India Veterinary Medicine Market Size, Share, Trends and Forecast by Product, Animal Type, Route of Administration, Distribution Channel, and Region, 2025-2033

Market Overview:

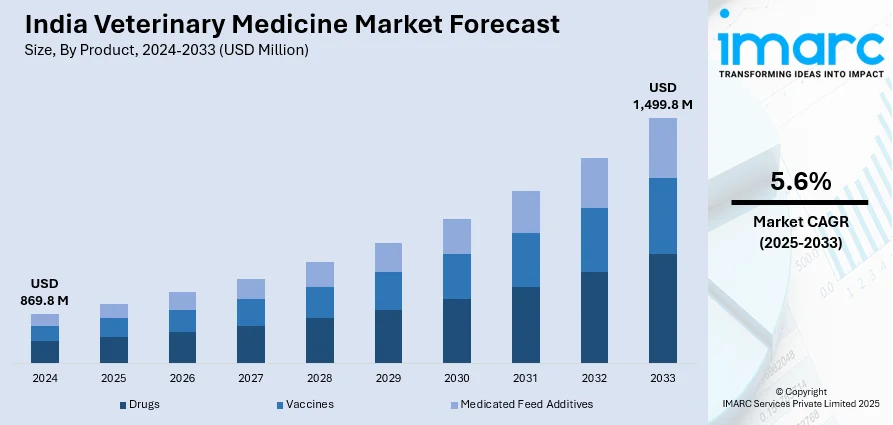

The India veterinary medicine market size reached USD 869.8 Million in 2024. The market is expected to reach USD 1,499.8 Million by 2033, exhibiting a growth rate (CAGR) of 5.6% during 2025-2033. The market growth is attributed to increasing number of pet parents, rise in the prevalence of zoonotic diseases, Government of India's implementation of centrally sponsored Livestock Health and Disease Control (LH&DC) scheme, launch of National Animal Disease Control Programme (NADCP), growing consumption of meat and dairy products, introduction of 24x7 veterinary hospitals by state governments, introduction of online veterinary consultation for pets, and increasing adoption of the one health (OH) approach.

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East India.

- On the basis of product, the market has been divided into drugs, vaccines, and medicated feed additives.

- On the basis of animal type, the market has been divided into companion animals and livestock animals.

- On the basis of route of administration, the market has been divided into oral, parenteral, and topical.

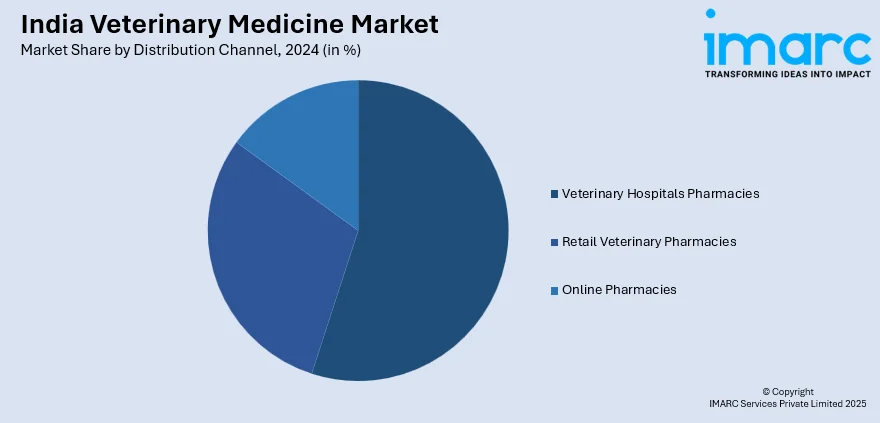

- On the basis of distribution channel, the market has been divided into veterinary hospitals pharmacies, retail veterinary pharmacies, and online pharmacies.

Market Size and Forecast:

- 2024 Market Size: USD 869.8 Million

- 2033 Projected Market Size: USD 1,499.8 Million

- CAGR (2025-2033): 5.6%

Veterinary medicine is a branch of medicine involving the prevention, management, diagnosis, and treatment of diseases that affect the health of household pets, exotic species, and wild animals. It assists in biomedical research and monitoring of animal health in commercial animal husbandry. Besides this, as it also aids in providing advanced medical, dental, and surgical care, which includes insulin injections, root canals, hip replacements, cataract extractions, and pacemakers, there is a rise in the demand for veterinary medicine across India.

To get more information on this market, Request Sample

The increasing number of pet parents represent one of the key factors impelling the growth of the market in India. Moreover, there is a rise in the prevalence of zoonotic diseases, such as rabies, plague, toxoplasmosis, cysticercosis, echinococcosis, leptospirosis, nipah, trypanosomiasis, and kyasanur forest disease (KFD), in the country. As a result, the Government of India has implemented a centrally sponsored Livestock Health and Disease Control (LH&DC) scheme to tackle the issue of livestock health and disease effectively. It has also launched National Animal Disease Control Programme (NADCP) for controlling foot and mouth disease (FMD) and brucellosis by vaccinating cattle, buffalo, sheep, goat and pig population. This, coupled with the growing consumption of meat and dairy products in the country, is positively influencing the veterinary industry in India. Apart from this, several state governments are introducing 24x7 veterinary hospitals to provide extended care to companion and farm animals. Additionally, leading players are introducing online veterinary consultation for pets across India. The increasing adoption of the one health (OH) approach, which is strategically gaining significance from veterinarians and healthcare providers, is also fueling the growth of the market in the country.

India Veterinary Medicine Market Trends:

Increasing Demand for Livestock Health Management

India's increasing population, coupled with increasing disposable incomes, is driving increased demand for milk, meat, and poultry products. This, in turn, has put focus on livestock productivity, with animal health management as a natural consequence. Farmers are increasingly turning to preventive healthcare strategies, such as vaccinations, feed additives, and parasite control medications, in order to lower mortality rates and increase yield. In addition, government programs addressing foot-and-mouth disease and brucellosis are widening the applications of veterinary drugs, thereby enhancing India veterinary medicine market outlook. private sector players are also creating awareness among rural farmers through training and veterinary camps. With the largest portion of the livestock sector being dairy, therapeutic and nutritional veterinary drugs are witnessing consistent growth. This is supported by the transition towards intensive farming methods, which increase the likelihood of disease outbreaks and subsequently require more veterinary attention. The outcome is a continuous growth of conventional pharmaceuticals and biologics to enhance livestock health and productivity.

Expansion of Companion Animal Healthcare

Increased urbanization and changes in lifestyle are fueling an increase in the number of pets in India, particularly in urban areas. This trend is significantly augmenting the India veterinary medicine market share. pet populace is dominated by cats and dogs, and owners are now treating them more like members of their families, thereby spending more on their well-being and health. This pattern of need is driving the demand for vaccines, anti-infectives, dermatology treatments, and dietary supplements for companion animals. Nuclear family growth and increased Western pet influence have also helped drive this growth. Veterinary clinics, diagnostic centers, and pet specialty pharmacies are increasing in cities with the help of e-commerce sites that make veterinary drugs more accessible. Multinational players are also consolidating their bases in India with product offerings directed towards companion animals as they see huge growth potential in this segment. Preventive care, including regular vaccination and flea-tick control, is increasingly becoming mainstream, a significant departure from the past emphasis on treatment only when the animal was ill. This trend has spurred a strong market for companion animal therapeutics in India.

Some of the other trends include,

- AI-Enabled Diagnostic Solutions: AI-enabled platforms like Zoetis's Vetscan Imagyst system are revolutionizing veterinary diagnostics through real-time cytology interpretation. Early tumor and other abnormality detection is made possible by the AI Masses module, resulting in reduced turnaround time for treatment decisions. This technology enhances accuracy, aids veterinarians in high-volume hospitals, and extends access to advanced diagnostics beyond specialty centers.

- Telehealth Scale-Up: Telehealth platforms that are integrated with the Ayushman Bharat Digital Mission are reaching specialist consultations to inaccessible districts. Rural farmers and animal owners are now able to access veterinarians through mobile apps for quicker interventions. The scale-up closes the urban-rural gap in healthcare while minimizing disease-related losses in livestock.

- Eco-Friendly Packaging in Veterinary Medicines: The India veterinary medicine industry is embracing biodegradable, recyclable, and plastic-reduced packaging for veterinary pharmaceuticals. It is a move that is in line with international sustainability ambitions and measures against increasing environmental awareness among consumers. Such companies are also enhancing their brand reputation and compliance with regulations.

- Antibiotic Stewardship Programs: Antibiotic stewardship programs are being encouraged in order to control antimicrobial resistance among livestock and companion animals. Regulators are pressuring the adoption of alternatives such as vaccines and probiotics while limiting unrestricted antibiotic use. These programs focus on preserving long-term drug effectiveness and maintaining public health through prudent veterinary practices.

- Monoclonal Antibody Therapies: Monoclonal antibody therapies like Librela (anti-NGF) for dogs with osteoarthritis are raising the bar in managing pet pain. FDA approval has enhanced faith in their safety and efficacy, leading to increased adoption on a global scale. Indian pet healthcare consciousness is likely to drive interest in such state-of-the-art therapeutics faster.

- Personalized Veterinary Medicine: Genetic screening and breed-specific medicines are personalizing veterinary medicine in India's cities, which is expanding the veterinary medicine market size in India. Pet owners are demanding customized treatment protocols for disorders such as allergy, metabolic disease, and arthritis. This is a sign of increased willingness to spend on precision medicine for better outcomes and preventive care.

Growth, Opportunities, and Challenges in the India Veterinary Medicine Market:

- Growth Drivers: The primary growth drivers include the expanding pet population, increasing disposable income among Indian households, and growing awareness about animal health and welfare. Government initiatives such as the National Animal Disease Control Programme and state-level veterinary infrastructure development are providing boost to India veterinary medicine market growth. The rising consumption of animal protein products is driving demand for livestock health management solutions across the country.

- Market Opportunities: Significant opportunities exist in rural market penetration where veterinary services remain underserved and demand for livestock healthcare is substantial. The development of affordable telemedicine platforms and mobile veterinary services can address geographical access challenges. Partnerships between international veterinary companies and local players present opportunities for technology transfer and market expansion in specialized therapeutic areas.

- Market Challenges: As per the India veterinary medicine market forecast, key challenges include the shortage of qualified veterinary professionals, particularly in rural areas, which limits service accessibility and quality. Regulatory complexities and lengthy approval processes for new veterinary drugs can delay market entry and innovation. Price sensitivity among consumers, especially in rural markets, poses challenges for premium product positioning and profitability.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India veterinary medicine market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product, animal type, route of administration and distribution channel.

Breakup by Product:

- Drugs

- Anti-infective

- Anti-inflammatory

- Parasiticide

- Vaccines

- Inactivated Vaccines

- Attenuated Vaccines

- Recombinant Vaccines

- Medicated Feed Additives

- Amino Acids

- Antibiotics

Breakup by Animal Type:

- Companion Animals

- Livestock Animals

Breakup by Route of Administration:

- Oral

- Parenteral

- Topical

Breakup by Distribution Channel:

- Veterinary Hospitals Pharmacies

- Retail Veterinary Pharmacies

- Online Pharmacies

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The report provides a comprehensive analysis of the competitive landscape in the India veterinary medicine market with detailed profiles of all major companies, including:

- Ani Healthcare Private Limited

- Ashish Life Science Pvt Limited

- Century Pharmaceuticals Ltd

- GMT Pharma International

- Hester Biosciences Limited

- Indian Immunologicals Ltd.

- MarchVET

- SSS Pharmachem Pvt. Ltd

- Stanex Drugs & Chemicals Pvt. Ltd.

- Virbac

- Zenley Animal Health

- Zovix Pharmaceuticals

Latest News and Developments:

- In August 2025, India’s first animal stem cell biobank was inaugurated by Union Minister Dr. Jitendra Singh at Gachibowli, Hyderabad. Developed by the National Institute of Animal Biotechnology under the Biotechnology Research Innovation Council, the facility is designed to supply quality-assured animal stem cells along with locally developed, cost-effective cell culture media. It will cater to veterinary clinics, research organizations, hospitals, and industry stakeholders, thereby fostering progress in veterinary medicine, enhancing livestock productivity, and promoting animal health.

- In March 2025, the Union Cabinet approved revisions to the Livestock Health and Disease Control Programme (LHDCP), introducing a new component, Pashu Aushadhi, to supply generic veterinary medicines at affordable rates. With a total budget of INR 3,880 Crore for 2024-25 and 2025-26, including INR 75 Crore earmarked for procuring and promoting these medicines, the initiative aims to improve access to high-quality animal healthcare. The program will be implemented through PM-Kisan Samriddhi Kendras and cooperative societies, while also strengthening veterinary infrastructure, enhancing disease control measures.

- In October 2024, Panav Biotech announced the launch of Maropitine Injection, a veterinary pharmaceutical designed to treat and prevent nausea and vomiting in dogs and cats—including cases due to motion sickness, chemotherapy, or post-anaesthesia. The active ingredient, Maropitant Citrate, is an FDA-approved NK-1 receptor antagonist that targets both central and peripheral emetic pathways, useful in conditions such as gastritis, parvovirus, pancreatitis, and uremic vomiting.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Product, Animal Type, Route of Administration, Distribution Channel, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Ani Healthcare Private Limited, Ashish Life Science Pvt Limited, Century Pharmaceuticals Ltd, GMT Pharma International, Hester Biosciences Limited, Indian Immunologicals Ltd., MarchVET, SSS Pharmachem Pvt. Ltd, Stanex Drugs & Chemicals Pvt. Ltd., Virbac, Zenley Animal Health, Zovix Pharmaceuticals, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

We expect the India veterinary medicine market to exhibit a CAGR of 5.6% during 2025-2033.

The rising prevalence of zoonotic diseases, such as rabies, plague, toxoplasmosis, etc., along with the emerging trend of pet humanization, is primarily driving the India veterinary medicine market.

The sudden outbreak of the COVID-19 pandemic had led to limited visits to veterinary hospitals and delay in diagnosis and treatment for animals on account of mitigating the risk of the coronavirus infection, thereby negatively impacting the demand for veterinary medicines across the nation.

Based on the product, the India veterinary medicine market has been divided into drugs, vaccines, and medicated feed additives. Currently, drugs exhibit a clear dominance in the market.

Based on the animal type, the India veterinary medicine market can be categorized into companion animals and livestock animals, where companion animals currently account for the majority of the total market share.

Based on the route of administration, the India veterinary medicine market has been segregated into oral, parenteral, and topical. Among these, parenteral holds the largest market share.

Based on the distribution channel, the India veterinary medicine market can be bifurcated into veterinary hospitals pharmacies, retail veterinary pharmacies, and online pharmacies. Currently, veterinary hospitals pharmacies exhibit a clear dominance in the market.

On a regional level, the market has been classified into North India, West and Central India, South India and East India, where South India currently dominates the India veterinary medicine market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)