India Weight Management Market Size, Share, Trends and Forecast by Diet, Equipment, Service, and Region, 2026-2034

India Weight Management Market Summary:

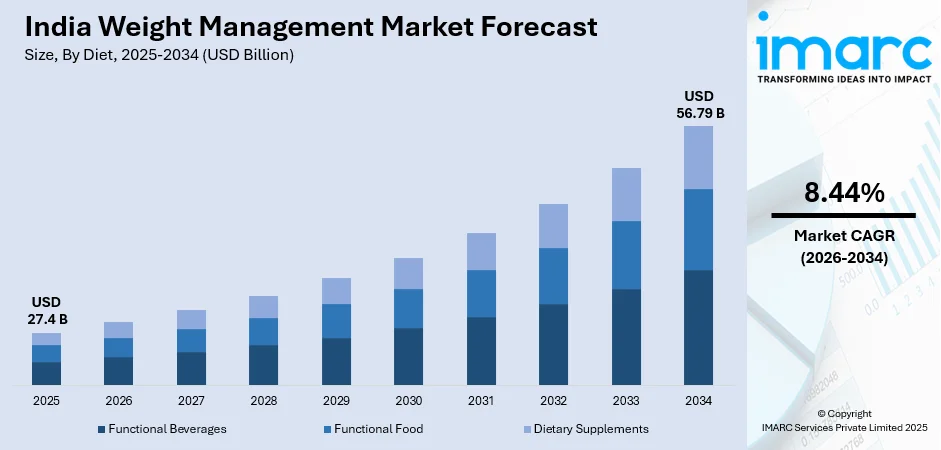

The India weight management market size was valued at USD 27.4 Billion in 2025 and is projected to reach USD 56.79 Billion by 2034, growing at a compound annual growth rate of 8.44% from 2026-2034.

The India weight management market represents a rapidly expanding sector driven by evolving health consciousness among the population. The increasing urbanization and changing eating habits have led to the increased demand for holistic management of weight. The market involves different product lines such as dietary supplements, fitness equipment, and professional wellness. Consumer behavior is being redefined using social media and online health platforms, especially among younger generations, as well as old-time traditions such as Ayurveda still retain relevance in the contemporary wellness culture.

Key Takeaways and Insights:

-

By Diet: Dietary supplements dominate the market with a share of 58% in 2025, driven by increasing consumer preference for convenient, non-invasive weight management solutions and the growing popularity of protein supplements, metabolism boosters, and meal replacements among health-conscious urban consumers.

-

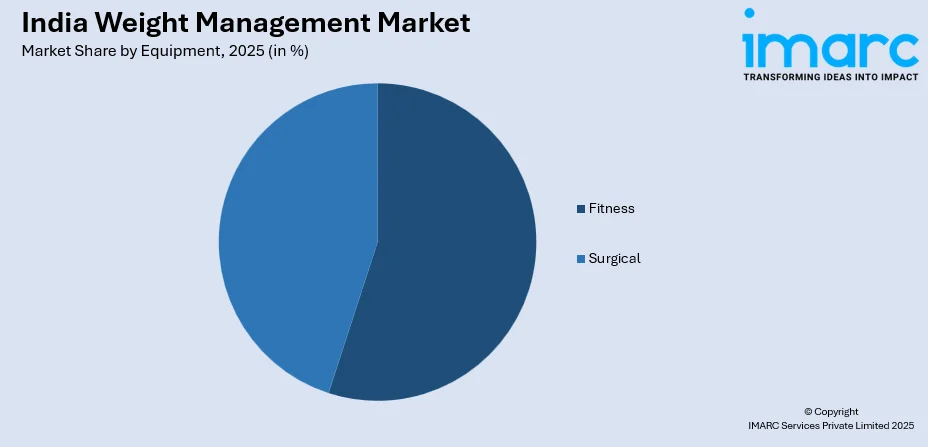

By Equipment: Fitness leads the market with a share of 52% in 2025, owing to the proliferation of health clubs, the expansion of home fitness trends, and rising disposable incomes enabling greater investment in personal fitness equipment across metropolitan and tier-two cities.

-

By Service: Health clubs represent the largest segment with a market share of 42% in 2025, attributed to the expansion of organized fitness chains, increasing adoption of structured workout programs, and the growing emphasis on professional guidance for achieving sustainable weight management goals.

-

By Region: North India dominates with a market share of 32% in 2025, supported by higher population density, greater concentration of fitness infrastructure in major metropolitan areas, and elevated health awareness among affluent urban populations.

-

Key Players: The intensity of competition in the India weight management market is moderate; it comprises multinational companies and local companies that are competing in the same products and services segment. The market comprises already established wellness chains, pharmaceutical firms, and new digital health platforms with their unique strategies based on franchise expansion up to technology-driven personalization.

To get more information on this market Request Sample

The India weight management market is experiencing a transformative phase characterized by the convergence of traditional wellness practices and modern health solutions. Obesity and other lifestyle-associated disorders have increased the number of lifestyle conditions, leading to a greater awareness among people about the significance of being proactive in their health. The Fit India Movement and the National Health Policy by the government have once again boosted the importance of being fit and taking preventive measures by the population. For instance, India's fitness economy is projected to grow from approximately USD 1.9 billion in 2024 to USD 4.5 billion by 2030, reflecting robust underlying demand for weight management solutions. The emergence of digital health platforms, wearable fitness devices, and AI-powered nutrition applications has democratized access to personalized wellness guidance, enabling consumers across diverse socioeconomic segments to engage with weight management programs tailored to their individual requirements.

India Weight Management Market Trends:

Digital Health Integration and AI-Powered Personalization

The India weight management market is witnessing rapid adoption of digital health solutions and artificial intelligence-driven personalization. The India digital health market size reached USD 16,114.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 76,012.7 Million by 2033, exhibiting a growth rate (CAGR) of 18.81% during 2025-2033. Among urban consumers, mobile applications that provide virtual fitness coaching, personalized meal planning, and calorie tracking have become increasingly popular. In India, the use of health and wellness apps has grown dramatically, indicating a growing dependence on tech-driven solutions for general fitness and weight control. AI-powered platforms are revolutionizing traditional methods of managing weight by enabling real-time health monitoring and personalized dietary recommendations based on individual metabolic profiles.

Revival of Traditional Ayurvedic and Natural Solutions

A significant trend shaping the India weight management market is the resurgence of Ayurvedic and natural wellness approaches. Consumers are increasingly seeking herbal supplements, traditional formulations, and holistic wellness programs that align with indigenous health philosophies. The India ayurvedic wellness market size reached USD 10.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 42.2 Billion by 2033, exhibiting a growth rate (CAGR) of 16.2% during 2025-2033, driven by growing consumer preference for natural remedies. Products featuring ingredients such as turmeric, triphala, and garcinia cambogia are witnessing heightened demand as consumers prioritize clean-label, plant-based alternatives over synthetic formulations.

Boutique Fitness and Community-Driven Wellness Models

The emergence of boutique fitness studios and community-driven wellness programs represents a notable trend in the India weight management market. For instance, in September 2025, Technogym, a leading fitness and wellness brand from Italy, made its formal entry into the Indian market by opening its first boutique, a modern showroom created to highlight its internationally recognized equipment and immersive workout solutions. Niche fitness offerings such as high-intensity interval training studios, yoga studios, and mixed martial arts gyms are growing at a rapid pace as consumers look for more personalized and immersive fitness experiences. The boutique fitness studios are experiencing robust growth as consumers are favoring specialized fitness offerings led by an instructor who provides more personalized fitness experiences. Community interaction, gamification in fitness challenges, and social accountability elements are aiding in improved membership retention efforts.

Market Outlook 2026-2034:

The outlook for India’s weight management market remains highly optimistic, driven by supportive demographic trends, growing health awareness, and expanding infrastructure. Market growth is further fueled by the rising presence of organized fitness centers in tier-two and tier-three cities, the widespread adoption of cost-effective digital health and wellness solutions, and the expected introduction of advanced pharmaceutical options, such as next-generation GLP-1 receptor agonists, offering more effective weight management interventions across diverse consumer segments. The market generated a revenue of USD 27.4 Billion in 2025 and is projected to reach a revenue of USD 56.79 Billion by 2034, growing at a compound annual growth rate of 8.44% from 2026-2034.

India Weight Management Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Diet | Dietary Supplements | 58% |

| Equipment | Fitness | 52% |

| Service | Health Clubs | 42% |

| Region | North India | 32% |

Diet Insights:

- Functional Beverages

- Functional Food

- Dietary Supplements

The dietary supplements dominate with a market share of 58% of the total India weight management market in 2025.

The dietary supplements segment has emerged as the dominant force within the India weight management diet category, driven by the increasing consumer preference for convenient and targeted nutritional solutions. Protein supplements, metabolism enhancers, and meal replacement products have witnessed substantial adoption among fitness enthusiasts and health-conscious individuals. For instance, in July 2025, Ahmedabad-based Torrent Pharmaceuticals introduced a nutritional supplement powder for adults, aimed at enhancing its consumer-focused nutrition offerings. The product, branded as Shelcal Total, a name the company acquired in 2013, was previously used to market gummy supplements for both children and adults. The segment benefits from extensive retail distribution networks, growing e-commerce penetration, and aggressive marketing campaigns by both domestic and international brands targeting diverse consumer demographics.

The growth trajectory of dietary supplements is further supported by the rising prevalence of lifestyle diseases and nutritional deficiencies across the population. Weight management supplements featuring natural ingredients such as green tea extract, garcinia cambogia, and fiber-based formulations are gaining prominence as consumers prioritize clean-label products. The segment is also benefiting from the expanding presence of specialized nutrition stores and the integration of personalized supplement recommendations through digital health platforms.

Equipment Insights:

Access the comprehensive market breakdown Request Sample

- Fitness

- Surgical

The fitness leads with a share of 52% of the total India weight management market in 2025.

The fitness equipment segment commands a leading position within the equipment category, reflecting the robust expansion of the organized fitness industry across India. The India fitness equipment market size reached USD 792.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,869.15 Million by 2033, exhibiting a growth rate (CAGR) of 10.00% during 2025-2033. Health clubs, gymnasiums, and boutique fitness studios are driving significant demand for commercial-grade cardiovascular and strength training equipment. The segment benefits from rising consumer investment in home fitness solutions, accelerated by the pandemic-induced shift toward at-home workout regimes and the growing availability of connected fitness devices.

The fitness equipment market is also experiencing growth from institutional buyers including corporate wellness facilities, hotels, and residential complexes incorporating fitness amenities. The increasing adoption of smart fitness equipment featuring real-time performance tracking, virtual coaching integration, and gamified workout experiences is enhancing consumer engagement and driving premium equipment sales across metropolitan markets.

Service Insights:

- Health Clubs

- Consultation Services

- Online Weight Loss Services

The health clubs exhibits clear dominance with a 42% share of the total India weight management market in 2025.

Health clubs represent the largest service segment within the India weight management market, driven by the rapid expansion of organized fitness chains and the increasing consumer preference for structured workout environments. For instance, in November 2025, US-based high-value, budget-friendly fitness chain Crunch Fitness made its debut in India, entering one of the fastest-growing fitness markets globally. The newly launched gym in Noida represents the initial phase of a larger expansion strategy, with plans to establish at least 75 Crunch Fitness locations across Indian cities over the coming years, further extending the brand’s presence throughout South Asia. The segment benefits from franchise-based expansion models, enabling rapid geographic penetration across metropolitan and emerging urban centers.

The health clubs segment is experiencing transformation through the integration of technology-enabled services, personalized training programs, and holistic wellness offerings combining physical fitness with mental well-being components. The emergence of membership flexibility options, pay-per-session models, and corporate wellness partnerships is expanding the addressable market and attracting previously underserved consumer segments. Boutique fitness studios are emerging as the fastest-growing sub-segment, capturing consumers seeking specialized, community-driven fitness experiences.

Region Insights:

- North India

- West and Central India

- South India

- East India

The North India leads with a share of 32% of the total India weight management market in 2025.

North India’s weight management market is driven by rising obesity and lifestyle-related health concerns linked to sedentary routines, high-calorie diets, and work-related stress in urban centers such as Delhi NCR, Chandigarh, and Jaipur. Increasing awareness of the health risks associated with excess weight, including diabetes, cardiovascular diseases, and joint disorders, has encouraged consumers to actively seek weight control solutions. Government-led health awareness initiatives, growing fitness culture, and higher penetration of gyms and wellness centers are further accelerating demand for structured weight management programs.

Another key driver is the growing adoption of holistic and personalized weight management approaches in North India. Consumers are increasingly turning to nutrition counseling, ayurvedic and herbal supplements, digital fitness platforms, and medically supervised programs. Rising disposable incomes and greater willingness to spend on preventive healthcare support market expansion. Additionally, the influence of social media, fitness influencers, and celebrity endorsements has normalized fitness-focused lifestyles, particularly among younger demographics, boosting demand for weight loss products, dietary supplements, and online coaching services across the region.

Market Dynamics:

Growth Drivers:

Why is the India Weight Management Market Growing?

Rising Prevalence of Lifestyle-Related Health Conditions

The India weight management market is experiencing robust growth driven by the escalating prevalence of lifestyle-related health conditions including obesity, diabetes, and cardiovascular diseases. India is among the seven nations and territories that comprise the IDF South-East Asia Region and ranks second globally in terms of the number of adults aged 20–79 living with diabetes. Rapid urbanization, sedentary work environments, and changing dietary patterns have contributed to increasing body weight concerns across the population. The growing burden of non-communicable diseases has heightened public awareness regarding the importance of proactive weight management as a preventive healthcare measure. Government health initiatives and media campaigns are further reinforcing the significance of maintaining healthy body weight, motivating individuals to adopt comprehensive weight management programs encompassing dietary modifications, physical activity, and professional guidance.

Expanding Digital Health Infrastructure and Technological Innovation

The proliferation of digital health platforms and technological innovation represents a significant driver of market growth. For instance, in December 2025, iLive Connect unveiled what it describes as India’s first ‘Doctor-Led Continuous Care’ platform, designed to provide 24/7 health monitoring and facilitate early medical intervention for patients outside traditional hospital environments. Mobile health applications, wearable fitness devices, and AI-powered nutrition platforms have democratized access to personalized weight management guidance. The increasing smartphone penetration and affordable internet connectivity have enabled consumers across diverse socioeconomic segments to engage with digital wellness solutions. Virtual fitness classes, online nutrition consultations, and connected home workout equipment have expanded the market beyond traditional gym-based models. The integration of machine learning algorithms and predictive analytics is enabling more sophisticated personalization of dietary recommendations and workout programs.

Growing Middle-Class Population and Rising Disposable Incomes

The expanding middle-class population and rising disposable income levels are supporting increased consumer spending on health and wellness products and services. The Per Capita Income, measured as Per Capita Net National Income at current prices, is projected at ₹1,69,145 for 2022-23 and ₹1,88,892 for 2023-24. Similarly, the Per Capita Private Final Consumption Expenditure (PFCE) at current prices is estimated at ₹1,19,516 for 2022-23 and ₹1,29,967 for 2023-24, enabling greater allocation toward discretionary wellness expenditure. The growing affluence of urban households has fueled demand for premium fitness memberships, branded dietary supplements, and professional consultation services. The emergence of aspirational health consciousness among younger demographics, influenced by social media fitness trends and celebrity endorsements, is driving market expansion across metropolitan and tier-two cities.

Market Restraints:

What Challenges the India Weight Management Market is Facing?

High Operational Costs and Infrastructure Limitations

The India weight management market faces challenges from high operational costs and infrastructure limitations, particularly affecting fitness service providers and equipment manufacturers. Rising property prices, equipment maintenance expenditure, and staffing costs are constraining margin expansion and limiting geographic penetration beyond metropolitan centers. Inadequate fitness infrastructure in tier-three cities and rural areas restricts market accessibility for substantial portions of the population.

Regulatory Uncertainty and Quality Standardization Concerns

The market encounters restraints from regulatory uncertainty and concerns regarding quality standardization across dietary supplements and weight management products. Inconsistent enforcement of labeling requirements, product efficacy claims, and manufacturing standards creates challenges for consumer trust and market credibility. The presence of unverified products and misleading marketing claims poses risks to consumer safety and brand reputation across the industry.

Affordability Barriers and Socioeconomic Disparities

Affordability remains a significant barrier limiting broader market penetration, with substantial portions of the population unable to access premium weight management products and services. Socioeconomic disparities create uneven market distribution, with weight management solutions concentrated among urban, affluent consumer segments. The cost of quality dietary supplements, fitness memberships, and professional consultation services excludes lower-income households from comprehensive weight management programs.

Competitive Landscape:

The India weight management market exhibits a fragmented competitive landscape characterized by the presence of multinational corporations, established domestic players, and emerging digital health startups. The market features diverse business models ranging from franchise-based fitness chains to direct-to-consumer supplement brands and technology-driven wellness platforms. Competition is intensifying across product innovation, pricing strategies, and customer engagement capabilities. Market participants are increasingly leveraging digital marketing channels, influencer partnerships, and personalized service delivery to differentiate their offerings. Strategic alliances between fitness service providers, nutritional supplement manufacturers, and healthcare institutions are emerging as key competitive strategies. The anticipated entry of next-generation pharmaceutical interventions, including GLP-1 receptor agonists, is expected to reshape competitive dynamics within the market over the forecast period.

Recent Developments:

-

In December 2025, Emcure Pharmaceuticals announced the nationwide commercial launch of Poviztra, a semaglutide injection designed for weight loss. With this introduction, Emcure becomes the first Indian company to exclusively market and distribute Poviztra, marking Novo Nordisk’s second semaglutide brand focused on weight management in India.

-

In March 2025, Eli Lilly launched Mounjaro (tirzepatide) in India, marking a significant development in the pharmaceutical weight management segment with the introduction of an advanced GLP-1/GIP receptor agonist therapy.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Diet Covered |

Functional Beverages, Functional Food, Dietary Supplements |

| Equipment Covered | Fitness, Surgical |

| Service Covered | Health Clubs, Consultation Services, Online Weight Loss Services |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India weight management market size was valued at USD 27.4 Billion in 2025.

The India weight management market is expected to grow at a compound annual growth rate of 8.44% from 2026-2034 to reach USD 56.79 Billion by 2034.

Dietary supplements dominated the diet segment with a 58% market share in 2025, driven by increasing consumer preference for convenient nutritional solutions, the growing popularity of protein supplements and metabolism boosters, and the expanding retail and e-commerce distribution infrastructure.

Key factors driving the India weight management market include rising prevalence of lifestyle-related health conditions, expanding digital health infrastructure, growing middle-class population with rising disposable incomes, and increasing health consciousness influenced by social media and government wellness initiatives.

Major challenges include high operational costs limiting geographic expansion, inadequate fitness infrastructure in smaller cities and rural areas, regulatory uncertainty affecting product standardization, affordability barriers excluding lower-income segments, and consumer skepticism regarding unverified product efficacy claims.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)