India Wireless Power Transmission Market Size, Share, Trends and Forecast by Type, Technology, Implementation, Receiver Application, End-Use Industry, and Region, 2025-2033

India Wireless Power Transmission Market Size and Share:

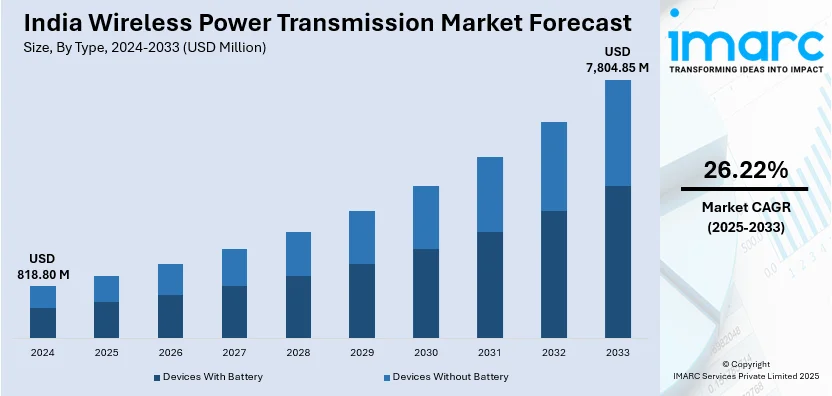

The India wireless power transmission market size reached USD 818.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 7,804.85 Million by 2033, exhibiting a growth rate (CAGR) of 26.22% during 2025-2033. Increasing adoption of wireless charging in consumer electronics, growing electric vehicle (EV) market, advancements in resonant and inductive charging technologies, rising demand for efficient energy transfer, government initiatives for clean energy, and expanding smart infrastructure are expanding the India wireless power transmission market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 818.80 Million |

| Market Forecast in 2033 | USD 7,804.85 Million |

| Market Growth Rate 2025-2033 | 26.22% |

India Wireless Power Transmission Market Trends:

Rising Adoption of Wireless Charging in Consumer Electronics

India wireless power transmission market growth is driven by the increasing adoption of wireless charging in consumer electronics. Notably, TennRich's Energizer Portable Power announced its debut in the Indian market on September 4, 2024, offering a variety of cutting-edge charging options. The product portfolio includes portable air compressors that can inflate up to 150 PSI, wireless charging pads that can support up to 15W, 2-in-1 car mounts that can wirelessly charge smartphones and earphones at 15W and 5W, and fast charge power banks with up to 22.5W output. With aspirations to grow into general trade channels and relationships with large format shops throughout the nation, these products will initially be accessible on Amazon India. Smartphones, wearables, and tablets are integrating wireless charging technology, reducing dependence on conventional wired chargers. The push for a cable-free experience and convenience has driven major smartphone manufacturers to incorporate Qi-based wireless charging standards. Additionally, innovations in fast wireless charging and extended range capabilities are enhancing user experience. With India's expanding smartphone penetration and growing disposable incomes, the demand for wireless charging solutions is increasing, fostering further advancements in wireless power transmission technologies across the country.

To get more information of this market, Request Sample

Growing Demand for Wireless Power Solutions in Electric Vehicles (EVs)

India's push toward electric mobility is accelerating the demand for wireless power transmission in the automotive sector. Wireless charging for EVs eliminates the need for cables, offering a seamless and efficient charging experience. Companies are exploring inductive and resonant wireless charging solutions to improve energy efficiency and reduce infrastructure costs. Government initiatives supporting EV adoption, coupled with increasing R&D investments in wireless charging technology, are driving market growth. For instance, the 'PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE)' Scheme was approved with a cash outlay of INR 10,900 crore and was announced by the Ministry of Heavy Industries on November 5, 2024. The program offers incentives for a number of EV categories, including roughly 24.79 lakh electric two-wheelers and 3.2 lakh electric three-wheelers, with the goals of accelerating the adoption of EVs, building charging infrastructure, and creating a strong EV manufacturing ecosystem. Sales of electric vehicles have increased since their introduction; in 2024–2025, sales of electric two-wheelers reached 5,71,411 units, indicating the growing impetus behind EV adoption. As urban infrastructure changes to support electric transportation, wireless power transmission is poised to play a crucial role in India's transition to a more sustainable and technologically advanced mobility ecosystem, which in turn positively impacting India wireless power transmission market outlook.

India Wireless Power Transmission Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, technology, implementation, receiver application, and end-use industry.

Type Insights:

- Devices With Battery

- Devices Without Battery

The report has provided a detailed breakup and analysis of the market based on the type. This includes devices with battery and devices without battery.

Technology Insights:

- Near-Field Technology

- Inductive

- Magnetic Resonance

- Capacitive Coupling/Conductive

- Far-Field Technology

- Microwave/RF

- Laser/Infrared

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes near-field technology (inductive, magnetic resonance, and capacitive coupling/conductive) and far-field technology (microwave/RF and laser/infrared).

Implementation Insights:

- Aftermarket

- Integrated

A detailed breakup and analysis of the market based on the implementation have also been provided in the report. This includes aftermarket and integrated.

Receiver Application Insights:

- Smartphones

- Tablets

- Wearable Electronics

- Notebooks

- Electric Vehicles

- Robots

- Others

A detailed breakup and analysis of the market based on the receiver application have also been provided in the report. This includes smartphones, tablets, wearable electronics, notebooks, electric vehicles, robots, and others.

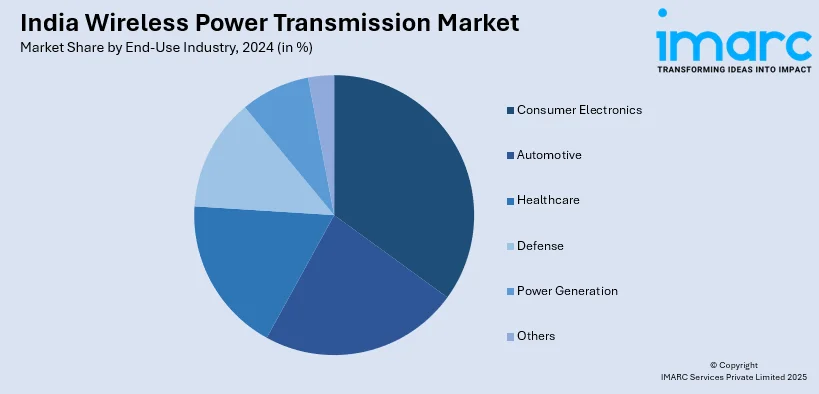

End-Use Industry Insights:

- Consumer Electronics

- Automotive

- Healthcare

- Defense

- Power Generation

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes consumer electronics, automotive, healthcare, defense, power generation, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Wireless Power Transmission Market News:

- September 5, 2024: INFRGY LLC developed a practical wireless energy transfer technology that can charge multiple devices within its vicinity using safe, low-voltage radio frequency (RF), without the need for direct contact or line of sight. This technology overcomes the limitations of traditional wireless charging pads and other systems like microwaves and infrared, by providing long-range transmission that is not significantly affected by obstacles.

India Wireless Power Transmission Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Devices With Battery, Devices Without Battery |

| Technologies Covered |

|

| Implementations Covered | Aftermarket, Integrated |

| Receiver Applications Covered | Smartphones, Tablets, Wearable Electronics, Notebooks, Electric Vehicles, Robots, Others |

| End-Use Industries Covered | Consumer Electronics, Automotive, Healthcare, Defense, Power Generation, Others |

| Regions Covered | North India, South India, East India, and West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India wireless power transmission market performed so far and how will it perform in the coming years?

- What is the breakup of the India wireless power transmission market on the basis of type?

- What is the breakup of the India wireless power transmission market on the basis of technology?

- What is the breakup of the India wireless power transmission market on the basis of implementation?

- What is the breakup of the India wireless power transmission market on the basis of receiver application?

- What is the breakup of the India wireless power transmission market on the basis of end-use industry?

- What is the breakup of the India wireless power transmission market on the basis of region?

- What are the various stages in the value chain of the India wireless power transmission market?

- What are the key driving factors and challenges in the India wireless power transmission market?

- What is the structure of the India wireless power transmission market and who are the key players?

- What is the degree of competition in the India wireless power transmission market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India wireless power transmission market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India wireless power transmission market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India wireless power transmission industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)