India Video Surveillance Systems Market Size, Share, Trends and Forecast by System Type, Component, Application, Enterprise Size, Customer Type, and Region, 2026-2034

India Video Surveillance Systems Market Overview:

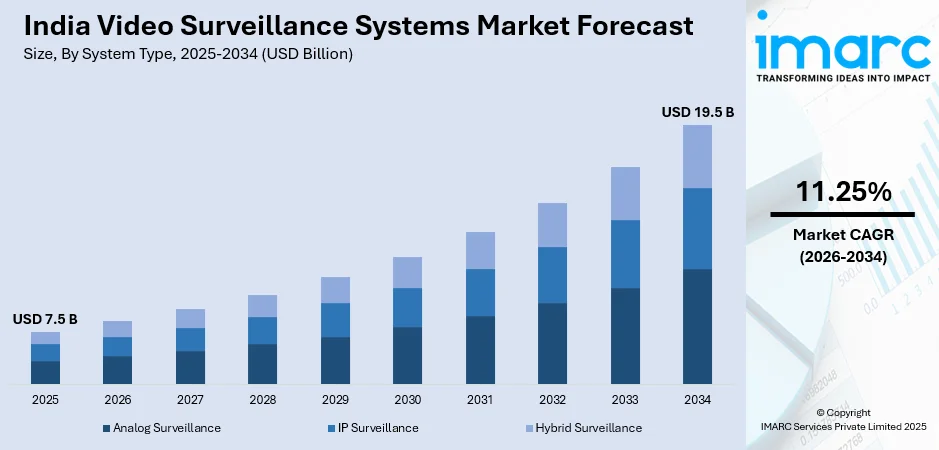

The India video surveillance systems market size reached USD 7.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 19.5 Billion by 2034, exhibiting a growth rate (CAGR) of 11.25% during 2026-2034. Government initiatives like the Smart Cities Mission, rising urbanization, industrial expansion, technological advancements such as AI and IoT integration, increasing security concerns, law enforcement modernization, and cybersecurity enhancements in surveillance solutions are driving the India video surveillance systems market, fostering widespread adoption across public and private sectors.

Key Takeaways:

- In 2025, the India video surveillance systems market was estimated at USD 7.5 billion.

- The market is expected to grow to USD 19.5 billion by 2034, reflecting a compound annual growth rate (CAGR) of approximately 11.25% from 2026 to 2034.

- Major growth drivers include rising concerns over public safety and security, increasing adoption of advanced IP-based surveillance technologies, government initiatives for smart city development, and growing demand from commercial, industrial, and residential sectors across India.

- Segmentation Highlights:

- System Type: Analog Surveillance, IP Surveillance, Hybrid Surveillance.

- Component: Hardware, Software, Services.

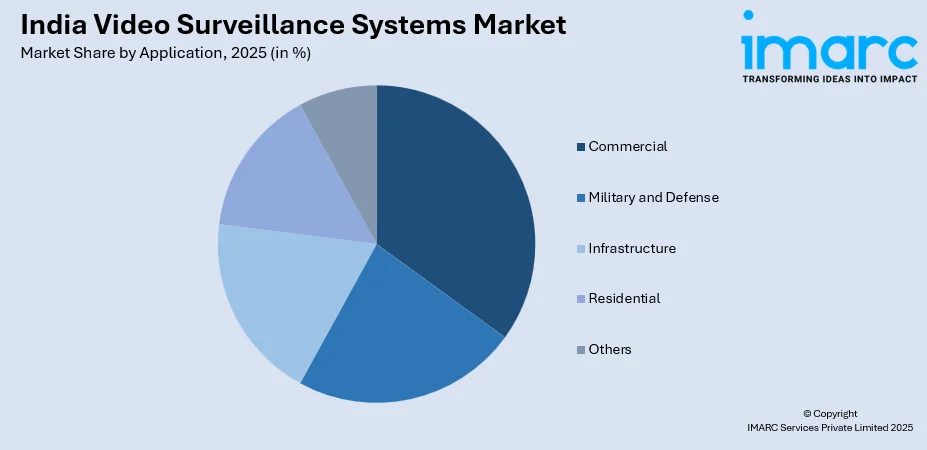

- Application: Commercial, Military and Defense, Infrastructure, Residential, Others.

- Enterprise Size: Small Scale Enterprise, Medium Scale Enterprise, Large Scale Enterprise.

- Customer Type: B2B, B2C

- Regional Insights: Covering North, South, East, and West India, the analysis outlines promising opportunities across different regions.

To get more information on this market, Request Sample

India Video Surveillance Systems Market Trends:

Government Initiatives and Policies

Proactive initiatives by the Indian government have gone a long way in popularizing video surveillance systems in India. Programs like the Smart Cities Mission seek to upgrade urban spaces by deploying cutting-edge technologies to augment infrastructure and services. The adoption of sound surveillance systems is a central part of the mission to promote public security and effective management of urban spaces. Up to 2022, 100 cities were chosen under this mission, and a big part of the budget was allocated for deploying surveillance systems. Furthermore, the Ministry of Home Affairs has stressed the modernization of police forces through the inclusion of technology-based solutions. The modernization also involves the setting up of city-wide surveillance networks to assist law enforcement agencies in preventing and investigating crimes. The government's focus on "Digital India" also supports these efforts by encouraging the development of digital infrastructure, which naturally facilitates the integration of surveillance technologies. Such policies have not just expedited the installation of surveillance systems in the public domain but have also driven private industries like retail and transportation to implement identical technologies, providing a nationwide web of security systems.

Rapid Urbanization and Industrial Growth

India's urban growth has been witnessing a revolutionary transformation, as a major segment of the population is migrating toward the urban hubs. Urbanization calls for the creation of infrastructure to accommodate the increasing population. Cities, with problems regarding traffic control, public security, and infrastructure surveillance, are also increasingly turning toward video surveillance systems as effective means. At the same time, India's industrial sector has been witnessing a massive rise, which has created many manufacturing facilities, warehouses, and commercial complexes, all of which need to be protected by strong surveillance systems to maintain operational security and asset protection. The mutual interaction between industrial expansion and urbanization has provided a productive soil for the spread of video surveillance systems, both private and public organizations striving to strengthen security in an increasingly changing environment. Moreover, the collective actions of the government through strategic plans and innovative urban and industrial development have played a vital role in propelling the growth of the Indian video surveillance systems market as an indication of the dedication towards security, upgradation, and technological progress.

India Video Surveillance Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on system type, component, application, enterprise size, and customer type.

System Type Insights:

- Analog Surveillance

- IP Surveillance

- Hybrid Surveillance

The report has provided a detailed breakup and analysis of the market based on the system type. This includes analog surveillance, IP surveillance, and hybrid surveillance.

Component Insights:

- Hardware

- Software

- Services

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware, software, and services.

Application Insights:

- Commercial

- Military and Defense

- Infrastructure

- Residential

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, military and defense, infrastructure, residential, and others.

Enterprise Size Insights:

- Small Scale Enterprise

- Medium Scale Enterprise

- Large Scale Enterprise

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small scale enterprise, medium scale enterprise, and large-scale enterprise.

Customer Type Insights:

- B2B

- B2C

A detailed breakup and analysis of the market based on the customer type have also been provided in the report. This includes B2B and B2C.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Video Surveillance Systems Market News:

- December 2025: The IFSEC India 2025 event highlighted AI and IoT-based security solutions, with more than 300 brands and sophisticated surveillance technologies. The presence of government and private sector entities underscored the need for innovative video surveillance systems. The use of AI and IoT in security solutions improved efficiency and scalability, boosting the uptake of sophisticated surveillance systems in India.

- September 2025: TRASSIR India held its first 'Tech Meet' in Ahmedabad, to demonstrate AI-based video management and analytics solutions, as well as hardware solutions such as CCTV cameras and NVRs. The company revealed plans to set up experience centers in India and increase local manufacturing and R&D facilities. These efforts help develop the Indian video surveillance systems market by bringing in new technologies and enhancing local production capabilities.

- June 2025: Sparsh CCTV emerged as the first international video surveillance company to gain the IoTSCS cyber-security certification from India's Standardisation Testing and Quality Certification (STQC) Directorate for its full product portfolio. The accomplishment highlights the intent of India to improve the standards of cybersecurity in surveillance technology. Such advancements are driving the Indian video surveillance systems market by building confidence and promoting the uptake of locally manufactured, secure surveillance solutions.

India Video Surveillance Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| System Types Covered | Analog Surveillance, IP Surveillance, Hybrid Surveillance |

| Components Covered | Hardware, Software, Services |

| Applications Covered | Commercial, Military and Defense, Infrastructure, Residential, Others |

| Enterprise Sizes Covered | Small Scale Enterprise, Medium Scale Enterprise, Large Scale Enterprise |

| Customer Types Covered | B2B, B2C |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India video surveillance systems market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India video surveillance systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India video surveillance systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The video surveillance systems market in India was valued at USD 7.5 Billion in 2025.

The India video surveillance systems market is projected to exhibit a CAGR of 11.25% during 2026-2034, reaching a value of USD 19.5 Billion by 2034.

The market is driven by a rise in security concerns across residential and commercial spaces. Organizations are prioritizing asset protection and employee safety. Urban expansion and infrastructure development also demand better coverage for urban areas. Technological improvements in cameras, storage, and analytics enhance system capabilities, making surveillance more accessible, cost-effective, and suited for diverse end-use environments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)