodegradable Sanitary Napkin Market Size and Share:

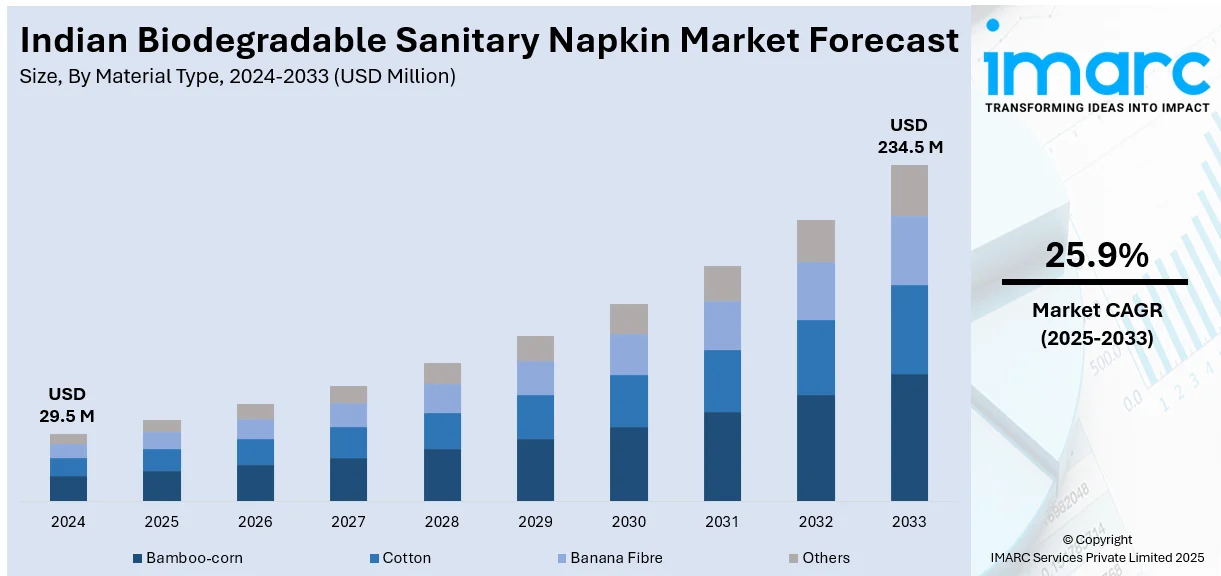

The Indian biodegradable sanitary napkin market size was valued at USD 29.5 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 234.5 Million by 2033, exhibiting a CAGR of 25.9% from 2025-2033. Maharashtra currently dominates the market. The market is primarily driven by rise in consumer awareness of sustainability, supportive government initiatives promoting eco-friendly alternatives, and continual innovation in materials and product design, with companies leading in sustainable menstrual care solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 29.5 Million |

|

Market Forecast in 2033

|

USD 234.5 Million |

| Market Growth Rate (2025-2033) | 25.9% |

The market in India is witnessing substantial growth, driven by rising awareness about the environmental impact of conventional plastic-based products. In line with this, consumers are increasingly opting for eco-friendly alternatives due to concerns about plastic waste and its detrimental effects on ecosystems, is propelling the Indian biodegradable sanitary napkin market growth. Besides this, favorable government initiatives promoting sustainable products and favorable policies for eco-friendly startups are fostering market expansion. For instance, on 25 July 2024, the Ministry of Housing and Urban Affairs announced initiatives under Swachh Bharat Mission-Urban (SBM-U) 2.0 to reduce plastic waste. Efforts include waste segregation, Material Recovery Facilities (MRFs), and enforcing bans on single-use plastics, supporting the shift towards eco-alternatives like biodegradable sanitary napkins in India.

To get more information on this market, Request Sample

In addition to this, rising disposable incomes, particularly in urban areas, are fueling the growth of the market. Similarly, women are increasingly prioritizing health and hygiene, augmenting demand for products made from natural, chemical-free materials. As on October 16, 2024, CII’s Indian Women Network (IWN) hosted the 6th edition of “She Matters” in Mumbai, focusing on women's health and wellness. The summit highlighted gender disparities in healthcare and the need for inclusive healthcare solutions. Furthermore, the growing availability of biodegradable sanitary napkins made from organic materials like bamboo fibers, cotton, and plant-based biopolymers is gaining popularity among health-conscious consumers. Moreover, brands offering better product performance and comfort are attracting a broader audience, expanding the Indian biodegradable sanitary napkin market share.

Indian Biodegradable Sanitary Napkin Market Trends:

Increased Consumer Awareness

Increasing consumer consciousness about sustainability, particularly concerning the detrimental impacts that conventional plastic-based items have on the environment and human health, is a significant factor in the market's growth. As customers grow increasingly aware of the damage plastic inflicts on ecosystems and women's health, they seek eco-friendly alternatives. Social media conversations encouraging sustainable choices, environmental campaigning, and educational efforts all assist this change. The demand for sanitary napkins comprised of organic materials is being driven by women's preference for natural, chemical-free, and biodegradable products, according to the Indian biodegradable sanitary napkins market trends. Consumer loyalty is better for brands that share these ideals. In a noteworthy partnership with Aakar Innovations Pvt Ltd., CSIR-IICT, Hyderabad, on January 22, 2025, developed a sustainable technique that turns banana pseudostems into pulp for compostable sanitary pads, offering an economical and environmentally beneficial substitute for conventional raw materials.

Government Initiatives Supporting Sustainability

The market is expanding as a result of government initiatives to support environmental sustainability. Biodegradable product manufacturing and use have risen given the policies aimed at lowering plastic consumption and promoting environmentally suitable substitutes. The Indian biodegradable sanitary napkins market demand is being bolstered by tax breaks, public awareness initiatives, and assistance for environmentally conscious businesses. For example, on December 2, 2024, Key Communications' survey revealed that over 6,600 cleantech startups operate across 450 districts in India. Over 60% of these startups seek increased government funding, while one-third struggle with limited financial resources for innovation. The survey emphasized the need for government incentives, streamlined regulations, and increased research and development (R&D) investment to foster India’s sustainable startup ecosystem. These initiatives are creating favorable conditions for biodegradable sanitary napkins, helping local producers scale operations while aligning with sustainability goals.

Innovation in Materials and Product Design

The Indian biodegradable sanitary napkin market outlook is heavily influenced by continuous improvements in product design and materials. To improve the quality and usability of biodegradable napkins, manufacturers are progressively utilizing organic and plant-derived materials such as bamboo, cotton, and biodegradable plastics. For instance, Mahina achieved a major milestone in sustainable menstrual care on March 27, 2024, by launching its reusable, eco-friendly, and leak-resistant period underwear. Crafted with eco-friendly materials, Mahina's product provides four tiers of protection and can absorb for up to 12 hours, enduring up to 100 washes. The GRS and Oeko-Tex certifications of the underwear showcase its commitment to safety and sustainability. As research continues to improve materials, biodegradable products are increasingly rivaling conventional choices regarding absorbency, comfort, and leak protection. Enhanced cost-effectiveness and design are driving wider adoption across urban and rural India.

Indian Biodegradable Sanitary Napkin Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Indian biodegradable sanitary napkin market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on material type and distributional channel.

Analysis by Material Type:

- Bamboo-corn

- Cotton

- Banana Fibre

- Others

Bamboo-corn blends dominate the market in 2024 due to their natural, eco-friendly properties and superior performance. Corn-based textiles improve comfort and biodegradability, while bamboo fibers provide great absorbency, breathability, and antibacterial properties. This combination addresses the health and environmental hazards associated with synthetic materials and offers a sustainable substitute for conventional plastic-based products. Bamboo-corn napkins are perfect for environmentally aware customers because they break down quickly without leaving any toxic residues behind. Growing environmental consciousness and government backing for sustainable products are other contributing factors to their rising appeal, which is propelling acceptance in India's cities and rural areas.

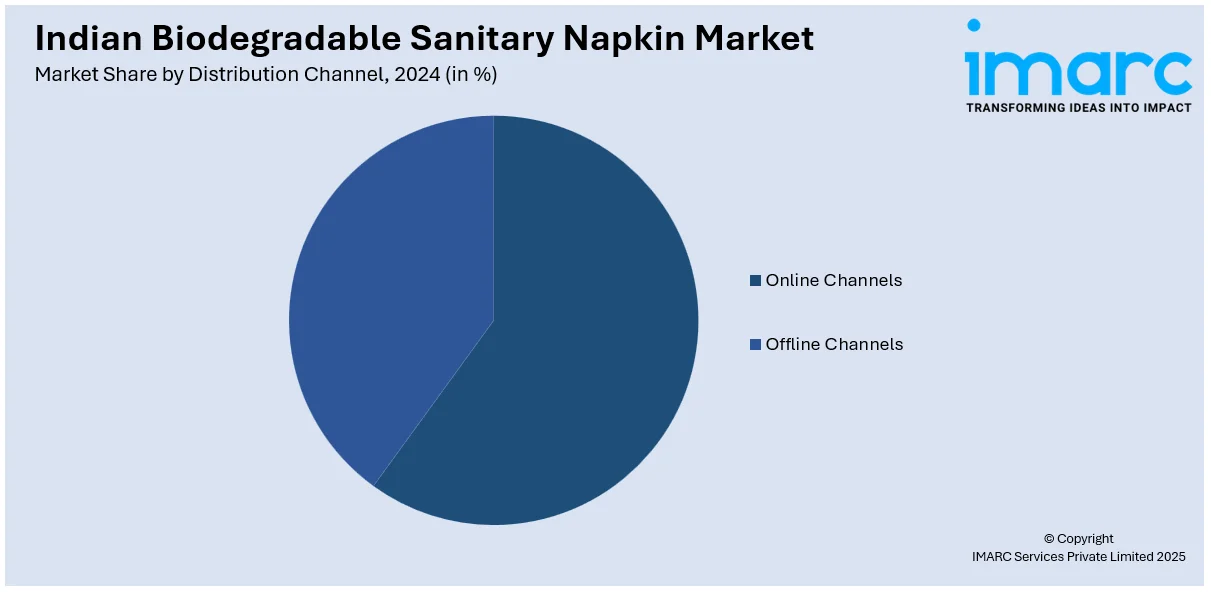

Analysis by Distribution Channel:

- Online Channels

- Offline Channels

Offline channels lead the market in 2024 driven by their widespread reach and trust-building capabilities, especially in rural areas. Traditional retail outlets, local pharmacies, and kirana stores serve as key touchpoints for consumers who prefer to purchase sanitary products in person. Numerous women still prioritize tactile experiences and product accessibility, which offline channels provide. Additionally, strong distributor networks, regional brand presence, and the ability to directly interact with customers have contributed to higher market penetration. As awareness of biodegradable options grows, offline sales are further augmented by in-store promotions and localized educational campaigns.

Region Analysis:

- Maharashtra

- Gujarat

- Delhi-NCR

- Tamil Nadu

- Karnataka

In 2024, Maharashtra accounts for the largest market share attributed to its progressive policies, strong urban infrastructure, and high level of consumer awareness. The demand for eco-friendly products is being driven by the sizable, environmentally concerned urban population, with cities like Mumbai and Pune leading the way in sustainability. The state's active participation in government-sponsored projects and the existence of a number of environmentally conscious companies also contribute to market expansion. The use of biodegradable sanitary napkins has been further accelerated by rising health and environmental concern as well as high disposable money. Maharashtra is a major market given its robust retail networks, which also improve accessibility.

Competitive Landscape:

The market for biodegradable sanitary napkins in India is becoming more competitive, fueled by both well-known FMCG brands and environmentally conscious startups. These businesses are distinguishing their offerings by means of material innovation, cost-effectiveness, and sustainability. Natural fibers combined with sustainable manufacturing methods are becoming increasingly popular. Pricing strategies are increasingly inclusive, aimed at both high-end and budget-minded shoppers. Collaborations with retailers and digital platforms are broadening brand visibility. A key moment occurred on January 29, 2025, when Pee Safe partnered with the 38th National Games as the official "Health & Wellbeing Partner," providing biodegradable hygiene products and promoting menstrual health awareness. This competitive landscape accelerates innovation and strengthens the shift towards sustainable menstrual hygiene.

The report provides a comprehensive analysis of the competitive landscape in the Indian biodegradable sanitary napkin market with detailed profiles of all major companies.

Latest News and Developments:

- February 5, 2025: Niine Sanitary Pads, along with Vatsalya Seva Samiti and local officials, provided biodegradable sanitary pads at the Maha Kumbh Mela to guarantee that menstruation does not impede women's involvement. This program enhances awareness of menstrual hygiene and encourages sustainability, representing a key achievement in Niine's goal to dismantle menstrual taboos and offer environmentally friendly, accessible period care during public events.

- December 19, 2024: Under 'Operation Sadbhavana,' the Indian Army established a facility for biodegradable sanitary napkins in the village of Martselang, Ladakh. Operated by local women, the establishment manufactures eco-friendly, cost-effective sanitary items, promoting awareness of menstrual hygiene and empowering women. The program supports sustainability and improves the well-being of women in neglected areas of Ladakh.

Indian Biodegradable Sanitary Napkin Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Bamboo-Corn, Cotton, Banana Fibre, Others |

| Distribution Channels Covered | Online Channels, Offline Channels |

| Regions Covered | Maharashtra, Gujarat, Delhi-NCR, Tamil Nadu, Karnataka |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indian biodegradable sanitary napkin market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Indian biodegradable sanitary napkin market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indian biodegradable sanitary napkin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Indian biodegradable sanitary napkin market was valued at USD 29.5 Million in 2024.

The growth of the market is largely driven by increased consumer awareness about sustainability, government support for eco-friendly products, health-conscious women seeking natural options, and continuous innovation in materials like bamboo, cotton, and biodegradable polymers, which enhance product performance and environmental benefits.

The Indian biodegradable sanitary napkin market is projected to reach a value of USD 234.5 Million by 2033, growing at a CAGR of 25.9% from 2025-2033.

Bamboo-corn is the leading segment by material type, driven by its natural, eco-friendly properties, high absorbency, and rapid biodegradability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)