India Vinyl Acetate Monomer Market Size, Share, Trends and Forecast by Application, End-Use, and Region, 2025-2033

India Vinyl Acetate Monomer Market Overview:

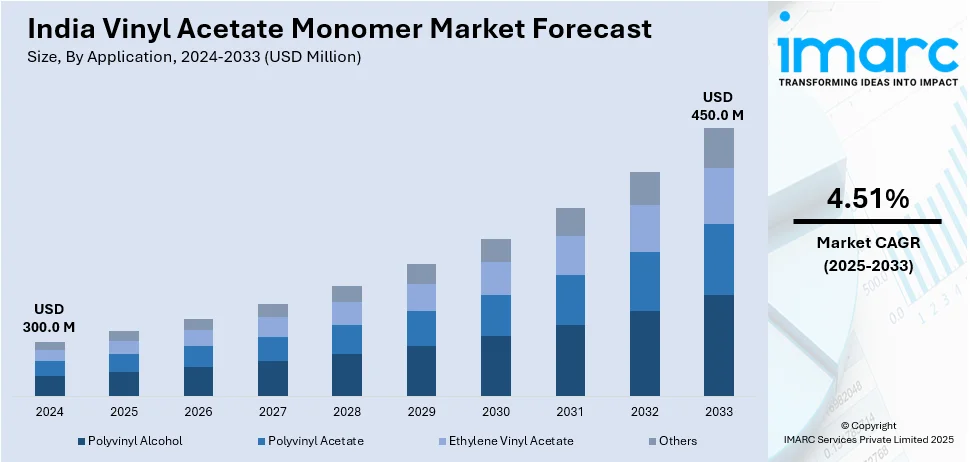

The India vinyl acetate monomer market size reached USD 300.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 450.0 Million by 2033, exhibiting a growth rate (CAGR) of 4.51% during 2025-2033. The market share is expanding, driven by the increasing implementation of government initiatives that support textile manufacturing and exports, along with the rising trend of high-end finishes and improved vehicle aesthetics, which is creating the need for vinyl acetate monomer in paints and varnishes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 300.0 Million |

| Market Forecast in 2033 | USD 450.0 Million |

| Market Growth Rate 2025-2033 | 4.51% |

India Vinyl Acetate Monomer Market Trends:

Growing applications in textile industry

Rising applications in the textile industry are impelling the India vinyl acetate monomer market growth. Firms rely on vinyl acetate monomer-based items for a variety of textile applications. Vinyl acetate monomer is an important raw ingredient in the manufacturing of polyvinyl alcohol (PVOH) and polyvinyl acetate (PVA), which are commonly used in fabric coatings, adhesives, and textile finishes. With India's textile industry thriving to fulfill strong domestic and export demand, the need for high-quality binders, coatings, and finishes is growing. Textile makers employ vinyl acetate monomer-derived polymers for fabric stiffening, wrinkle resistance, and increased durability, which improves the quality of finished textiles. Furthermore, the growing popularity of technical textiles and sustainable fabric processing is fueling the market growth, as vinyl acetate monomer-oriented products are known for their versatility and eco-friendliness. The rising popularity of synthetic and hybrid fabrics, which require strong adhesives and coatings, is catalyzing the demand for vinyl acetate monomers. Furthermore, government programs supporting textile manufacturing and exports are encouraging investments in fabric processing technology, resulting in increasing vinyl acetate monomer usage. In October 2024, India introduced its textile policy, aimed at bolstering the textile industry through various financial incentives. The policy emphasized two key sectors, including technical textiles, which encompassed clothing and apparel, and diverse manufacturing processes, such as weaving and dyeing. The policy offered different financial assistance options for businesses, including capital subsidies between 10% and 35% of qualifying fixed capital expenditures, with a cap of INR 100 Crores depending on the taluka and activity.

To get more information of this market, Request Sample

Rising vehicle production

The increasing automotive production is offering a favorable India vinyl acetate monomer market outlook. As per the information published on the official website of the Invest India, the automotive industry accounted for around 6% of India's national GDP, with exports totaling 4.5 Million units in all categories during the fiscal year 2023-24, comprising 672,105 passenger cars and 3.45 million two-wheelers. Vinyl acetate monomer is a key ingredient in manufacturing adhesives, coatings, and paints essential for vehicle interiors and exteriors. As car production rises to meet the growing consumer demand, automakers require more high-performance adhesives for assembling components, bonding materials, and improving durability. Vinyl acetate monomer-based coatings are also widely employed for corrosion resistance, ensuring longevity and aesthetic appeal in vehicles. Additionally, the ongoing shift towards lightweight and fuel-optimized vehicles is promoting the use of advanced materials, including vinyl acetate monomer-oriented items, in plastic components, seat laminations, and safety glass. With India’s encouragement for electric vehicles (EVs), manufacturers are investing in innovative materials that enhance efficiency and durability. The rising trend of high-end finishes and refined vehicle aesthetics is also creating the need for vinyl acetate monomers in paints and varnishes.

India Vinyl Acetate Monomer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on application and end-use.

Application Insights:

- Polyvinyl Alcohol

- Polyvinyl Acetate

- Ethylene Vinyl Acetate

- Others

The report has provided a detailed breakup and analysis of the market based on the applications. This includes polyvinyl alcohol, polyvinyl acetate, ethylene vinyl acetate, and others.

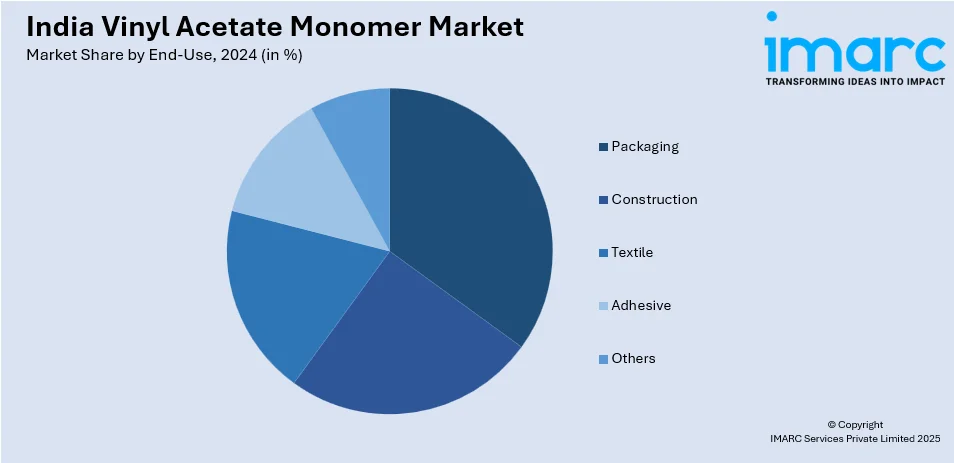

End-Use Insights:

- Packaging

- Construction

- Textile

- Adhesive

- Others

A detailed breakup and analysis of the market based on the end-uses have also been provided in the report. This includes packaging, construction, textile, adhesive, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Vinyl Acetate Monomer Market News:

- In May 2024, Asian Paints (Polymers) Pvt Ltd, began working on a greenfield project, covering an expected 25 acres of land in Dahej, Gujarat. The project planned to establish a manufacturing facility for vinyl acetate monomer, redispersible polymer (RDP), and vinyl acetate ethylene emulsion (VAE). The total capacity was set to reach 605,000 MTPA, with vinyl acetate monomer contributing 220,000 MTPA and VAE adding 360,000 MTPA.

India Vinyl Acetate Monomer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Polyvinyl Alcohol, Polyvinyl Acetate, Ethylene Vinyl Acetate, Others |

| End-Uses Covered | Packaging, Construction, Textile, Adhesive, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India vinyl acetate monomer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India vinyl acetate monomer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India vinyl acetate monomer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vinyl acetate monomer market in India was valued at USD 300.0 Million in 2024.

The India vinyl acetate monomer market is projected to exhibit a CAGR of 4.51% during 2025-2033, reaching a value of USD 450.0 Million by 2033.

The India vinyl acetate monomer market is driven by rising demand from the adhesives, paints, and coatings industries. Growth in construction, packaging, and automotive sectors further boosts consumption. Increasing industrialization and expansion of manufacturing facilities support the market's upward trajectory across various end-use applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)