India Wood Pellet Market Size, Share, Trends and Forecast by Feedstock Type, Application, and Region, 2025-2033

India Wood Pellet Market Overview:

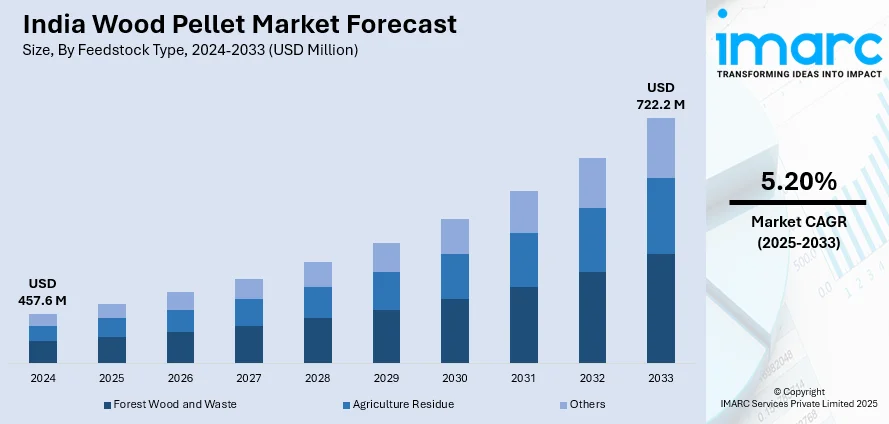

The India wood pellet market size reached USD 457.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 722.2 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. Rising demand for renewable energy, government incentives for biomass utilization, increasing focus on carbon emission reduction, growing industrial and residential heating needs, surplus agricultural and forestry waste availability, advancements in pellet production technology, and expanding export opportunities are expanding the India wood pellet market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 457.6 Million |

| Market Forecast in 2033 | USD 722.2 Million |

| Market Growth Rate 2025-2033 | 5.20% |

India Wood Pellet Market Trends:

Growing Demand for Wood Pellets in Renewable Energy Generation

The rising emphasis on sustainable energy solutions is driving the demand for wood pellets in India’s renewable energy sector. As the government pushes for cleaner fuel alternatives under initiatives like the National Bio-Energy Mission, industries and power plants are increasingly adopting wood pellets as a cost-effective and eco-friendly substitute for coal. The market is expanding due to the increasing use of biomass-based power generation, especially in areas such as Uttar Pradesh, Punjab, and Haryana. Carbon emissions and reliance on fossil fuels are also being decreased by the use of wood pellets in industrial boilers and heating systems. Domestic producers are expanding their operations to meet the growing demand as a result of technological improvements that have improved the efficiency of pellet production. Export prospects for the Indian market are also growing, especially to Asian and European nations where biomass energy is heavily promoted. As awareness about sustainable energy grows, wood pellets are poised to become a key player in India’s renewable energy landscape, thereby driving India wood pellet market growth.

To get more information of this market, Request Sample

Increasing Adoption of Wood Pellets in Industrial and Commercial Heating

The adoption of wood pellets in industrial and commercial heating applications is gaining traction in India due to their high energy efficiency and low emissions. Notably, The Bureau of Energy Efficiency (BEE) and the Power Foundation of India (PFI) collaborated to organize a National Conference on sustainable cooling and doubling the rate of energy efficiency improvement in New Delhi from February 21–22, 2025. Union Minister of Power and Housing and Urban Affairs Shri Manohar Lal stressed the importance of energy efficiency in his inaugural speech, pointing out that India's non-fossil fuel capacity had surpassed previous pledges by reaching 47.15% and that emission intensity had dropped by 36%. Industries such as food processing, textile manufacturing, and pharmaceuticals are shifting towards biomass-based heating systems to comply with stringent environmental regulations and reduce operational costs. Additionally, the hospitality sector, including hotels and resorts, is exploring biomass heating as an alternative to conventional LPG and diesel-based systems. The ease of storage, transportation, and combustion efficiency of wood pellets make them a preferred choice over traditional firewood. With rising fuel costs, industries are increasingly investing in biomass boilers and pellet-based heating technologies to achieve energy savings and sustainability goals, which in turn is positively impacting India wood pellet market outlook. Government incentives and subsidies for biomass energy projects are also encouraging industries to transition to wood pellets. As the demand for cleaner and cost-effective heating solutions rises, wood pellets are emerging as a viable alternative across multiple industrial and commercial sectors in India, which in positively impacting the India wood pellet market outlook.

India Wood Pellet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on feedstock type and application.

Feedstock Type Insights:

- Forest Wood and Waste

- Agriculture Residue

- Others

The report has provided a detailed breakup and analysis of the market based on the feedstock type. This includes forest wood and waste, agriculture residue, and others.

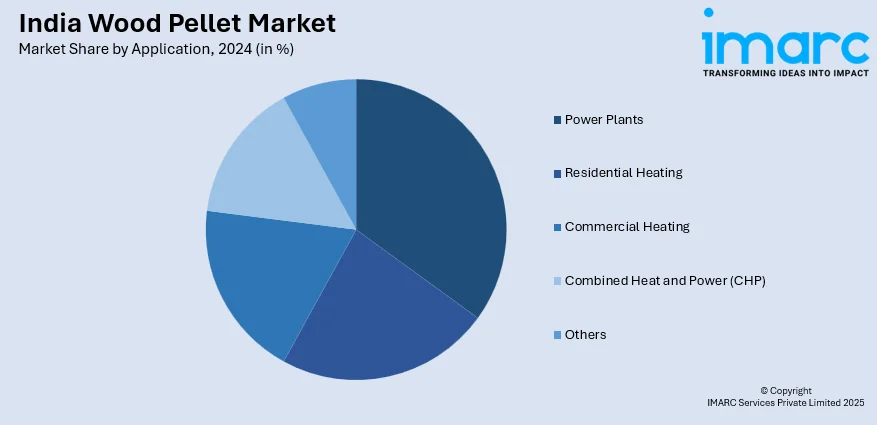

Application Insights:

- Power Plants

- Residential Heating

- Commercial Heating

- Combined Heat and Power (CHP)

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes power plants, residential heating, commercial heating, combined heat and power (CHP), and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Wood Pellet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Feedstock Types Covered | Forest Wood and Waste, Agriculture Residue, Others |

| Applications Covered | Power Plants, Residential Heating, Commercial Heating, Combined Heat and Power (CHP), Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India wood pellet market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India wood pellet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India wood pellet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wood pellet market in India was valued at USD 457.6 Million in 2024.

The India wood pellet market is projected to exhibit a CAGR of 5.20% during 2025-2033, reaching a value of USD 722.2 Million by 2033.

The India wood pellet market is expanding due to increased focus on sustainable energy sources and cleaner fuel alternatives. Government initiatives promoting biomass energy, along with easy access to raw materials like agricultural waste, and rising use in industrial heating and power generation, are key growth drivers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)