Indian Access Control Market Size, Share, Trends and Forecast by Component, Type, End User, and Region, 2025-2033

Market Overview:

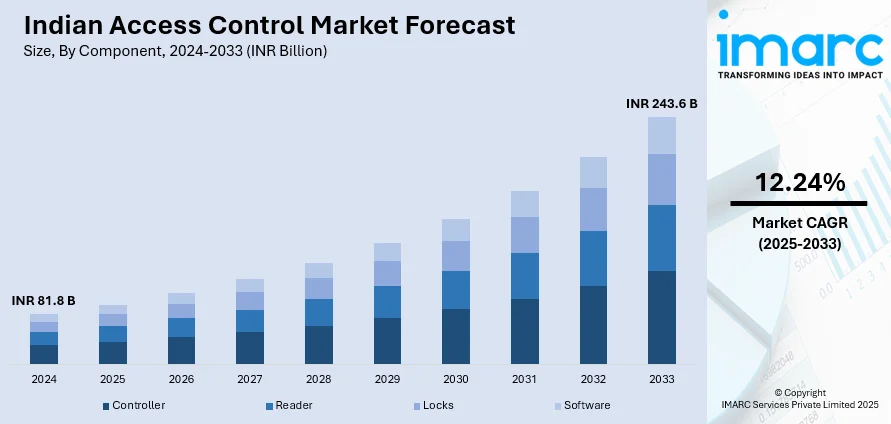

The Indian access control market size reached INR 81.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach INR 243.6 Billion by 2033, exhibiting a growth rate (CAGR) of 12.24% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 81.8 Billion |

|

Market Forecast in 2033

|

INR 243.6 Billion |

| Market Growth Rate 2025-2033 | 12.24% |

Access control system recognizes, authenticates, and authorizes the entry and exit of an authorized person into the premises ensuring complete security. The access control systems can either use biometric or proximity/smart cards. Owing to the rising security concerns, along with the increasing crime rates in India, these devices are majorly deployed in data centers, offices, hotels, retail stores, entertainment stores, government institutions, banks, etc.

To get more information of this market, Request Sample

Several factors, such as the rapid installation of access control systems across commercial and defense sectors, are currently bolstering the market growth in India. Various private and government entities are investing in enhanced security systems for data protection and providing a safer and secure environment for their employees. The urbanized regions of the country, such as Hyderabad, Chennai, Bangalore, Delhi-NCR, Mumbai, etc. have made impressive progress in advancing their security systems, pertaining to government buildings, IT hubs and commercial spaces. Moreover, the introduction of technologically advanced, contactless smart cards for diversified applications, further catalyzes the product demand, based on their user-friendly and seamless experience. Apart from this, due to the escalating crime incidents in the country, various commercial premises such as IT companies, enterprises, data centers, etc. are installing access control systems to protect personnel and data breaches as well as for recording employees' entry and exit timings.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Indian access control market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on component, type and end user.

Breakup by Component:

- Controller

- Reader

- Locks

- Software

Breakup by Type:

- Card Based

- Contact

- Contactless

- Biometric Based

- Fingerprint

- Face Recognition

- Face Recognition and Fingerprint

- Iris Recognition

- Others

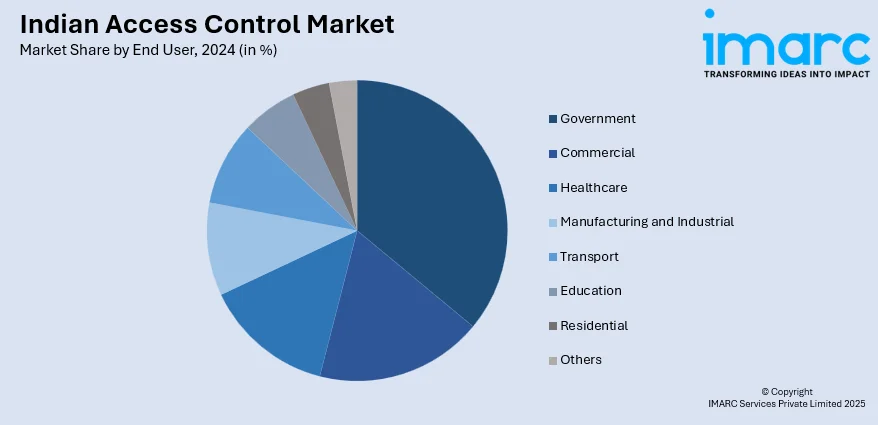

Breakup by End User:

- Government

- Commercial

- Healthcare

- Manufacturing and Industrial

- Transport

- Education

- Residential

- Others

Breakup by Region:

- South India

- North India

- West and Central India

- East India

Competitive Landscape:

The report has also examined the competitive landscape of Indian access control market. Some of the major players include ESSL, Gemalto (3M Cognet), HID India Pvt. Ltd., Honeywell International India Pvt. Ltd, IDEMIA Ltd., Mantra Softech (India) Pvt. Ltd, Matrix Comsec Pvt. Ltd., Realtime Biometric Co. Ltd, Tyco Security Products and ZKTeco Biometrics India Pvt Ltd.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Billion |

| Segment Coverage | Component, Type, End User, Region |

| Region Covered | South India, North India, West and Central India, East India |

| Companies Covered | ESSL, Gemalto (3M Cognet), HID India Pvt. Ltd., Honeywell International India Pvt. Ltd, IDEMIA Ltd., Mantra Softech (India) Pvt. Ltd, Matrix Comsec Pvt. Ltd., Realtime Biometric Co. Ltd, Tyco Security Products and ZKTeco Biometrics India Pvt Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indian access control market was valued at INR 81.8 Billion in 2024.

We expect the Indian access control market to exhibit a CAGR of 12.24% during 2025-2033.

The rising installation of access control system across several industrial verticals for enhanced security systems to provide data protection and secure environment for the employees is primarily driving the Indian access control market.

The sudden outbreak of the COVID-19 pandemic has led to the growing inclination towards remote working models across the nation, resulting in the increasing deployment of access control systems for tracking and monitoring purposes, preventing data breaches, and ensuring business continuity.

Based on the component, the Indian access control market can be segregated into controller, reader, locks, and software. Among these, controller holds the largest market share.

Based on the type, the Indian access control market has been bifurcated into card based and biometric based, where card based reader exhibits a clear dominance in the market.

Based on the end user, the Indian access control market can be segmented into government, commercial, healthcare, manufacturing and industrial, transport, education, residential, and others. Currently, the government sector holds the majority of the total market share.

On a regional level, the market has been classified into South India, North India, West and Central India, and East India, where West and Central India currently dominates the Indian access control market.

Some of the major players in the Indian access control market include ESSL, Gemalto (3M Cognet), HID India Pvt. Ltd., Honeywell International India Pvt. Ltd, IDEMIA Ltd., Mantra Softech (India) Pvt. Ltd, Matrix Comsec Pvt. Ltd., Realtime Biometric Co. Ltd, Tyco Security Products, and ZKTeco Biometrics India Pvt Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)