India Workflow Orchestration Market Size, Share, Trends and Forecast by Type, Organization Size, End User, and Region, 2025-2033

India Workflow Orchestration Market Overview:

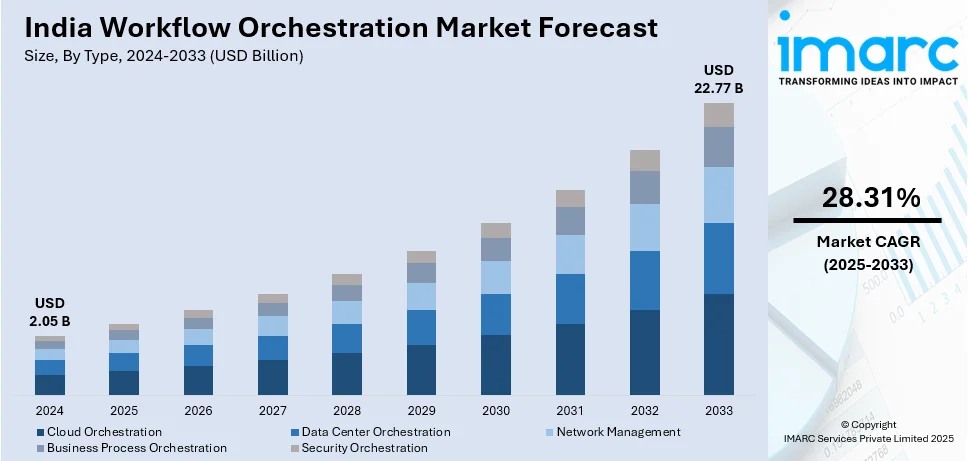

The India workflow orchestration market size reached USD 2.05 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 22.77 Billion by 2033, exhibiting a growth rate (CAGR) of 28.31% during 2025-2033. The India workflow orchestration market share is expanding, driven by the increasing usage of hybrid and multi-cloud strategies, which is creating the need for reliable tools to coordinate workflows efficiently, along with the expansion of e-commerce sites.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.05 Billion |

| Market Forecast in 2033 | USD 22.77 Billion |

| Market Growth Rate 2025-2033 | 28.31% |

India Workflow Orchestration Market Trends:

Increasing usage of cloud computing

The rising adoption of cloud computing is offering a favorable India workflow orchestration market outlook. Businesses are increasingly relying on cloud-based platforms to manage and automate their operations. An IDC study indicated that around 40% of Indian companies were anticipated to implement cloud services in various forms by 2024. Workflow orchestration solutions are becoming important, as enterprises are migrating to cloud environments for greater scalability, cost efficiency, and remote access. They streamline complicated processes and assure smooth execution across many platforms. Cloud computing allows businesses to combine several apps, data sources, and services, but managing these operations manually may be time-taking and error-prone. This is where workflow orchestration comes into play, automating repetitive tasks and optimizing resource allocation. Cloud-based workflow orchestration is being used by industries, such as IT, finance, and healthcare, to boost productivity, minimize reaction times, and ensure continuous data flow between systems. Furthermore, as hybrid and multi-cloud solutions become more prevalent, businesses demand orchestration technologies to easily coordinate operations across several cloud providers. The ongoing utilization of machine learning (ML) and artificial intelligence (AI) in cloud-based operations is also creating the need for smart orchestration solutions that can predict and prevent workflow disruptions. Government initiatives supporting cloud adoption and digital transformation are further accelerating this trend, making workflow orchestration a critical component for businesses aiming to enhance scalability and overall operational agility in India’s growing cloud ecosystem.

To get more information of this market, Request Sample

Expansion of e-commerce sites

The rapid expansion of e-commerce sites is impelling the India workflow orchestration market growth. Online businesses need efficient automation to manage their growing operations. With millions of orders being placed daily, e-commerce platforms rely on workflow orchestration to streamline order processing, inventory management, payment handling, and logistics coordination. Manual management of these processes can lead to delays, errors, and inefficiencies, but workflow orchestration ensures smooth and automated execution, improving customer experience. As online shopping continues to rise, companies are integrating multiple payment gateways, warehouses, and third-party delivery partners, making workflow automation crucial for handling complex transactions in real time. Additionally, customer service in e-commerce, including chatbots, returns processing, and personalized recommendations, is becoming more dependent on automated workflows. The increasing use of data analytics in e-commerce also requires well-coordinated workflows to process large amounts of data efficiently. With businesses continuously broadening their digital presence, workflow orchestration is playing a key role in ensuring seamless operations in India’s burgeoning e-commerce sector. According to the IBEF, the India e-commerce market is expected to hit USD 325 Billion by 2030, propelled by 500 Million users and enhanced internet availability, particularly in rural regions.

India Workflow Orchestration Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, organization size, and end user.

Type Insights:

- Cloud Orchestration

- Data Center Orchestration

- Network Management

- Business Process Orchestration

- Security Orchestration

The report has provided a detailed breakup and analysis of the market based on the type. This includes cloud orchestration, data center orchestration, network management, business process orchestration, and security orchestration.

Organization Size Insights:

- SME’s

- Large Enterprise

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes SME’s and large enterprise.

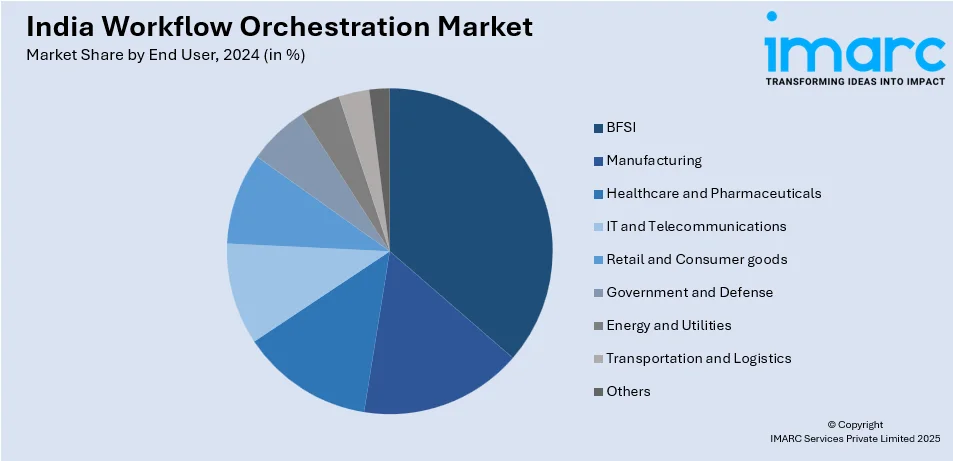

End User Insights:

- BFSI

- Manufacturing

- Healthcare and Pharmaceuticals

- IT and Telecommunications

- Retail and Consumer goods

- Government and Defense

- Energy and Utilities

- Transportation and Logistics

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes BFSI, manufacturing, healthcare and pharmaceuticals, IT and telecommunications, retail and consumer goods, government and defense, energy and utilities, transportation and logistics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Workflow Orchestration Market News:

- In November 2024, Qntrl, a business process management (BPM) platform, released an updated version of its platform, adding new features aimed at enterprises with an emphasis on the Indian market. Among its features were Bridge, a tool that could automate workflows between cloud and legacy systems, and Circuit, which was a visual engine for orchestrating IT workflows that made coding and managing business processes easier.

- In August 2024, Finarkein secured USD 4.75 Million in a pre-series A funding round headed by Nexus Venture Partners. The data and workflow orchestration platform created by the firm enabled businesses to collaboratively develop data items utilizing India’s digital public infrastructure (DPI), such as the account aggregator (AA) ecosystem. Through the investment, the company aimed to reduce the cost of financial services while promoting innovations and distribution.

India Workflow Orchestration Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cloud Orchestration, Data Center Orchestration, Network Management, Business Process Orchestration, Security Orchestration |

| Organization Sizes Covered | SME’s, Large Enterprise |

| End Users Covered | BFSI, Manufacturing, Healthcare and Pharmaceuticals, IT and Telecommunications, Retail and Consumer goods, Government and Defense, Energy, Utilities, Transportation and Logistics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India workflow orchestration market performed so far and how will it perform in the coming years?

- What is the breakup of the India workflow orchestration market on the basis of type?

- What is the breakup of the India workflow orchestration market on the basis of organization size?

- What is the breakup of the India workflow orchestration market on the basis of end user?

- What is the breakup of the India workflow orchestration market on the basis of region?

- What are the various stages in the value chain of the India workflow orchestration market?

- What are the key driving factors and challenges in the India workflow orchestration market?

- What is the structure of the India workflow orchestration market and who are the key players?

- What is the degree of competition in the India workflow orchestration market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India workflow orchestration market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India workflow orchestration market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India workflow orchestration industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)