India Water Dispenser Market Size, Share, Trends, and Forecast by Product, Application, Distribution Channel, and Region, 2025-2033

India Water Dispenser Market Overview:

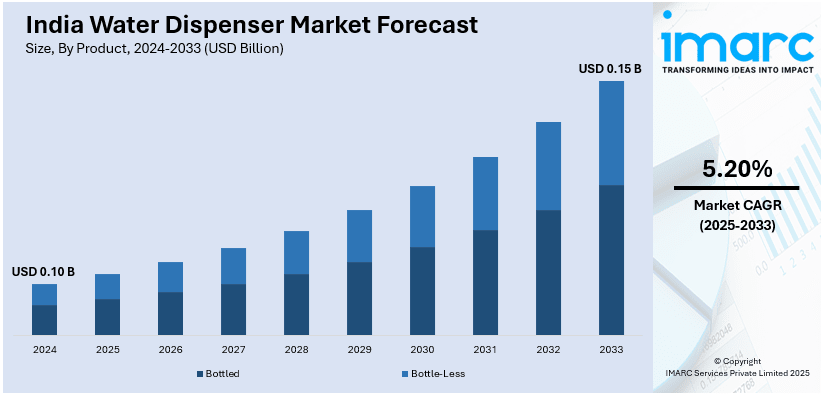

The India water dispenser market size reached USD 0.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.15 Billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is driven by rising urbanization, increasing health awareness, and growing demand for clean drinking water. Technological advancements, workplace hydration needs, and expanding commercial sectors further boost India water dispenser market growth. Additionally, government initiatives promoting clean water access and sustainability enhance adoption rates.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.10 Billion |

| Market Forecast in 2033 | USD 0.15 Billion |

| Market Growth Rate (2025-2033) | 5.20% |

India Water Dispenser Market Trends:

Rising Urbanization and Changing Lifestyles

India’s rapid urbanization has led to increased demand for convenient and hygienic drinking water solutions. With more people moving to cities, access to clean water has become a priority, especially in residential complexes, offices, and public spaces. According to the World Bank Group, by 2036, 600 million individuals, or 40% of the population, are projected to reside in urban areas, increasing from 31% in 2011, with cities expected to contribute approximately 70% of the nation’s GDP. The rise of nuclear families, busy work schedules, and modern lifestyle preferences have also contributed to the popularity of water dispensers. Consumers prefer easy-to-use, low-maintenance, and efficient water dispensing solutions over traditional storage methods. Additionally, urban dwellers are more willing to invest in advanced water purification technologies, further fueling the India water dispenser market share.

To get more information of this market, Request Sample

Growing Health Awareness and Demand for Clean Drinking Water

The increasing awareness of waterborne diseases and their health implications has significantly driven demand for water dispensers in India. According to Indian Standard IS 1475 (Part 1):2001, all self-contained drinking water coolers in India must be ISI Certified as of March 25, 2024. The Department of Promotion of Industry and Internal Trade (DPIIT) has taken a health-saving measure. This Order does not apply to domestically produced items or articles intended for export. June 25, 2024, is the date of implementation for micro, small, and medium-sized businesses. Any individual who violates the terms of this order will face penalties under the 2016 Bureau of Indian Standards Act. Consumers are becoming more conscious of the importance of safe drinking water, leading to higher adoption of water purification technologies. Poor water quality in several regions has intensified concerns, prompting individuals and businesses to install dispensers with built-in filtration systems. Additionally, rising disposable incomes allow more consumers to invest in high-quality water dispensers, creating a positive India water dispenser market outlook. The demand is particularly strong in healthcare institutions, schools, and corporate offices, where providing clean and safe drinking water is a top priority.

Technological Advancements and Product Innovations

The market for water dispensers in India is witnessing rapid technological advancements, leading to innovative and energy-efficient products. Features such as touchless dispensing, multi-stage filtration, hot and cold water options, and smart connectivity are attracting consumers. Manufacturers are focusing on eco-friendly designs, such as dispensers with energy-saving modes and recyclable materials, to appeal to environmentally conscious buyers. Additionally, the integration of IoT (Internet of Things) in water dispensers allows remote monitoring and maintenance, ensuring convenience for users. These innovations not only enhance user experience but also contribute to higher adoption rates, making technological advancements a key driver of market growth. For instance, in January 2025, KENT, a well-known brand in household appliances, presented the KENT Instant Drinking Water Heater, a ground-breaking invention created to improve warmth and ease in daily living as the winter months approach. At the push of a button, this cutting-edge device rapidly produces hot water, which makes it ideal for making tea, coffee, baby milk, instant meals, or just sipping warm water. With six temperature settings (45°C, 55°C, 65°C, 75°C, 85°C, and 100°C) and a 2.2-liter water tank, the device lets customers easily customize their hot water demands with customizable 150ml, 250ml, and 460ml water dispensing options.

India Water Dispenser Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product, application, and distribution channel.

Product Insights:

- Bottled

- Top Load

- Bottom Load

- Bottle-Less

The report has provided a detailed breakup and analysis of the market based on the product. This includes bottled (top load, and bottom load), and bottle-less.

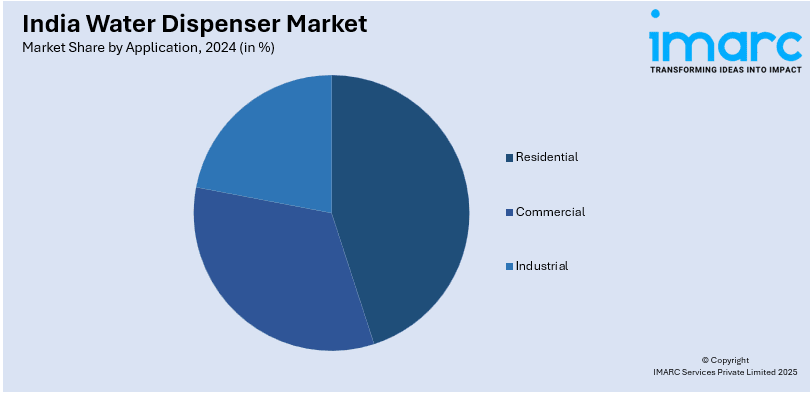

Application Insights:

- Residential

- Commercial

- Hospitality

- Transport Terminals

- Institutions

- Corporate Offices

- Others

- Industrial

- Healthcare

- Food and Beverages

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial (hospitality, transport terminals, institutions, corporate offices, and others), and industrial (healthcare, food and beverages, and others).

Distribution Channel Insights:

- Online

- Retail Stores

- Non-Branded Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online, retail stores, and non-branded stores.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Water Dispenser Market News

- In January 2023, The Department for Promotion of Industry and Internal Trade (DPIIT) plans to make bicycles, bottled water dispensers, and air coolers subject to quality standards. This was an attempt to reduce the import of inferior products and support domestic manufacturing.

India Water Dispenser Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered |

|

| Distribution Channels Covered | Online, Retail Stores, Non-Branded Stores |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India water dispenser market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India water dispenser market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India water dispenser industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The water dispenser market in India was valued at USD 0.10 Billion in 2024.

The India water dispenser market is projected to exhibit a CAGR of 5.20% during 2025-2033, reaching a value of USD 0.15 Billion by 2033.

The India water dispenser market is driven by rising urbanization, growing awareness about safe drinking water, and increasing demand in workplaces and public spaces. Technological advancements, health-conscious consumers, and higher disposable incomes are also fueling the shift toward modern, hygienic, and energy-efficient water dispensing solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)