India Wastewater Treatment Market Size, Share, Trends and Forecast by Product Type, Technology, Application and Region, 2025-2033

India Wastewater treatment Market Overview:

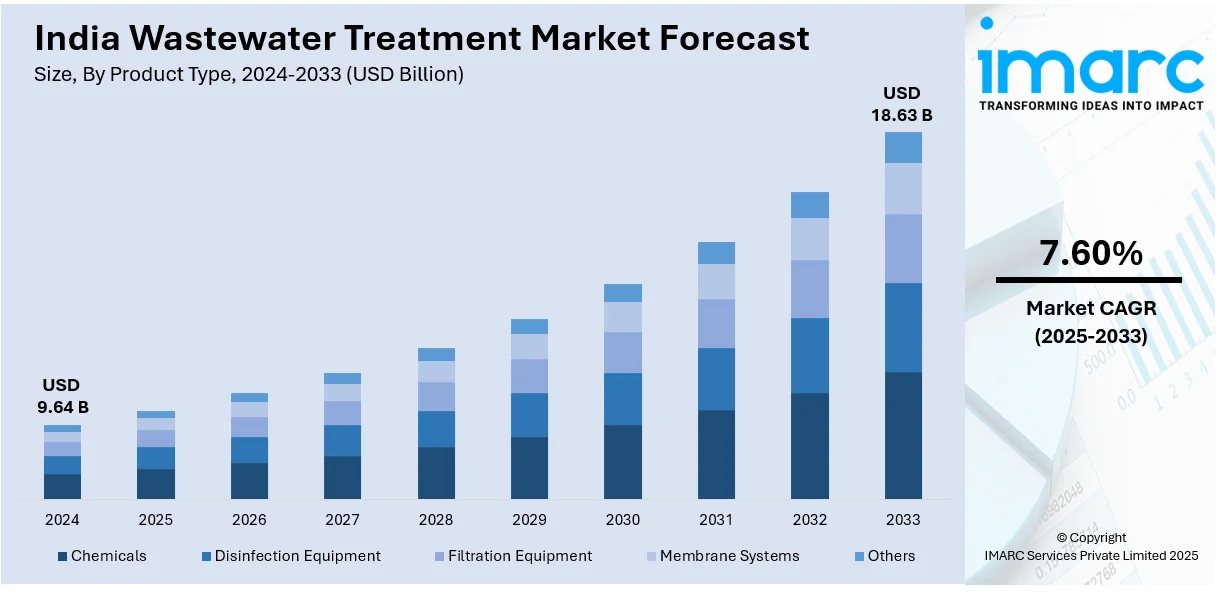

The India wastewater treatment market size reached USD 9.64 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 18.63 Billion by 2033, exhibiting a growth rate (CAGR) of 7.60% during 2025-2033. The India wastewater treatment market share is propelled by accelerating urbanization, industrialization, and growing water scarcity. Increasing environmental awareness, tighter regulations, and the requirement for sustainable water management drive demand for effective wastewater treatment solutions. Moreover, government policies, population growth, and industrialization drive further India wastewater treatment market growth and innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.64 Billion |

| Market Forecast in 2033 | USD 18.63 Billion |

| Market Growth Rate (2025-2033) | 7.60% |

India Wastewater treatment Market Trends:

Growing Adoption of Advanced Wastewater Treatment Technologies

One of the key trends driving the India wastewater treatment market outlook is the growing adoption of advanced treatment technologies. As per the most recent data released by the Central Pollution Control Board in December 2022, Indian cities treat merely 28 percent of the 72,368 million litres of sewage they produce daily. Conventional techniques such as chemical and biological treatment are being supplemented with new technologies like membrane filtration, reverse osmosis (RO), and advanced oxidation processes (AOP). These technologies are more efficient in eliminating contaminants to make wastewater safe for reuse by industries such as textiles, pharmaceuticals, and agriculture. Increasing water scarcity will continue to lead to increased demands for treated wastewater, especially in water-scarce areas. Furthermore, intelligent technologies combined with IoT (Internet of Things) are enhancing monitoring and optimization, allowing real-time water quality analysis. This shift toward embracing cutting-edge treatment technologies assists industries in complying with strict environmental regulations, lowering operational expenses, and attaining sustainable water management strategies. With more government encouragement and regulatory policies, the trend of technological development in wastewater treatment is likely to further pick up speed in India.

To get more information of this market, Request Sample

Focus on Wastewater Recycling and Reuse

The trend of focusing on wastewater recycling and reuse is gaining significant traction in India’s wastewater treatment market. As water scarcity intensifies, there is an urgent need to adopt sustainable practices for managing water resources. Industries, municipalities, and agricultural sectors are increasingly turning to wastewater recycling systems to meet their water demands. Many cities are investing in decentralized wastewater treatment plants, where treated water is directly reused for non-potable purposes such as irrigation, landscaping, and industrial cooling. This trend is supported by government initiatives promoting wastewater reuse, such as the Atal Mission for Rejuvenation and Urban Transformation (AMRUT), which encourages water recycling and the creation of wastewater treatment plants. As part of Atal Mission for Rejuvenation and Urban Transformation (AMRUT) 2.0, cities with populations exceeding 100,000 are required to recycle a minimum of 20% of their wastewater. Industries, particularly those in water-intensive sectors like textiles and food processing, are adopting closed-loop systems to reduce dependency on freshwater resources. This shift toward recycling and reuse conserves water while helping businesses lower costs and mitigate environmental impacts.

India Wastewater treatment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, technology, and application.

Product Type Insights:

- Chemicals

- Disinfection Equipment

- Filtration Equipment

- Membrane Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes chemicals, disinfection equipment, filtration equipment, membrane, and others.

Technology Insights:

- Primary Treatment

- Secondary Treatment

- Tertiary Treatment

The report has provided a detailed breakup and analysis of the market based on the technology. This includes primary treatment, secondary treatment, and tertiary treatment.

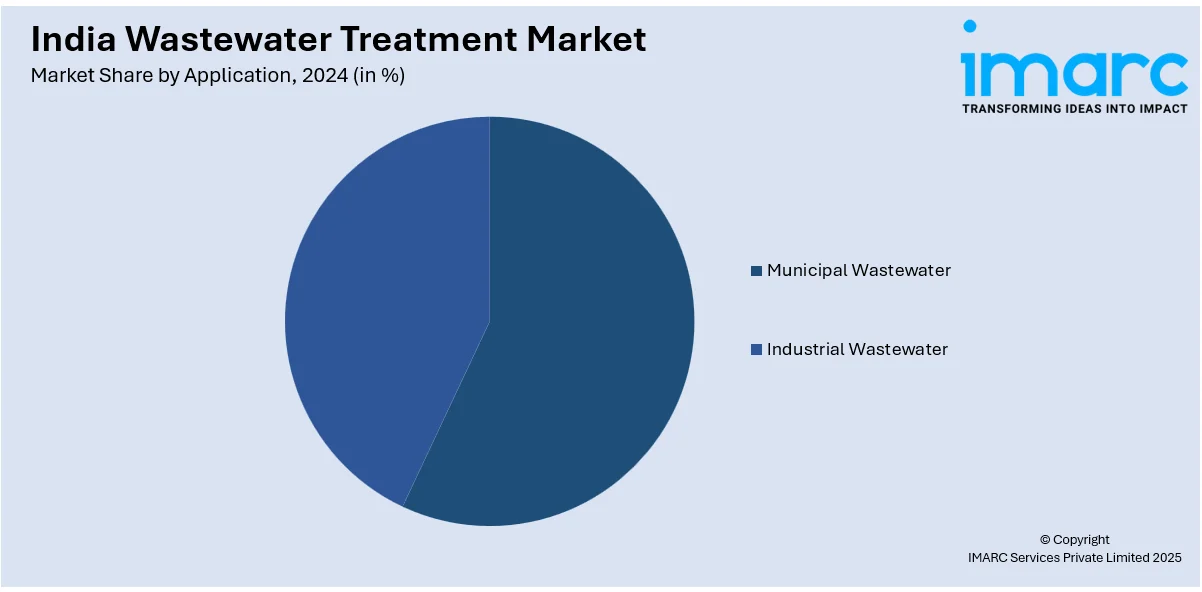

Application Insights:

- Municipal Wastewater

- Industrial Wastewater

The report has provided a detailed breakup and analysis of the market based on the application. This includes municipal wastewater, and industrial wastewater.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Wastewater Treatment Market News:

- In February 2025, Chennai-based water treatment company VA Tech WABAG obtained a consortium contract valued at USD 371 million (approximately Rs 3,251 crore) from Al Haer Environmental Services Company in Riyadh, Saudi Arabia. The contract is for engineering, procurement, and construction (EPC) of a 200 MLD Independent Sewage Treatment Plant (ISTP), along with connections to discharge facilities.

- In March 2023, Aquacare Solution Enviro Engineers partnered with Aldee Water Pvt Ltd to form a strategic alliance, merging their skills and resources to deliver comprehensive solutions in water and wastewater treatment. This partnership seeks to meet the varied requirements of clients in different sectors, while promoting environmental sustainability and encouraging cleaner, greener methods.

India Wastewater treatment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Chemicals, Disinfection Equipment, Filtration Equipment, Membrane Systems, Others |

| Technologies Covered | Primary Treatment, Secondary Treatment, Tertiary Treatment |

| Applications Covered | Municipal Wastewater, Industrial Wastewater |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India wastewater treatment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India wastewater treatment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India wastewater treatment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wastewater treatment market in india was valued at USD 9.64 Billion in 2024.

The India wastewater treatment market is projected to exhibit a CAGR of 7.60% during 2025-2033, reaching a value of USD 18.63 Billion by 2033.

The market is driven by increased demand for treated water reuse, rising volumes of household and industrial effluents, and awareness about environmental responsibility. Technological adaptability in treatment systems and the need for decentralized setups in smaller towns and gated communities is shaping the market. Compact, energy-efficient solutions are gaining preference for long-term sustainability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)