India Water Cooler Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033

India Water Cooler Market Overview:

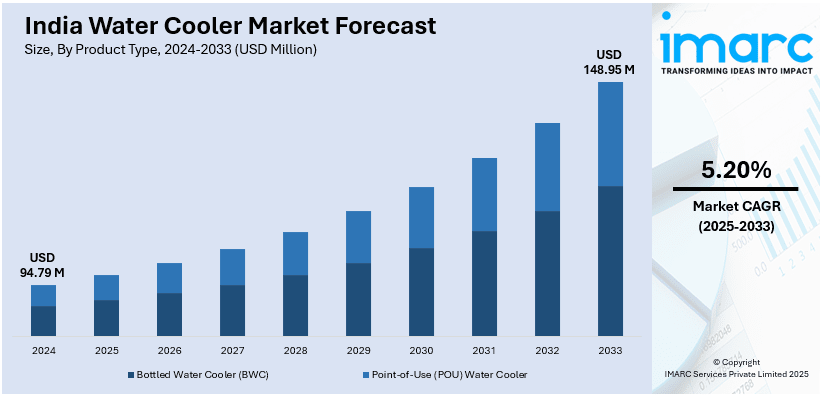

The India water cooler market size reached USD 94.79 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 148.95 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is driven by growing urbanization, climate change, and health and hydration awareness. Energy-efficient and green products, coupled with increasing use of commercial and residential water coolers further drive the India water cooler market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 94.79 Million |

| Market Forecast in 2033 | USD 148.95 Million |

| Market Growth Rate 2025-2033 | 5.20% |

India Water Cooler Market Trends:

Growing Preference for Energy-Efficient and Eco-Friendly Water Coolers

With growing awareness about environmental sustainability and energy conservation, there is a growing trend in India toward energy-efficient and eco-friendly water coolers. An Ipsos survey regarding Sustainability, amid increased focus on ESG and efforts to protect the environment from additional harm, reveals significant worry among Indians about environmental issues, with at least 92% of respondents expressing concern and two thirds believing that our planet is in jeopardy. Hence, customers are increasingly becoming aware of their carbon footprint and are looking for products that reduce energy usage while still offering effective cooling solutions. Manufacturers of water coolers are adapting by offering models that utilize energy-efficient compressors, less power consumption, and environmentally friendly refrigerants such as R-134a or R-600a, which contribute less to the environment than the conventional refrigerants. Such water coolers save electricity bills while also enabling consumers to join the international trend toward green energy consumption. As energy efficiency starts to become an important issue for both consumers and companies, demand for green water coolers will increase. Government policies and incentives to cut down on energy use and encourage the adoption of environmentally friendly technologies in appliances are also further fueling the India water cooler market growth.

To get more information of this market, Request Sample

Integration of Advanced Filtration Technologies

The increasing water safety and quality concern in India is dictating the trend toward blending sophisticated filtration technologies with water coolers. As tap water quality issues abound in most areas, particularly in urban and semi-urban locations, consumers are favoring water coolers that provide inherent filtration systems. Sophisticated filtration systems such as activated carbon filters, UV purifiers, and reverse osmosis (RO) units are being installed in water coolers to provide not just cooling but also purification of the water to eliminate contaminants. This option is especially popular in regions where water quality is poor, or the level of contamination is high. With increasing health awareness among consumers and their desire to be sure of the quality of water they drink, water cooler companies are placing emphasis on adding multi-stage filtration systems that provide safe, pure drinking water. This is likely to define the future of the Indian water cooler industry.

Shift Toward Smart and Connected Water Coolers

The India water cooler market outlook is experiencing a rising trend toward smart and connected water coolers, fueled by the rising use of IoT (Internet of Things) and connected home technologies. Smart water coolers provide various features, including remote monitoring, temperature adjustment, and filter status through mobile apps. Customers are able to manage the temperature, track water usage, and be alerted to maintenance or filter changes, all via their smartphones. Moreover, the coolers could be integrated with smart home platforms, enabling hassle-free use along with other smart appliances. Increased urbanization and the rising dependency on technology in everyday life are the major driving forces behind this trend. As incomes rise and technology is made available, the need for smart water coolers is likely to rise. They are convenient, efficient, and improve user experience, which makes them a good choice for residential as well as commercial applications in India.

India Water Cooler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Bottled Water Cooler (BWC)

- Point-of-Use (POU) Water Cooler

The report has provided a detailed breakup and analysis of the market based on the product type. This includes bottled water cooler (BWC) and point-of-use (POU) water cooler.

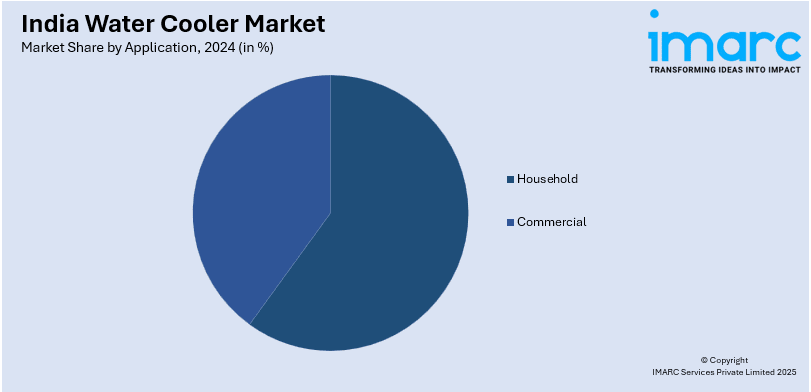

Application Insights:

- Household

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes household and commercial.

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Water Cooler Market News:

- In May 2023, IIT Kanpur reached an important milestone by creating 'Shuddham', an enhanced water purifier-cum-cooler aimed at delivering cost-effective and innovative solutions for safe drinking water. This groundbreaking product, created by the Imagineering Laboratory at IIT Kanpur, is designed to meet the demands of rural families and the urban middle-class community.

India Water Cooler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Bottled Water Cooler (BWC), Point-of-Use (POU) Water Cooler |

| Applications Covered | Household, Commercial |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India water cooler market performed so far and how will it perform in the coming years?

- What is the breakup of the India water cooler market on the basis of product type?

- What is the breakup of the India water cooler market on the basis of application?

- What is the breakup of the India water cooler market on the basis of distribution channel?

- What is the breakup of the India water cooler market on the basis of region?

- What are the various stages in the value chain of the India water cooler market?

- What are the key driving factors and challenges in the India water cooler market?

- What is the structure of the India water cooler market and who are the key players?

- What is the degree of competition in the India water cooler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India water cooler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India water cooler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India water cooler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)