India Walnut Market Size, Share, Trends and Forecast by Type, Product, Nature, Form, End Use, and Region, 2026-2034

India Walnut Market Size and Share:

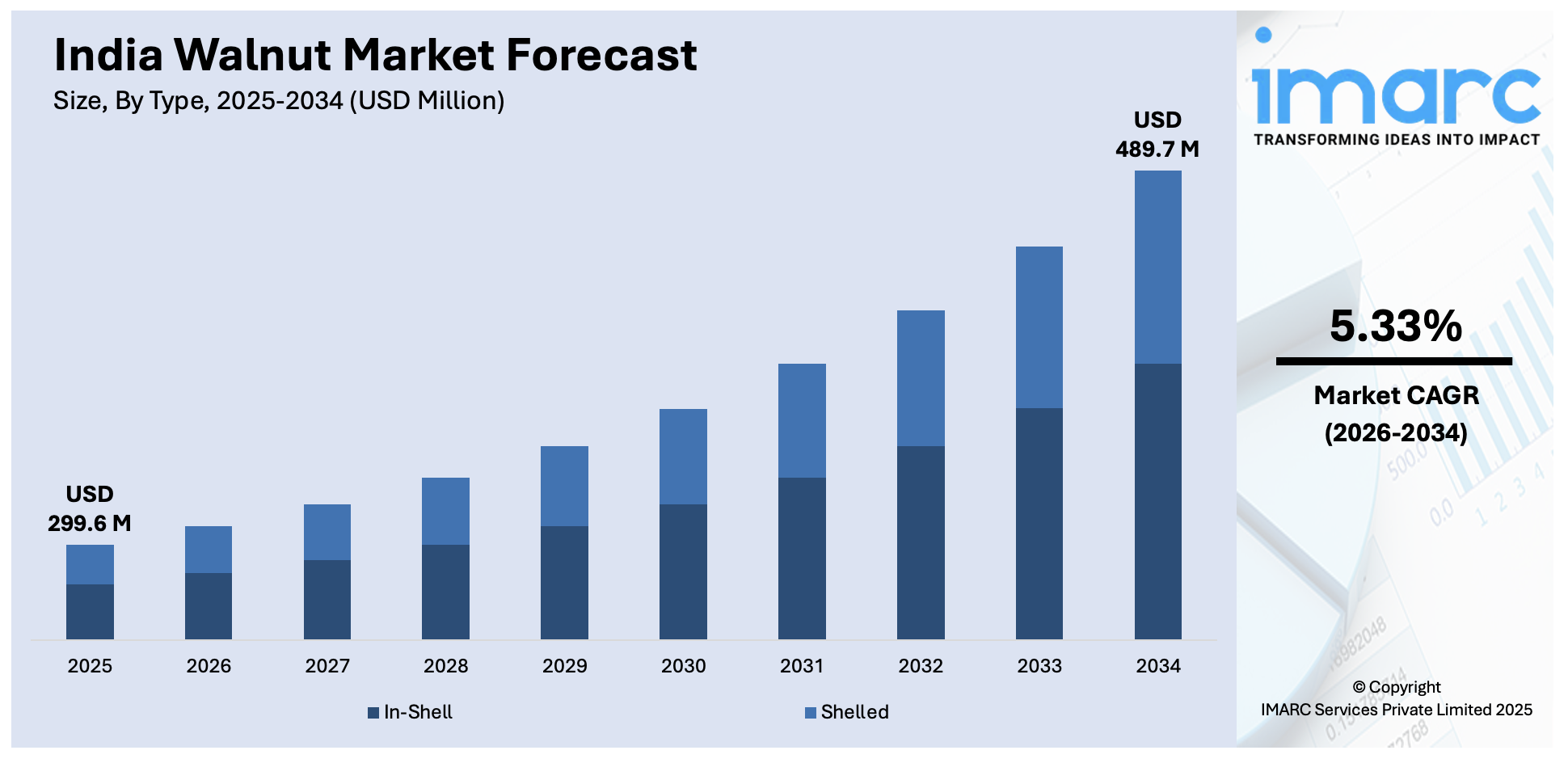

The India walnut market size reached USD 299.6 Million in 2025. The market is expected to reach USD 489.7 Million by 2034, exhibiting a growth rate (CAGR) of 5.33% during 2026-2034. The market growth is attributed to the growing awareness of health and wellness among Indian consumers, the expanding use of walnut oil in India's thriving cosmetics industry, and the rising shift towards sustainable and eco-friendly consumption.

Market Insights:

- On the basis of region, the market has been divided into South India, North India, West & Central India, and East India.

- On the basis of type, the market has been divided into in-shell and shelled.

- On the basis of product, the market has been divided into Persian or English walnut and black walnut.

- On the basis of nature, the market has been divided into organic and conventional.

- On the basis of form, the market has been divided into raw and processed.

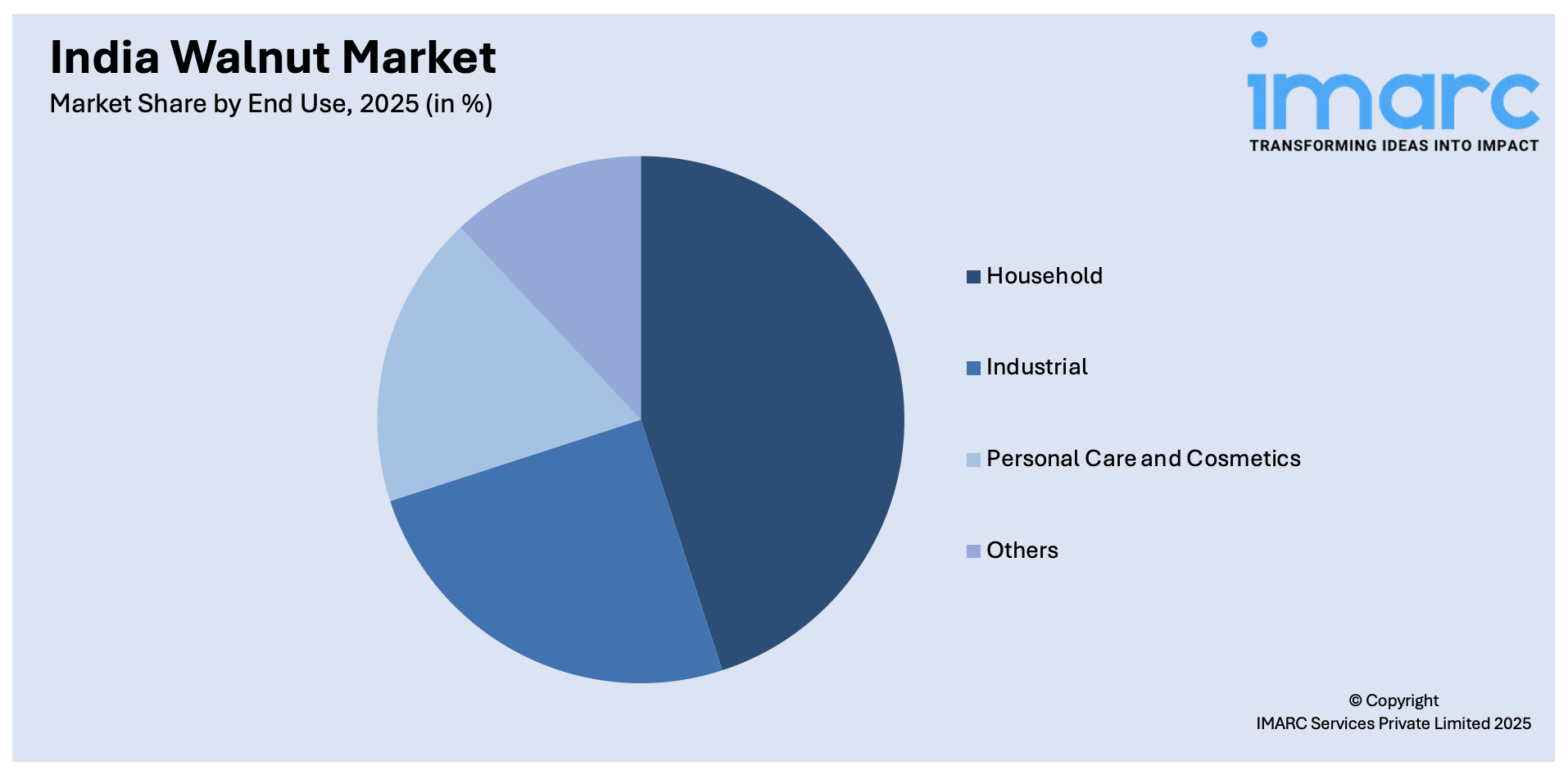

- On the basis of end use, the market has been divided into household, industrial, personal care and cosmetics, and others.

Market Size and Forecast:

- 2025 Market Size: USD 299.6 Million

- 2034 Projected Market Size: USD 489.7 Million

- CAGR (2026-2034): 5.33%

Walnut is a nutrient-rich nut known for its flavorful taste and health-promoting characteristics. It originates from the tree of the genus Juglans, which belongs to the family Juglandaceae. The tree produces a hard-shelled nut enveloped within a green husk: the walnut. This nut is recognized globally for its high nutritional value, with a rich profile of proteins, healthy fats, fiber, vitamins, and minerals. Additionally, it is a key ingredient in various culinary dishes and is also consumed in its raw form as a healthy snack. Its oil, obtained by pressing walnuts, is widely used for cooking, cosmetics, and medicinal purposes. Moreover, the wood of the walnut tree has an esteemed place in furniture manufacturing due to its superior quality and rich, dark color. From a business standpoint, the walnut represents a high-value commodity that integrates several sectors, including food and beverage, cosmetics, healthcare, and woodworking industries.

To get more information on this market Request Sample

In recent years, the India walnut market has seen significant growth, fueled by the escalating awareness of health and wellness among Indian consumers. This is leading to a rise in the consumption of nutritious food products, including walnuts. These nuts, rich in antioxidants and omega-3 fats, align perfectly with the growing demand for functional foods that promote health and prevent diseases. Along with this, the culinary versatility of walnuts, used in a variety of Indian dishes, from sweets to savory, further enhances their popularity. Another major driver is the expanding use of walnut oil in India's thriving cosmetics industry. With its hydrating and anti-aging properties, walnut oil is gaining prominence in skincare and haircare products, bolstering the India walnut market share. The expanding woodworking industry also contributes to the market's expansion, as Indian walnut wood is highly prized for furniture making due to its durability and aesthetic appeal. Apart from this, organic and sustainably sourced walnuts are increasingly favored among the masses, matching the global shift towards sustainable and eco-friendly consumption. Several manufacturers are shifting towards organic farming practices and obtaining the necessary certifications to meet this demand, offering a competitive edge in the market. Moreover, advancements in walnut processing technologies and improvements in the supply chain, driven by digitalization and infrastructure development, are contributing to the India walnut market growth. This, coupled with the rising penetration of online retail, the widespread preference for purchasing grocery items online, and easy availability of walnut on online grocery platforms with quick delivery options is creating a positive market outlook.

India Walnut Market Trends:

Increased Organic and Sustainable Sourcing

The walnut industry in India is experiencing a paradigm shift toward sustainably sourced and organic products, catalyzed by green-minded consumers and rigorous quality control. This trend is especially high among millennials and Gen Z consumers who value environmental sustainability and are prepared to pay higher prices for certified organic walnuts. Farmers and suppliers are meeting this need by embracing organic farming methods, securing necessary certification, and adopting sustainable harvesting practices that promote long-term environmental sustainability. Government support for organic farming through several schemes and subsidies is also helping fuel this shift, as well as retailers offering more organic walnuts to respond to increased consumer demand. This transformation is also opening doors for traceability systems and supply chains that are open to the customer, so buyers can make informed choices based on the product's social and environmental footprint.

Technological Upgrade in Processing and Distribution

Technological advancements in processing, storage, and distribution systems are expanding the walnut market size in India and upgrading the quality of the product and the market. Emergent processing technologies are facilitating improved retention of nutritional value coupled with longer shelf life, bringing walnuts into reach across varied geographical points. Cold chain logistics and superior packaging solutions are maintaining product freshness during transportation, minimizing wastage, and ensuring compliance with quality standards. Digital platforms and e-commerce connectivity are revolutionizing the distribution model, enabling direct farmer-to-consumer sales and skipping intermediaries. Adoption of blockchain technology for supply chain traceability and IoT-enabled monitoring systems for quality inspection is creating new industry benchmarks. Such technological developments are also enabling improved inventory management, demand forecasting, and customer engagement strategies.

Another significant trend in the market is,

- Growing Health Awareness and Demand for Functional Foods: Consumers are increasingly valuing foods that provide nutritional advantages over and above ordinary eating. Walnuts are becoming trendy with their high omega-3 and antioxidant contents, which enhances the India walnut market outlook. Post-pandemic has pushed the demand for immunity-building and cardiovascular-healthy foods.

Growth, Opportunities, and Challenges in the India Walnut Market:

- Growth Drivers: Import surge and supply chain improvements are significantly contributing to market expansion as India continues to rely heavily on walnut imports to meet domestic demand while simultaneously developing robust distribution networks. Expanding end-use sectors including food processing, cosmetics, pharmaceuticals, and nutraceuticals are creating diverse revenue streams and increasing overall market consumption patterns. Climatic and production advantages in regions like Jammu & Kashmir, Himachal Pradesh, and Uttarakhand are enabling local cultivation expansion, reducing import dependency while maintaining quality standards.

- Market Opportunities: According to the India walnut market analysis, the expanding middle-class population with increasing disposable income presents significant opportunities for premium walnut products and value-added offerings. Development of innovative walnut-based products such as protein bars, health supplements, and fortified foods can tap into the growing functional food market. Export potential to neighboring countries and emerging markets offers substantial revenue growth opportunities for Indian walnut processors and traders. Strategic partnerships between farmers, processors, and retailers can create integrated value chains that optimize profitability while ensuring quality and sustainability.

- Market Challenges: Climate change and unpredictable weather patterns pose significant risks to domestic walnut production, affecting both quality and quantity of harvests. As per the India walnut market forecast, intense competition from established international suppliers, particularly from countries like Chile and USA, creates pricing pressure on domestic producers. Limited awareness about walnut health benefits among rural populations restricts market penetration and growth potential in tier-2 and tier-3 cities. Post-harvest losses due to inadequate storage infrastructure and processing facilities continue to impact overall market efficiency and profitability.

India Walnut Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India walnut market report, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, product, nature, form, and end use.

Type Insights:

- In-Shell

- Shelled

The report has provided a detailed breakup and analysis of the market based on the type. This includes in-shell and shelled.

Product Insights:

- Persian or English Walnut

- Black Walnut

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes Persian or English walnut and black walnut.

Nature Insights:

- Organic

- Conventional

The report has provided a detailed breakup and analysis of the market based on the nature. This includes organic and conventional.

Form Insights:

- Raw

- Processed

A detailed breakup and analysis of the market based on the form has also been provided in the report. This includes raw and processed.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Household

- Industrial

- Personal Care and Cosmetics

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes household, industrial, personal care and cosmetics, and others.

Regional Insights:

- South India

- North India

- West & Central India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, North India, West & Central India, and East India.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In September 2025, ChileNut, in collaboration with ProChile, launched the new season of Chilean walnuts in India. Leveraging Chile's southern hemisphere harvest, these walnuts are available in India from August onwards, aligning with the country's festive season. Celebrated for their light color, freshness, and high yield, Chilean walnuts have made India their largest market, with exports to over 70 countries.

- In June 2025, Jammu and Kashmir inaugurated India's first QR-coded walnut orchard at the Walnut Research Station in Kulangam, Handwara. This pioneering initiative enables real-time access to detailed information about each of the state's over 5 million walnut trees, including data on age, nut and kernel size, and nutritional content. The project aims to modernize horticultural practices, enhance orchard management, and promote Kashmiri walnuts as a premium product both domestically and internationally.

- In January 2025, the Nuts and Dry Fruit Council of India (NDFC(I)) inaugurated a walnut plantation initiative in Chakrata, Uttarakhand. This project aims to promote sustainable agriculture and enhance local livelihoods through the cultivation of high-quality walnuts. The initiative is part of NDFC(I)'s broader strategy to bolster the domestic walnut industry and contribute to the region's economic development.

India Walnut Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | In-Shell, Shelled |

| Products Covered | Persian or English Walnut, Black Walnut |

| Natures Covered | Organic, Conventional |

| Forms Covered | Raw, Processed |

| End Uses Covered | Household, Industrial, Personal Care and Cosmetics, Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India walnut market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India walnut market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India walnut industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The walnut market in India was valued at USD 299.6 Million in 2025.

The India walnut market is projected to exhibit a CAGR of 5.33% during 2026-2034, reaching a value of USD 489.7 Million by 2034.

The India walnut market is driven by rising health awareness, increasing demand for nutrient-rich and protein-packed foods, growing use of walnuts in bakery, confectionery, and snack products, expanding domestic production in key walnut-growing regions, and rising consumer preference for premium, organic, and functional nuts.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)