India Veterinary Service Market Size, Share, Trends and Forecast by Service, Animal Type, End Use, and Region, 2025-2033

India Veterinary Service Market Overview:

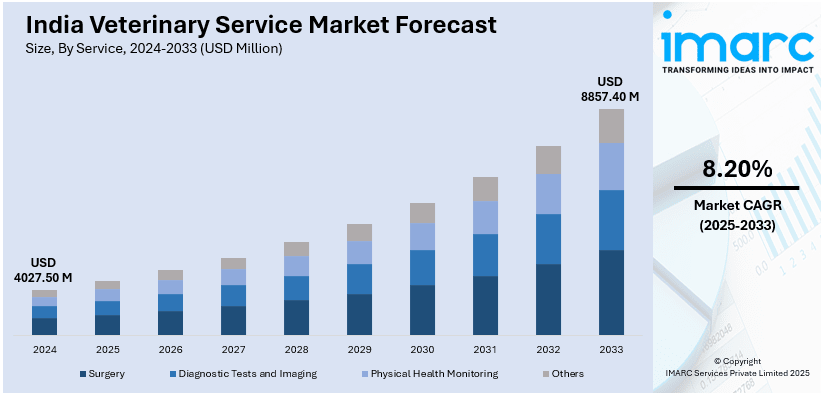

The India veterinary service market size reached USD 4,027.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 8,857.40 Million by 2033, exhibiting a growth rate (CAGR) of 8.20% during 2025-2033. The market is driven by rising pet ownership, increasing livestock demand, government initiatives, zoonotic disease awareness, and advanced veterinary healthcare. Growth in animal husbandry, technological advancements, expanding pet insurance, and higher disposable incomes further boost demand for quality veterinary services and pharmaceuticals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,027.50 Million |

| Market Forecast in 2033 | USD 8,857.40 Million |

| Market Growth Rate 2025-2033 | 8.20% |

India Veterinary Service Market Trends:

Advancements in Veterinary Healthcare and Pharmaceuticals

Technological innovations and advancements in veterinary medicine are significantly improving animal healthcare. The development of diagnostic tools, new vaccines, and telemedicine services is making veterinary care more efficient and accessible. AI-based diagnostics, wearable health monitoring devices for pets, and digital health records are transforming the industry. Additionally, the growing veterinary pharmaceutical sector is introducing advanced treatments for diseases, nutritional supplements, and pet wellness products. With increasing investments from private players and startups, the Indian veterinary market share is witnessing rapid modernization, ensuring better healthcare for pets, livestock, and farm animals. For instance, in December 2024, Healthtech company Crown Veterinary Services (Crown Vet) secured an undisclosed amount of funding from Mars Veterinary Health. This marks Mars Veterinary Health's initial investment in India. It offers extensive global knowledge to Crown Vet’s well-established local presence, which will aid in enhancing veterinary care in India. The funds will be allocated to grow its network and launch enhanced training initiatives for its 240 staff members, which includes 60 veterinarians.

To get more information of this market, Request Sample

Rising Pet Ownership and Humanization of Pets

The increasing adoption of pets, particularly in urban areas, is a key driver of India’s veterinary service market. According to industry reports, in 2024 approximately 66% of the population in India demonstrates the strong emotional bonds that younger generations have with their pets. As pet owners treat their animals as family members, there is a growing demand for advanced healthcare, diagnostics, and specialized treatments. The rise of pet insurance, premium pet food, and wellness services further boosts the need for veterinary care. Social media influence, pet-friendly policies, and awareness campaigns have also contributed to the surge in pet ownership. This trend is expected to continue, leading to higher spending on veterinary services, including vaccinations, surgeries, and preventive healthcare thereby driving the India veterinary service market growth.

Government Initiatives and Veterinary Infrastructure Development

The Indian government is actively promoting veterinary healthcare through policies and programs that enhance rural veterinary services. For instance, in August 2024, The Delhi government intends to establish a call centre in addition to three mobile veterinary units for individuals to report suffering stray animals and request medical assistance for them. The Development Department's Animal Husbandry unit issued a request for proposals to establish the center. The government has designed the model to deliver enhanced veterinary services for livestock right at the doorstep where such services are lacking and animal owners require veterinary assistance. Initiatives such as free vaccination drives, mobile veterinary clinics, and subsidies for animal healthcare encourage farmers to invest in veterinary care. The focus on preventing zoonotic diseases and improving food safety regulations has increased the need for veterinary diagnostics and biosecurity measures. Furthermore, investments in veterinary colleges and research centers help develop skilled professionals, boosting overall veterinary infrastructure. These efforts aim to make veterinary services more accessible and affordable, particularly in rural and semi-urban areas, creating a positive India veterinary service market outlook.

India Veterinary Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional/country level for 2025-2033. Our report has categorized the market based on service, animal type, and end use.

Service Insights:

- Surgery

- Diagnostic Tests and Imaging

- Physical Health Monitoring

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes surgery, diagnostic tests and imaging, physical health monitoring, and others.

Animal Type Insights:

- Companion Animal

- Farm Animal

A detailed breakup and analysis of the market based on animal type have also been provided in the report. This includes companion animal and farm animal.

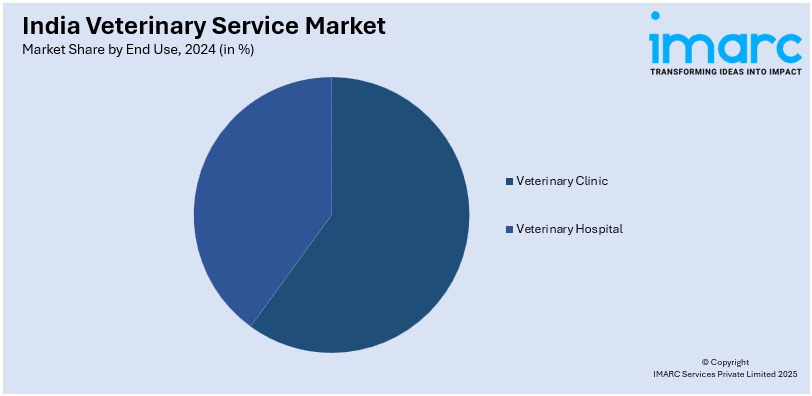

End Use Insights:

- Veterinary Clinic

- Veterinary Hospital

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes veterinary clinic and veterinary hospital.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Veterinary Service Market News:

- In February 2025, Supertails, a prominent tech-driven pet care brand in India, inaugurated its initial offline clinic in Bengaluru, fully staffed with Fear Free Certified veterinarians and healthcare experts. This program seeks to change anxious vet appointments into peaceful, caring, and supportive encounters for pets and their owners.

- In March 2024, Sukhvinder Singh Sukhu, the chief minister of Himachal Pradesh, inaugurated the 1962 mobile veterinary service for 44 blocks in the initial phase, at an expense of ₹7.04 crore. Three mobile ambulances will be allocated to the districts of Una Bilaspur, Kullu, and Solan, two to Lahaul-Spiti, five to Mandi and Shimla, Sirmaur, and Hamirpur, four each to Chamba, one to Kinnaur, and seven to Kangra district.

India Veterinary Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Surgery, Diagnostic Tests and Imaging, Physical Health Monitoring, Others |

| Animal Types Covered | Companion Animal, Farm Animal |

| End Uses Covered | Veterinary Clinic, Veterinary Hospital |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India veterinary service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India veterinary service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India veterinary service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India veterinary service market size reached USD 4,027.50 Million in 2024.

The India veterinary service market is expected to reach USD 8,857.40 Million by 2033, exhibiting a CAGR of 8.20% during 2025-2033.

Market growth is driven by increasing pet ownership, rising awareness of animal health and welfare, growing demand for livestock healthcare, advancements in veterinary diagnostics and treatments, and government initiatives supporting animal husbandry and veterinary infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)