India Vitamin and Mineral Premixes Market Size, Share, Trends and Forecast by Type, Form, Functionality, Application, and Region, 2025-2033

India Vitamin and Mineral Premixes Market Overview:

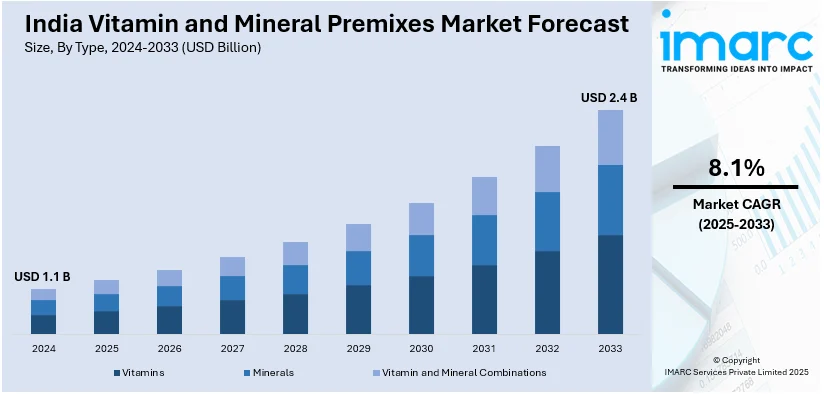

The India vitamin and mineral premixes market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.4 Billion by 2033, exhibiting a growth rate (CAGR) of 8.1% during 2025-2033. The rising health awareness, increasing demand for fortified foods, government initiatives promoting nutrition, growing infant and maternal nutrition needs, expanding dietary supplement consumption, and the food and beverage industry's shift toward functional and fortified products are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Market Growth Rate 2025-2033 | 8.1% |

India Vitamin and Mineral Premixes Market Trends:

Expansion of Vitamin and Mineral Premix Manufacturing

The increasing demand for high-quality vitamin and mineral premixes is driving significant investment in production facilities across India. Manufacturers are setting up large-scale plants to enhance supply chain efficiency and meet the growing requirements of the feed, food, and nutraceutical industries. These facilities focus on precision formulation, ensuring consistency and bioavailability in premixes tailored for various applications. The shift toward localized production reduces import dependence, stabilizes pricing, and aligns with regulatory standards. Advanced automation and quality control systems are also being integrated to maintain formulation accuracy and safety. As the market expands, companies are strengthening their distribution networks across South Asia, catering to rising demand in Bangladesh, Nepal, and Sri Lanka. This shift highlights a broader movement toward self-sufficiency and innovation in the nutrition sector, making India a key hub for premix production. For example, Trouw Nutrition, Nutreco's animal nutrition division’s, 20,000 MT facility in Jadcherla, near Hyderabad, India, produces vitamins, mineral premixes, and mineral blends for various species.

To get more information of this market, Request Sample

Strengthening Standards for Vitamin and Mineral Premixes in Fortification

Regulatory authorities are refining guidelines for vitamin and mineral premixes to improve the quality and effectiveness of food fortification programs. New specifications ensure consistency in nutrient levels, optimizing the impact of fortified staples on public health. With micronutrient deficiencies remaining a concern, stricter oversight supports uniformity in formulations, reducing variability across manufacturers. Standardization enhances consumer trust while aligning with broader nutritional policies aimed at addressing malnutrition. Compliance with these updated requirements is prompting producers to refine their formulations and quality control processes. This shift is also fostering innovation in premix development, with a focus on improved bioavailability and stability. As fortified foods play an increasing role in addressing dietary gaps, clearer guidelines ensure that essential nutrients are delivered more effectively, supporting long-term nutritional security and strengthening food fortification initiatives at scale. For instance, in November 2023, the Food Safety and Standards Authority of India (FSSAI) implemented revised regulations specifying micronutrient limits in vitamin and mineral premixes for fortified rice kernels (FRKs). This move aims to standardize premix quality, enhancing the efficacy of rice fortification programs across India.

India Vitamin and Mineral Premixes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, form, functionality, and application.

Type Insights:

- Vitamins

- Minerals

- Vitamin and Mineral Combinations

The report has provided a detailed breakup and analysis of the market based on the type. This includes vitamins, minerals, and vitamin and mineral combinations.

Form Insights:

- Powder

- Liquid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes powder and liquid.

Functionality Insights:

- Bone Health

- Skin Health

- Energy

- Immunity Digestion

- Others

The report has provided a detailed breakup and analysis of the market based on the functionality. This includes bone health, skin health, energy, immunity digestion, and others.

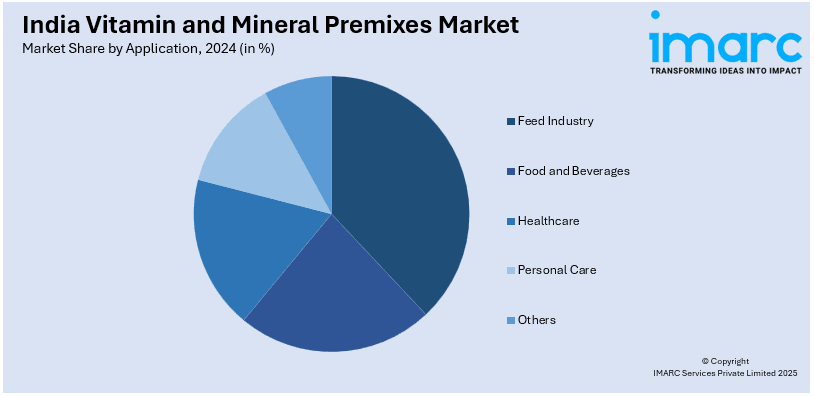

Application Insights:

- Feed Industry

- Food and Beverages

- Healthcare

- Personal Care

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes feed industry, food and beverages, healthcare, personal care, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Vitamin and Mineral Premixes Market News:

- In March 2025, Antara, a senior care provider under India's Max Group, partnered with Wellbeing Nutrition to address nutritional deficiencies among the elderly, focusing on gut health. This collaboration aims to develop nutraceuticals rich in essential nutrients like calcium, vitamin D, and B12, targeting prevalent deficiencies and enhancing overall well-being.

- In August 2024, Abbott India announced its plans to expand its multi-specialty portfolio by focusing on vitamin D and micronutrient supplements targeting thyroid health. Products like Arachitol (vitamin D supplement) and Thyrowl Plus (selenium and L-tyrosine supplement for thyroid support) are leading this growth. The company also introduced Arachitol Gummies 300 IU and Brufen Power Gel for musculoskeletal pain, aiming to strengthen its product pipeline.

India Vitamin and Mineral Premixes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Vitamins, Minerals, Vitamin and Mineral Combinations |

| Forms Covered | Powder, Liquid |

| Functionalities Covered | Bone Health, Skin Health, Energy, Immunity Digestion, Others |

| Applications Covered | Feed Industry, Food and Beverages, Healthcare, Personal Care, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India vitamin and mineral premixes market performed so far and how will it perform in the coming years?

- What is the breakup of the India vitamin and mineral premixes market on the basis of type?

- What is the breakup of the India vitamin and mineral premixes market on the basis of form?

- What is the breakup of the India vitamin and mineral premixes market on the basis of functionality?

- What is the breakup of the India vitamin and mineral premixes market on the basis of application?

- What are the various stages in the value chain of the India vitamin and mineral premixes market?

- What are the key driving factors and challenges in the India vitamin and mineral premixes?

- What is the structure of the India vitamin and mineral premixes market and who are the key players?

- What is the degree of competition in the India vitamin and mineral premixes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India vitamin and mineral premixes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India vitamin and mineral premixes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India vitamin and mineral premixes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)