India Virtual Production Market Size, Share, Trends and Forecast by Component, Type, End Use, and Region, 2025-2033

India Virtual Production Market Overview:

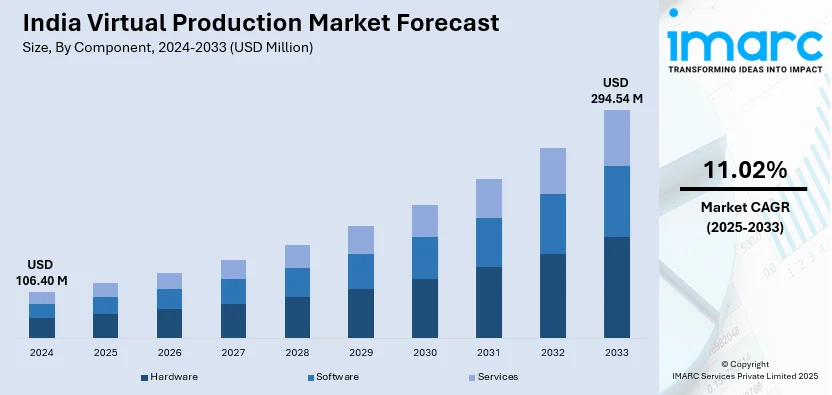

The India virtual production market size reached USD 106.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 294.54 Million by 2033, exhibiting a growth rate (CAGR) of 11.02% during 2025-2033. The India virtual production market share is fueled by growing demand for high-quality content production, growth in digital technology, and the entertainment and media industries. Moreover, the growth in OTT platforms, and demand for cost-efficient production options are also fueling the India virtual production market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 106.40 Million |

| Market Forecast in 2033 | USD 294.54 Million |

| Market Growth Rate 2025-2033 | 11.02% |

India Virtual Production Market Trends:

Growing Adoption of Virtual Sets and Real-Time Rendering Technology

One of the key trends driving the India virtual production market is the growing adoption of virtual sets and real-time rendering technologies. Virtual production enables filmmakers to create immersive and interactive environments by leveraging advanced digital technologies such as Unreal Engine, LED walls, and motion capture. It has developed strongly in India's television and film-making industries since it provides creative freedom and cost-effectiveness over the conventional approach. With virtual sets, producers are able to create complicated scenes without spending time and money traveling to different locations or creating extensive physical sets, hence shortening production time and expenditure. Real-time rendering also improves the process, allowing directors and crews to see scenes live while shooting, instead of in post-production. It is especially welcoming for the fast-emerging OTT and digital content markets, where high-end, visually rich content is needed. For example, Mahindra’s Thar campaign (2023) employed virtual production to transport audiences on an exhilarating journey across deserts and mountains while remaining comfortably in a studio. This combination of physical and digital was a particularly intriguing advertisement, and no one ever imagined that a significant portion of it was not filmed on site. The continuous development of these technologies is likely to drive the market growth in India.

To get more information of this market, Request Sample

Rise in Demand for Virtual Production in the OTT and Web Series Industry

The virtual production market in India is also witnessing increased demand from the web series and OTT sector. As the streaming services like Netflix, Amazon Prime Video, and Disney+ Hotstar continue to expand rapidly, the demand for quality content is on the rise to fulfill consumer needs. According to industry reports, the Indian subscription video on demand (SVOD) sector is expected to expand at a compounded annual growth rate (CAGR) of 11.1%, reaching a USD 2.77 Billion market by 2027. Virtual production is an effective method of generating visually appealing, high-production-value content at a lower price and reduced turnaround time. This is particularly useful for web series, which tend to have many episodes that involve complex visual effects. Virtual sets and real-time technology allow directors to be as creative as possible, creating settings that would be impractical or too costly to execute using conventional means. With the need for unique and visually appealing content still on the increase, more OTT platforms are implementing virtual production methods. According to the IMARC Group, the India over the top (OTT) market size reached USD 4.5 Billion in 2024 and is further expected to reach USD 27.2 Billion by 2033. This trend is set to expand, as studios and production houses look for new means of addressing the competitive, fast-moving OTT content space in India.

India Virtual Production Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, type, and end use.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Type Insights:

- Pre-Production

- Production

- Post-Production

The report has provided a detailed breakup and analysis of the market based on the type. This includes pre-production, production, and post-production.

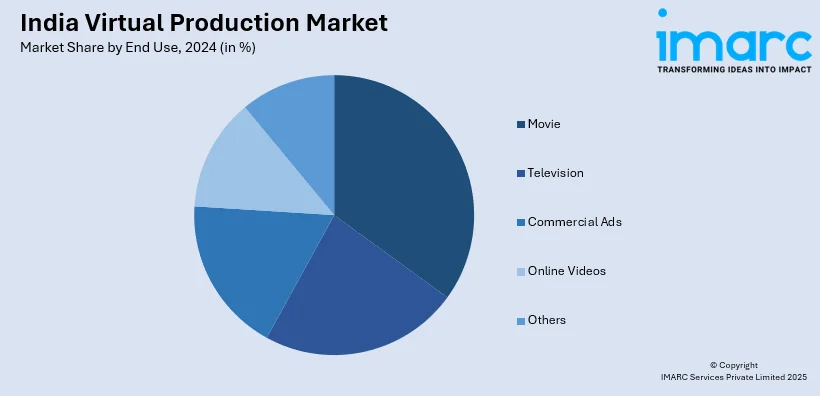

End Use Insights:

- Movie

- Television

- Commercial Ads

- Online Videos

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes movie, television, commercial ads, online videos, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Virtual Production Market News:

- In October 2024, Adobe announced that it has begun publicly releasing an AI model capable of creating video from text prompts, entering the expanding arena of companies aiming to transform film and television production through generative artificial intelligence.

- In October 2023, Aptech inaugurated India's First Comprehensive end-to-end Virtual Production Academy in Mumbai.

- In January 2025, Annapurna Studios, in partnership with Dolby, inaugurated India’s premier Dolby certified post-production facility for both cinema and home use. The renowned filmmaker S S Rajamouli inaugurated the facility alongside the famous actor Nagarjuna Akkineni, Vice Chairman of Annapurna Studios.

India Virtual Production Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Types Covered | Pre-Production, Production, Post-Production |

| End Uses Covered | Movie, Television, Commercial Ads, Online Videos, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India virtual production market performed so far and how will it perform in the coming years?

- What is the breakup of the India virtual production market on the basis of component?

- What is the breakup of the India virtual production market on the basis of type?

- What is the breakup of the India virtual production market on the basis of end use?

- What is the breakup of the India virtual production market on the basis of region?

- What are the various stages in the value chain of the India virtual production market?

- What are the key driving factors and challenges in the India virtual production?

- What is the structure of the India virtual production market and who are the key players?

- What is the degree of competition in the India virtual production market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India virtual production market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India virtual production market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India virtual production industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)