India Women Health and Wellness Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Age Group, and Region, 2025-2033

India Women Health and Wellness Market Overview:

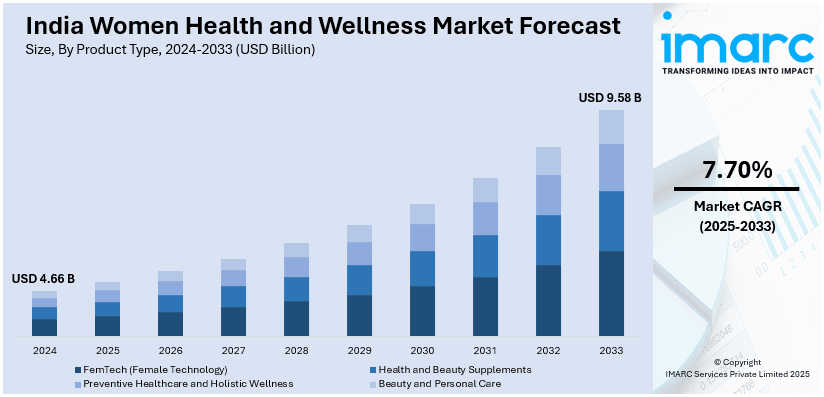

The India women health and wellness market size reached USD 4.66 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.58 Billion by 2033, exhibiting a growth rate (CAGR) of 7.70% during 2025-2033. The market is experiencing significant growth, driven by increased awareness, digital health adoption, and rising demand for natural products. E-commerce and urbanization further accelerate market expansion across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.66 Billion |

| Market Forecast in 2033 | USD 9.58 Billion |

| Market Growth Rate 2025-2033 | 7.70% |

India Women Health and Wellness Market Trends:

Increased Demand for Reproductive Health Products

Increased demand for reproductive health products is a major factor contributing to India women health and wellness market growth. Rising awareness, better education and more open conversations around menstruation, fertility and sexual health have shifted consumer behavior especially among younger women in urban areas. The market has seen a surge in demand for sanitary pads, menstrual cups and organic period care products. Fertility tracking apps and ovulation kits are also gaining traction as more women proactively manage their reproductive health. Access to over-the-counter contraceptives and discreet online purchases has further supported this shift. Several startups and D2C brands are tapping into this demand with targeted marketing and subscription-based models. Government schemes promoting menstrual hygiene in schools and rural areas are also helping expand the consumer base. For instance, in November 2024, the Union Health Ministry approved a Menstrual Hygiene Policy for School Going Girls aimed at improving menstrual hygiene standards in government schools. The policy includes provisions for free sanitary pads, separate toilets for female students and initiatives for distributing menstrual hygiene kits to enhance school participation among girls. These changes are expected to play a strong role in shaping the India women health and wellness market outlook.

To get more information of this market, Request Sample

Shift Toward Natural and Organic Products

The shift toward natural and organic products is gaining momentum as more women prioritize clean-label toxin-free options in their daily routines. Rising concerns over long-term effects of synthetic chemicals combined with a growing interest in Ayurveda and plant-based ingredients are driving this preference. From herbal supplements for hormonal balance to organic skincare ranges and sulfate-free haircare demand is coming from both urban metros and tier-2 cities. For instance, in August 2024, Aurelle Health launched as India’s first direct-to-consumer nutraceutical brand focused on women hormonal health. The brand offers natural scientifically backed supplements designed to address hormonal issues such as PCOS. Aurelle Health's innovative products target hair, skin, gut health and weight management while also emphasizing education and support for women health. Influencer endorsements, social media trends and higher availability through ecommerce platforms have made these products more accessible and aspirational. Startups and legacy brands alike are expanding their natural product lines to cater to this shift. The trend is especially strong among millennial and Gen Z consumers who actively seek ingredient transparency and sustainable packaging. This preference for natural alternatives is expected to contribute significantly to the India women health and wellness market share.

India Women Health and Wellness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and age group.

Product Type Insights:

- FemTech (Female Technology)

- Menstrual Health

- Fertility and Reproductive Health

- Maternal Health

- Sexual Wellness

- Mental Health Solutions

- Health and Beauty Supplements

- Vitamins and Minerals

- Proteins

- Botanicals

- Omega-3 Supplements

- Preventive Healthcare and Holistic Wellness

- Yoga and Ayurveda

- Fitness and Nutrition Services

- Beauty and Personal Care

- Skincare

- Haircare

- Personal Hygiene

The report has provided a detailed breakup and analysis of the market based on the product type. This includes femtech (menstrual health, fertility and reproductive health, maternal health, sexual wellness and mental health solutions), health and beauty supplements (vitamins and minerals, proteins, botanicals and omega-3 supplements), preventive healthcare and holistic wellness (yoga and ayurveda and fitness and nutrition services) and beauty and personal care (skincare, haircare and personal hygiene).

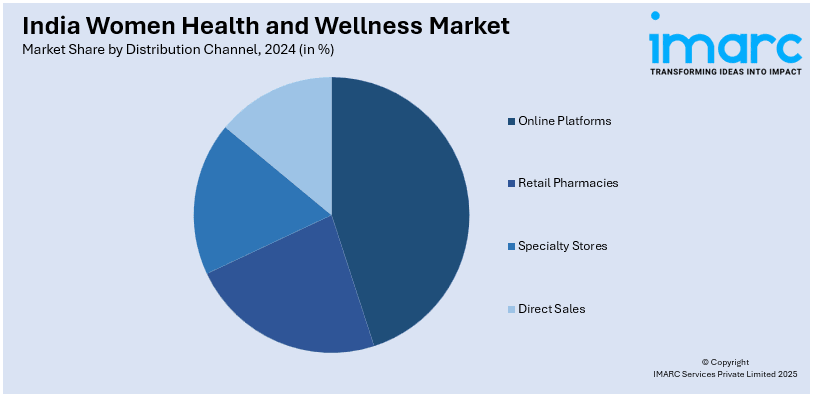

Distribution Channel Insights:

- Online Platforms

- Retail Pharmacies

- Specialty Stores

- Direct Sales

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online platforms, retail pharmacies, specialty stores and direct sales.

Age Group Insights:

- Teenage and Young Adults (13-24 years)

- Reproductive Age (25-45 years)

- Middle Age (46-60 years)

- Senior Women (60+ years)

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes teenage and young adults (13-24 years), reproductive age (25-45 years), middle age (46-60 years) and senior women (60+ years).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Women Health and Wellness Market News:

- In January 2024, Dr. Reddy's Laboratories announced the acquisition of MenoLabs, a portfolio of women health dietary supplements, from Amyris as part of its Chapter 11 sales process. The acquisition includes seven products addressing menopause symptoms and a health tracker app.

- In August 2024, Dame Health launched as India’s leading reproductive wellness brand, focusing on gynecological issues and supporting the health of both women and men. The brand offers USFDA-certified nutraceuticals designed for various stages of reproductive health. It aims to address gaps in women healthcare while promoting fertility support.

India Women Health and Wellness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Online Platforms, Retail Pharmacies, Specialty Stores, Direct Sales |

| Age Groups Covered | Teenage and Young Adults (13-24 years), Reproductive Age (25-45 years), Middle Age (46-60 years), Senior Women (60+ years) |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India women health and wellness market performed so far and how will it perform in the coming years?

- What is the breakup of the India women health and wellness market on the basis of product type?

- What is the breakup of the India women health and wellness market on the basis of distribution channel?

- What is the breakup of the India women health and wellness market on the basis of age group?

- What is the breakup of the India women health and wellness market on the basis of region?

- What are the various stages in the value chain of the India women health and wellness market?

- What are the key driving factors and challenges in the India women health and wellness market?

- What is the structure of the India women health and wellness market and who are the key players?

- What is the degree of competition in the India women health and wellness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India women health and wellness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India women health and wellness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India women health and wellness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)