India Veterinary Healthcare Market Size, Share, Trends and Forecast by Product, Animal Type, End User, and Region, 2025-2033

India Veterinary Healthcare Market Overview:

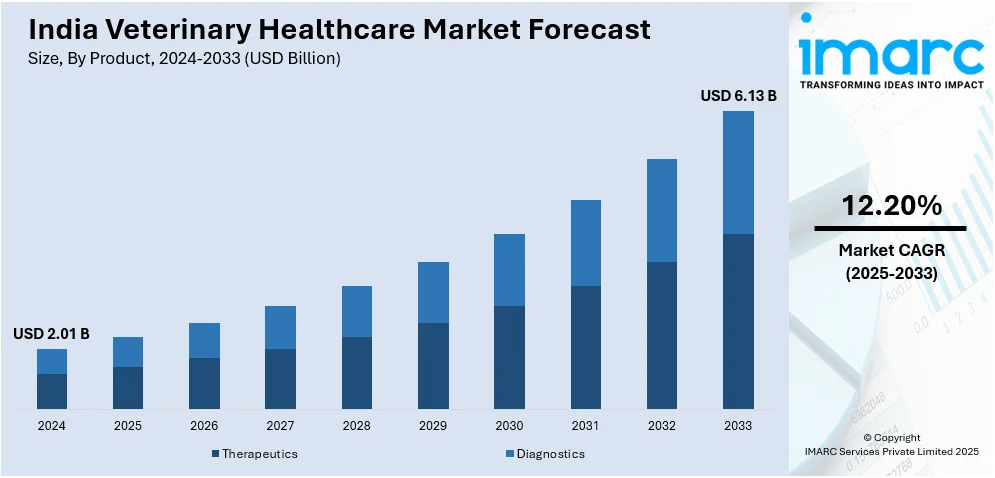

The India veterinary healthcare market size reached USD 2.01 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.13 Billion by 2033, exhibiting a growth rate (CAGR) of 12.20% during 2025-2033. The India veterinary healthcare market is driven by rising pet adoption, increasing livestock farming, and growing awareness of animal health. Advancements in veterinary medicines, expanding veterinary clinics, and government initiatives supporting animal welfare further boost demand. Additionally, the surge in zoonotic diseases accelerates the need for preventive healthcare solutions and diagnostics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.01 Billion |

| Market Forecast in 2033 | USD 6.13 Billion |

| Market Growth Rate (2025-2033) | 12.20% |

India Veterinary Healthcare Market Trends:

Rising Demand for Preventive Veterinary Care

Growing interest in preventive health care in India's animal husbandry industry is influencing market dynamics. Livestock farmers and pet owners are increasingly taking disease prevention measures, driven by awareness of zoonotic diseases and financial losses resulting from infections. Vaccination initiatives, deworming, and parasite control efforts are gaining strength, driven by government support and private investment. The growth in veterinary diagnostics, comprising point-of-care (POC) solutions and fast tests, enhances the ability of detecting disease in early stages. Also, international veterinary regulations and standards are leading to growing uses of high-quality healthcare solutions. All this is enhanced further through digital platforms delivering telemedicine services as well as veterinary consultancy, bringing preventive services within easy reach, particularly across rural and semi-urban areas.

To get more information of this market, Request Sample

Technological Advancements in Veterinary Pharmaceuticals and Biologics

The Indian veterinary healthcare industry is experiencing major developments in pharmaceuticals and biologics, improving treatment effectiveness and therapeutic options. Advances in veterinary vaccines, antimicrobial substitutes, and nutritional supplements are enhancing disease control in companion and livestock animals. The creation of targeted drug formulations, such as long-acting injectables and oral drugs, is improving compliance and treatment outcomes. Furthermore, biopharmaceutical firms are making investments in research on species-specific medications, serving the varied needs of poultry, cattle, and pets. Biotechnology, including recombinant vaccines and monoclonal antibodies, is increasing in prominence, minimizing the dependence on traditional antibiotics. The increased multinational presence of pharmaceutical firms and domestic manufacturing capacities is also boosting innovation and cost-effectiveness in the industry.

Expansion of Veterinary Healthcare Infrastructure and Services

India’s veterinary healthcare landscape is evolving with the expansion of veterinary hospitals, clinics, and mobile health units. The increasing number of specialized veterinary care centers, equipped with advanced diagnostic and surgical facilities, is enhancing service accessibility. Government initiatives promoting veterinary education and training are strengthening the availability of skilled professionals. Additionally, there are 65,894 veterinary institutions in the country, indicating a shortfall of approximately 41,000. Also, the corporate investments in pet healthcare chains and multi-specialty hospitals are driving service standardization. The rise of online veterinary platforms is facilitating remote consultations, improving healthcare accessibility in underserved areas. Furthermore, mobile veterinary services are playing a crucial role in providing on-the-spot treatment for livestock in rural regions. This infrastructural growth is expected to support long-term industry expansion and improve overall animal health outcomes.

India Veterinary Healthcare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, animal type, and end user.

Product Insights:

- Therapeutics

- Vaccines

- Parasiticides

- Anti-Infectives

- Medical Feed Additives

- Others

- Diagnostics

- Immunodiagnostic Tests

- Molecular Diagnostics

- Diagnostic Imaging

- Clinical Chemistry

- Others

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes therapeutics (vaccines, parasiticides, anti-infectives, medical feed additives, others), diagnostics (immunodiagnostic tests, molecular diagnostics, diagnostic imaging, clinical chemistry, others).

Animal Type Insights:

- Dogs and Cats

- Horses

- Ruminants

- Swine

- Poultry

- Others

A detailed breakup and analysis of the market based on the animal type have also been provided in the report. This includes dogs and cats, horses, ruminants, swine, poultry, and others.

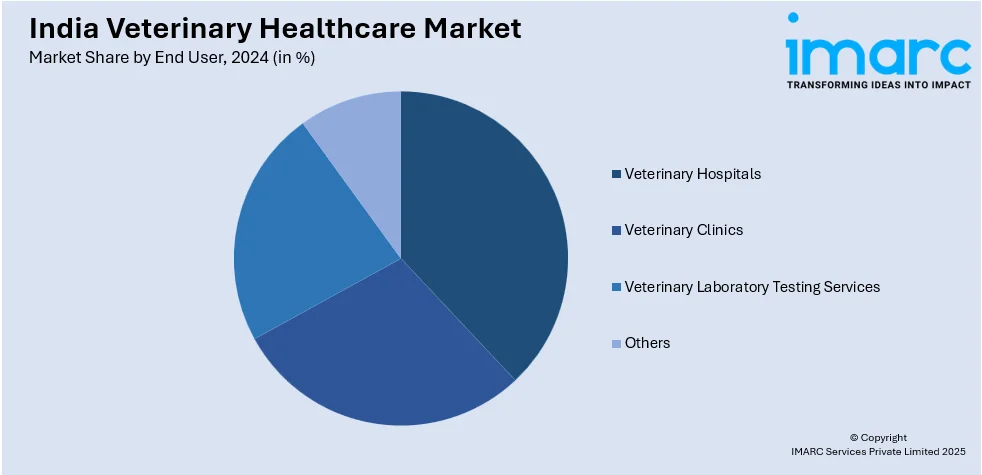

End User Insights:

- Veterinary Hospitals

- Veterinary Clinics

- Veterinary Laboratory Testing Services

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes veterinary hospitals, veterinary clinics, veterinary laboratory testing services, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Veterinary Healthcare Market News:

- In August 2024, Tata Trusts is set to launch India’s first state-of-the-art small animal hospital in Mumbai in March 2024. This facility will provide advanced veterinary care, including diagnostics, surgery, and rehabilitation, catering to companion animals. The initiative aims to elevate pet healthcare standards in India with cutting-edge medical technology and expert veterinary services, enhancing accessibility to specialized treatments for small animals.

India Veterinary Healthcare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Animal Types Covered | Dogs and Cats, Horses, Ruminants, Swine, Poultry, Others |

| End Users Covered | Veterinary Hospitals, Veterinary Clinics, Veterinary Laboratory Testing Services, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India veterinary healthcare market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India veterinary healthcare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India veterinary healthcare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The veterinary healthcare market in the India was valued at USD 2.01 Billion in 2024.

The India veterinary healthcare market is projected to exhibit a CAGR of 12.20% during 2025-2033, reaching a value of USD 6.13 Billion by 2033.

Key factors driving the India veterinary healthcare market include rising pet ownership, heightened awareness regarding animal health, and the increasing need for livestock healthcare. Improved access to veterinary services and advancements in animal diagnostics and treatments are also supporting market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)