India Waste Management Market Size, Share, Trends and Forecast by Waste Type, Disposal Methods, and Region, 2025-2033

India Waste Management Market Overview:

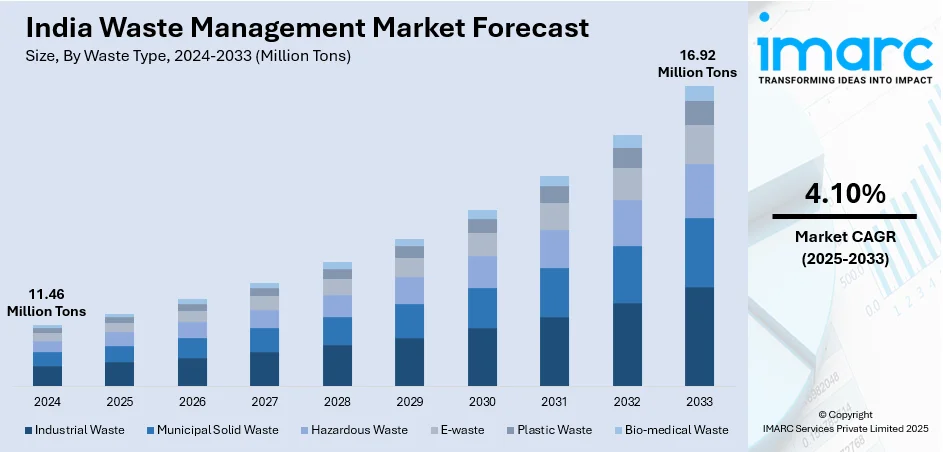

The India waste management market size reached 11.46 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 16.92 Million Tons by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The market is expanding due to rapid urbanization, government initiatives like Swachh Bharat Mission, and growing environmental awareness. The sector includes solid waste recycling, composting, and waste-to-energy solutions, with increasing private sector participation and technology-driven innovations enhancing efficiency and sustainability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 11.46 Million Tons |

| Market Forecast in 2033 | 16.92 Million Tons |

| Market Growth Rate (2025-2033) | 4.10% |

India Waste Management Market Trends:

Growing Adoption of Waste-to-Energy (WTE) Solutions

The growing adoption of Waste-to-Energy (WTE) technology to mitigate the increasing waste emergency while producing sustainable energy is boosting the India waste management market share. According to the reports, more than 62 million tons of municipal solid waste (MSW) is produced every year, and only 43 MT of the total waste generated is collected, with just 12 MT treated before disposal, leaving nearly 72% improperly managed. In addition to this, the WTE facilities provide a low-carbon pathway. Policies made by the Government of India as part of Swachh Bharat Mission, along with offering financial incentives by the WTE programme, attract capital towards incineration, biogas, and refuse-derived fuel (RDF) processes. Moreover, cities such as Delhi and Hyderabad have installed WTE plants to treat non-recyclable waste, cutting down on landfill reliance. Besides this, high capital expenses and air pollution worries hinder large-scale implementation, and to contain environmental hazards, advanced emission control systems and tough regulations are being integrated into modern WTE plants. Furthermore, the growing focus on circular economy frameworks and enhanced private sector investment are likely to propel additional investment in India's WTE sector, positioning it as a core element of India's waste management policy.

To get more information on this market, Request Sample

Rising Focus on Plastic Waste Recycling and Circular Economy

The rising focus on plastic waste recycling and circular economy is enhancing the India waste management market outlook, led by regulatory requirements and business sustainability targets. For instance, researchers have urged India to consider banning microbeads in personal care products, as studies found these tiny plastics in 45% of tested items. Microbeads contribute significantly to microplastic pollution, posing health risks and environmental challenges. The Plastic Waste Management Rules, 2016 (subsequently amended in 2022), brought into force Extended Producer Responsibility (EPR) responsibilities for producers, which forced them to collect and recycle post-consumer plastic waste. Concurrently, firms are investing in new recycling technologies, including chemical recycling and pyrolysis, to recycle plastic waste into reusable material and fuel. In confluence with this, startups and waste management companies are building decentralized collection systems, which is encouraging segregation of waste at the source. Additionally, various cities such as Pune and Indore have established effective public-private partnerships (PPP) to increase plastic waste recovery. Furthermore, the increasing use of recycled plastics in packaging, textiles, and construction industries is bolstering India's recycling industry. Apart from this, the rising consumer consciousness and increased enforcement of plastic bans is significantly contributing to the India waste management market growth.

India Waste Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on waste type and disposal methods.

Waste Type Insights:

- Industrial Waste

- Municipal Solid Waste

- Hazardous Waste

- E-waste

- Plastic Waste

- Bio-medical Waste

The report has provided a detailed breakup and analysis of the market based on the waste type. This includes industrial waste, municipal solid waste, hazardous waste, e-waste, plastic waste, and bio-medical waste.

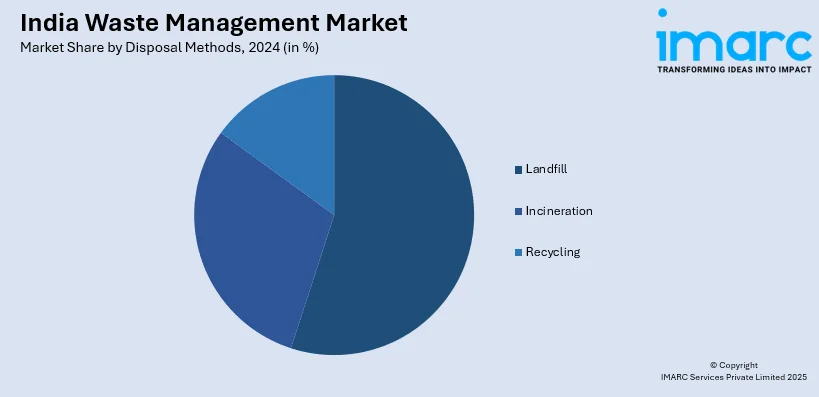

Disposal Methods Insights:

- Landfill

- Incineration

- Recycling

A detailed breakup and analysis of the market based on the disposal methods have also been provided in the report. This includes landfill, incineration, and recycling.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Waste Management Market News:

- In December 2024, India's Environment Ministry introduced the draft Environment Protection (Extended Producer Responsibility for Packaging) Rules, 2024. Set to take effect on April 1, 2026, these regulations mandate producers, importers, and brand owners to manage the entire lifecycle of packaging materials, promoting recycling and sustainable practices.

- In August 2024, Kerala's Chief Minister Pinarayi Vijayan inaugurated the Kerala Solid Waste Management Project (KSWMP) in Kochi. This ₹2,400 crore initiative, in collaboration with the World Bank and the Asian Infrastructure Investment Bank, aims to equip 93 urban local bodies with advanced waste collection, transportation, and treatment facilities by March 2025.

India Waste Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Waste Types Covered | Industrial Waste, Municipal Solid Waste, Hazardous Waste, E-Waste, Plastic Waste, Bio-Medical Waste |

| Disposal Methods Covered | Landfill, Incineration, Recycling |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India waste management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India waste management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India waste management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The waste management market in India reached 11.46 Million Tons in 2024.

The India waste management market is projected to exhibit a CAGR of 4.10% during 2025-2033, reaching a volume of 16.92 Million Tons by 2033.

Key factors driving the India waste management market include rapid urbanization, rising population, and increasing waste generation across residential, commercial, and industrial sectors. Government initiatives promoting clean cities, stricter environmental regulations, and growing public awareness about sustainable waste disposal practices are also contributing to market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)