India Wood Adhesives Market Size, Share, Trends and Forecast by Resin Type, Technology, Application, and Region, 2025-2033

India Wood Adhesives Market Overview:

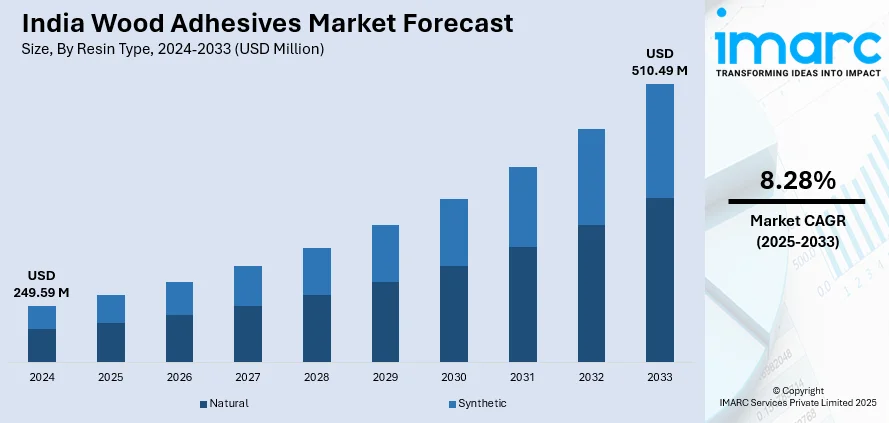

The India wood adhesives market size reached USD 249.59 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 510.49 Million by 2033, exhibiting a growth rate (CAGR) of 8.28% during 2025-2033. The India wood adhesives market is driven by rapid urbanization, elevating demand for modular furniture, rapid growth in residential and commercial construction, rising preference for eco-friendly adhesives, advancements in engineered wood products, the launch of favorable government housing schemes, the growing woodworking sector, and substantial investments in sustainable and high-performance adhesive technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 249.59 Million |

| Market Forecast in 2033 | USD 510.49 Million |

| Market Growth Rate 2025-2033 | 8.28% |

India Wood Adhesives Market Trends:

Growth in Residential and Commercial Construction

India's wood adhesives industry is largely influenced by the expanding construction industry, especially in the residential and commercial segments. The escalating urbanization rates, the launch of various housing programs by the government bodies, such as Pradhan Mantri Awas Yojana (PMAY), and the emerging middle-class economy are bolstering the demand for wooden furniture, doors, flooring, and cabinetry. With real estate developers favoring contemporary and visually appealing interiors, wood products are being increasingly used, leading to rising demand for high-performance adhesives. The commercial segment, such as hotels, shopping malls, corporate offices, and co-working spaces, is also seeing significant growth. These facilities need high-quality wood adhesives for long-lasting furniture assembly, paneling, and interior design. Moreover, the transition toward modular furniture and ready-to-assemble (RTA) wooden fittings also promotes market growth because manufacturers use robust adhesive formulations to create long-lasting products and maintain structural strength. Additionally, the elevating disposable incomes and the shifting consumer preferences towards high-quality wooden furniture are catalyzing the need for innovative adhesives with enhanced bonding strength, water resistance, and environmental friendliness.

To get more information of this market, Request Sample

Increasing Adoption of Sustainable and Eco-Friendly Adhesives

The transition to sustainability models across industries is fundamentally transforming India's wood adhesives sector, as consumer demand and regulation are compelling firms to produce sustainable products. Traditional adhesives have volatile organic compounds (VOCs) and formaldehyde, which harm the environment and human health. In response to this, manufacturers are making significant investments in water-based, bio-based, and low-VOC adhesive technologies, which ensure bonding strength with the least hazardous emissions. Moreover, various government initiatives, including the National Action Plan on Climate Change (NAPCC) and green building projects, promote the usage of non-toxic adhesives that support sustainability objectives. Builders and furniture makers are extensively opting for LEED (Leadership in Energy and Environmental Design) certifications, which mandate the use of eco-friendly materials, including wood adhesives with low chemical emissions. Furthermore, furniture market players, such as IKEA and Pepperfry, are also dictating market trends by focusing on eco-friendly adhesives in their product offerings. This is also being adopted by Indian furniture producers, owing to the long-term advantages of sustainable materials in upholding brand reputation and adherence to new green regulations.

India Wood Adhesives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on resin type, technology, and application.

Resin Type Insights:

- Natural

- Synthetic

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes natural and synthetic.

Technology Insights:

- Solvent-Based

- Water-Based

- Others

A detailed breakup and analysis of the market based on technology have also been provided in the report. This includes solvent-based, water-based, and others.

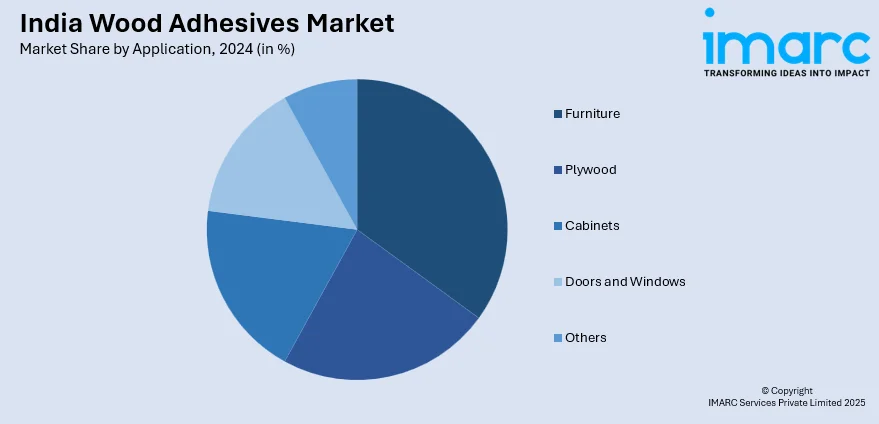

Application Insights:

- Furniture

- Plywood

- Cabinets

- Doors and Windows

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes furniture, plywood, cabinets, doors and windows, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Wood Adhesives Market News:

- January 2025: Shalimar Paints announced that it would be expanding into the wood adhesives market as part of its strategy to increase market share in rural India. By introducing new product lines like the Mela Series and Smart Bharat, the company aims to address affordability and performance concerns, particularly in areas where over 50% of paintable surfaces remain unpainted. This diversification into wood adhesives, along with other categories like spray paints, is intended to strengthen Shalimar Paints' product portfolio and provide a more comprehensive experience for customers.

- February 2024: INDIAWOOD 2024, a conference held at Bangalore International Exhibition Centre, presented woodworking and furniture-making innovations in terms of materials, machinery, and adhesives. It featured over 950 companies from more than 50 countries, showcasing the latest in woodworking and furniture production technologies. This event will highlight advancements in machinery, materials, and supplies, including adhesives, essential for modern woodworking.

India Wood Adhesives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Natural, Synthetic |

| Technologies Covered | Solvent-Based, Water-Based, Others |

| Applications Covered | Furniture, Plywood, Cabinets, Doors and Windows, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India wood adhesives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India wood adhesives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India wood adhesives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wood adhesives market in India was valued at USD 249.59 Million in 2024.

The India wood adhesives market is projected to exhibit a CAGR of 8.28% during 2025-2033, reaching a value of USD 510.49 Million by 2033.

The market is driven by rising urbanization, demand for modular furniture, growth in residential and commercial construction, and a shift toward eco-friendly adhesives. Government housing initiatives, technological advancements in engineered wood, and increasing investment in sustainable bonding solutions are further boosting growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)