India Wet Wipes Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

India Wet Wipes Market Overview:

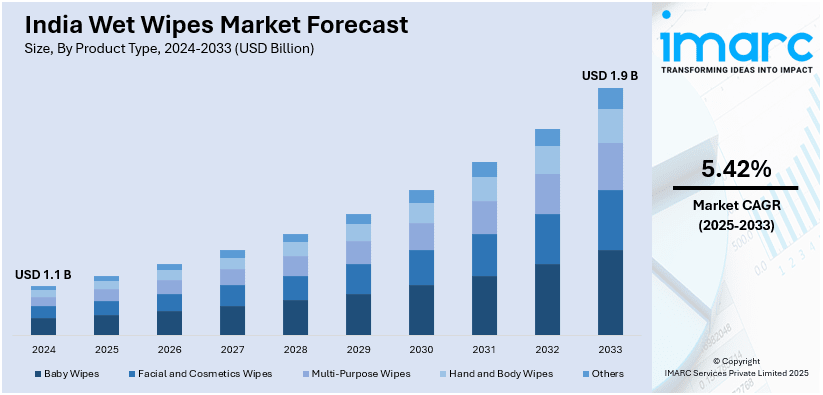

The India wet wipes market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.42% during 2025-2033. The market is expanding due to rising hygiene awareness, increasing demand for baby and facial wipes, and eco-friendly innovations. Growth in e-commerce, premium skincare, government regulations on plastic use and evolving consumer preferences for natural and chemical-free wipes are driving sustained industry growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Market Growth Rate (2025-2033) | 5.42% |

India Wet Wipes Market Trends:

Growth of Baby Wipes Segment

The baby wipes segment is witnessing significant growth in India due to the rising infant population, increasing disposable income and growing parental awareness about infant hygiene. Parents are opting for gentle, chemical-free and dermatologically tested wipes to ensure safe and irritation-free cleaning for babies. The growing demand for paraben-free, alcohol-free and fragrance-free wipes is also contributing positively to the India wet wipes market growth as consumers prioritize natural and organic ingredients in baby care products. New product launches are further driving competition and expanding consumer choices in the premium baby wipes segment. For instance, in January 2025, Panacea Biotec's subsidiary, Panacea Biotec Pharma launched a new premium baby diaper and wipes brand named 'NikoMom.' The brand will initially target the domestic market with plans for future international expansion. Leading manufacturers are focusing on biodegradable and eco-friendly baby wipes, aligning with the growing preference for sustainable and skin-friendly products. Additionally, the expansion of online retail platforms and easy access to premium baby wipes are further boosting market penetration. With the shift towards premium hygiene products and the rising awareness of infant care, India wet wipes market share is growing as manufacturers introduce high-quality, safe, and eco-friendly baby wipes.

To get more information of this market, Request Sample

Rising Popularity of Biodegradable and Eco-Friendly Wipes

The increasing awareness of environmental sustainability is driving demand for biodegradable and plastic-free wet wipes in India. Consumers are shifting towards compostable, plant-based, and chemical-free alternatives to reduce their carbon footprint. New product innovations are reinforcing the shift towards eco-friendly alternatives, offering consumers safer and sustainable choices. For instance, in May 2024, Cugo launched ecofriendly baby wipes enriched with natural aloe extract designed to soothe and nourish babies' skin. Made from 100% biodegradable materials these dermatologist-tested wipes ensure a gentle safe cleansing experience while prioritizing environmental responsibility. Brands are responding by launching wipes made from bamboo fiber, organic cotton, and biodegradable viscose, eliminating microplastics and synthetic materials that contribute to pollution. Government regulations on single-use plastics and growing advocacy for sustainable personal care products are further accelerating this trend. Companies are focusing on eco-friendly packaging, using recyclable materials and water-based solutions to enhance sustainability. The demand is particularly strong in baby wipes, facial wipes, and disinfectant wipes, as consumers prioritize both skin safety and environmental impact. These factors, including consumer preference for sustainability, regulatory support, and product innovations, are creating a positive India wet wipes market outlook, driving long-term growth and market expansion.

India Wet Wipes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Baby Wipes

- Facial and Cosmetics Wipes

- Multi-Purpose Wipes

- Hand and Body Wipes

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baby wipes, facial and cosmetics wipes, multi-purpose wipes, hand and body wipes and others.

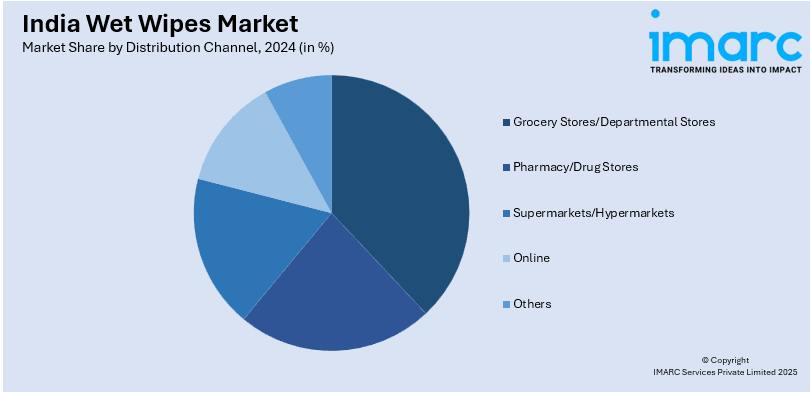

Distribution Channel Insights:

- Grocery Stores/Departmental Stores

- Pharmacy/Drug Stores

- Supermarkets/Hypermarkets

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes Grocery Stores, Pharmacy/Drug Stores, Supermarkets/Hypermarkets, Online and Others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Wet Wipes Market News:

- In May 2024, Medicare Hygiene Ltd. launched Earthika Eco-friendly Wet Wipes, marking its entry into the cosmetics sector. Made from 99% pure water and biodegradable materials, these dermatologically tested wipes offer a refreshing experience. Initially available in Ahmedabad, they will expand across Gujarat and nationwide, available online and through various retail outlets.

- In June 2023, Ginni Filaments Ltd. introduced 'Adore Baby' ultra-pure water wipes, the first in India, featuring 99.9% water and aloe vera for gentle cleansing. Free from harmful chemicals and with dermatological approval, these wipes promise to protect babies' sensitive skin while ensuring a soothing clean during diaper changes.

India Wet Wipes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Baby Wipes, Facial and Cosmetics Wipes, Multi-Purpose Wipes, Hand and Body Wipes, Others |

| Distribution Channels Covered | Grocery Stores, Pharmacy/Drug Stores, Supermarkets/Hypermarkets, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India wet wipes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India wet wipes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India wet wipes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India wet wipes market was valued at USD 1.2 Billion in 2025.

The India wet wipes market is projected to exhibit a CAGR of 5.42% during 2025-2033, reaching a value of USD 1.9 Billion by 2033.

The India wet wipes market is propelled by urban lifestyle shifts, increasing demand for hygiene and convenience, and heightened awareness about germ protection. Rising baby care needs, travel-friendly packaging preferences, and expanding rural retail distribution further drive growth. Health-conscious consumers and the influence of on-the-go culture further support sustained market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)