India Water Treatment Equipment Market Size, Share, Trends and Forecast by Product Type, Technology, Distribution Channel, End Use, and Region, 2026-2034

India Water Treatment Equipment Market Overview:

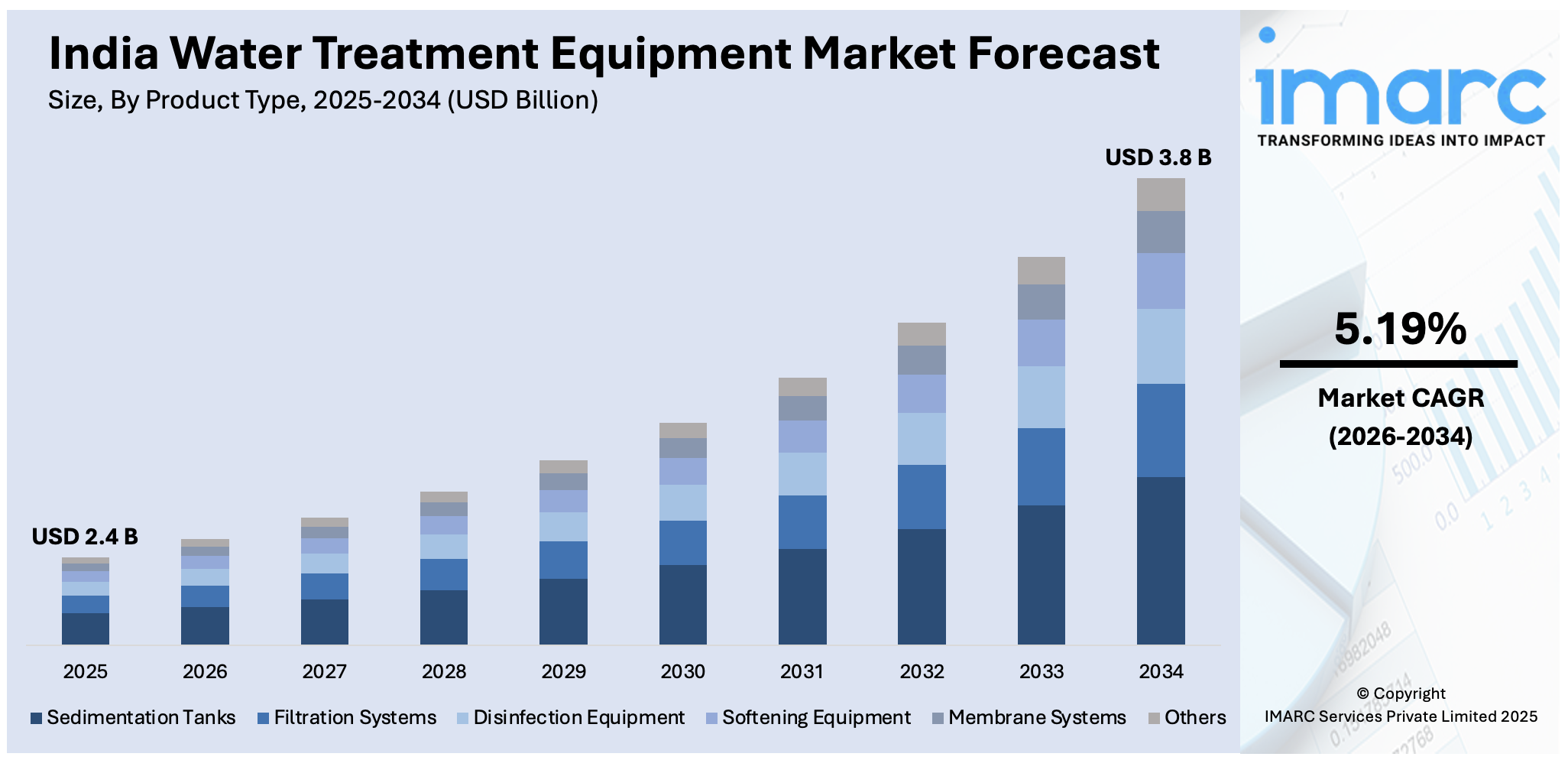

The India water treatment equipment market size reached USD 2.4 Billion in 2025. The market is expected to reach USD 3.8 Billion by 2034, exhibiting a growth rate (CAGR) of 5.19% during 2026-2034. The market growth is attributed to increasing concerns about water scarcity, growing need for purifiers in rural regions due to lack of clean and safe drinking water, public campaigns, government programs, and private collaborations.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of product type, the market has been divided into sedimentation tanks, filtration systems, disinfection equipment, softening equipment, membrane systems, and others.

- On the basis of technology, the market has been divided into reverse osmosis, microfiltration, clarifier, distillation, ion exchange, and others.

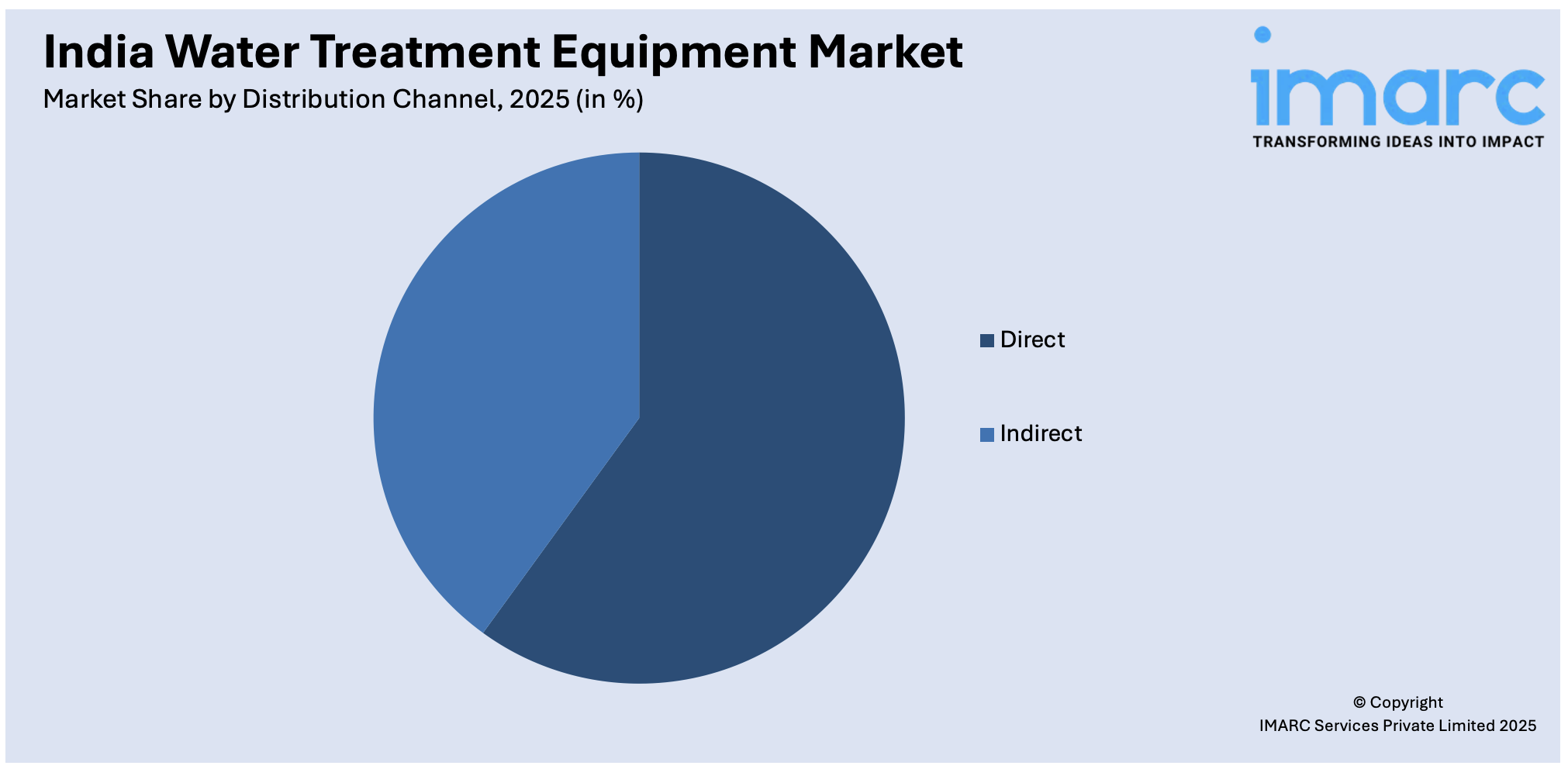

- On the basis of distribution channel, the market has been divided into direct and indirect.

- On the basis of end use, the market has been divided into residential, agriculture, chemical manufacturing, food processing, construction, pharmaceutical production, and others.

Market Size and Forecast:

- 2025 Market Size: USD 2.4 Billion

- 2034 Projected Market Size: USD 3.8 Billion

- CAGR (2026-2034): 5.19%

India Water Treatment Equipment Market Trends:

Increasing Awareness About Water Scarcity

The growing consciousness about water shortage in India is a major factor propelling the need for water treatment equipment. With water resources facing mounting pressure from overexploitation, contamination, and climate change, both individuals and entities are acknowledging the necessity for effective water management strategies. Furthermore, the increasing number of campaigns to raise public awareness and educational initiatives regarding the significance of conserving water are catalyzing the demand for advanced water treatment technologies. Individuals are eager to purchase water purifiers and filtration systems for home use, while businesses are adopting water recycling and reuse methods. For instance, in 2025, Boson Whitewater and IAPMO India signed a memorandum of understanding (MoU) to standardize recycled water, focusing on compliance, workforce training, and adoption of water-saving technologies. The partnership aims to validate Boson Whitewater's treated water process and implement Zero Liquid Discharge (ZLD). The collaboration seeks to promote safe and sustainable water reuse amidst growing water scarcity concerns. This growing awareness is resulting in a transition toward sustainable water treatment options, encouraging more innovation and funding in water treatment technologies to tackle the issues of water scarcity.

To get more information on this market Request Sample

Growing Demand for Water Purifiers in Rural Areas

Rural India is witnessing a significant rise in the demand for water purifiers and treatment devices as communities face unsafe drinking water, inadequate sanitation, and restricted access to dependable infrastructure. This, in turn, is positively impacting the water treatment equipment market size in India. Pollution of groundwater, periodic shortages of water, and reliance on untreated surface water are increasing health hazards, particularly from waterborne illnesses. This is catalyzing the demand for easily accessible purification technologies, such as reverse osmosis (RO) systems, ultraviolet (UV) filters, and activated carbon solutions, intended for minimal maintenance and off-grid application. Government initiatives focused on rural water supply and public health are further promoting adoption. Non-profit organizations (NGOs) and private entities are also stepping in with targeted interventions. For example, in 2024, The Art of Living partnered with Kent to distribute 1,00,000 Kent Gold UF (Optima) water filters throughout India, initially launching with 25,000 filters in Maharashtra. The project sought to enhance health and hygiene in rural areas by offering complimentary, high-quality water filters. The initiative targeted regions with contaminated drinking water and promoted sustainable access to safe water in rural areas. These initiatives are enhancing public health while also creating new opportunities for manufacturers of water treatment equipment, positioning rural India as an important target for industry stakeholders.

Smart Water Management Systems

The introduction of smart water management systems is a paradigm change in the functioning and monitoring of water treatment equipment. IoT-connected devices are offering real-time monitoring features through which users can monitor water quality parameters, filter performance, and system maintenance requirements remotely. the water treatment equipment demand in Indian market is being spurred on by the use of artificial intelligence and machine learning algorithms that automatically optimize the treatment process. Smart sensors incorporated into treatment systems are able to identify contamination levels, forecast maintenance needs, and regulate treatment parameters as needed. Mobile apps are allowing consumers to keep track of their water purification systems and be alerted to the need for filter changes or system faults. This digitalization wave is especially attractive to urban consumers who are tech-savvy and appreciate convenience and efficiency. Blockchain technology-based water quality certification and supply chain transparency are also increasingly popular. These smart systems are lowering operation expenses and enhancing treatment efficiency in many end-use segments.

Decentralized Treatment Solutions

The move to decentralized water treatment solutions is changing the market landscape by solving localized water issues more efficiently. Community-based treatment systems are being implemented in rural and peri-urban regions where centralized infrastructure is not cost-effective or viable. The water treatment equipment industry in India is experiencing growing demand for modular and scalable treatment units, which can be conveniently transported and installed in remote areas. Point-of-use treatment systems are becoming increasingly popular with households and small businesses looking for instant access to clean water without reliance on municipal supplies. Solar-powered treatment systems are being designed for use in off-grid communities that bring together renewable energy and water purification technology. Decentralized systems are making it possible to deploy water treatment infrastructure at a quicker pace, as well as ease the load on centralized treatment plants. The modular design methodology makes it simple to scale up and tailor based on specific water quality issues and community requirements. This trend is most relevant for meeting the needs of India's wide geographic and demographic diversity in water treatment.

Some of the other market trends are,

- Bio-based Treatment Processes: Biological treatment processes provide green alternatives to chemical-based purification techniques. Enzyme-assisted filtration systems enhance contaminant removal efficiency while minimizing environmental impact. Microbial fuel cells are being investigated for simultaneous water treatment and power generation. These bio-based approaches are highly effective for treating industrial wastewater streams.

- Urban-Industrial Wastewater Infrastructure and Climate-Resilient Design: The integrated wastewater treatment system is being planned to treat both urban sewage and industrial effluents. Climate-adaptive infrastructure features flood-resistance and drought-resistance techniques. These facilities provide redundant treatment paths to maintain uninterrupted functioning during severe weather conditions. Resilient designs ensure the community's water security in the face of climate fluctuations.

- Affordability Schemes: Revolutionary financing methods are bringing water treatment technology within the reach of low-income families, thereby expanding the water treatment equipment industry size in India. Microfinance partnerships facilitate the purchase of water purification systems through installments. Government subsidy schemes are directing water treatment schemes to rural and disadvantaged sections. Pay-as-you-go mechanisms enable individuals to utilize clean water services without substantial initial investments.

- Sustainability and Urban-Industrial Integration: Integrated treatment networks make optimal use of resources and minimize waste generation. Sustainable design dictates energy efficiency and recyclability. The industry in India is enhanced through integrated urban planning, incorporating water treatment infrastructure. Smart city programs create demand for technology-driven and eco-friendly treatment solutions.

Growth Drivers of the India Water Treatment Equipment Market:

The India water treatment equipment market share is primarily driven by increasing water scarcity concerns and deteriorating water quality across urban and rural regions. Government initiatives promoting clean water access through programs like Jal Jeevan Mission and Swachh Bharat Abhiyan are accelerating market adoption. Rising health consciousness among consumers regarding waterborne diseases is fueling demand for residential water purification systems. Industrial expansion in sectors like pharmaceuticals, chemicals, and food processing is creating substantial demand for specialized water treatment solutions. Growing awareness about environmental sustainability and water conservation is encouraging investments in advanced treatment technologies. Rapid urbanization and population growth are putting additional pressure on existing water infrastructure, necessitating modern treatment equipment.

Opportunities in the India Water Treatment Equipment Market:

The rural market presents enormous untapped potential with over 600 million people lacking access to reliable clean water sources. Public-private partnerships offer significant opportunities for India water treatment equipment market growth through government-backed water infrastructure projects. Emerging technologies like IoT-enabled smart water treatment systems create new market segments for tech-savvy consumers. Export opportunities are expanding as India develops expertise in cost-effective water treatment solutions suitable for developing nations. The growing industrial sector requires customized water treatment solutions, creating niche market opportunities for specialized equipment manufacturers. Climate change adaptation strategies are driving demand for resilient water treatment infrastructure that can withstand extreme weather conditions.

Challenges in the India Water Treatment Equipment Market:

According to the India water treatment equipment market analysis, high initial investment costs for advanced water treatment systems limit adoption among price-sensitive consumers, particularly in rural areas. Lack of adequate technical expertise and skilled workforce hampers proper installation, maintenance, and operation of sophisticated treatment equipment. Inconsistent power supply in many regions affects the performance of electrically-operated water treatment systems. Competition from unorganized sectors offering low-cost, substandard products poses challenges for established manufacturers maintaining quality standards. Complex regulatory frameworks and varying state-level policies create compliance challenges for manufacturers operating across different regions. Limited awareness about the importance of regular maintenance and filter replacement affects system performance and customer satisfaction.

India Water Treatment Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type, technology, distribution channel, and end use.

Product Type Insights:

- Sedimentation Tanks

- Filtration Systems

- Disinfection Equipment

- Softening Equipment

- Membrane Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sedimentation tanks, filtration systems, disinfection equipment, softening equipment, membrane systems, and others.

Technology Insights:

- Reverse Osmosis

- Microfiltration

- Clarifier

- Distillation

- Ion exchange

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes reverse osmosis, microfiltration, clarifier, distillation, ion exchange, and others.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct

- Indirect

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct and indirect.

End Use Insights:

- Residential

- Agriculture

- Chemical Manufacturing

- Food Processing

- Construction

- Pharmaceutical production

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential, agriculture, chemical manufacturing, food processing, construction, pharmaceutical production, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Water Treatment Equipment Market News:

- In August 2025, Buckman Laboratories, a leading Indian chemical company, announced the formation of a joint venture named 'Atul-Buckman' to provide advanced water treatment solutions in India and Sri Lanka. The venture aims to combine Buckman's expertise in water treatment chemistries and digital solutions with Atul's manufacturing capabilities and market access to deliver sustainable, innovative solutions across various industries.

- In February 2025, Memsift Innovations and the Murugappa Group inaugurated a state-of-the-art manufacturing facility in India to produce the GOSEP™ ultrafiltration (UF) membrane. This collaboration aims to address critical water challenges by delivering advanced, chemically resistant, and durable membrane solutions at scale. The facility boasts an annual production capacity of 1.2 million square meters of membranes, with the potential to treat up to 1.1 billion liters of water daily, supporting industries in sustainable water management.

- In November 2024, Toyobo MC Corporation, in collaboration with BI Marketing, launched its Spiral Wound RO Membranes in India to address the country's water treatment challenges. The launch event included a technical seminar discussing advances in RO membrane technology and solutions for water scarcity. The product aimed to enhance wastewater recycling and treatment efficiency across various sectors in India.

- In August 2024, Bengaluru's Water Supply and Sewerage Board (BWSSB) launched Asia's largest water treatment plant at Thorekadanahalli as part of the Cauvery V Stage project. The plant utilized advanced equipment powered by Japanese machinery and French technology. Its pumps, each with a capacity of 3,500 horsepower (HP), lifted 150 million liters of water per day, with the treatment technology specifically customized for the water from the Cauvery River.

India Water Treatment Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sedimentation Tanks, Filtration Systems, Disinfection Equipment, Softening Equipment, Membrane Systems, Others |

| Technologies Covered | Reverse Osmosis, Microfiltration, Clarifier, Distillation, Ion exchange, Others |

| Distribution Channels Covered | Direct, Indirect |

| End Uses Covered | Residential, Agriculture, Chemical Manufacturing, Food Processing, Construction, Pharmaceutical production, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India water treatment equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India water treatment equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India water treatment equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The water treatment equipment market in India was valued at USD 2.4 Billion in 2025.

The India water treatment equipment market is projected to exhibit a CAGR of 5.19% during 2026-2034, reaching a value of USD 3.8 Billion by 2034.

Urban expansion, industrial discharge, and stringent pollution norms are catalyzing the demand for water treatment equipment in India. Scarcity of clean water and rising public awareness about health encourage investment in efficient solutions. Infrastructure upgrades and government projects add momentum, while companies adopt advanced systems to meet compliance needs, manage costs, and secure sustainable water resources for future use.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)