India Wind Energy Market Size, Share, Trends and Forecast by Component, Rating, Installation, Turbine Type, Application, and Region, 2025-2033

India Wind Energy Market Overview:

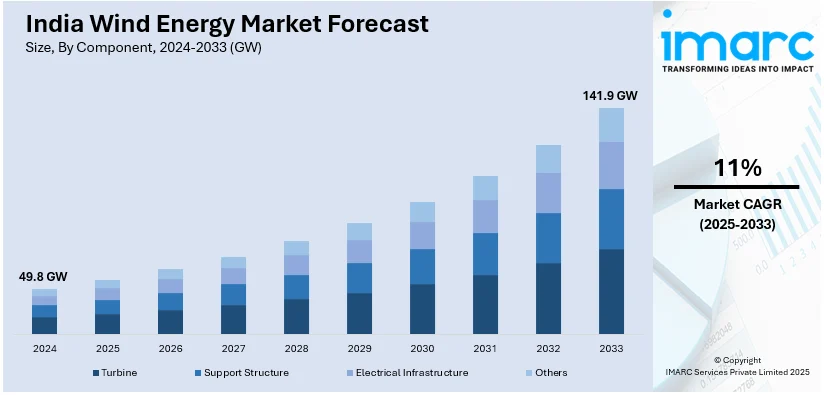

The India wind energy market size reached 49.8 GW in 2024. Looking forward, IMARC Group expects the market to reach 141.9 GW by 2033, exhibiting a growth rate (CAGR) of 11% during 2025-2033. The market has seen rapid growth, driven by favorable policies, technological advancements, and increasing investments. Additionally, government initiatives, including the Green Energy Corridor and hybrid policies, are enhancing grid integration and supporting sustainable energy goals, thereby driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 49.8 GW |

| Market Forecast in 2033 | 141.9 GW |

| Market Growth Rate 2025-2033 | 11% |

India Wind Energy Market Trends:

Growth of Wind Energy Installations

India’s wind energy market has experienced significant growth in recent years, driven by the government’s aggressive renewable energy targets. For instance, as per industry reports, by 2030, India is committed to reducing its emission intensity by 45% relative to 2005 levels, ensuring 50% of its electric power capacity comes from non-fossil fuel sources, and endorsing the 'LIFE' movement to foster sustainable lifestyles. Additionally, wind energy, being one of the most cost-effective sources of renewable energy, plays a crucial role in achieving these targets. Key states continue to dominate the wind energy landscape due to their favorable wind conditions and infrastructure development. Moreover, the introduction of the "Wind-Solar Hybrid Policy" is expected to further boost the sector’s growth, enabling more efficient utilization of land and resources. Furthermore, with favorable policies and government support, the market is projected to expand rapidly, attracting both domestic and international investors.

To get more information of this market, Request Sample

Policy Support and Government Initiatives

The Indian government has played a pivotal role in shaping the wind energy sector through proactive policies and incentives. The introduction of the "National Wind-Solar Hybrid Policy" and the “Green Energy Corridor” initiative has facilitated the integration of renewable energy into the national grid. For instance, as of October 2024, the InSTS Green Energy Corridor announced the successful commissioning 9,135 ckm of transmission lines and 21,313 MVA in substations, facilitating the integration of 24 GW of renewable energy across eight states. Additionally, the government's continued commitment to auction-based wind power procurement, along with financial incentives such as accelerated depreciation and tax benefits, has enhanced the attractiveness of investments in the sector. The Renewable Energy Development Agency (IREDA) offers low-interest loans, further encouraging project financing. Furthermore, the recent draft of the new "National Energy Policy" emphasizes the expansion of wind power to meet the country’s climate goals. These policies, combined with international climate commitments, provide the wind energy sector with a clear path to growth, ensuring that India remains a major player in the global renewable energy market.

India Wind Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component, rating, installation, turbine type, and application.

Component Insights:

- Turbine

- Support Structure

- Electrical Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes turbine, support structure, electrical infrastructure, and others.

Rating Insights:

- ≤ 2 MW

- >2 ≤ 5 MW

- >5 ≤ 8 MW

- >8 ≤ 10 MW

- >10 ≤ 12 MW

- > 12 MW

A detailed breakup and analysis of the market based on the rating have also been provided in the report. This includes ≤ 2 MW, >2 ≤ 5 MW, >5 ≤ 8 MW, >8 ≤ 10 MW, >10 ≤ 12 MW, and > 12 MW.

Installation Insights:

- Offshore

- Onshore

The report has provided a detailed breakup and analysis of the market based on the installation. This includes offshore and onshore.

Turbine Type Insights:

- Horizontal Axis

- Vertical Axis

A detailed breakup and analysis of the market based on the turbine type have also been provided in the report. This includes horizontal axis and vertical axis.

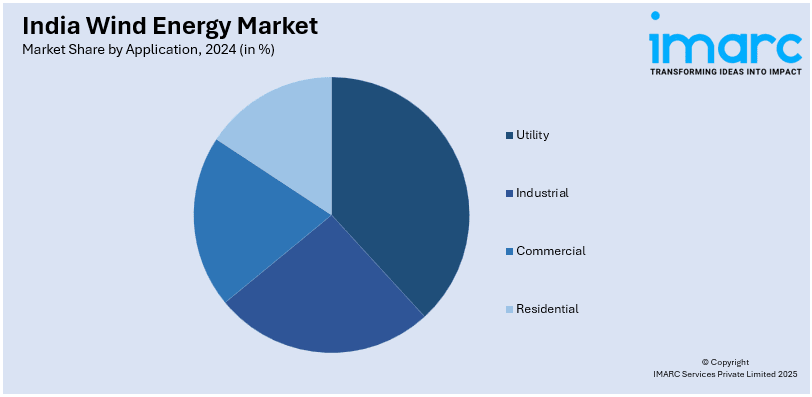

Application Insights:

- Utility

- Industrial

- Commercial

- Residential

The report has provided a detailed breakup and analysis of the market based on the application. This includes utility, industrial, commercial, and residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Wind Energy Market News:

- In October 2023, the Government of India (GOI) announced the approval of Phase-II of the Green Energy Corridor project. The committee allocated Rs. 20,773.70 Crore for this project and plans the completion by FY 2029-30. This initiative aims to enhance India's renewable energy infrastructure by integrating 13 GW of renewable energy from Ladakh into the national grid.

- In May 2024, Suzlon Energy announced that it had secured orders from Juniper Green Energy to develop 402 MW wind energy projects in Fatehgarh, Rajasthan. This contract involves installing 134 wind turbine generators, each with a 3 MW capacity. The aim of the project is to contribute significantly to India’s renewable energy goals by increasing wind energy capacity and supporting the country's transition towards a more sustainable energy future.

India Wind Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | GW |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Turbine, Support Structure, Electrical Infrastructure, Others |

| Ratings Covered | ≤ 2 MW, >2 ≤ 5 MW, >5 ≤ 8 MW, >8 ≤ 10 MW, >10 ≤ 12 MW, > 12 MW |

| Installations Covered | Offshore, Onshore |

| Turbine Types Covered | Horizontal Axis, Vertical Axis |

| Applications Covered | Utility, Industrial, Commercial, Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India wind energy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India wind energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India wind energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wind energy market in India reached a volume of 49.8 GW in 2024.

The India wind energy market is projected to exhibit a CAGR of 11% during 2025-2033, reaching a volume of 141.9 GW by 2033.

The market is driven by the push for renewable power generation, limited availability of fossil fuels, and the suitability of wind-rich zones. It also benefits from increasing grid capacity and private sector participation. As states aim to diversify energy sources, wind power remains attractive due to its scalability, operational simplicity, and relatively low long-term costs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)