India Venture Capital Investment Market Size, Share, Trends and Forecast by Sector, Fund Size, Funding Type, and Region, 2025-2033

Market Overview:

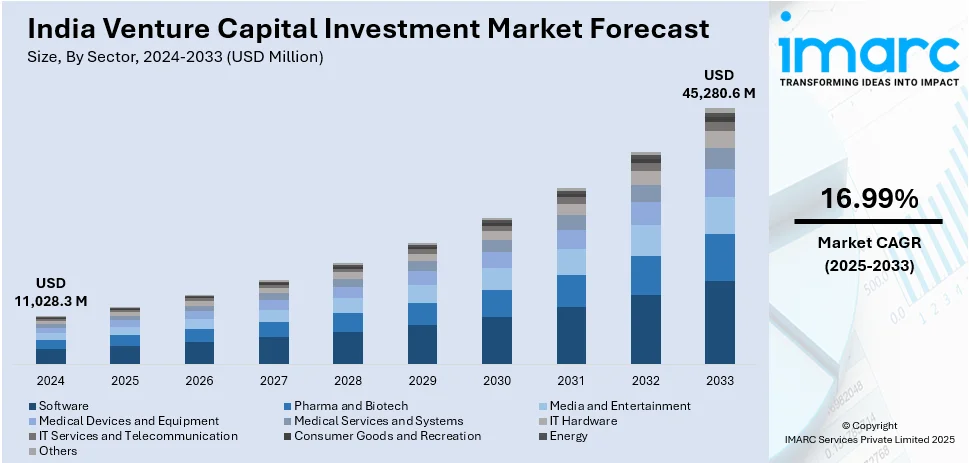

India venture capital investment market size reached USD 11,028.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 45,280.6 Million by 2033, exhibiting a growth rate (CAGR) of 16.99% during 2025-2033. The expanding sectors such as artificial intelligence, biotechnology, clean energy, and fintech, which tend to attract significant venture capital, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11,028.3 Million |

| Market Forecast in 2033 | USD 45,280.6 Million |

| Market Growth Rate (2025-2033) | 16.99% |

Venture capital (VC) investment is a financial mechanism wherein investors provide funding to early-stage, high-potential startups in exchange for equity ownership. This form of financing is crucial for fledgling businesses with significant growth potential but limited access to traditional funding sources. Venture capitalists, typically individuals or firms, carefully select and invest in innovative companies with promising ideas, disruptive technologies, or scalable business models. In addition to financial support, VC investors often offer strategic guidance and mentorship to help these startups navigate the challenges of scaling and achieving market success. While venture capital carries higher risk due to the early-stage nature of investments, successful ventures can yield substantial returns, making it an essential catalyst for fostering entrepreneurship and driving innovation in various industries.

To get more information of this market, Request Sample

India Venture Capital Investment Market Trends:

The venture capital investment market in India is propelled by several key drivers. Firstly, technological advancements serve as a catalyst, fostering innovation and creating opportunities for disruptive startups. As breakthroughs in fields like artificial intelligence, biotechnology, and renewable energy continue to emerge, venture capitalists are drawn to invest in ventures that promise transformative solutions. In addition to this, societal shifts and changing consumer preferences contribute significantly to the evolution of the venture capital landscape. As consumers demand sustainable and socially responsible products and services, venture capitalists are increasingly focusing on startups that align with these values. This aligns with a broader trend of impact investing, where financial returns are sought alongside positive social and environmental outcomes. Furthermore, regulatory frameworks play a pivotal role in shaping the venture capital ecosystem. Governments that foster a conducive environment through supportive policies and incentives attract more venture capital activity. Conversely, stringent regulations can act as barriers, impacting the attractiveness of a region for venture capital investment. In essence, the venture capital investment market in India is a dynamic arena shaped by the interplay of technological progress, societal trends, and regulatory landscapes. Understanding and navigating these drivers is essential for both investors and entrepreneurs seeking to thrive in this ever-evolving ecosystem.

India Venture Capital Investment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on sector, fund size, and funding type.

Sector Insights:

- Software

- Pharma and Biotech

- Media and Entertainment

- Medical Devices and Equipment

- Medical Services and Systems

- IT Hardware

- IT Services and Telecommunication

- Consumer Goods and Recreation

- Energy

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes software, pharma and biotech, media and entertainment, medical devices and equipment, medical services and systems, IT hardware, IT services and telecommunication, consumer goods and recreation, energy, and others.

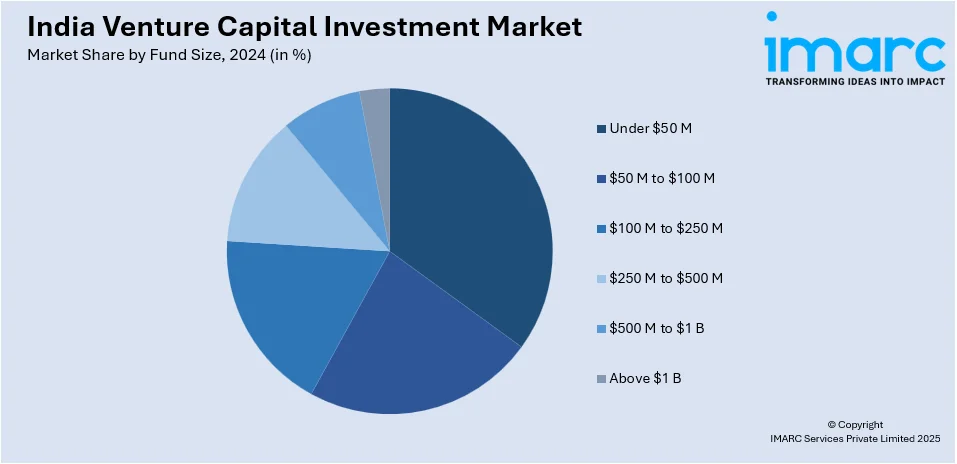

Fund Size Insights:

- Under $50 M

- $50 M to $100 M

- $100 M to $250 M

- $250 M to $500 M

- $500 M to $1 B

- Above $1 B

A detailed breakup and analysis of the market based on the fund size have also been provided in the report. This includes under $50 M, $50 M to $100 M, $100 M to $250 M, $250 M to $500 M, $500 M to $1 B, and above $1 B.

Funding Type Insights:

- First-Time Venture Funding

- Follow-on Venture Funding

The report has provided a detailed breakup and analysis of the market based on the funding type. This includes first-time venture funding and follow-on venture funding.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Venture Capital Investment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Software, Pharma and Biotech, Media and Entertainment, Medical Devices and Equipment, Medical Services and Systems, IT Hardware, IT Services and Telecommunication, Consumer Goods and Recreation, Energy, Others |

| Fund Sizes Covered | Under $50 M, $50 M to $100 M, $100 M to $250 M, $250 M to $500 M, $500 M to $1 B, Above $1 B |

| Funding Types Covered | First-Time Venture Funding, Follow-on Venture Funding |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India venture capital investment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India venture capital investment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India venture capital investment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The venture capital investment market in India was valued at USD 11,028.3 Million in 2024.

The India venture capital investment market is projected to exhibit a CAGR of 16.99% during 2025-2033, reaching a value of USD 45,280.6 Million by 2033.

India’s venture capital investment market is growing due to rising digital adoption, increased activity in sectors like fintech and edtech, and strong backing from government initiatives such as Startup India. A young entrepreneurial ecosystem and improved exit strategies have also attracted greater investor interest and funding.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)