Indian Agricultural Implements Market Size, Share, Trends and Forecast by Product Type, Type, Distribution Channel, and Region, 2025-2033

Market Overview:

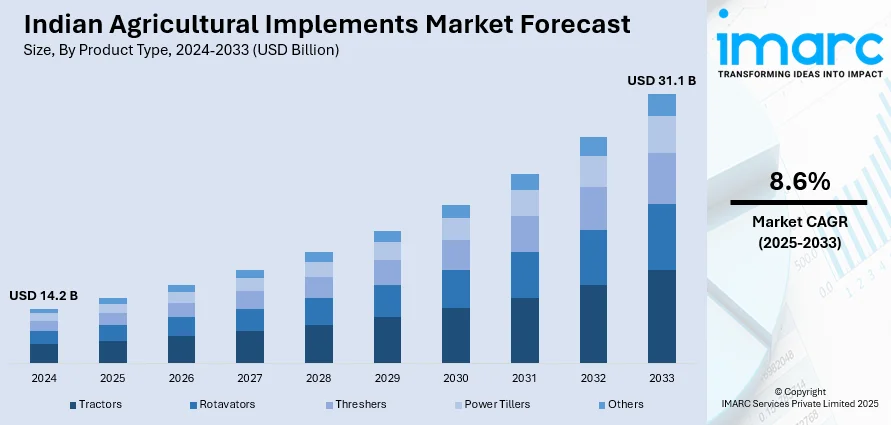

The Indian agricultural implements market size reached USD 14.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 31.1 Billion by 2033, exhibiting a growth rate (CAGR) of 8.6% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 14.2 Billion |

|

Market Forecast in 2033

|

USD 31.1 Billion |

| Market Growth Rate 2025-2033 | 8.6% |

Agricultural implements consist of a wide range of manual and mechanical tools such as threshers, cultivators, over plows, seed drills, chaff cutter machines, axes, etc. They help in reducing labor and improving the efficiency of agricultural activities. India has achieved considerable progress in the field of agricultural implements over the past decades. At the time of Independence, Indian farmers mostly used animal operated implements (such as bullock-drawn plows and wooden planks) and hand tools (including spades, pick axes, crowbars, sickles and choppers) for pulverization, compaction and smoothening of the soil. Later, the Green Revolution brought about large-scale farm mechanization which encouraged a significant number of farmers to opt for modern agricultural implements including combine harvesters, rice trans-planters, power tillers, threshers, tractors, pumping sets, etc.

To get more information of this market, Request Sample

In India, the growing incomes of the farmers have boosted the demand for farm implements. In addition, acute shortage of skilled labor for agricultural activities has further led to the growing demand for agricultural equipment. Moreover, the attractive subsidies provided by the Central and State governments have also encouraged farmers to purchase modern agricultural implements.

Indian Agricultural Implements Market Drivers:

- Substitute for manual labor: One of the biggest advantages of agriculture implements is that they can replace manual labour. Although, India represents amongst the largest countries for man power in the world, all sectors of the economy have been affected by the scarcity of labour. This impact is currently being felt more in the agricultural sector compared to other sectors. Labour constitute a vital input in agricultural production, however, with rising urbanisation and better oppurtunities, they are migrating from rural to urban parts of the country. This is creating a major imbalance between labour demand and supply. The migration from villages to cities is also leading to a lot of proxy farmers taking care of multiple plots of land. As a result, implements are expected to play a major role in agriculture productivity in the coming years.

- High Productivity and efficiency: Use of agricultural implements increase production, efficiency and per man productivity. Mechanization increases the yield of land per unit of area and also resulting in lower cost of work, resulting in better use of land and hence increasing farm income. Agricultural implements are expected to increase yields by 25-30% in states with a low level of mechanisation, and by up to 10% in states that are already highly mechanised.

- Long Terms Cost Savings: Although buying agricultural implements involve a high initial capital expenditure. Over a longer period of time, they prove to be more cost effective compared to manual labour and work animals. For instance, in actual operation, there are negligible costs when machines remain idle, on the other hand, the cost of maintenance of draught animals remains the same irrespective if they are working or are idle. This is because animals need to be fed whether they are doing work or not.

- Improvements in Agriculture Techniques: The use of agricultural implements also provides benefits during irrigation, land reclamation and the prevention of soil erosion. For example, ploughing by a tractor reclaims more land and therefore extends the cultivated area as it smoothens hillocks, fills in depressions and gullies and eradicate deeps-rooted weeds. It also prevents soil erosion.

- Government Support: Another major driver of the agriculture implements industry is the fact that it represents a major focus area for the government. Agriculture remains a primary means of livelihood for more than 50% of the country’s total population and, as a result, it represents an important vote bank for any government that wants to retain power. The government of India is also providing subsidies to local farmers on water, electricity, agricultural machinery, agrochemicals, hybrid seeds, etc. It has also exempted agriculture income under the Indian Income Tax Act, meaning income earned from agricultural operations is not taxed. In addition, both state and central government often waive off loans given to the farmers.

- Large Agricultural Economy: India is the second-largest populated country accounting for around 18% of the total world population. Catalysed by a rising population, the requirement for various agricultural products has also increased significantly. This rise has stimulated the farmers to adopt enhanced technologies and increase the level of mechanization in their agricultural practices resulting in an increasing demand of agricultural implements and methods in sectors such as farming, dairy, fisheries, livestock, etc. Moreover, more than 50% of India’s population is dependent on agricultural products which is further promoting the growth of the market.

- Increase in custom hiring of implements: The high capital cost of agriculture implements may often restrain many small-scale farmers to buy them. Moreover, farmers with small land holdings do not find it cost effective to invest into their own agricultural implements. This has resulted into a large market for the custom hiring of implements where implements can be rented out to farmers for a specific time and cost.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Indian agricultural implements market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product type, type and distribution channel.

Breakup by Product Type:

- Tractors

- Rotavators

- Threshers

- Power Tillers

- Others

The agricultural implements market in India has been categorized on the basis of product type including tractors, rotavators, threshers, power tillers, and others. Amongst these, tractors dominate this market.

Breakup by Type:

- Manual

- Mechanized

On the basis of type, the market has been segmented into manual and mechanized agricultural implements. Currently, manual implements represent the largest segment, holding the majority of the market share.

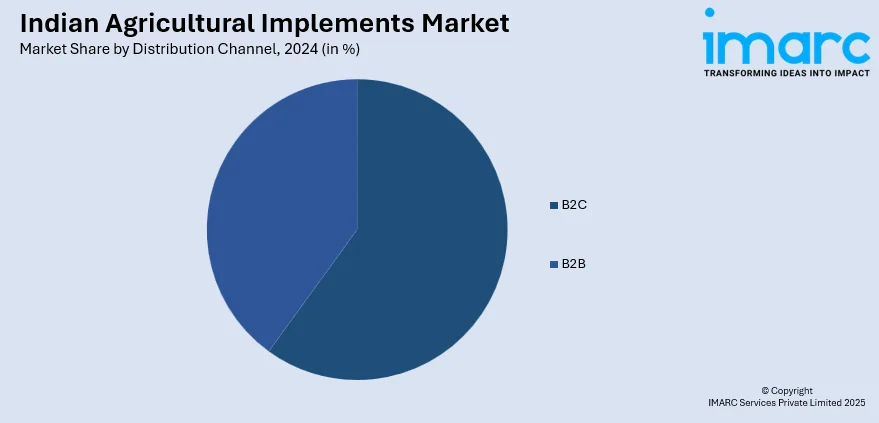

Breakup by Distribution Channel:

- B2C

- B2B

Based on distribution channels, the market has been divided into B2B and B2C, wherein the B2C channels account for the largest share.

Regional Insights:

- North India

- West and Central India

- South India

- East India

On a regional basis, the Indian agricultural implements market has been segregated into North India, South India, West and Central India, and East India. Presently, North India is the leading region with the highest level of mechanization.

Competitive Landscape:

The market is concentrated with the presence of a few large manufacturers. Some of the leading players operating in the market are:

- Mahindra & Mahindra Limited

- Tractors and Farm Equipment Limited

- Sonalika International Tractors Limited

- Escorts Group

- Deere & Company

This report provides a deep insight into the Indian agricultural implements market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Indian agricultural implements market in any manner.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Product Type, Type, Distribution Channel, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Mahindra & Mahindra Limited, Tractors and Farm Equipment Limited, Sonalika International Tractors Limited, Escorts Group, Deere & Company |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indian agricultural implements market performed so far and how will it perform in the coming years?

- What are the key regions in the Indian agricultural implements market?

- What has been the impact of COVID-19 on the Indian agricultural implements market?

- Which are the popular product types in the Indian agricultural implements market?

- What are the key type segments in the Indian agricultural implements market?

- What are the major distribution channels in the Indian agricultural implements market?

- What are the various stages in the value chain of the Indian agricultural implements market?

- What are the key driving factors and challenges in the Indian agricultural implements market?

- What is the structure of the Indian agricultural implements market and who are the key players?

- What is the degree of competition in the Indian agricultural implements market?

- How are agricultural implements manufactured?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)