India Water Treatment Chemicals Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034

Market Overview:

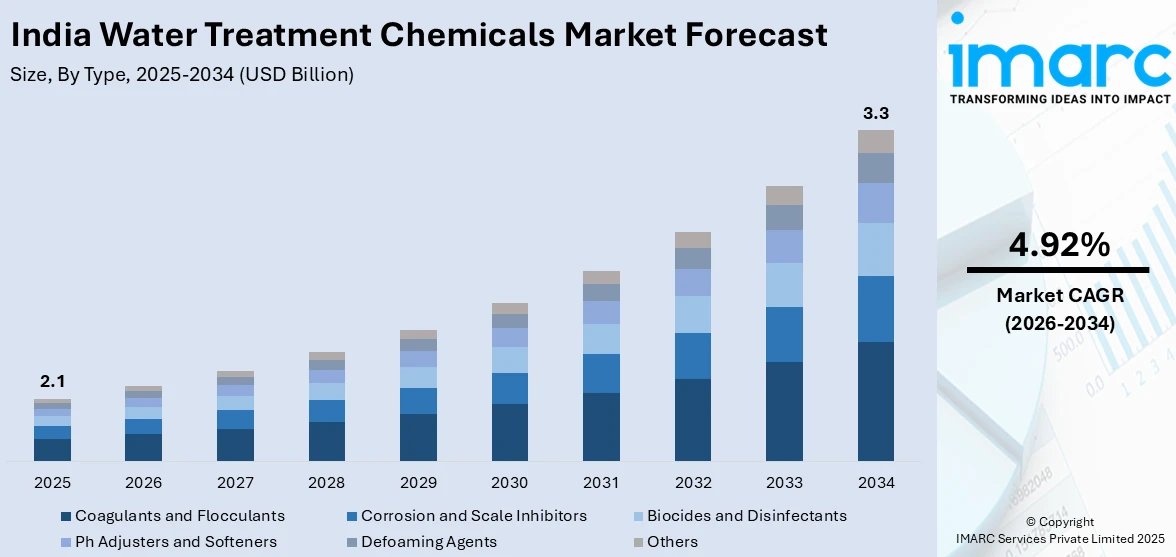

India water treatment chemicals market size reached USD 2.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.3 Billion by 2034, exhibiting a growth rate (CAGR) of 4.92% during 2026-2034. The expansion of industrial activities, including manufacturing, power generation, and chemical processing, which results in higher water usage and increased wastewater generation, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2.1 Billion |

|

Market Forecast in 2034

|

USD 3.3 Billion |

| Market Growth Rate 2026-2034 | 4.92% |

Water treatment chemicals are substances used to purify and optimize the quality of water for various applications. These chemicals play a crucial role in treating water from natural sources or wastewater to make it safe for consumption, industrial processes, or environmental discharge. Common water treatment chemicals include coagulants, flocculants, disinfectants, pH adjusters, and corrosion inhibitors. Coagulants help particles clump together for easier removal, while flocculants aid in their precipitation. Disinfectants like chlorine or ozone eliminate harmful microorganisms. pH adjusters maintain optimal acidity or alkalinity, ensuring chemical processes and microbial activity function effectively. Corrosion inhibitors protect infrastructure from deterioration. The careful application of these chemicals ensures water meets regulatory standards and is suitable for its intended purpose, safeguarding public health and the environment. The field continues to evolve with ongoing research to improve efficiency, sustainability, and the overall effectiveness of water treatment processes.

To get more information on this market Request Sample

India Water Treatment Chemicals Market Trends:

The water treatment chemicals market in India is propelled by several key drivers that reflect the growing regional awareness of water scarcity and the imperative need for sustainable water management practices. Increasing industrialization and urbanization have led to a surge in water pollution, prompting stringent regulatory measures to ensure safe water quality. The demand for clean water across various sectors, including municipal, industrial, and agricultural, has escalated, driving the adoption of advanced water treatment technologies. Moreover, the rising awareness about the environmental impact of untreated wastewater discharge has stimulated the deployment of water treatment chemicals to address contamination issues. Technological advancements in water treatment solutions, coupled with the need for cost-effective and efficient treatment methods, are fostering the market's growth. Additionally, the expansion of end-use industries such as power generation, chemicals, and manufacturing is amplifying the demand for water treatment chemicals. As industries seek sustainable and eco-friendly solutions, the regional market is witnessing a shift toward innovative and green water treatment chemicals, further influencing its trajectory.

India Water Treatment Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and end user.

Type Insights:

- Coagulants and Flocculants

- Corrosion and Scale Inhibitors

- Biocides and Disinfectants

- Ph Adjusters and Softeners

- Defoaming Agents

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes coagulants and flocculants, corrosion and scale inhibitors, biocides and disinfectants, ph adjusters and softeners, defoaming agents, and others.

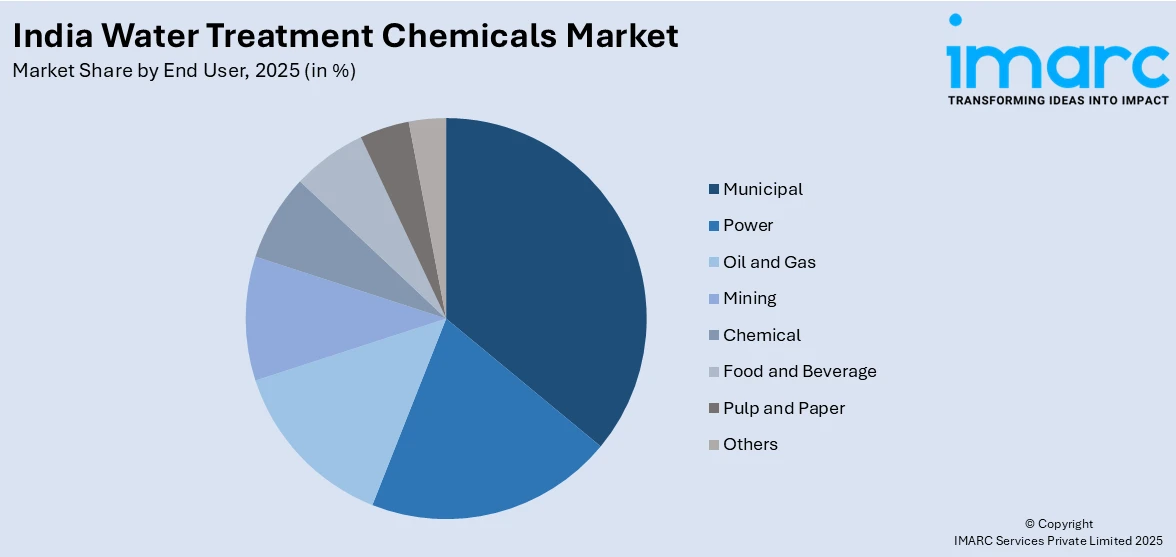

End User Insights:

Access the comprehensive market breakdown Request Sample

- Municipal

- Power

- Oil and Gas

- Mining

- Chemical

- Food and Beverage

- Pulp and Paper

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes municipal, power, oil and gas, mining, chemical, food and beverage, pulp and paper, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Water Treatment Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Coagulants and Flocculants, Corrosion and Scale Inhibitors, Biocides and Disinfectants, Ph Adjusters and Softeners, Defoaming Agents, Others |

| End Users Covered | Municipal, Power, Oil and Gas, Mining, Chemical, Food and Beverage, Pulp and Paper, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India water treatment chemicals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India water treatment chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India water treatment chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The water treatment chemicals market in the India was valued at USD 2.1 Billion in 2025.

The India water treatment chemicals market is projected to exhibit a CAGR of 4.92% during 2026-2034, reaching a value of USD 3.3 Billion by 2034.

The India water treatment chemicals market is primarily driven by increasing industrial developments, rising demand for clean water across municipal and industrial sectors, and stringent government regulations on wastewater disposal. Additionally, growing awareness about water conservation and advancements in chemical formulations are further fueling the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)