India Water Pumps Market Size, Share, Trends and Forecast by Type, Pump Type, Pump Capacity, Application, and Region, 2025-2033

Market Overview:

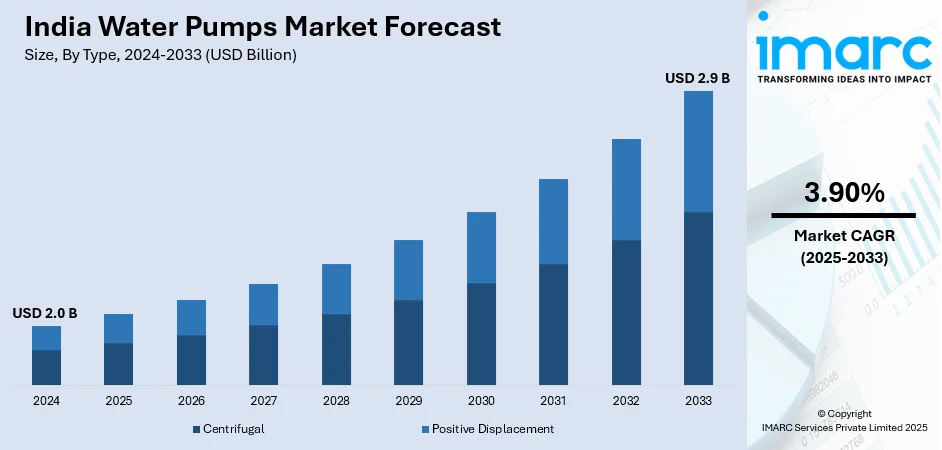

The India water pumps market size reached USD 2.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.9 Billion by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.0 Billion |

|

Market Forecast in 2033

|

USD 2.9 Billion |

| Market Growth Rate 2025-2033 | 3.90% |

Water pumps are mechanical or electromechanical devices designed to move water through pipes or hoses by generating a pressure differential. They are driven by electricity and other power sources like gasoline engines. They can also be powered using solar panels in remote areas, such as desert regions. At present, water pumps find extensive applications in the municipal, industrial, agricultural, and residential sectors for supplying water across India.

To get more information on this market, Request Sample

India Water Pumps Market Trends:

Increasing investments in agricultural infrastructure represent one of the key factors bolstering the growth of the market in India. Water pumps help pump water from the source to the agricultural field and can be used for drip, sprinkler, and hose pipe irrigation. Additionally, the Government of India is adopting schemes, reforms, policies and programs to increase the incomes of farmers and overall agricultural activities in the country. This, coupled with the growing reliance on groundwater for other agricultural purposes, is driving the market. Besides this, there is a considerable rise in the development of sewage treatment plants (STPs) across India. These plants generally rely on municipal wastewater pumps, also known as sewage pumps, which transport sewage, sludge, stormwater, and mechanically treated wastewater from treatment tanks. Apart from this, several states across the country are focusing on increasing desalination plants on account of acute water shortages. Furthermore, water pumps are utilized in construction sites to remove excess water accumulated due to heavy rain or high-water table. This, coupled with the burgeoning construction sector, is catalyzing the demand for water pumps in India. Factors like rapid industrialization and the rising requirement of safe drinking water are anticipated to fuel the market growth.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India water pumps market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on type, pump type, pump capacity and application.

Breakup by Type:

- Centrifugal

- Positive Displacement

Breakup by Pump Type:

- Submersible Pumps

- Multistage Pumps

- End Suction Pumps

- Split Case Pumps

- Engineered Pumps

- Others

Breakup by Pump Capacity:

- Up to 3 HP

- 3-5 HP

- 5-10 HP

- 10-15 HP

- 15-20 HP

- 20-30 HP

- More Than 30 HP

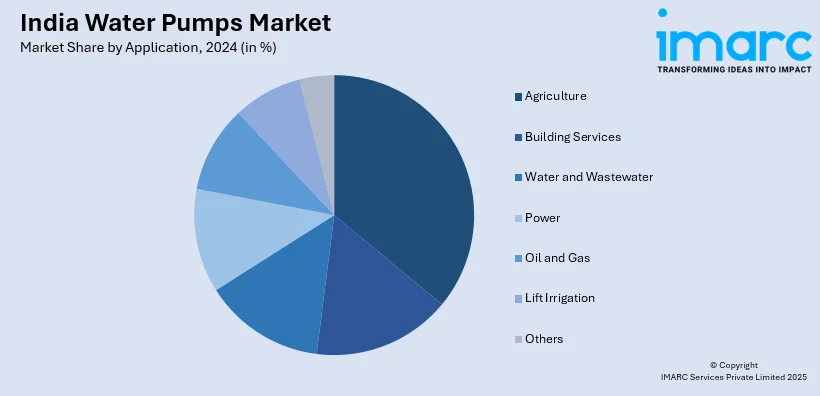

Breakup by Application:

- Agriculture

- Building Services

- Water and Wastewater

- Power

- Oil and Gas

- Lift Irrigation

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Type, Pump Type, Pump Capacity, Application, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India water pumps market was valued at USD 2.0 Billion in 2024.

We expect the India water pumps market to exhibit a CAGR of 3.90% during 2025-2033.

The rising number of sewage treatment plants, along with the growing adoption of water pumps to transport sludge, stormwater, mechanically- treated wastewater, etc., is primarily driving the India water pumps market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary closure of numerous end-use industries for water pumps.

Based on the type, the India water pumps market can be categorized into centrifugal and positive displacement. Currently, centrifugal exhibits clear dominance in the market.

Based on the pump type, the India water pumps market has been segmented into submersible pumps, multistage pumps, end suction pumps, split case pumps, engineered pumps, and others. Among these, submersible pumps currently hold the largest market share.

Based on the application, the India water pumps market can be bifurcated into agriculture, building services, water and wastewater, power, oil and gas, lift irrigation, and others. Currently, the agriculture sector accounts for the majority of the total market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where South India currently dominates the India water pumps market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)