India Virtualized Evolved Packet Core Market Size, Share, Trends and Forecast by Component Type, Use, End User, and Region, 2026-2034

India Virtualized Evolved Packet Core Market Summary:

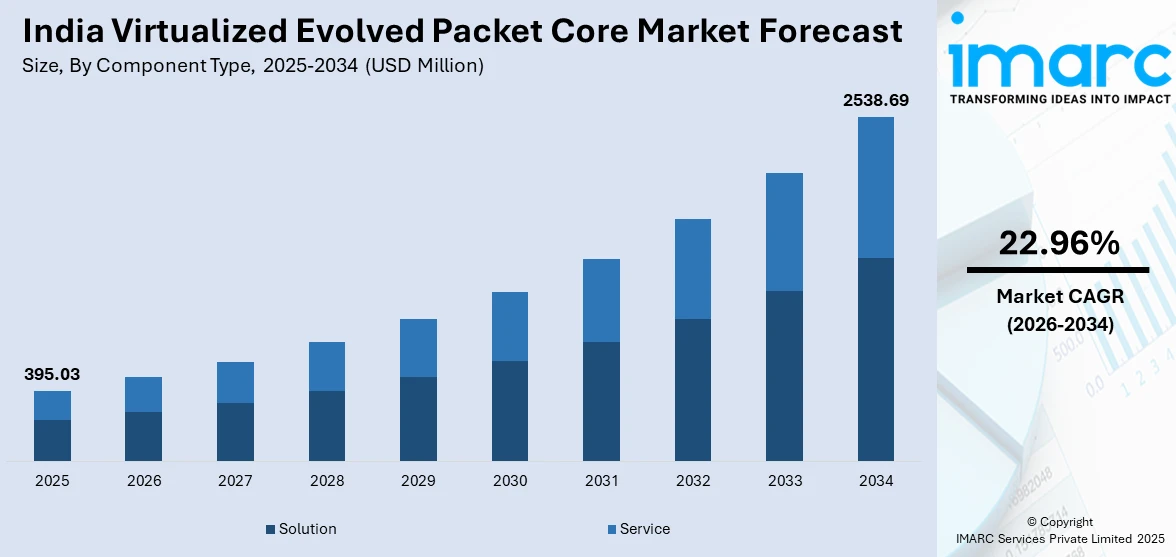

The India virtualized evolved packet core market size was valued at USD 395.03 Million in 2025 and is projected to reach USD 2,538.69 Million by 2034, growing at a compound annual growth rate of 22.96% from 2026-2034.

The India virtualized evolved packet core market is expanding rapidly, driven by the accelerating deployment of 5G networks across the country and the increasing adoption of cloud computing technologies by telecom operators. Virtualized EPC solutions enable operators to enhance network flexibility, reduce hardware dependencies, and efficiently manage growing data traffic volumes. The rising focus on smart city initiatives, expanding IoT ecosystem, and the need for scalable network infrastructure are further propelling the India virtualized evolved packet core market share.

Key Takeaways and Insights:

- By Component Type: Solution dominates the market with a share of 56% in 2025, driven by increasing demand for comprehensive virtualized network function software that enables operators to deploy scalable and flexible core network architectures efficiently.

- By Use: Internet of things (IoT) and machine to machine (M2M) leads the market with a share of 25% in 2025, owing to the massive growth in connected devices and the government's smart city initiatives requiring robust network connectivity for automated systems.

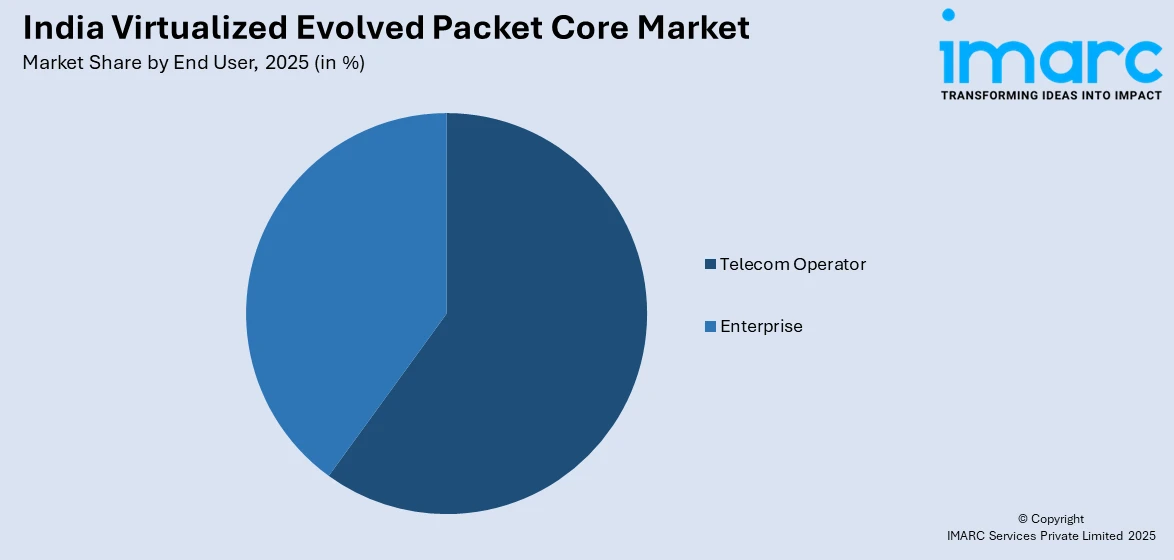

- By End User: Telecom operator represents the largest segment with a market share of 71% in 2025, attributed to major investments by operators like Reliance Jio and Bharti Airtel in virtualized infrastructure to support nationwide 5G rollouts.

- By Region: South India dominates with a market share of 32% in 2025, driven by the concentration of technology hubs in Bangalore, Chennai, and Hyderabad with strong IT infrastructure and data center presence.

- Key Players: The India virtualized evolved packet core market exhibits a moderately competitive landscape, with global telecommunications equipment manufacturers and software providers competing for market share. Key players are focusing on partnerships with domestic telecom operators and investing in cloud-native solutions to strengthen their market positioning.

To get more information on this market Request Sample

The India virtualized evolved packet core market is undergoing significant transformation as telecom operators transition from traditional hardware-based infrastructure to software-defined, cloud-native architectures. This shift is enabling faster service deployment, improved network agility, and reduced capital expenditures. The country's rapid 5G rollout, with services now available in 99.6% of districts supported by over 4.69 lakh Base Transceiver Stations serving approximately 25 crore users, has created substantial demand for virtualized core network solutions. Reliance Jio's deployment of the world's largest 5G Standalone network, built on cloud-native principles with an in-house technology stack, exemplifies the industry's direction toward virtualized infrastructure. The expansion of data centers, with investments exceeding USD 32 billion announced in recent years, further supports market growth by providing the foundational infrastructure for vEPC deployments.

India Virtualized Evolved Packet Core Market Trends:

Accelerating 5G Network Deployments

The rapid deployment of 5G networks across India is a primary trend driving vEPC adoption. With 5G services launched in October 2022 and achieving near-universal coverage within two years, virtualized evolved packet core solutions have become essential for managing increased data traffic and ensuring network scalability. According to the Ministry of Communications, by January 2025, 5G services were available in nearly all districts, supported by over 4.69 lakh Base Transceiver Stations. Reliance Jio achieved 213 million 5G subscribers by mid-2025, while Bharti Airtel reached approximately 90 million, demonstrating the massive scale requiring virtualized core infrastructure.

Growing Cloud Computing Adoption

The increasing employment of cloud computing is significantly propelling market growth. Nearly 40% of Indian enterprises were expected to incorporate cloud services by 2024, enabling virtualized evolved packet core solutions to function in virtualized environments. Cloud-based vEPC solutions enhance network performance through dynamic resource allocation and efficient bandwidth management. Major cloud providers including Amazon Web Services, Microsoft Azure, and Google Cloud have collectively pledged over USD 15 billion for expanding data center infrastructure around Mumbai, Chennai, and Hyderabad, providing the foundation for cloud-native vEPC deployments.

Rising Focus on Smart City and IoT Connectivity

The expansion of smart city projects and IoT connectivity is encouraging vEPC adoption. Under the Smart Cities Mission, all 100 Smart Cities now have fully operational Integrated Command and Control Centres utilizing AI, IoT, and Data Analytics. As of March 2025, over 7,555 projects worth Rs. 1,51,361 crore have been completed. India’s machine-to-machine cellular connections have expanded rapidly, reflecting strong growth in connected devices across industries. This accelerating adoption highlights rising demand for scalable, flexible, and efficient connectivity frameworks, increasing the importance of robust virtualized core network infrastructure capable of supporting large volumes of devices, diverse use cases, and dynamic traffic patterns.

Market Outlook 2026-2034:

The India virtualized evolved packet core market outlook remains highly positive, supported by continued investments in telecom infrastructure modernization and the transition toward cloud-native network architectures. The expansion of enterprise 5G networks and growing adoption of edge computing are expected to create additional demand for virtualized core solutions. The India AI Mission, with an outlay of USD 1.2 billion for GPU procurement and AI infrastructure development, will further drive the need for advanced network virtualization capabilities. The market generated a revenue of USD 395.03 Million in 2025 and is projected to reach a revenue of USD 2,538.69 Million by 2034, growing at a compound annual growth rate of 22.96% from 2026-2034.

India Virtualized Evolved Packet Core Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component Type |

Solution |

56% |

|

Use |

Internet of Things (IoT) and Machine to Machine (M2M) |

25% |

|

End User |

Telecom Operator |

71% |

|

Region |

South India |

32% |

Component Type Insights:

- Solution

- Service

Solution dominates with a market share of 56% of the total India virtualized evolved packet core market in 2025.

The solution segment encompasses comprehensive virtualized network function software including Mobility Management Entity, Serving Gateway, Packet Data Network Gateway, Home Subscriber Server, and Policy and Charging Rules Function. Telecom operators are increasingly investing in integrated solution packages that offer complete packet core functionality with seamless 4G to 5G transition capabilities. The demand for cloud-native solutions that support containerization and microservices architecture is particularly strong as operators modernize their infrastructure.

The expansion of the solution segment is reinforced by increasing demand for network slicing capabilities that can accommodate a wide range of applications, from high-capacity data services to latency-sensitive and mission-critical communications. The broader shift toward cloud-native, unified core architectures reflects an industry preference for integrated solutions that support multiple service types on a single platform, enabling greater scalability, operational efficiency, and flexible network management.

Use Insights:

- Long Term Evolution (LTE)

- Voice Over LTE (VoLTE)

- Voice over Wi-Fi (VoWiFi)

- Broadband Wireless Access (BWA)

- Internet of Things (IoT) and Machine to Machine (M2M)

- Mobile Private Networks (MPNs)

- Mobile Virtual Network Operators (MVNOs)

Internet of Things (IoT) and Machine to Machine (M2M) lead with a share of 25% of the total India virtualized evolved packet core market in 2025.

The IoT and M2M segment is experiencing robust growth driven by the massive expansion of connected devices across industrial, automotive, and utility sectors. India's cellular M2M connections reached 94.57 million by September 2025, representing a 73% year-over-year growth, with projections indicating the base will cross 200 million by end of 2026. The deployment of vEPC in IoT core networks facilitates superior connectivity for M2M devices, enabling operators to explore new customer services and revenue streams.

Public-sector digitalization programs and nationwide technology initiatives are acting as key enablers for the expansion of IoT and machine-to-machine connectivity. Widespread adoption of smart utility systems and the growing integration of connected vehicle technologies are accelerating demand for reliable cellular connectivity across multiple sectors. This momentum is increasing the need for scalable and flexible virtualized core network infrastructure capable of efficiently handling rising IoT traffic and diverse application requirements.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Telecom Operator

- Enterprise

Telecom operator exhibits clear dominance with a 71% share of the total India virtualized evolved packet core market in 2025.

Telecom operators remain the primary adopters of virtualized evolved packet core solutions as they transition from legacy hardware-based infrastructure to software-defined architectures. Major operators are investing heavily in virtualized core networks to support their 4G and 5G services. The need to efficiently handle growing data traffic while reducing operational costs drives operators to implement vEPC solutions that offer scalability and flexibility.

Intensifying competition within the telecom sector has accelerated the adoption of virtualized evolved packet core solutions, as service providers focus on improving service quality and enabling faster rollout of new capabilities. The shift toward cloud-native core architectures highlights the strategic role of virtualized core infrastructure in supporting scalability, flexibility, and future-ready networks. Overall, the operator segment remains a primary driver of market growth as network modernization and service differentiation continue to gain priority.

Regional Insights:

- North India

- South India

- East India

- West India

South India represents the largest regional share at 32% of the total India virtualized evolved packet core market in 2025.

South India’s strong position in the virtualized evolved packet core landscape is driven by the concentration of technology ecosystems and well-developed IT infrastructure across major metropolitan centers. These cities benefit from extensive data center presence and a mature digital backbone that supports high-volume, low-latency connectivity needs. The clustering of technology firms, IT service activities, and large enterprise operations generates sustained demand for advanced, scalable network solutions, reinforcing the importance of virtualized core infrastructure in the region.

The region benefits from strong submarine cable connectivity and established colocation facilities that support vEPC deployments. Major investments by hyperscale cloud providers in Hyderabad and Chennai, along with the growing enterprise adoption of private 5G networks in manufacturing and automotive sectors concentrated in the South, continue to drive regional market growth. State-level data center policies in Karnataka, Tamil Nadu, and Telangana provide additional incentives for digital infrastructure investments.

Market Dynamics:

Growth Drivers:

Why is the India Virtualized Evolved Packet Core Market Growing?

Rapid 5G Network Deployment Across India

The rapid rollout of 5G networks across India has emerged as a key driver for the adoption of virtualized evolved packet core solutions. The pace and scale of network expansion have increased the need for flexible, cloud-based core architectures that can efficiently manage higher data traffic, enable network slicing for varied applications, and optimize resource utilization. As 5G coverage continues to broaden nationwide, virtualized core infrastructure has become essential for supporting large user bases, ensuring service reliability, and enabling advanced use cases across consumer and enterprise segments.

Expansion of Data Center Infrastructure and Cloud Computing

The substantial growth in data center infrastructure is creating a favorable environment for vEPC adoption. Local and global technology firms have announced investments exceeding USD 32 billion in the past two years to expand data center infrastructure in India. India's IT load capacity totaled 1.4 GW as of mid-2025 and is expected to double within two years. Large-scale expansion of cloud and data center infrastructure across key metropolitan and industrial regions is strengthening the foundation for advanced telecom network architectures. Increased availability of high-capacity computing and storage resources is enabling broader adoption of cloud-native virtualized evolved packet core solutions. This infrastructure build-out supports the shift toward software-defined, scalable, and flexible network models, allowing operators to deploy and manage core network functions more efficiently while accommodating growing traffic demands and evolving service requirements.

Government Digital Initiatives and Smart City Programs

Nationwide digital transformation initiatives are playing a pivotal role in accelerating growth of the virtualized evolved packet core market by increasing demand for advanced and adaptable network infrastructure. Programs focused on smart urban development, domestic technology manufacturing, and artificial intelligence adoption are driving widespread deployment of connected systems across public services. These initiatives rely heavily on IoT-enabled applications, data-driven platforms, and real-time monitoring, all of which require scalable, flexible, and software-defined core networks. As connectivity needs expand across utilities, transportation, and public safety, virtualized core solutions are becoming essential for efficiently managing large volumes of devices and diverse traffic requirements.

Market Restraints:

What Challenges the India Virtualized Evolved Packet Core Market is Facing?

Complex Migration from Legacy Infrastructure

The transition from traditional hardware-based evolved packet core systems to virtualized architectures presents significant technical challenges. Telecom operators face complexities in integrating virtualized solutions with existing legacy infrastructure while maintaining service continuity. The migration process requires substantial technical expertise, careful planning, and extended implementation timelines, potentially delaying the adoption of vEPC solutions among operators with extensive legacy deployments.

High Initial Investment Requirements

The deployment of virtualized evolved packet core solutions requires substantial upfront investment in computing infrastructure, software licenses, and skilled personnel. While vEPC offers long-term operational cost benefits, the initial capital requirements can be prohibitive for smaller operators and enterprises. The need for compatible data center facilities, server infrastructure, and management systems adds to the total cost of ownership considerations.

Network Security and Reliability Concerns

The software-based nature of virtualized evolved packet core solutions raises concerns regarding network security and reliability compared to purpose-built hardware systems. Operators must address vulnerabilities associated with virtualization layers and ensure robust security protocols for multi-tenant cloud environments. Ensuring consistent quality of service and maintaining carrier-grade reliability standards in virtualized deployments requires advanced orchestration and management capabilities.

Competitive Landscape:

The India virtualized evolved packet core market exhibits a moderately competitive landscape characterized by the presence of global telecommunications equipment manufacturers alongside specialized software providers. Leading international players are actively competing for market share through partnerships with domestic telecom operators. The market is witnessing increased focus on cloud-native solutions, with vendors investing in containerized architectures and microservices-based platforms to address evolving operator requirements. Strategic collaborations between equipment vendors and cloud service providers are becoming increasingly common to deliver integrated vEPC solutions. Indigenous technology development is also emerging, exemplified by Reliance Jio's in-house 5G core stack. The competitive dynamics are further shaped by operators' preferences for multi-vendor strategies and the growing emphasis on interoperability and open standards compliance.

Recent Developments:

- April 2025: Bharti Airtel and Nokia expanded their core network collaboration to accelerate new 5G service delivery. The partnership focuses on enhancing Airtel's network capabilities to deliver differentiated 5G experiences, supporting the operator's strategy to improve service quality and expand connectivity options for its subscriber base.

- November 2024: Vodafone Idea announced a Rs 30,000 crore capital expenditure program for building 4G and 5G capacity across India. The operator selected Ericsson, Nokia, and Samsung for the network expansion contracts, signaling renewed investment in virtualized network infrastructure.

India Virtualized Evolved Packet Core Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Solution, Service |

| Uses Covered | Long Term Evolution (LTE), Voice Over LTE (VoLTE), Voice over Wi-Fi (VoWiFi), Broadband Wireless Access (BWA), Internet of Things (IoT) and Machine to Machine (M2M), Mobile Private Networks (MPN’s), Mobile Virtual Network Operators (MVNO’s) |

| End Users Covered | Telecom Operator, Enterprise |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India virtualized evolved packet core market size was valued at USD 395.03 Million in 2025.

The India virtualized evolved packet core market is expected to grow at a compound annual growth rate of 22.96% from 2026-2034 to reach USD 2,538.69 Million by 2034.

Solution dominated the market with a 56% share in 2025, driven by increasing demand for comprehensive virtualized network function software that enables operators to deploy scalable core network architectures efficiently.

Key factors driving the India virtualized evolved packet core market include rapid 5G network deployment across all states and territories, expansion of data center infrastructure with over USD 32 billion in investments, government digital initiatives including Smart Cities Mission and India AI Mission, and growing adoption of IoT and M2M connectivity.

Major challenges include the complexity of migrating from legacy hardware-based infrastructure to virtualized architectures, high initial investment requirements for computing infrastructure and software licenses, network security concerns in multi-tenant cloud environments, and the need for specialized technical expertise.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)