India Vitamin B12 Supplements Market Size, Share, Trends and Forecast by Form, End Use Industry, and Region, 2025-2033

India Vitamin B12 Supplements Market Overview:

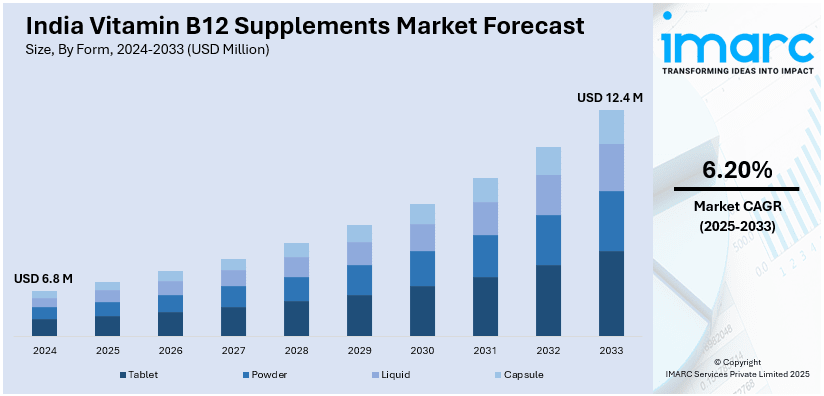

The India vitamin B12 supplements market size reached USD 6.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 12.4 Million by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. The market is expanding due to rising vegan and vegetarian population, growing health awareness and increasing cases of B12 deficiency. Additionally, growing demand for fortified and functional food and beverages, and innovations in delivery formats are also contributing positively to the India vitamin B12 supplements market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.8 Million |

| Market Forecast in 2033 | USD 12.4 Million |

| Market Growth Rate 2025-2033 | 6.20% |

India vitamin B12 supplements Market Trends:

Growing Vegan and Vegetarian Population

The increasing shift towards vegetarianism and veganism in India is significantly driving demand for Vitamin B12 supplements, as plant-based diets naturally lack this essential nutrient. According to reports, India has the world's highest rate of vegetarians at 38%. With low meat consumption, 9% are vegan. With growing awareness of B12 deficiency risks such as fatigue, anemia, and neurological disorders, more consumers are turning to fortified foods, dietary supplements, and functional beverages to meet their nutritional needs. Healthcare professionals and nutritionists are actively educating individuals about the importance of B12 supplementation, further fueling market growth. E-commerce platforms, pharmacies, and health stores are expanding their offerings, making B12 supplements widely accessible. Additionally, brands are launching methylcobalamin-based and organic B12 formulations, catering to consumer preferences for natural and bioavailable sources. As the vegan and vegetarian trend continues to grow, the India vitamin B12 supplements market outlook remains positive, with increasing innovation and product diversification shaping future market expansion.

To get more information of this market, Request Sample

Rising Demand for Functional Foods and Fortified Products

The demand for functional foods and fortified products enriched with Vitamin B12 is growing in India as consumers seek convenient and effective dietary solutions. With a rising vegan and vegetarian population, fortified plant-based milks, cereals, nutritional drinks, and dairy alternatives are gaining traction to address B12 deficiency. For instance, in September 2024, Maiva Fresh introduced Maiva Unsweetened Almond Milk a nutritious health drink boasting zero cholesterol and fortified with Vitamin B12 and D. Available in four flavors natural, vanilla, cocoa, and mango it aims to satisfy health-conscious consumers with delicious options. These products offer an easy way to meet daily nutritional needs without relying on traditional supplements. Brands are responding by introducing bioavailable B12-enriched formulations in breakfast staples, beverages, and protein supplements. Healthcare professionals are also encouraging fortified food consumption, particularly for individuals with low B12 levels, pregnant women, and the elderly. The expansion of e-commerce and supermarket availability is further increasing accessibility. With growing health awareness and product innovation, India vitamin B12 supplements market share is expanding as fortified foods become a preferred nutritional choice among consumers.

India Vitamin B12 Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on form and end use industry.

Form Insights:

- Tablet

- Powder

- Liquid

- Capsule

The report has provided a detailed breakup and analysis of the market based on the form. This includes tablet, powder, liquid and capsule.

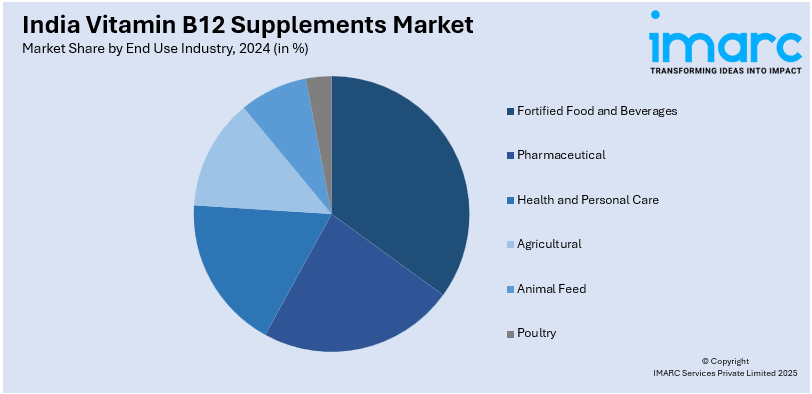

End Use Industry Insights:

- Fortified Food and Beverages

- Pharmaceutical

- Health and Personal Care

- Agricultural

- Animal Feed

- Poultry

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes fortified food and beverages, pharmaceutical, health and personal care, agricultural, animal feed and poultry.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Vitamin B12 Supplements Market News:

- In November 2024, Cadila Pharmaceuticals launched Militol, an iron supplement featuring ferric maltol, folic acid and additional vitamins including B-12. This formulation optimizes iron absorption while minimizing gastrointestinal side effects. Aimed at addressing widespread iron deficiency, Militol supports various health needs, particularly among women of reproductive age.

- In March 2023, Veera Health entered the nutraceutical market with the launch of VeeVital PCOS Support, designed to aid women with PCOS in managing symptoms. This supplement contains Myo-inositol, vitamin D, B12, and dietary folate, addressing nutrient deficiencies and supporting hormonal balance.

India Vitamin B12 Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Tablet, Powder, Liquid, Capsule |

| End Use Industries Covered | Fortified Food and Beverages, Pharmaceutical, Health and Personal Care, Agricultural, Animal Feed, Poultry |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India vitamin B12 supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India vitamin B12 supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India vitamin B12 supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vitamin B12 supplements market in India was valued at USD 6.8 Million in 2024.

The India vitamin B12 supplements market is projected to exhibit a CAGR of 6.20% during 2025-2033, reaching a value of USD 12.4 Million by 2033.

The India vitamin B12 supplements market is driven by increasing awareness about nutrient deficiencies, especially among vegetarians and aging populations, rising health-consciousness, and growing preventive healthcare trends. Accessibility through online pharmacies and stronger endorsements by wellness professionals further enhance market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)